Woodworking Machinery Market Share, Size, Trends, Industry Analysis Report, By Product Type (Grinding Machine, Routers, Planers, Drills, Saws, Others), By Operating Principle, By Application, By Region, Segments & Forecast, 2024 – 2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM3538

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

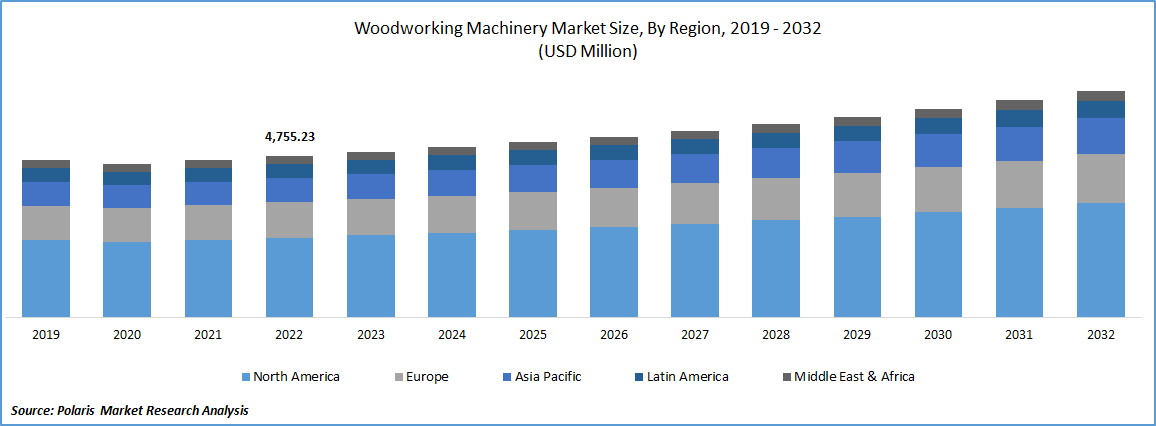

The global woodworking machinery market was valued at USD 4883.62 Million in 2023 and is expected to grow at a CAGR of 3.60% in the forecast period. The increasing demand for prefabricated wooden houses, growing adoption of automated woodworking machines and preference towards automated manufacturing units have escalated the use of woodworking machineries in the last few years.

To Understand More About this Research: Request a Free Sample Report

Woodworking machinery comprises a range of power tools and equipment designed specifically for woodworking tasks. These machines are widely used in woodworking shops, furniture manufacturing, and carpentry industries to enhance productivity and precision.

Key woodworking machinery includes the table saw, which facilitates straight cuts on wood with adjustable angles and depths. The band saw allows for curved cuts and resawing lumber. Jointers flatten and straighten board edges, while planers uniformly smooth surfaces and reduce thickness. Routers enable cutting, shaping, and hollowing wood, while miter saws provide accurate crosscuts and miter cuts. Drill presses create precise holes, and wood lathes turn wood to form cylindrical shapes. Sanders help in sanding and smoothing wood surfaces. A dust collection system also maintains cleanliness and safety by capturing sawdust and wood particles generated during operations.

Woodworking machinery comprises a range of power tools and equipment designed specifically for woodworking tasks. These machines are widely used in woodworking shops, furniture manufacturing, and carpentry industries to enhance productivity and precision.

Key woodworking machinery includes the table saw, which facilitates straight cuts on wood with adjustable angles and depths. The band saw allows for curved cuts and resawing lumber. Jointers flatten and straighten board edges, while planers uniformly smooth surfaces and reduce thickness. Routers enable wood cutting, shaping, and hollowing, while miter saws provide accurate crosscuts and miter cuts.

Drill presses create precise holes, and wood lathes turn wood to form cylindrical shapes. Sanders help in sanding and smoothing wood surfaces. A dust collection system also maintains cleanliness and safety by capturing sawdust and wood particles generated during operations.

While woodworking machinery offers efficiency and precision, there are restraining factors to consider. Cost can be a significant barrier, as high-quality and specialized machines can be expensive. Adequate space and infrastructure, including safety measures, are necessary for setting up a workshop. Regular maintenance and upkeep add to operational costs. There is a learning curve associated with operating the machinery effectively. Additionally, staying updated with evolving technology can pose a challenge. Despite these factors, proper planning, training, and investment can help overcome limitations and maximize woodworking machinery's benefits.

Industry Dynamics

Growth Drivers

The growing utilization of prefabricated wooden houses is a driving factor for the woodworking machinery market. Prefabricated wooden houses, also known as modular or off-site construction, require efficient and precise manufacturing processes. Woodworking machinery plays a crucial role in producing the components and assembling these structures. Machines such as CNC routers, panel saws, and edge banders enable high-quality and cost-effective production of prefabricated wooden houses. The increasing demand for sustainable and eco-friendly construction methods further fuels the adoption of woodworking machinery in this sector. As a result, the market is experiencing growth due to the expanding demand for prefabricated wooden houses.

The preference for automated manufacturing units acts as a another key driving factor for the market. Automation offers increased efficiency, precision, and productivity in woodworking processes. Woodworking machinery, with advanced features like computer numerical control (CNC) systems and robotics, is vital in automated manufacturing. These machines enable streamlined production, reduced labor costs, and improved quality control. The demand for faster production, customization, and optimization of resources further fuels the adoption of automated woodworking machinery. As a result, the market is witnessing growth as industries increasingly shift towards automated manufacturing units to stay competitive in today's market.

Report Segmentation

The market is primarily segmented based on product type, operating principle, application, and region

|

By Product Type |

By Operating Principle |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

The planers segment is projected to experience the highest market share in the forecast period.

The growth of planers in the market has been substantial in recent years. Planers are essential for smoothing rough lumber and achieving consistent thickness throughout the wood. They play a crucial role in improving wood products' surface finish and dimensional accuracy, making them highly sought after in various woodworking applications.

Advancements in technology have contributed to the development of more efficient and user-friendly planers. Modern planers are equipped with adjustable cutting depth, automatic feed mechanisms, and digital controls, enabling precise and effortless operation. These advancements have significantly enhanced productivity and quality in woodworking processes.

The demand for planers is also driven by the growing popularity of DIY woodworking projects and the increasing number of small-scale woodworking businesses. These enthusiasts and entrepreneurs often require planers to transform rough lumber into usable, well-finished pieces. Moreover, planers are essential in the woodworking industry's pursuit of sustainable practices. By reducing the thickness of lumber, planers help maximize the utilization of wood resources, minimizing waste and promoting eco-friendly production.

The electrical woodworking machinery segment is anticipated to dominate the market in the forecast period.

The growth of the electrical woodworking machinery segment is driven by its advantages, including increased precision, efficiency, and productivity. These machines allow higher production volumes, improved quality control, and reduced labor requirements. Integrating electronic controls and automation further enhances safety and ease of operation.

One of the central operating principles is using electric motors to power the machinery. Electric motors provide consistent power and torque, enabling precise cutting, shaping, and sanding of wood materials. These motors are highly efficient, making them suitable for various woodworking applications.

Another operating principle in electrical woodworking machinery is incorporating electronic controls and automation systems. These systems allow for precise adjustments, automatic feed mechanisms, and advanced safety features. Integrating electronics enhances the efficiency, accuracy, and ease of operation in woodworking processes.

The furniture segment is anticipated to account for the highest market share in the forecast period.

The furniture segment has experienced significant growth in the market, driven by various end-uses and factors. The demand for furniture across residential, commercial, and institutional sectors has risen, increasing production and consumption. This growth is fueled by population growth, urbanization, changing lifestyles, and interior design trends.

The residential furniture segment has seen robust growth due to rising homeownership rates, remodeling activities, and the popularity of customized furniture. Woodworking machinery allows manufacturers to create various furniture styles and designs to cater to diverse customer preferences.

In the commercial sector, the demand for office furniture, retail fixtures, and hospitality furnishings has increased with the growth of industries and the expansion of commercial spaces. Woodworking machinery enables the production of functional and aesthetically appealing furniture for these sectors.

Europe region dominated the market in 2022 and is expected to account for the highest revenue share in the forecast period.

The woodworking machinery market in the European region has experienced steady growth over the years, driven by several factors. Europe has a rich history and tradition in woodworking, and the region is known for its high-quality woodworking products and craftsmanship.

One of the key drivers of the market growth is the strong demand for wooden furniture. European countries have a strong furniture manufacturing industry, focusing on quality, design, and sustainability. Woodworking machinery plays a crucial role in meeting the production requirements of the furniture sector, enabling efficient and precise manufacturing processes. Furthermore, the European region has witnessed advancements in technology and automation in the woodworking industry. CNC systems, robotics, and digital controls have been increasingly adopted to enhance woodworking operations' productivity, precision, and customization.

Competitive Insight

Some of the prominent key players operating in the marketspace includes Biesse Group, SCM Group, Durr Group, CKM, Cantek America Inc., RS Wood S.R.L., Oliver Machinery Company, KTCC Woodworking Machinery, WEINIG Group, Gongyou Group, A L Dalton Ltd., SOCOMEC S.R.L., IMA Schelling Group GmbH

Recent Developments

- May 2023: The latest line of 3-Axis CNC Router machines from CNC Router Machine, a manufacturer of woodworking machinery, has been introduced. This new series is designed to offer woodworkers exceptional precision and efficiency, meeting the requirements of different industries.

Woodworking Machinery Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 5023.78 Million |

|

Revenue forecast in 2032 |

USD 6,684.33 Million |

|

CAGR |

3.60% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2024 to 2032 |

|

Segments covered |

By Product Type, By Operating Principle, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Biesse Group, SCM Group, Durr Group, CKM, Cantek America Inc., RS Wood S.R.L., Oliver Machinery Company, KTCC Woodworking Machinery, WEINIG Group, Gongyou Group, A L Dalton Ltd., SOCOMEC S.R.L., IMA Schelling Group GmbH |

FAQ's

The global woodworking machinery market size is expected to reach USD 6,684.33 Million by 2032.

Key players in the woodworking machinery market are Biesse Group, SCM Group, Durr Group, CKM, Cantek America Inc., RS Wood S.R.L., Oliver Machinery Company.

Europe contribute notably towards the global woodworking machinery market.

The global woodworking machinery market is expected to grow at a CAGR of 3.55% in the forecast period.

The woodworking machinery market report covering key segments are product type, operating principle, application, and region.