Wireless Gigabit Market Size, Share, Trends, Industry Analysis Report: By Offering (SoC and Module), Protocol, Channel, Product, End-User Industry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 137

- Format: PDF

- Report ID: PM5227

- Base Year: 2024

- Historical Data: 2020-2023

Wireless Gigabit Market Overview

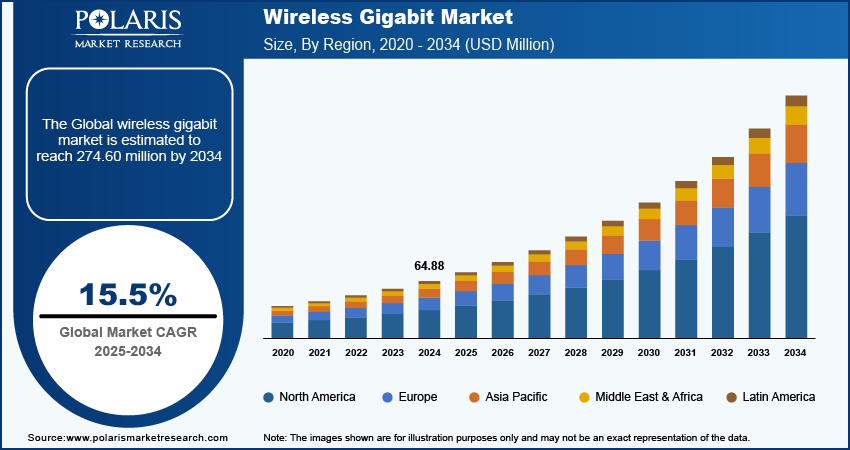

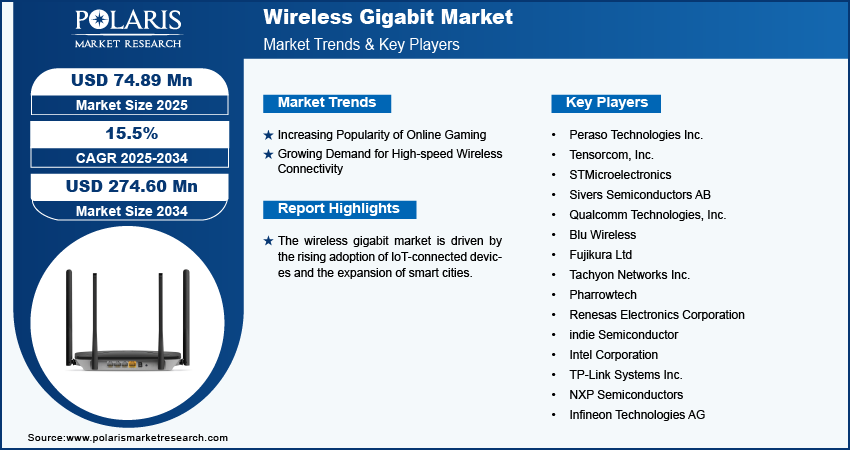

The global wireless gigabit market size was valued at USD 64.88 million in 2024. The market is projected to grow from USD 74.89 million in 2025 to USD 274.60 million by 2034, exhibiting a CAGR of 15.5% during 2025–2034.

Wireless gigabit, also known as 802.11ad or WiGig, is a high-speed wireless communication technology that majorly operates in the 60 GHz frequency band. Wireless gigabits typically offer data rates up to 7 Gbps, which is significantly faster than traditional Wi-Fi technologies. The networks consist of devices and routers that communicate using 60 GHz millimeter waves.

The growing demand for high-speed wireless connectivity is driving the wireless gigabit market. The development of wireless gigabit standards such as Wi-Fi 6 and Wi-Fi 6E provides significant performance improvements over previous generations. Advancements in wireless gigabit, such as higher speeds, lower latency, and better handling of multiple connections, address the increasing demand for fast and reliable wireless connectivity.

The increasing popularity of online gaming is estimated to expand the global wireless gigabit market in the coming years. Online games with high-resolution graphics, complex environments, and real-time multiplayer interactions demand rapid data transfer to minimize lag and maintain high performance. Wireless gigabit technology provides the high speeds necessary to support these requirements.

The demand for IoT-connected devices is rising across the world. As per published data, the number of IoT-connected devices is estimated to grow by ∼2.5 times between 2021 and 2030. IoT devices such as smart home appliances, sensors, cameras, and wearable tech generate large amounts of data that need to be transmitted over the network. Wireless gigabit technology, with its high data transfer rates, helps manage this inflow of data efficiently. Therefore, the rising adoption of IoT-connected devices propels the growth of the wireless gigabit market.

Wireless Gigabit Market Dynamics

Wireless Gigabit Market Opportunities and Drivers Analysis

Increasing Deployment of 5G Network

5G networks bring high-speed, low-latency connectivity to mobile devices. This shift raises user expectations for high-speed wireless connectivity across all devices, not just those on 5G networks. To match the performance and experience of 5G, users and businesses seek wireless gigabit solutions for their local networks, ensuring consistency in speed and responsiveness across all devices and applications. According to data published by the Groupe Speciale Mobile Association (GSMA), 5G infrastructure or networks are likely to cover one-third of the world's population by 2025. Thus, the increasing deployment of 5G networks is expected to create an immense opportunity for the wireless gigabit market during the forecast period.

Expansion of Smart Cities

Smart cities rely on a vast network of connected devices and sensors to manage infrastructure, public services, and utilities efficiently. These devices, ranging from traffic cameras and environmental sensors to smart streetlights and public Wi-Fi hotspots, generate large amounts of data. Wireless gigabit technology provides the high-speed connectivity required to handle this data traffic effectively. Thus, the expansion of smart cities across the globe fuels the wireless gigabit market growth.

Wireless Gigabit Market Segment Analysis

Wireless Gigabit Market Assessment by Offering Insights

In terms of offering, the global wireless gigabit market is bifurcated into SoC and module. The module segment dominated the market in 2024 and is expected to continue its dominance during the forecast period, owing to the increasing demand for modular solutions that offer flexibility and ease of integration into various devices and systems. Modules that incorporate high-speed connectivity features enable manufacturers to quickly upgrade their products and meet evolving market demands. The rising adoption of IoT and smart devices, which require reliable and high-performance communication modules, contributes significantly to this growth. Furthermore, as industries adopt advanced technologies such as edge computing and smart manufacturing, they rely on connectivity modules to ensure seamless integration and high data throughput.

Wireless Gigabit Market Evaluation by Product Insights

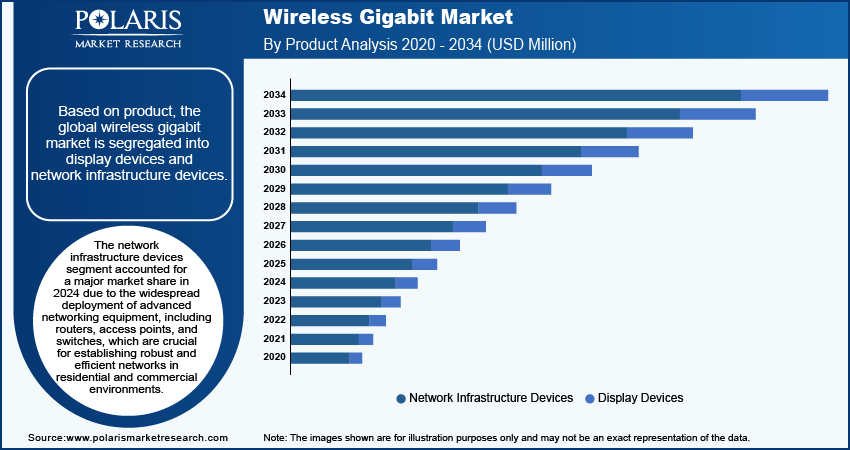

Based on product, the global wireless gigabit market is segregated into display devices and network infrastructure devices. The network infrastructure devices segment accounted for a major market share in 2024 due to the widespread deployment of advanced networking equipment, including routers, access points, and switches, which are crucial for establishing robust and efficient networks in residential and commercial environments. The rapid adoption of smart devices and the proliferation of high-bandwidth applications drove the demand for upgraded network infrastructure capable of supporting faster and more reliable connectivity. Businesses, in particular, invested heavily in network infrastructure to enhance performance, ensure scalability, and support the increasing data traffic resulting from cloud computing, video conferencing, and other data-intensive applications.

The display devices segment is estimated to grow at a rapid pace during the forecast period owing to the rapid adoption of high-definition displays in consumer electronics, such as smartphones, tablets, and laptops. Additionally, the proliferation of high-definition streaming services and the expansion of virtual reality applications fueled the demand for advanced display technologies.

Wireless Gigabit Market Share by Region

By region, the study provides the wireless gigabit market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest market share in 2024 due to the advanced technological infrastructure and high consumer demand for robust and reliable connectivity. The widespread adoption of smart devices, proliferation of high-definition streaming services, and the growth of remote work have contributed to North America's dominant position. The US, in particular, drives this growth due to its large investment in upgrading network infrastructure and supporting the latest connectivity standards. The rapid deployment of 5G networks and the extensive presence of tech giants in the region fueled the demand for high-speed solutions such as wireless gigabit.

The Asia Pacific wireless gigabit market is expected to record a significant CAGR during the forecast period due to rapid urbanization, expanding middle-class population, and significant investments in technology infrastructure. Countries such as China and India are expanding this growth due to their large populations and increasing adoption of smart devices and high-speed internet services. The large tech industry in Asia Pacific, with a focus on innovation and large-scale production of electronics, supports the widespread deployment of wireless gigabit. Additionally, the push toward digital transformation and industrial smart city initiatives in the region drives demand for advanced connectivity solutions such as wireless gigabit. In August 2024, the government of India approved 12 new industrial smart cities across the country to strengthen India's domestic manufacturing ecosystem, attract foreign investments, and boost job creation.

Wireless Gigabit Market – Key Players and Competitive Analysis Report

Major market players are investing heavily in research and development to expand their offerings, which will boost the wireless gigabit market growth in the coming years. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments such as innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations. To expand and survive in a more competitive and rising market environment, the market players must offer innovative solutions.

The wireless gigabit market is fragmented, with the presence of numerous global and regional market players. The players are leveraging extensive resources and customer bases to enhance wireless gigabit capabilities. A few major players in the wireless gigabit market are Peraso Technologies Inc.; Tensorcom, Inc.; STMicroelectronics; Sivers Semiconductors AB; Qualcomm Technologies, Inc.; Blu Wireless; Fujikura Ltd.; Tachyon Networks Inc.; Pharrowtech; Renesas Electronics Corporation; indie Semiconductor; Intel Corporation; TP-Link Systems Inc.; NXP Semiconductors; and Infineon Technologies AG.

Peraso Technologies Inc., established in 2008, is a major semiconductor company specializing in the development of millimeter-wave (mmWave) technology, particularly focusing on wireless gigabit solutions. The company is recognized for its innovative chipsets that enable high-speed data transfer, low latency, and reliable connectivity. In January 2022, Peraso Inc. received a USD 3M order to supply 60 GHz modules from a tier 1, fixed wireless OEM for its PRM2140X 802.11ad mmWave phased array modules.

Sivers Semiconductors AB, founded in 1990, is a prominent technology company based in Sweden specializing in advanced semiconductor solutions for wireless and optical communication systems. The company focuses on providing integrated chips and modules that are crucial for high-performance gigabit wireless networks and optical systems. In February 2022, Sivers Semiconductors AB announced the acquisition of MixComm Inc. to strengthen its customer base across the US, Europe, and Asia.

Key Companies in Wireless Gigabit Industry Outlook

- Peraso Technologies Inc.

- Tensorcom, Inc.

- STMicroelectronics

- Sivers Semiconductors AB

- Qualcomm Technologies, Inc.

- Blu Wireless

- Fujikura Ltd

- Tachyon Networks Inc.

- Pharrowtech

- Renesas Electronics Corporation

- indie Semiconductor

- Intel Corporation

- TP-Link Systems Inc.

- NXP Semiconductors

- Infineon Technologies AG

Wireless Gigabit Industry Developments

July 2024: Tachyon Networks Inc., a technology developer and network service provider, introduced fixed wireless products based on Peraso 60 GHz mmWave technology to address the growing demand for reliable broadband solutions.

February 2022: Pharrowtech, a company that designs and develops mmWave hardware and software for next-generation wireless applications, launched the 60 GHz CMOS radio chip and phased antenna array for 5G unlicensed fixed wireless access, wireless infrastructure, and consumer applications.

May 2021: TP-Link Systems Inc., a global multinational group in consumer networking, consumer electronics, enterprise networking, enterprise security, software, and cloud services, launched the AC1200 Gigabit WiFi Router Archer C64. Archer C64 has better wireless performance on the 2.4GHz band at 400 Mbps compared to most routers on the market, which operate at 300 Mbps.

Wireless Gigabit Market Segmentation

By Offering Outlook (Revenue, USD Million, 2020–2034)

- SoC

- Module

By Protocol Outlook (Revenue, USD Million, 2020–2034)

- IEEE 802.11 ad

- IEEE 802.11 ay

By Channel Outlook (Revenue, USD Million, 2020–2034)

- 57–59 GHz

- 59–61 GHz

- 61–63 GHz

- 63–65 GHz

- Others

By Product Outlook (Revenue, USD Million, 2020–2034)

- Display Devices

- Network Infrastructure Devices

By End-User Industry Outlook (Revenue, USD Million, 2020–2034)

- Telecom

- Automotive

- Consumer Electronics

- Railway

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Wireless Gigabit Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 64.88 million |

|

Market Size Value in 2025 |

USD 74.89 million |

|

Revenue Forecast by 2034 |

USD 274.60 million |

|

CAGR |

15.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global wireless gigabit market size was valued at USD 64.88 million in 2024 and is projected to grow to USD 274.60 million by 2034.

The global market is projected to register a CAGR of 15.5% during the forecast period.

North America accounted for the largest share of the global market in 2024.

A few key players in the market are Peraso Technologies Inc.; Tensorcom, Inc.; STMicroelectronics; Sivers Semiconductors AB; Qualcomm Technologies, Inc.; Blu Wireless; Fujikura Ltd.; Tachyon Networks Inc.; Pharrowtech; Renesas Electronics Corporation; indie Semiconductor; Intel Corporation; TP-Link Systems Inc.; NXP Semiconductors; and Infineon Technologies AG.

The module segment is projected for significant growth in the global market during the forecast period.

The network infrastructure devices segment dominated the market in 2024