Global Wind Turbine Protection Market Size, Share, Trends, Industry Analysis Report: By Protection Type (Coatings and Tapes & Films), Equipment, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025 - 2034

- Published Date:Dec-2024

- Pages: 120

- Format: PDF

- Report ID: PM5125

- Base Year: 2024

- Historical Data: 2020-2023

Wind Turbine Protection Market Overview

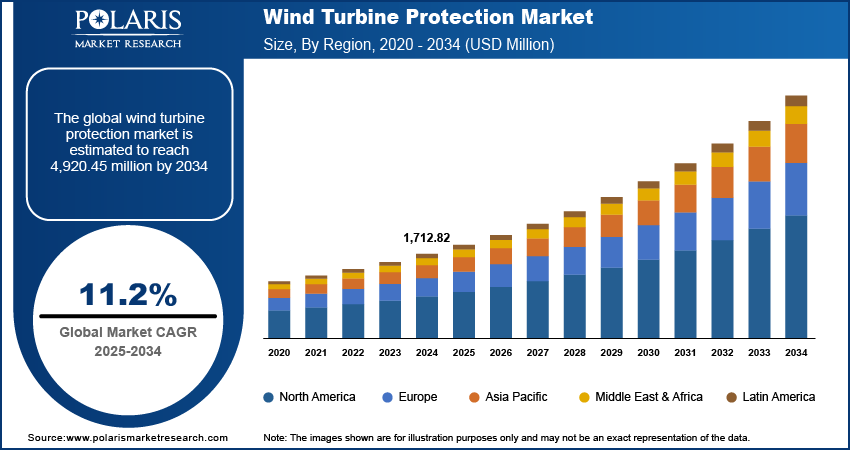

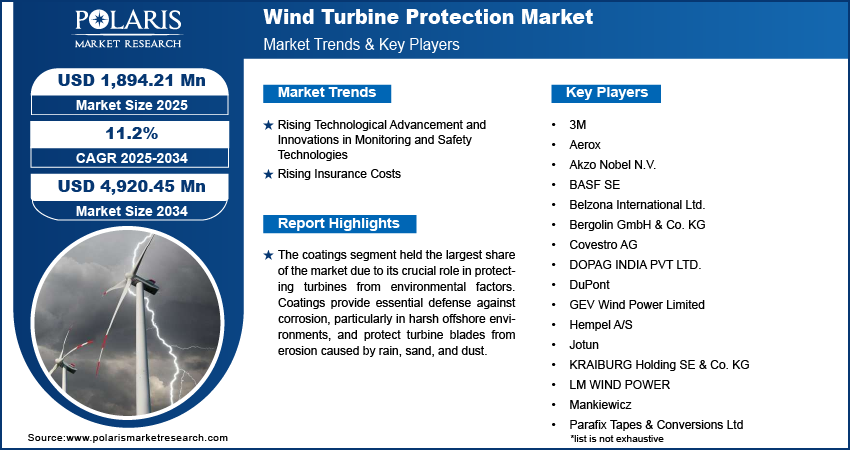

Global wind turbine protection market size was valued at USD 1,712.82 million in 2024. It is projected to grow from USD 1,894.21 million in 2025 to USD 4,920.45 million by 2034, exhibiting a CAGR of 11.2% during the forecast period.

Wind turbine protection refers to the materials and technologies designed to safeguard wind turbine components, including blades, nacelles, and towers, from environmental damage and operational wear. This market encompasses various protective solutions such as leading-edge protection systems, anti-corrosion coatings, and erosion-resistant materials. These address challenges such as rain erosion, UV radiation, and mechanical impacts that can hamper turbine efficiency and lifespan.

To Understand More About this Research: Request a Free Sample Report

The drivers for the Wind Turbine Protection Market are primarily fueled by the rising awareness of climate change and the global shift toward sustainable energy. As governments, businesses, and investors increasingly prioritize reducing carbon emissions and transitioning to clean energy, there is significant growth in the renewable energy sector, particularly in wind power. This surge in investment is accelerating the development and deployment of wind farms worldwide. For instance, in August 2024, the National Farmers' Union (NFU) called for a coordinated offshore transmission network to minimize farmland disruption while supporting offshore wind energy expansion. Additionally, the growing demand for advanced protection systems is essential to safeguard wind turbines, ensuring their efficiency, preventing potential damage, and extending their operational lifespan. These factors are collectively driving the expansion of the Wind Turbine Protection Market.

The growing offshore wind sector is driving the wind turbine protection market demand. Offshore wind installations are expanding rapidly, with countries investing heavily in renewable energy infrastructure to meet climate targets. However, offshore turbines face challenges due to their exposure to harsh marine environments, including severe weather conditions, saltwater corrosion, and high humidity. These harsh conditions accelerate the degradation of turbine components, making robust protection essential to maintain performance and extend the lifespan of offshore wind farms. As a result, there is an increasing demand for specialized protective measures, such as advanced coatings and materials to protect wind turbines.

Wind Turbine Protection Market Dynamics

Rising Technological Advancement and Innovations in Monitoring and Safety Technologies

The Wind Turbine Protection Market is being significantly driven by technological advancements and innovations in monitoring and safety technologies. As the wind energy sector continues to grow, there is a heightened focus on improving the operational efficiency and longevity of wind turbines. Advances in sensor technologies, predictive maintenance systems, and real-time monitoring solutions are allowing for more accurate detection of potential issues and failures, enabling proactive maintenance. These innovations not only enhance the safety of wind turbines by preventing damage from mechanical or environmental stresses but also help optimize energy output by ensuring that turbines operate at peak performance.

Furthermore, developments in artificial intelligence (AI) and machine learning (ML) are enabling smarter diagnostics and automated responses to changing operational conditions, thereby minimizing downtime and extending the lifespan of wind turbines. As a result, these technological innovations are essential in driving the growth of the Wind Turbine Protection Market by ensuring safer, more efficient, and cost-effective wind energy production.

Rising Insurance Costs

Rising insurance premiums for wind turbines are becoming a growing concern due to the risks of potential damage and operational downtime. As insurance costs increase, wind farm operators are investing in advanced protection systems to mitigate these risks. By implementing effective protection measures, operators can reduce the frequency and severity of claims, which can help lower their insurance premiums. According to an April 2024 natural disaster damage report, rising insurance costs for clean energy projects—driven by natural disasters and higher reinsurance rates—are leading to increased power purchase agreement (PPA) prices and stricter coverage limits.

Advanced protection systems not only guard against physical damage but also minimize operational disruptions, improving reliability and reducing maintenance costs. As a result, adopting advanced protection technologies are becoming a strategic approach for wind turbine operators to manage financial risks and enhance overall cost-efficiency.

Wind Turbine Protection Market Segment Insights

Wind Turbine Protection Market Breakdown By Protection Type

The global wind turbine protection market segmentation, based on protection type, includes coatings, and tapes & films. The coatings segment held the largest share of the market due to its crucial role in protecting turbines from environmental factors. Coatings provide essential defense against corrosion, particularly in harsh offshore environments, and protect turbine blades from erosion caused by rain, sand, and dust. This helps maintain the aerodynamic efficiency of the blades and extends the operational lifespan of turbines by preventing wear and degradation.

Moreover, coatings help reduce maintenance costs by minimizing the need for frequent repairs, which is especially valuable for remote or offshore installations. Technological advancements in coatings, such as self-healing and anti-fouling properties, further improve their durability and performance. As the wind energy sector continues to grow, particularly with the expansion of offshore installations, the demand for these protective coatings is expected to remain strong, ensuring their continued dominance in the market.

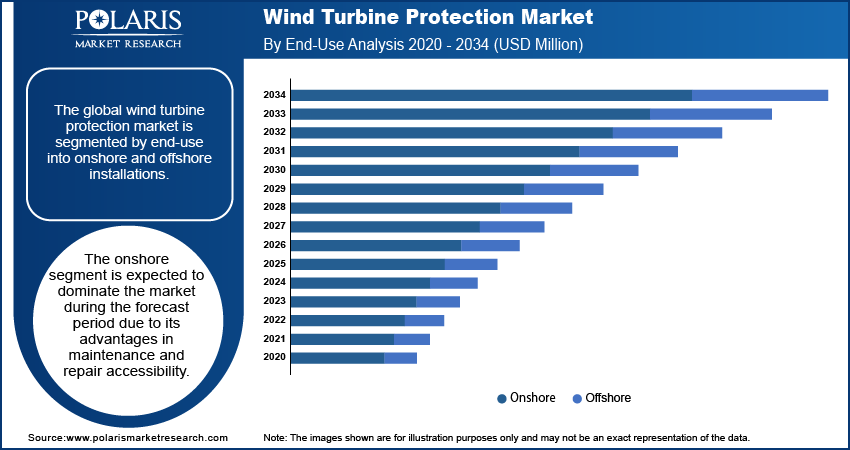

Wind Turbine Protection Market Breakdown By End-Use Insights

The global wind turbine protection market is segmented by end-use into onshore and offshore installations. The onshore segment is expected to dominate the market during the forecast period due to its advantages in maintenance and repair accessibility. Onshore turbines are easier to access than offshore installations, reducing the need for specialized equipment and personnel, which results in significant cost savings and improved operational efficiency.

Additionally, onshore wind farms often utilize existing infrastructure such as roads, power lines, and communication networks, minimizing the need for extensive new infrastructure development. This advantage further reduces costs and accelerates project timelines. The combination of lower initial capital expenditures and fewer logistical challenges makes onshore wind projects more financially viable and attractive to investors.

Wind Turbine Protection Regional Insights

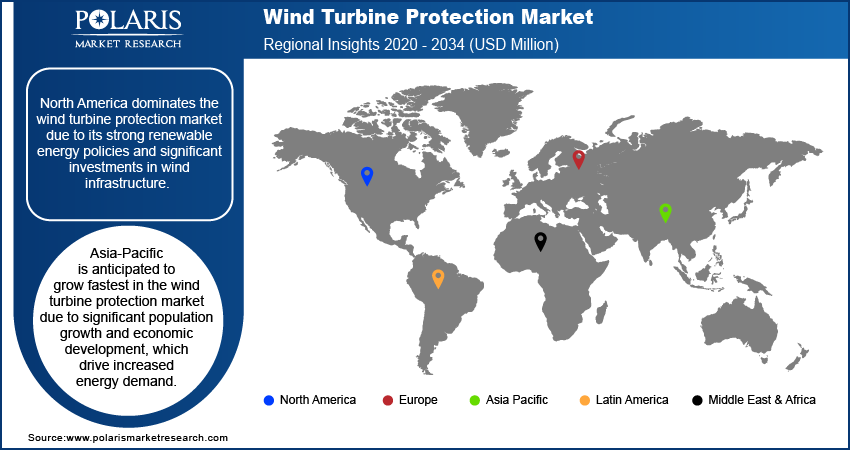

By region, the study provides the market insights into North America, Europe, Asia-Pacific Latin America, and Middle East & Africa.

North America dominates the wind turbine protection market due to its strong renewable energy policies and significant investments in wind infrastructure. The U.S. and Canada have implemented supportive measures such as tax incentives and subsidies, which encourage the growth of wind energy projects. For instance, in August 2023, the U.S. Department of Energy reported that wind power continues to grow rapidly, accounting for 22% of new electricity capacity in 2022, driven by transformative tax incentives and substantial investments in both land-based and offshore wind energy. This expansion drives the need for advanced protection systems to safeguard these assets, especially given the region’s various and sometimes severe weather conditions.

North America’s leadership in technological innovation and its mature wind energy market contribute to its dominance. Companies in the region are at the forefront of developing and deploying advanced protection technologies, such as lightning protection systems and predictive maintenance solutions. The combination of these factors ensures a high demand for effective protection solutions to enhance the operational efficiency and longevity of wind turbines.

Asia-Pacific is anticipated to grow fastest in the wind turbine protection market due to significant population growth and economic development, which drive increased energy demand. Countries like China, India, and Japan are expanding their wind power capacity to meet these demands and achieve renewable energy targets. For instance, China’s large-scale wind projects and India’s supportive policies, such as the National Wind-Solar Hybrid Policy, are driving this expansion and increasing the need for advanced protection solutions.

Additionally, the region is witnessing a boom in offshore wind projects and the need to address the challenges posed by aging turbine fleets. Technological advancements in the region, including innovative monitoring systems developed in South Korea, further contribute to the rapid growth of the wind turbine protection market.

Wind Turbine Protection Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the wind turbine protection market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, wind turbine protection industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global wind turbine protection industry to benefit clients and increase the market sector. In recent years, the wind turbine protection industry has offered some technological advancements. Major players in the wind turbine protection market, including 3M, Aerox, Akzo Nobel N.V., BASF SE, Belzona International Ltd., Bergolin GmbH & Co. KG, Covestro AG, DOPAG INDIA PVT LTD., DuPont, GEV Wind Power Limited, Hempel A/S, Jotun, KRAIBURG Holding SE & Co. KG, LM WIND POWER, Mankiewicz, Parafix Tapes & Conversions Ltd, PES-Performance, Polytech, PPG Industries, Inc., Sika AG, Teknos Group, tesa Tapes (India) Private Limited, The Sherwin-Williams Company, Thermion, and Trelleborg AB.

BASF SE is a global chemical corporation with seven distinct business segments: chemicals, industrial solutions, materials, surface technologies, nutrition & care, agricultural solutions, and others. The chemical segment supplies petrochemicals and their intermediates. In June 2024, Vattenfall and BASF contracted Vestas to supply and service 112 V236-15.0 MW offshore wind turbines for the Nordlicht 1 and 2 projects in the German North Sea, set to power 1.6 million households from 2028.

3M is a global technology services provider with operations spanning the United States and international markets. The company organized into four main segments including, Transportation and Electronics, Safety and Industrial, Health Care, and Consumer. The company offers a diverse array of products and solutions. For instance, 3M unveiled its enhanced Wind Protection Tape 2.0 at WindEnergy Hamburg, offering superior blade protection with up to three times longer life against erosion, UV exposure, and damage.

Key Companies in the Wind Turbine Protection market include:

- 3M

- Aerox

- Akzo Nobel N.V.

- BASF SE

- Belzona International Ltd.

- Bergolin GmbH & Co. KG

- Covestro AG

- DOPAG INDIA PVT LTD.

- DuPont

- GEV Wind Power Limited

- Hempel A/S

- Jotun

- KRAIBURG Holding SE & Co. KG

- LM WIND POWER

- Mankiewicz

- Parafix Tapes & Conversions Ltd

- PES-Performance

- Polytech

- PPG Industries, Inc.

- Sika AG

- Teknos Group

- tesa Tapes (India) Private Limited

- The Sherwin-Williams Company

- Thermion

- Trelleborg AB

Wind Turbine Protection Industry Developments

June 2024: AkzoNobel opened the world's first wind turbine blade testing facility at its UK plant, capable of simulating conditions at half the speed of sound to enhance protective coatings and accelerate innovation in wind energy.

February 2024: Arctura and Mankiewicz are launching ArcGuide, a revolutionary lightning protection coating for wind turbines designed to reduce lightning damage and enhance safety.

September 2022: Hempel launched Hempablade Edge 171, a new leading edge protection coating for wind turbine blades that offers the highest rain erosion performance and reduces maintenance costs.

Wind Turbine Protection Market Segmentation:

By Protection Type Outlook

- Coatings

- Polyurethane

- Epoxy

- Others

- Tapes & Films

By Equipment Outlook

- Blades

- Towers

- Nacelles

- Others

By End-Use Outlook

- Onshore

- Offshore

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Wind Turbine Protection Report Scope:

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1,712.82 million |

|

Market size value in 2025 |

USD 1,894.21 million |

|

Revenue Forecast in 2034 |

USD 4,920.45 million |

|

CAGR |

11.2% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global wind turbine protection market size was valued at USD 1,712.82 million in 2024 and is anticipated to reach at USD 4,920.45 million in 2034.

The global market is projected to grow at a CAGR of 11.2% during the forecast period, 2025-2034.

North America had the largest share in the global market

The key players in the market are 3M, Aerox, Akzo Nobel N.V., BASF SE, Belzona International Ltd., Bergolin GmbH & Co. KG, Covestro AG, DOPAG INDIA PVT LTD., DuPont, GEV Wind Power Limited, Hempel A/S, Jotun, KRAIBURG Holding SE & Co. KG, LM WIND POWER, Mankiewicz, Parafix Tapes & Conversions Ltd, PES-Performance, Polytech, PPG Industries, Inc., Sika AG, Teknos Group, tesa Tapes (India) Private Limited, The Sherwin-Williams Company, Thermion, and Trelleborg AB.

The coatings category dominated the market in 2024.

The onshore had the largest share in the global market.