Wood Coatings Market Size, Share, Trends, Industry Analysis Report: By Resin Type (Polyurethane, Acrylic, Nitrocellulose, Unsaturated Polyester, and Others), Technology, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 119

- Format: PDF

- Report ID: PM5394

- Base Year: 2024

- Historical Data: 2020-2023

Wood Coatings Market Overview

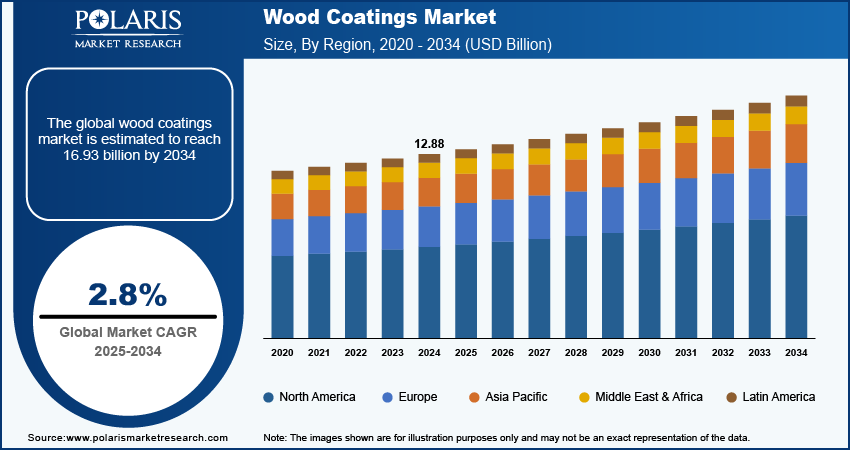

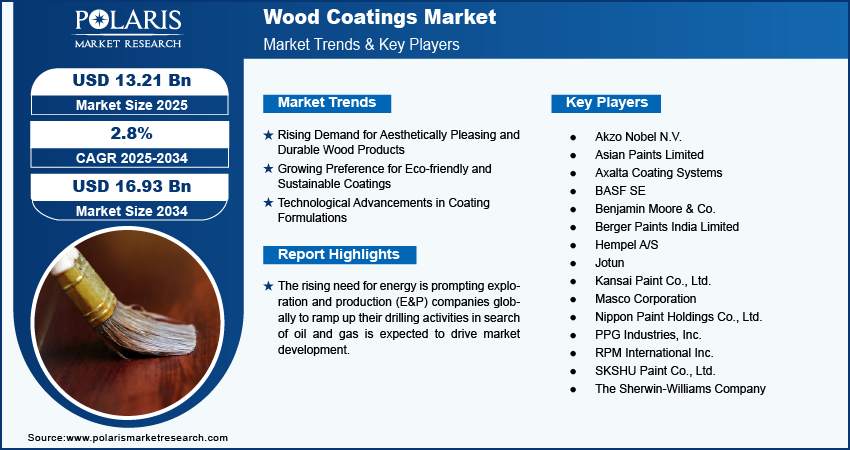

The wood coatings market size was valued at USD 12.88 billion in 2024. The market is projected to grow from USD 13.21 billion in 2025 to USD 16.93 billion by 2034, exhibiting a CAGR of 2.8% during 2025–2034.

The wood coatings market involves the application of protective and decorative coatings on wood surfaces, including furniture, flooring, and structural elements. The market is driven by the increasing demand for durable and aesthetically appealing wood products, particularly in the construction, furniture, and automotive industries. Key trends include the rising preference for eco-friendly and low-VOC (volatile organic compound) coatings, driven by environmental concerns and regulatory standards. Additionally, technological advancements in coating formulations, such as the development of water-based and UV-cured coatings, are enhancing product performance and creating lucrative wood coatings market opportunities. Furthermore, the growing popularity of home renovation and interior design projects is contributing to the market growth.

To Understand More About this Research: Request a Free Sample Report

Wood Coatings Market Dynamics

Rising Demand for Aesthetically Pleasing and Durable Wood Products

The increasing consumer demand for high-quality, durable, and visually appealing wood products is a significant driver of the wood coatings market growth. As wood is a versatile material used across multiple industries, including furniture, construction, and automotive, consumers seek coatings that enhance its appearance and extend its lifespan. The desire for long-lasting finishes has led to the development of advanced coatings that improve the durability and resistance of wood surfaces to elements such as moisture, UV light, and wear. The global furniture market, a major end user of wood coatings, is expected to continue growing as consumer preferences shift toward premium, high-end products. The demand for enhanced aesthetics and functionality is, therefore, directly driving the need for high-performance wood coatings.

Growing Preference for Eco-Friendly and Sustainable Coatings

Environmental sustainability has become a top priority for industries worldwide, including the wood coatings sector. As regulations tighten and consumer awareness about environmental impact rises, there is an increasing shift toward eco-friendly coatings that emit lower levels of harmful VOCs and are based on renewable resources. Water-based coatings, which release fewer pollutants compared to solvent-based alternatives, are gaining popularity due to their lower environmental impact. In the US, the Environmental Protection Agency (EPA) has set strict limits on VOC emissions, prompting manufacturers to develop safer, more sustainable formulations. Thus, the growing preference for eco-friendly and sustainable coatings is expected to drive the wood coatings market growth during the forecast period as companies and consumers prioritize environmental responsibility in product selection.

Technological Advancements in Coating Formulations

Advancements in coating technologies, including the development of UV-cured and water-based coatings, are contributing to the wood coatings market development. UV-cured coatings, which offer fast curing times and excellent durability, are gaining traction in industries such as furniture and flooring, where quick production turnaround times are essential. Water-based coatings, which are increasingly favored for their lower toxicity and ease of application, are also becoming more effective and versatile, offering improved resistance to stains, scratches, and fading. The innovations in wood coating formulations lead to better product performance, which enables the coatings to cater to a wide range of applications across various industries. Technological advancements continue to evolve, positioning the wood coatings market for further expansion and improved coatings performance.

Wood Coatings Market Segment Insights

Wood Coatings Market Assessment – Resin Type-Based Insights

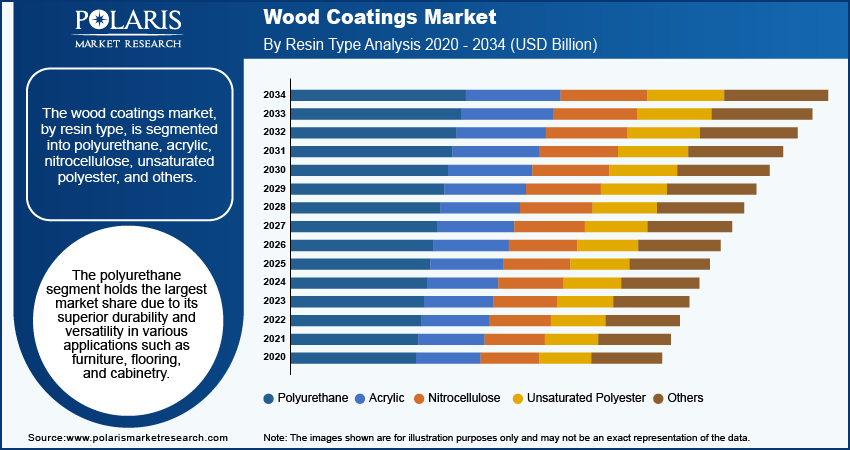

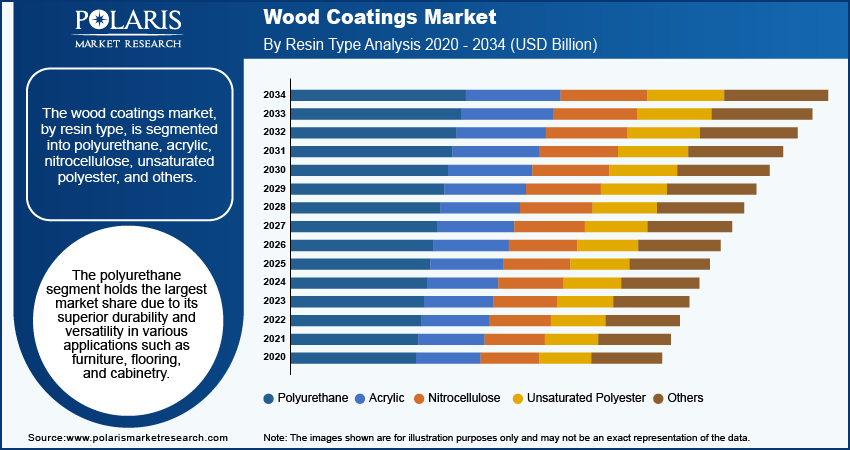

The wood coatings market, by resin type, is segmented into polyurethane, acrylic, nitrocellulose, unsaturated polyester, and others. The polyurethane segment dominates the wood coatings market share due to their superior durability and versatility in various applications such as furniture, flooring, and cabinetry. This resin type offers excellent resistance to moisture, abrasion, and UV light, making it a preferred choice for high-performance coatings in both residential and commercial applications. The demand for polyurethane coatings is particularly strong in the construction and furniture sectors, where the need for long-lasting finishes is critical. Furthermore, the segment is registering significant growth driven by increasing consumer preferences for premium products that offer enhanced performance and longevity.

The acrylic resin segment is experiencing substantial growth, driven by the increasing demand for eco-friendly and water-based coatings. Acrylic-based coatings are known for their low VOC content, which aligns with regulatory standards and environmental concerns. As the trend toward sustainability continues to rise, the preference for waterborne acrylic coatings is gaining momentum, particularly in regions with stringent environmental regulations. This shift is supporting the expansion of acrylic-based coatings in the market, particularly within the residential and commercial building sectors. Other resin types, including nitrocellulose and unsaturated polyester, continue to serve niche applications, but their growth is relatively slower compared to polyurethane and acrylic resins.

Wood Coatings Market Outlook – Technology-Based Insights

The wood coatings market, by technology, is segmented into waterborne, solvent-borne, powder coating, radiation cured, and others. The waterborne segment holds the largest market share, driven by its environmental advantages and compliance with increasingly stringent VOC regulations. Waterborne coatings are favored for their lower levels of toxicity, easier application, and reduced environmental impact, making them a preferred choice in regions with strict environmental regulations, such as Europe and North America. As sustainability becomes a more significant factor in consumer and industrial decision making, the waterborne segment is registering the highest growth. This growth is also supported by advancements in resin formulations that enhance the performance of waterborne coatings, such as improved resistance to stains, scratches, and UV degradation, making them suitable for a wide range of applications, from furniture to flooring.

The solvent-borne segment remains important in the wood coatings market, particularly in regions where environmental regulations are less stringent. These coatings are preferred for certain applications due to their excellent durability and ability to perform well under harsh conditions. However, the growth of the solvent-borne segment is slower compared to waterborne coatings due to increasing regulatory pressures. Powder coatings are also gaining traction, particularly in industrial applications, where durability and resistance to extreme conditions are critical. Although they currently hold a smaller market share compared to waterborne and solvent-borne technologies, powder coatings are expected to experience steady growth, driven by their eco-friendly attributes, such as zero VOC emissions. Radiation-cured coatings, while still a niche segment, are advancing in technological applications, offering fast curing times and high performance in specific industries, particularly in areas that demand precision and speed.

Wood Coatings Market Evaluation – Application-Based Insights

The wood coatings market, by application, is segmented into furniture, joinery, flooring & decking, siding, and others. The furniture segment holds the largest share of the wood coatings market revenue, driven by the continuous demand for high-quality and visually appealing furniture products. As consumer preferences for durable, aesthetically pleasing furniture grow, the need for coatings that provide both protection and enhanced appearance is rising. This segment includes coatings for wooden surfaces in residential, commercial, and office furniture, with a significant emphasis on finishes that offer long-lasting durability, scratch resistance, and moisture protection. The growth in the furniture sector is supported by trends in interior design, where wood finishes are highly sought after for their natural aesthetic and versatility. The increased demand for premium furniture and custom designs is contributing to the strong market presence of this segment.

The flooring & decking segment is experiencing the highest growth, driven by the rising popularity of hardwood flooring and outdoor wooden decking. With more consumers opting for hardwood floors and outdoor wooden structures due to their durability and visual appeal, the demand for protective coatings that enhance the lifespan of these surfaces is increasing. Wood coatings for flooring and decking must offer resistance to abrasion, moisture, UV rays, and wear, making high-performance coatings highly sought after in these applications. Additionally, the growing trend of home renovations and outdoor living spaces is further driving the expansion of the flooring and decking segment. Other applications, such as siding, continue to serve specific markets but do not show the same level of growth as the flooring and decking segment.

Wood Coatings Market Regional Insights

By region, the study provides wood coatings market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific holds the largest share of the global wood coatings market revenue, driven by rapid urbanization, rising infrastructure development, and the booming furniture and construction industries in countries such as China, India, and Southeast Asian nations. The region’s growing middle-class population and rising disposable incomes are fueling demand for aesthetically pleasing, premium, and durable wood products, further boosting the adoption of advanced wood coatings. Additionally, the presence of a strong manufacturing base for furniture and building materials, coupled with increasing investments in home improvement and renovation activities, supports market growth in the region. While other regions such as North America and Europe are witnessing steady growth due to advancements in eco-friendly coatings and strict regulatory standards, the sheer scale of demand and production in Asia Pacific makes it the dominant regional market. Key countries, including China, India, and Japan, are significant contributors to the Asia Pacific wood coatings market expansion, with China being a leading producer of furniture and wood products globally. Additionally, the presence of major manufacturing hubs and a growing focus on eco-friendly coatings, particularly waterborne formulations, further strengthen the market’s position in the region.

Europe is a significant market for wood coatings, supported by stringent environmental regulations and a strong emphasis on sustainability. The demand for low-VOC and waterborne coatings is particularly high in the region as manufacturers comply with the European Union’s strict environmental standards. Germany, Italy, and France are among the key contributors, with a well-established furniture and construction industry driving the adoption of high-performance coatings. Additionally, the growing trend of renovation and restoration projects, especially in Western Europe, is boosting demand for wood coatings that enhance durability and aesthetics.

Wood Coatings Market – Key Players and Competitive Insights

The wood coatings market comprises several prominent companies actively contributing to its growth and innovation. A few notable players include PPG Industries, Inc.; The Sherwin-Williams Company; Akzo Nobel N.V.; Nippon Paint Holdings Co., Ltd.; RPM International Inc.; Axalta Coating Systems; BASF SE; Asian Paints Limited; Kansai Paint Co., Ltd.; Masco Corporation; Jotun; Hempel A/S; Benjamin Moore & Co.; SKSHU Paint Co., Ltd.; and Berger Paints India Limited. These companies offer a diverse range of wood coating products catering to various applications and industries.

In the competitive landscape, The Sherwin-Williams Company stands out with its extensive product portfolio and global reach, further strengthened by its acquisition of Sayerlack, an Italian wood coatings manufacturer. PPG Industries, Inc. maintains a strong market position through continuous innovation and a broad range of coating solutions. Akzo Nobel N.V. emphasizes sustainability, offering eco-friendly products to meet the growing demand for environmentally responsible coatings. Nippon Paint Holdings Co., Ltd. leverages its technological expertise to provide high-performance wood coatings, while RPM International Inc. focuses on specialty coatings, serving niche markets effectively.

Regional players contribute significantly to the wood coatings market dynamics. Asian Paints Limited, based in India, has a substantial presence in Asia Pacific; it offers products tailored to local preferences and climatic conditions. Kansai Paint Co., Ltd., a Japanese company, expands its footprint through strategic partnerships and a focus on innovation. European companies such as Jotun and Hempel A/S maintain strong positions in the market by providing high-quality coatings and expanding their global distribution networks. Overall, the wood coatings market is characterized by a mix of global and regional players, each contributing to the industry's growth through diverse strategies and offerings.

PPG Industries, Inc., established in 1883 and headquartered in Pittsburgh, Pennsylvania, is a global supplier of paints, coatings, and specialty materials. The company operates in various sectors, including industrial, automotive, and architectural coatings, serving customers worldwide. PPG emphasizes innovation and sustainability in its product offerings.

The Sherwin-Williams Company, founded in 1866 and based in Cleveland, Ohio, specializes in the manufacture, distribution, and sale of paints, coatings, and related products. With a vast network of over 5,000 stores across the US, Canada, Latin America, and the Caribbean, Sherwin-Williams serves professional and DIY markets. The company focuses on expanding its global footprint and developing environmentally friendly products.

List of Key Companies in Wood Coatings Market

- Akzo Nobel N.V.

- Asian Paints Limited

- Axalta Coating Systems

- BASF SE

- Benjamin Moore & Co.

- Berger Paints India Limited

- Hempel A/S

- Jotun

- Kansai Paint Co., Ltd.

- Masco Corporation

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- SKSHU Paint Co., Ltd.

- The Sherwin-Williams Company

Wood Coatings Industry Developments

- In September 2024, Sherwin-Williams has launched SHER-WOOD Environmentally Adaptive (EA) Hydroplus technology, an innovative waterborne wood coating that performs effectively across various environmental conditions without the productivity drawbacks typically linked to waterborne coatings.

- In June 2024, Axalta Building Products, a division of Axalta Coating Systems, has introduced the Zenamel range of solutions designed for the cabinet manufacturing market.

Wood Coatings Market Segmentation

By Resin Type Outlook

- Polyurethane

- Acrylic

- Nitrocellulose

- Unsaturated Polyester

- Others

By Technology Outlook

- Waterborne

- Solvent-Borne

- Powder Coating

- Radiation Cured

- Others

By Application Outlook

- Furniture

- Joinery

- Flooring & Decking

- Siding

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Wood Coatings Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 12.88 billion |

|

Market Size Value in 2025 |

USD 13.21 billion |

|

Revenue Forecast by 2034 |

USD 16.93 billion |

|

CAGR |

2.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The wood coatings market has been segmented into detailed segments of resin type, technology, and application. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: The wood coatings market growth and marketing strategies focus on product innovation, sustainability, and geographic expansion. Manufacturers are investing in developing eco-friendly coatings, such as waterborne and low-VOC products, to meet environmental regulations and consumer demand for sustainable solutions. Strategic partnerships, mergers and acquisitions, and collaborations are being leveraged to expand market presence and enhance distribution networks. Additionally, companies are targeting high-growth regions such as Asia Pacific, where urbanization and increasing disposable incomes drive demand for wood coatings in furniture and construction applications. Digital marketing and direct engagement with end users also play a crucial role in promoting premium product offerings.

FAQ's

The wood coatings market size was valued at USD 12.88 billion in 2024 and is projected to grow to USD 16.93 billion by 2034.

The market is projected to register a CAGR of 2.8% during the forecast period.

Asia Pacific held the largest share of the market in 2024.

A few key players in the wood coatings market are PPG Industries, Inc.; The Sherwin-Williams Company; Akzo Nobel N.V.; Nippon Paint Holdings Co., Ltd.; RPM International Inc.; Axalta Coating Systems; BASF SE; Asian Paints Limited; Kansai Paint Co., Ltd.; Masco Corporation; Jotun; Hempel A/S; Benjamin Moore & Co.; SKSHU Paint Co., Ltd.; and Berger Paints India Limited.

The polyurethane segment dominated the wood coatings market share in 2024.

The waterborne segment holds the largest market share in 2024.

Wood coatings are protective and decorative finishes applied to wooden surfaces to enhance their durability, appearance, and resistance to environmental factors such as moisture, UV light, and wear. These coatings are commonly used in applications such as furniture, flooring, decking, and joinery to improve the wood's lifespan and maintain its aesthetic appeal. Wood coatings can be formulated using various resins such as polyurethane, acrylic, and nitrocellulose and are available in different technologies, including waterborne, solvent-borne, and radiation-cured options. They are designed to meet specific performance requirements while also addressing environmental and regulatory considerations, particularly through the development of low-VOC and eco-friendly products.

A few key trends in the market are described below: Rising Demand for Eco-Friendly Products: Increasing emphasis on sustainability is driving the adoption of low-VOC, waterborne, and bio-based coatings to meet environmental regulations and consumer preferences. Growth in Furniture and Construction Sectors: Expanding residential, commercial, and infrastructure projects globally are fueling demand for wood coatings in furniture, flooring, and decking applications. Technological Advancements: Innovations in coating technologies, such as UV-curable and powder coatings, are gaining traction for their superior performance, faster curing times, and reduced environmental impact. Increased Focus on Aesthetic Appeal: Growing consumer interest in high-quality finishes that enhance the visual and tactile aspects of wood surfaces is driving the development of premium coatings.

A new company entering the wood coatings market could focus on developing eco-friendly and low-VOC products to align with growing environmental regulations and consumer demand for sustainable solutions. Investing in innovative technologies, such as waterborne and UV-curable coatings, would provide a competitive edge in terms of performance and application efficiency. Targeting high-growth regions such as Asia Pacific, where rapid urbanization and construction activities drive demand, can offer significant opportunities. Additionally, building strong distribution networks and leveraging digital marketing to reach diverse customer bases would help establish a strong market presence. Emphasizing customization and premium finishes for furniture and flooring applications could further differentiate the company's offerings.

Companies manufacturing, distributing, or purchasing wood coatings and related products and other consulting firms must buy the report.