Women’s Health App Market Share, Size, Trends, Industry Analysis Report, By Type; By Service (Wellness & Fitness, Remote Monitoring, Diagnosis & Consultation); By Application; By Region; Segment Forecast, 2021 - 2028

- Published Date:Oct-2021

- Pages: 128

- Format: PDF

- Report ID: PM2019

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

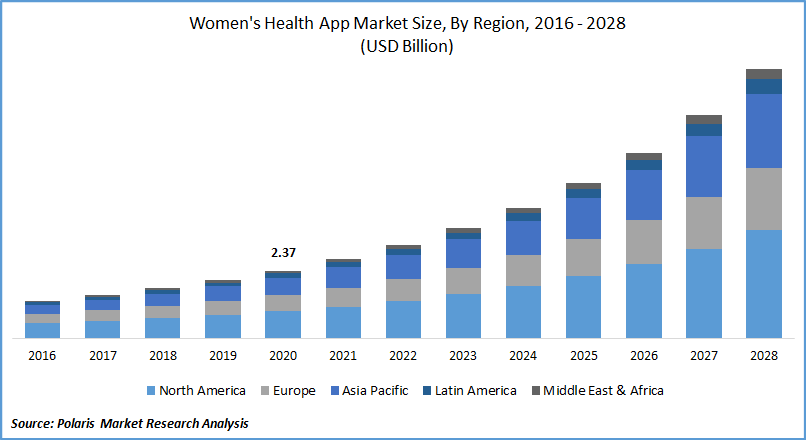

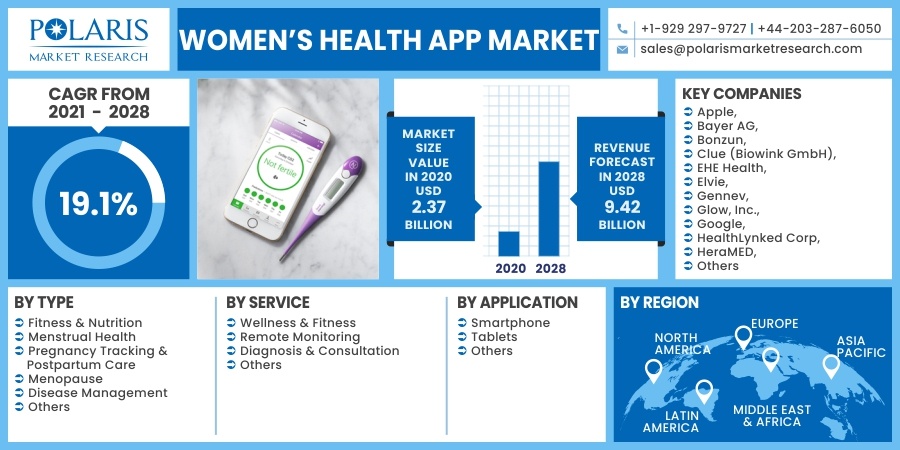

The global women’s health app market was valued at USD 2.37 billion in 2020 and is expected to grow at a CAGR of 19.1% during the forecast period. Market growth is driven by the rise in the incidence of target diseases among women, along with the growing utilization of mobile phones to maintain women’s health and fitness—also, the hectic work schedule of women due to the rising working female population.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Increasing government and private investments also contribute towards the adoption of women’s well-being software. For instance, in October 2020, the University of Queensland and the University of Newcastle received a funding of USD 8.5 million over the next three years from 2020, intending to study (South Korean Longitudinal Study on Women’s Health) on women’s well-being status across South Korea.

Furthermore, the rise in technological breakthroughs and the emerging digital world are expanding the growth of the global women’s health app market. In addition, several companies are advancing health software for women’s well-being that predominantly emphasize distinct women’s health aspects and recommend the user for its treatment, which expands the global market.

The COVID-19 pandemic has had a negative impact on women’s fitness in the market. Medtech developers and providers are facing significant disruptions in their business operations, which is suspending the products' deliveries. In April 2021, a study performed by the University of Chicago Medicine has registered an increased occurrence of Health-related Socioeconomic Risks (HRSRs) that include food security and interpersonal violence associated with mental well-being.

The study analyzed around 3,200 women beyond 18 in the United States between April 10 to April 24, 2020. However, the risk of infection and other challenges related to staying at the medical facilities is projected to result in a high preference for well-being app as a substitute leading to market growth in recent years.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The continual variations in dietary habits, anxiety, and consumption of alcohol are major factors accountable for hormonal imbalance among women. Typically, they are more susceptible to few diseases, especially after menopause, such as Osteoarthritis (OA), menstrual disorders, anemia, obesity, fibromyalgia, and depression. With aging and the rising prevalence of obesity, the occurrence of OA is estimated to increase at a significant rate.

According to the World Health Organization (WHO), nearly 10 to 15% of all individuals aged more than 60 years have some form of OA, and the condition is more prevalent in women than men. Thus, the constant rise in cases of women's well-being conditions, coupled with growing consumer spending for maintaining well-being, is paving toward women's health fitness, which eventually accelerates the demand for women’s health app market all over the world.

To promote the proficiency of mobile software by key players cooperating with health organizations, Flo Health and Clue are some market players who received a high amount of funds for updating existing applications and introducing innovative applications. Hence, it plays a critical role in changing the women’s health app market dynamics during the forecast period.

Report Segmentation

The market is primarily segmented on the basis of type, service, application, and region.

|

By Type |

By Service |

By Application |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Type

On the basis of type segment, the menstrual health segment is projected to register the largest market share in the global market over the foreseen period. Menstrual women’s well-being apps generally support tracking ovulation and instructing women who intend to prevent or conceive a pregnancy. The market holds a considerable share on account of the rise in the adoption of menstrual cycle tracking software along with the growing technological developments and innovations in such women’s well-being applications worldwide.

Further, companies including Apple, Google, and FitBit specialize in introducing and advancing menstrual women’s well-being apps. Thus the segment is gaining wide prominence in segmental growth all over the world. For instance, in June 2019, Apple added a menstrual cycle tracking software, namely Cycle Tracker, which is consistent with Apple’s Health App on the impending Watch OS 6 and iOS 13 update. Such initiative is also projected to strengthen the demand for menstrual women’s well-being software around the world.

Fitness and nutrition women’s health app segment accounted for the fastest CAGR over the forecast period, and hence, is witnessing considerable market growth throughout the world. This can be attributed to factors, such as the rapid rise in consumer shift towards a better lifestyle and wellness therapies.

Geographic Overview

Geographically, North America dominated the global market in 2020 due to the rise in the adoption of mobile well-being software for tracking pregnancy, menstrual cycles, and fitness, along with the growing government initiatives in curbing medical costs in the region. In addition to this, the rise in the prevalence of women's well-being conditions and the growing proliferation of smart-phones and other advanced devices among females is further driving the market growth in this region.

As per U.S. Census data and Simmons National Consumer Survey (NHCS), in 2020, there were around 31.31 million women reported pre-menstrual syndrome (PMS). Besides, the Center for Disease Control and Prevention in 2019 reported heart-related ailments are the leading cause of death among women, accounting for almost 3,01,280 deaths. Thus, the rise in both chronic and acute health conditions among women, making it a considerable opportunity for the women’s healthcare software in the market.

Moreover, Asia Pacific is expected to witness considerable growth in the global market in 2020. The demand for women’s well-being software in the region is attributed to an increase over the forecast period, owing to the rising demand for efficient medical technology along with a rise in the penetration of smartphones and internet access in the market. As per the International Journal of Health Sciences and Research (IJHSR), the overall occurrence of menstrual disorders was estimated at 76.9% in 2019. The most prevalent menstrual disorder was PMS that accounted for 71.3%. Dysmenorrhoea estimated 46.3%, followed by polymenorrhea (22.2%), amenorrhoea (21.3%), menorrhagia (15.9%), hypomenorrhea (15%), and oligomenorrhea (12.8%).

Competitive Landscape

Some of the Major Players operating in the global market are Apple, Bayer AG, Bonzun, Clue (Biowink GmbH), EHE Health, Elvie, Gennev, Glow, Inc., Google, HealthLynked Corp, HeraMED, LactApp, Miracare, Natural Cycles USA Corp, NURX Inc., Ovia Health, Pregnascan, and Withings.

These players in the market are often involved in a study to develop advanced solutions that can mitigate the risk to women’s well-being. For instance, in July 2020, U.S.-based Evvy entered the race to develop data sets to aid research into and awareness about the health concerns that affect women’s well-being.

Women’s Health App Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 2.37 billion |

|

Revenue forecast in 2028 |

USD 9.42 billion |

|

CAGR |

19.1% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Type, By Service, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Apple, Bayer AG, Bonzun, Clue (Biowink GmbH), EHE Health, Elvie, Gennev, Glow, Inc., Google, HealthLynked Corp, HeraMED, LactApp, Miracare, Natural Cycles USA Corp, NURX Inc., Ovia Health, Pregnascan, and Withings |