Wood Pellets Market Size, Share, Trends, Industry Analysis Report: By Application (Heat, CHP, and Power), End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM3421

- Base Year: 2024

- Historical Data: 2020-2023

Wood Pellets Market Overview

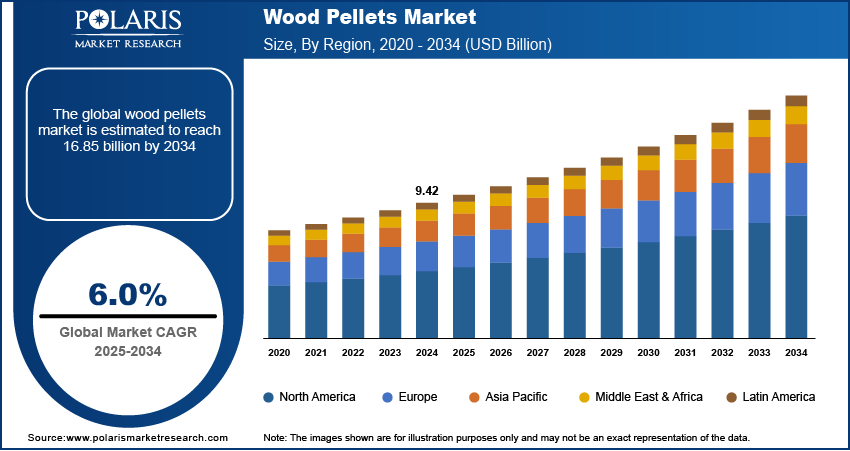

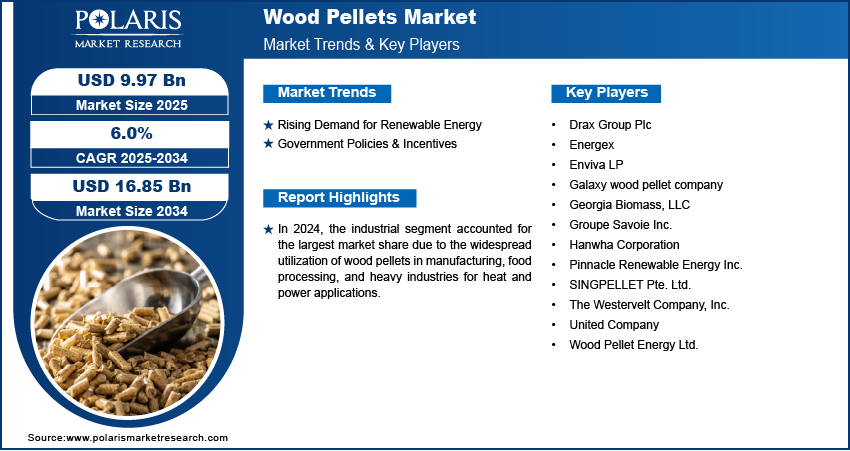

Wood pellets market size was valued at USD 9.42 billion in 2024 and is expected to reach USD 9.97 billion by 2025 and USD 16.85 billion by 2034, exhibiting a CAGR of 6.0% during the forecast period.

The wood pellets market includes the production, distribution, and use of small, compressed biomass pellets made from sawdust, wood shavings, and other wood waste materials. These pellets are an eco-friendly and renewable energy source, commonly used for heating homes, businesses, and industries, as well as for generating electricity. They provide an efficient and sustainable alternative to fossil fuels such as coal and oil.

One of the main reasons for the growing demand for wood pellets is the increasing use of biomass heating systems in both residential and commercial spaces. Homeowners and businesses are looking for cost-effective and environmentally friendly ways to heat their spaces. Wood pellets burn cleanly, producing less carbon emissions compared to traditional fuels, making them a popular choice for those looking to reduce their environmental impact. Additionally, governments in many countries are promoting renewable energy solutions, offering incentives and subsidies for using biomass-based heating systems. As a result, more consumers and businesses are switching to wood pellet heating to save costs and meet sustainability goals. The wood pellets market demand is expected to grow steadily in the coming years with continuous advancements in pellet production and distribution.

To Understand More About this Research: Request a Free Sample Report

More people are becoming aware of environmental issues, leading to a higher demand for sustainable biomass fuels such as wood pellets. Many consumers and businesses are choosing wood pellets as a cleaner alternative to fossil fuels because they produce lower carbon emissions and help reduce dependence on non-renewable energy sources. This shift toward eco-friendly heating solutions is driving the wood pellets market growth. At the same time, responsible forestry practices are helping maintain a steady supply of raw materials for wood pellet production. Governments and environmental organizations are promoting sustainable forest management, ensuring that wood waste from sawmills and logging operations is used efficiently. This not only prevents deforestation but also supports the long-term availability of raw materials.

Wood Pellets Market Dynamics

Rising Demand for Renewable Energy

Growing emphasis on reducing reliance on fossil fuels is accelerating wood pellets market expansion, particularly in the power generation sector. For instance, renewable energy adoption across the power, heating, and transportation sectors is projected to surge by nearly 60% between 2024 and 2030, significantly driving the transition toward sustainable energy solutions. The shift towards renewable energy sources is contributing to market growth, as wood pellets offer a sustainable and carbon-neutral alternative for electricity and heat production. Increasing investments in biomass-based power plants and industrial heating solutions are expanding the market. Rising awareness of environmental sustainability and stricter emission regulations are further driving demand, encouraging industries to adopt wood pellets as a cleaner energy source. Market statistics indicate strong growth potential as utilities and industrial sectors increasingly integrate biomass solutions into their energy portfolios.

Government Policies & Incentives

Government policies and incentives, such as subsidies, tax benefits, and carbon reduction programs, are increasing the demand for wood pellets. Many governments are encouraging the use of biomass energy by offering financial support, making wood pellets a more affordable alternative to coal and natural gas. For instance, in the US, the Department of Agriculture and the Department of Energy run the Biomass Research and Development Initiative. This program supports research and development of biomass-based products, bioenergy, and biofuels. Around $15 million is allocated each year, with grants of up to $2 million given to projects, requiring a 20% contribution from applicants. This helps boost investment in sustainable energy solutions.

Government policies, such as renewable energy targets and emission reduction plans, are also driving the market. Financial support for residential and commercial biomass heating systems is making wood pellets more popular. At the same time, regulations promoting carbon neutrality are increasing investment in wood pellet production and distribution. The wood pellets market is expected to continue expanding as part of the global shift toward renewable energy with strong government backing and a growing focus on clean energy.

Wood Pellets Market Segment Insights

Wood Pellets Market Assessment by Application Outlook

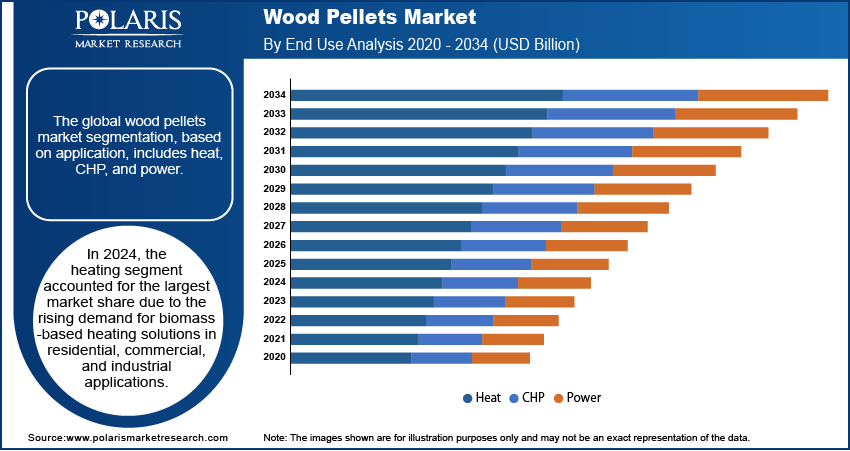

The global wood pellets market segmentation, based on application, includes heat, CHP, and power. In 2024, the heat segment accounted for the largest market share due to the rising demand for biomass-based heating solutions in residential, commercial, and industrial applications. Increasing concerns over carbon emissions and volatile fossil fuel prices have accelerated the adoption of wood pellets as an efficient and cost-effective alternative for space and water heating. Government incentives promoting renewable heating technologies, along with stricter emission regulations, are further contributing to wood pellets market growth. Additionally, advancements in pellet stove and boiler technologies are enhancing efficiency. The expansion of district heating networks utilizing biomass is also driving market, strengthening the role of wood pellets in sustainable energy solutions.

The power segment is also expected to register the highest CARG over the forecast period due to increasing investment in biomass-based power plants and co-firing applications in coal power stations. Utilities are integrating wood pellets to reduce carbon emissions and comply with stringent environmental regulations. Growing government policies supporting bioenergy in national energy strategies further enhance wood pellets market statistics, solidifying its role in the renewable energy sector.

Wood Pellets Market Evaluation by End User Outlook

The global wood pellets market segmentation, based on end user, includes residential, commercial, and industrial. In 2024, the industrial segment accounted for the largest market share due to the widespread utilization of wood pellets in manufacturing, food processing, and heavy industries for heat and power applications. The transition toward cleaner energy sources is contributing to market expansion as industries seek alternatives to coal and oil-based fuels. Regulatory mandates on emissions and corporate sustainability commitments are driving demand, encouraging large-scale industrial consumers to integrate biomass solutions. Additionally, advancements in industrial pellet boilers and co-generation systems are improving efficiency. Expanding production capacities and supply chain developments are ensuring steady market growth across key industrial sectors.

The residential segment is also expected to register the highest wood pellets market CARG over the forecast period due to increasing consumer preference for sustainable heating solutions and government subsidies on pellet stoves and boilers. Rising energy costs and incentives for household biomass heating are fueling market demand, supporting segmental growth.

Wood Pellets Market Regional Analysis

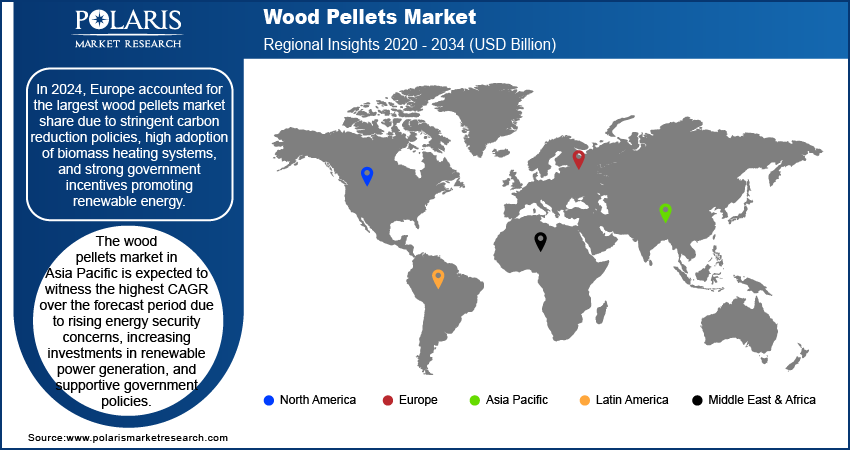

By region, the study provides wood pellets market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Europe accounted for the largest market share due to stringent carbon reduction policies, high adoption of biomass heating systems, and strong government incentives promoting renewable energy. For instance, the European Climate Law mandates climate neutrality by 2050 and targets a 55% reduction in net greenhouse gas emissions by 2030, aligning with the European Green Deal. Moreover, the widespread integration of wood pellets in district heating networks, industrial applications, and co-firing in coal power plants is contributing to market growth. The region’s well-established supply chain, advancements in pellet production technologies, and increasing investments in bioenergy infrastructure are further driving market. The European Union’s commitment to achieving net-zero emissions and reducing dependence on fossil fuels continues to strengthen region’s dominant position.

The wood pellets market in Asia Pacific is expected to witness the highest CAGR over the forecast period due to rising energy security concerns, increasing investments in renewable power generation, and supportive government policies. Rapid industrialization, growing demand for sustainable fuel alternatives, and expanding residential heating applications are contributing to market expansion. Countries such as Japan and South Korea are driving market with long-term biomass co-firing initiatives, while China’s focus on cleaner energy solutions is accelerating market demand. Additionally, improving pellet production capabilities and cross-border trade agreements are enhancing supply chain efficiency, further fueling regional growth.

Wood Pellets Key Market Players & Competitive Analysis Report

The competitive landscape of the wood pellets market is characterized by strategic partnerships, mergers and acquisitions, capacity expansions, and advancements in production technologies. Leading players are focusing on scaling up production to meet rising market demand with investments in new manufacturing facilities and supply chain optimization. Companies are engaging in long-term contracts with power utilities and industrial users to secure market share and ensure stable revenue streams. Strategic collaborations between pellet producers and biomass suppliers are strengthening raw material availability, contributing to market expansion. Additionally, advancements in pelletizing technologies and sustainability initiatives, such as carbon-neutral production and certified sustainable sourcing, are driving market value. The market is also witnessing increased participation from energy companies and government-backed enterprises, further intensifying competition.

Hanwha Corporation specializes in comprehensive process equipment, offering a range of high-value and ecofriendly solutions for various purposes, such as rechargeable batteries, solar energy, display technology, clean logistics, factory automation, robotics, and new renewable energy. Through continuous technological advancements and innovation, the company has become a leader in providing advanced process equipment. The company's wood pellet manufacturing line involves processes such as sorting alien substances, drying, smashing, shedding, and pellet forming from raw materials such as hardwood, woodchips, and unused wood to produce high-quality wood pellets as the final product. Additionally, Hanwha Corporation is actively involved in Waste-to-Energy (WTE) construction projects, offering services for the construction, design, and operation of incineration and drying facilities.

Galaxy wood pellet company is a manufacturer and supplier of wood pellets. The company is a family-owned business in the furniture industry in Central Java, they operate among a community of over 300,000 furniture producers in the city of Jepara, Indonesia. Galaxy wood pellet products are used for both residential and commercial purposes. The company offers renewable wood pellets as a substitute for fossil fuel, reducing carbon emissions. Galaxy wood pellet possesses a readily available source of raw materials for producing wood pellets. The company employs planer shavings, sawmill sawdust, and other wood waste as the main ingredients in their pellet manufacturing process. The company produces about 50,000 tons of pellets per year.

Key Companies in Wood Pellets Market

- Drax Group Plc

- Energex

- Enviva LP

- Galaxy wood pellet company

- Georgia Biomass, LLC

- Groupe Savoie Inc.

- Hanwha Corporation

- Pinnacle Renewable Energy Inc.

- SINGPELLET Pte. Ltd.

- The Westervelt Company, Inc.

- United Company

- Wood Pellet Energy Ltd.

Wood Pellets Market Developments

December 2024: Drax Group and Pathway Energy agreed to a multi-year deal to supply over 1 million tonnes of sustainable biomass pellets annually to Pathway's proposed SAF plant on the US Gulf Coast.

November 2024: Blackwood Technology BV inaugurated its first commercial FlashTor black pellet plant in Lampang Province, Thailand.

March 2024: Traeger, Inc. partnered with Louisville Slugger and launched limited-edition Traeger Louisville Slugger Pellets. This collaboration combines the traditions of baseball and wood-fire grilling, using maple wood from baseball bat production to create a unique flavor experience.

Wood Pellets Market Segmentation

By Application Outlook (Revenue USD Billion 2020 - 2034)

- Heat

- CHP

- Power

By End User Outlook (Revenue USD Billion 2020 - 2034)

- Residential

- Commercial

- Industrial

By Regional Outlook (Revenue USD Billion 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Wood Pellets Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 9.42 Billion |

|

Market Size Value in 2025 |

USD 9.97 Billion |

|

Revenue Forecast in 2034 |

USD 16.85 Billion |

|

CAGR |

6.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global wood pellets market size was valued at USD 9.42 billion in 2024 and is projected to grow to USD 16.85 billion by 2034.

The global market is projected to register a CAGR of 6.0% during the forecast period.

In 2024, Europe accounted for the largest market share due to stringent carbon reduction policies, high adoption of biomass heating systems, and strong government incentives promoting renewable energy.

Some of the key players in the market are Drax Group Plc; Energex; Enviva LP; Galaxy wood pellet company; Georgia Biomass, LLC; Groupe Savoie Inc.; Hanwha Corporation; Pinnacle Renewable Energy Inc.; SINGPELLET Pte. Ltd.; The Westervelt Company, Inc.; United Company; and Wood Pellet Energy Ltd.

In 2024, the heating segment accounted for the largest market share due to the rising demand for biomass-based heating solutions in residential, commercial, and industrial applications.

In 2024, the industrial segment accounted for the largest market share due to the widespread utilization of wood pellets in manufacturing, food processing, and heavy industries for heat and power applications.