Workshop Management Software Market Share, Size, Trends, Industry Analysis Report, By Workshop Type; By Type of Communication; By End-User; By Deployment Mode; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jul-2023

- Pages: 118

- Format: PDF

- Report ID: PM3487

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

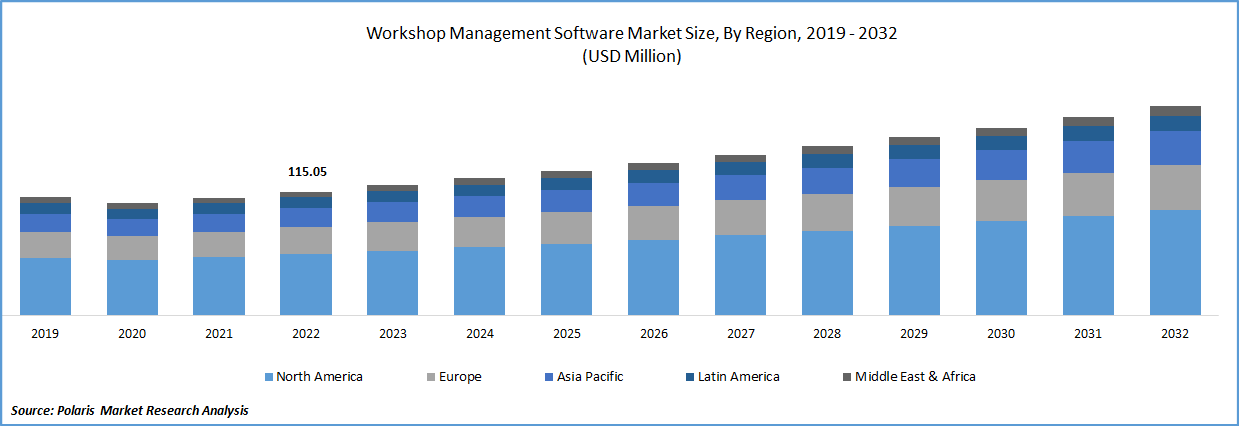

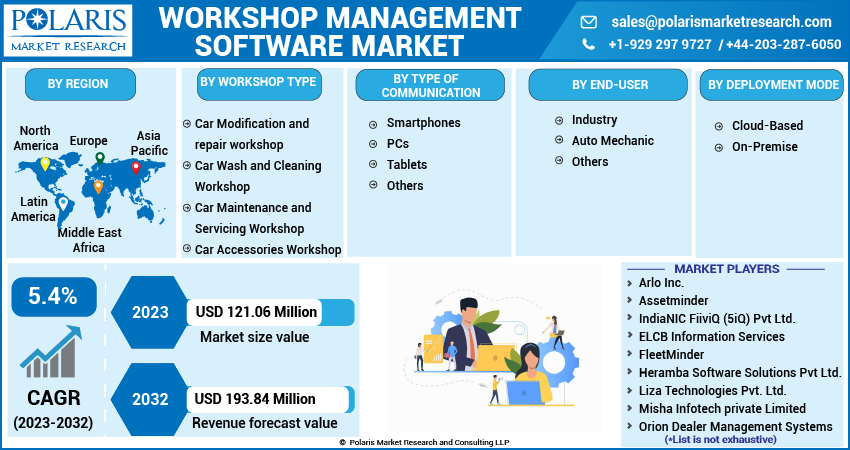

The global workshop management software market was valued at USD 115.05 million in 2022 and is expected to grow at a CAGR of 5.4% during the forecast period. Workshop management software is referred to as WMS (or system). A system for managing a workshop's everyday activities is called workshop management software. It is a piece of software that mechanics commonly use in vehicle repair shops to manage clients, tasks, inventory, and finances. All of the features required to run an automotive workshop are offered by the workshop management software. The workshop is capable of maintaining a database of every customer's list, history, and servicing and inspection data using the portal and the workshop's management system.

To Understand More About this Research: Request a Free Sample Report

Many elements, including customer connection management, vehicle record management, fundamentals of marketing, budgetary management, and accuracy, are offered by the workshop management software. These features make the workshop more efficient and save the workshop managers' time. The market for workshop management software is expanding as a result of this. The launch of AI-based customer-facing workshop management software is also supporting the market to grow rapidly. Usually, in the developing region, users did not focus on the servicing as well as maintenance of vehicles due to their hectic lifestyles, therefore the customer-facing software supports them by identifying the problem of users' vehicles and helping them talk with technicians.

Recently, the top marketing agencies are focusing on the adoption of AI-based software due to its benefits for businesses and manufacturers are focusing on its development of it. For instance, in December 2021, With the introduction of AutoX3, a cutting-edge AI-based workshop software, the Bluechem Corporation supported the global suppliers. The business offers lubricants, workshop supplies, and additives, and has just released AutoX3, a completely global software. It is clever software that helps technicians communicate with consumers about problems with their vehicles and persuade them to make the necessary servicing or part changes. It is an entirely intelligent AI-based piece of software and it will advance Bluechem. The operation is entirely cloud-based, and workshops can utilize it using a license arrangement.

However, workshop management software is expensive to purchase. The workshop management software requires numerous software integrations and hardware changes to be implemented. As a result, installing workshop management software is expensive. This is impeding the market's deployment of Workshop management software. The market share of workshop management software was negatively impacted by COVID-19. Yet, none of the main providers of workshop management software have announced a service stoppage.

In addition, the COVID-19 outbreak reduced production in the first half of 2020, which decreased demand for software solutions. Production would be planned by the need for vehicle repair software in OEM and Tier l. Output is likely to be modified to avoid bottlenecks. While nations all over the world adopted lockdown measures in response to the COVID-19 outbreak, numerous auto repair software companies encountered supply chain difficulties.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

The workshop management software makes the system more mobile by allowing remote access from anywhere. These elements are further boosting the market for workshop management software workshops effectively. The rising cost of luxury as a result of rising living standards has increased the buying of comfort amenities like cars.

Also, the increasing government schemes for the purchase of software are driving workshop management software market growth over the forecast period. For instance, The Car Allowance Rebate System (CARS), often known as Cash for Clunkers, was a program created to offer financial incentives to US citizens who trade in a less fuel-efficient car for a newer, more fuel-efficient one. The initiative's marketing claimed that it would stimulate the economy by increasing auto sales and placing safer, cleaner, and more fuel-efficient cars on the road. Due to this, there are more workshops now providing different services for these cars. The need for workshop management software has grown as a result of the need to manage these workshops.

Report Segmentation

The market is primarily segmented based on workshop type, type of communication, end-user, deployment mode, and region.

|

By Workshop Type |

By Type of Communication |

By End-User |

By Deployment Mode |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Car Maintenance and Servicing Workshop segment is expected to witness the fastest growth over the forecast period

The car maintenance and servicing workshop is growing with the fastest CAGR during the forecast period. Periodic maintenance is required for vehicles. Vehicles travel on unclean roads and operate in a polluted atmosphere. They are subjected to loads that harm them because they travel on unlevel roads with potholes and other impediments. Thus, regular automotive maintenance and servicing are required, which is often done in auto workshops or auto repair stations.

Additionally, the car wash and cleaning workshop segment is also having the largest share of the market. The segment has seen the development of software as a result of the difficulties that the increasing number of cars has placed on car wash service providers in managing each car. The workshop management system enables car wash service providers to manage customer profiles, maintain tabs on the vehicles being washed, and keep a record of each client. Business owners now have access to customizable invoices connected with GST, clear customer records, and customer tracking owing to the workshop management system. The solution enables business owners to send offers and SMS and provides for quicker client information retrieval. These elements are accelerating the development of workshop management software.

On-Premises accounted for the largest market share in 2022

The on-Premsies segment is holding the largest position in the market. This is because the majority of repair shops are tiny, independently owned firms, which prevents them from using cutting-edge technology and forces them to choose more affordable alternatives. While client data entry, inventory management, appointment scheduling, and other crucial operations may be handled on-site at the business, on-premises software is also recommended. Such solutions also do not pose many risks to cyber security because they are incorporated on the local server.

The demand in North America is expected to witness significant growth

North America generated the greatest revenue, as this area was the first to adopt the majority of cutting-edge technologies. The average age of cars in the area is rising, which further increases the demand for workshop management software. Increased disposable income in the aforementioned nations is likely to broaden the scope of Workshop Management Software's adoption there in the coming years.

As the largest market for workshop management software, Asia is anticipated to be a significant market. Given the increasing disposable income that is enabling consumers to adopt cutting-edge technology, Asia-Pacific (APAC) would experience the largest growth in demand for such solutions in the upcoming years. The biggest automotive sales are also found in APAC, which increases the need for repair and maintenance services. The widespread use of automation technologies is propelling the uptake of workshop management software in European nations like Germany and the UK. The expanding expenditure management software technology in these locations is indicative of the rising popularity of workshop management software in developing regions like Latin America and parts of Africa.

Competitive Insight

Some of the major players operating in the global market include Arlo Inc., Assetminder, IndiaNIC FiiviQ, ELCB Information Services, FleetMinder, Heramba Software Solutions, Liza Technologies, Misha Infotech, Orion Dealer Management, Smart Auto Systems, Sunrise Software Development, and WorkShop Management.

Recent Developments

- In July 2020, the Garage Management Software (GMS), a cloud-based version called CarSys., from LKQ Euro Auto Parts has been released recently, CarSys is a user-friendly technology platform that is only accessible to LKQ Euro Car Parts customers, and it enables workshops to streamline their processes, enhancing efficiency and productivity in the workshop and providing a more superior consumer experience.

Workshop Management Software Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 121.06 million |

|

Revenue forecast in 2032 |

USD 193.84 million |

|

CAGR |

5.4% from 2023- 2032 |

|

Base year |

2022 |

|

Historical data |

2019- 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments Covered |

By Workshop Type, By Deployment Mode, By Type of Communication, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Arlo Inc., Assetminder, IndiaNIC FiiviQ (5iQ) Pvt Ltd., ELCB Information Services, FleetMinder, Heramba Software Solutions Pvt Ltd., Liza Technologies Pvt. Ltd., Misha Infotech private Limited, Orion Dealer Management Systems, Smart Auto Systems Private Limited., Sunrise Software Development, and WorkShop Management System, |

FAQ's

key companies in workshop management software market are Arlo Inc., Assetminder, IndiaNIC FiiviQ, ELCB Information Services, FleetMinder, Heramba Software Solutions, Liza Technologies.

The global workshop management software market is expected to grow at a CAGR of 5.4% during the forecast period.

The workshop management software market report covering key segments are workshop type, type of communication, end-user, deployment mode, and region.

key driving factors in workshop management software market are increasing government schemes for the purchase of software.

The global workshop management software market size is expected to reach USD 193.84 million by 2032, according to a new study by Polaris Market Research.