Wind Turbine Casting Market Size, Share, Trends, Industry Analysis Report: By Type (Horizontal Axis and Vertical Axis), Material Type, Application, Casting Technology, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast 2025–2034

- Published Date:Jan-2025

- Pages: 119

- Format: PDF

- Report ID: PM1699

- Base Year: 2024

- Historical Data: 2020-2023

Wind Turbine Casting Market Overview

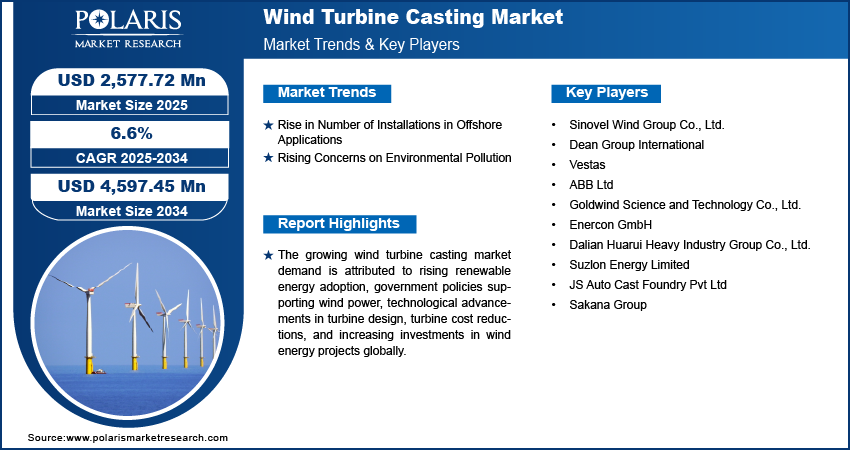

The global wind turbine casting market size was valued at USD 2,418.35 million in 2024. The market is projected to grow from USD 2,577.72 million in 2025 to USD 4,597.45 million by 2034, exhibiting a CAGR of 6.6% during the forecast period.

The wind turbine casting market growth is driven by the global shift toward renewable energy and sustainability. Wind energy has emerged as a key solution to reduce carbon emissions. To comply with stricter environmental regulations by governments, there are rising investments in wind power infrastructure. The growing focus on wind energy propels the demand for wind turbine castings, which are essential components in manufacturing turbines, including towers, hubs, nacelles, and rotor blades. Technological advancements in casting processes, such as precision casting, 3D printing, and advanced materials, have further improved the quality and performance of wind turbines, contributing to the wind turbine casting market development.

To Understand More About this Research: Request a Free Sample Report

Government initiatives such as the Norwegian offshore wind energy project and the UK’s Floating Offshore Wind Manufacturing Investment Scheme provide financial support and infrastructure development to strengthen the wind energy industry. The growing investments in wind energy projects, coupled with falling wind energy costs, have made wind power increasingly competitive with traditional energy sources, encouraging the wind turbine casting market demand.

The wind turbine casting market growth is supported by advancements in manufacturing techniques and materials, which enhance the durability and efficiency of wind turbines. The global deployment of wind energy projects is increasing, along with ongoing investment in research and development. Consequently, the market for wind turbine castings is expected to maintain its upward trend, playing a vital role in the transition to renewable energy worldwide.

Wind Turbine Casting Market Drivers

Rise in Number of Installations in Offshore Applications

The offshore wind energy sector has experienced significant growth due to the vast untapped potential of offshore wind resources, which offer stronger and more consistent wind speeds than onshore resources. This has made offshore wind farms an attractive option for expanding renewable energy capacity and reducing reliance on fossil fuels. Technological advancements in turbine design, foundation structures, and installation techniques have improved the feasibility and cost-effectiveness of offshore projects, enabling turbine deployments in deep waters and harsh environments.

The UK, Germany, China, the Netherlands, Japan, and Denmark have been key countries adopting offshore wind installations, with Germany targeting 30 GW by 2030. According to the Global Wind Energy Council (GWEC), the global offshore wind capacity reached 64.3 GW in 2022, with an additional 8.8 GW installed that year. Advancements in turbine technology, including taller turbines and larger blades, have reduced costs and further boosted the competitiveness of offshore wind energy as a sustainable solution to climate change. Thus, the rapid expansion of offshore wind energy, driven by technological advancements and increasing global adoption, positions it as a key solution for sustainable energy, helping reduce reliance on fossil fuels and addressing climate change effectively.

Rising Concerns on Environmental Pollution

Government initiatives and policies aimed at reducing carbon emissions are driving investments in wind energy infrastructure. For instance, India’s offshore wind power development plan focuses on constructing 10 to 12 GW of offshore turbines. Rising concerns over the environmental impact of fossil fuels have fueled demand for sustainable alternatives such as wind energy. Thus, increased global awareness of environmental issues and the shift toward renewable energy drives the wind turbine casting market growth.

Wind Turbine Casting Market Segment Analysis

Wind Turbine Casting Market Assessment by Type Outlook

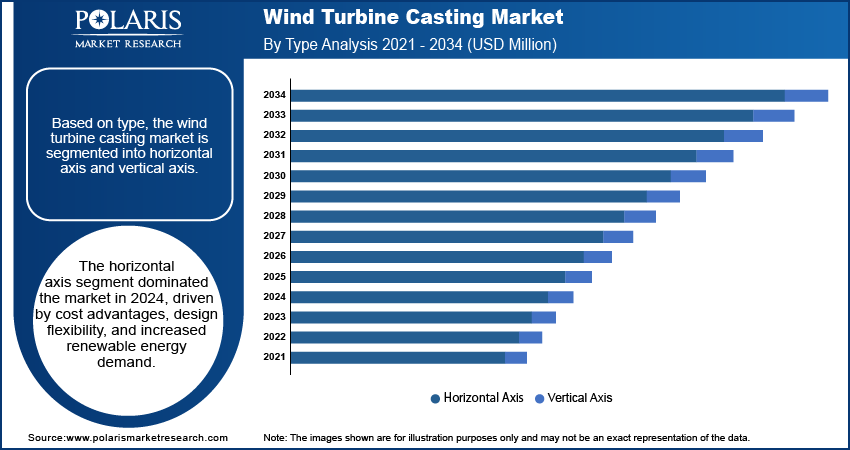

The global wind turbine casting market segmentation, based on type, includes horizontal axis and vertical axis. The horizontal axis segment dominated the market, accounting for over 90% of the market share in 2024. Horizontal-axis wind turbine (HAWT) casting involves creating key turbine components such as gearboxes, blades, and hubs using casting techniques. These methods offer significant cost advantages over traditional manufacturing processes such as welding or machining, driving the widespread adoption of HAWTs in large-scale and smaller applications. Wind turbine casting provides design flexibility, enabling the creation of complex, precise turbine components that optimize aerodynamics and performance. This capability is critical in meeting the growing demand for renewable energy and maximizing wind turbine efficiency, further boosting the demand for horizontal-axis wind turbine castings.

Wind Turbine Casting Market Evaluation by Material Type Outlook

The global wind turbine casting market segmentation, based on material type, includes steel, cast iron, aluminum alloy, glass-reinforced plastic, copper, and others. The steel segment is expected to register the highest CAGR of 6.8% during the forecast period. Steel has become the preferred material for wind turbine components such as towers and rotors due to its exceptional strength, durability, and high strength-to-weight ratio. The material's ability to withstand tremendous forces and loads ensures the long-term performance of these parts. Its excellent corrosion resistance, especially in offshore wind farms exposed to saltwater, also enhances the lifespan of turbine components and reduces maintenance costs. These advantages drive the increasing adoption of steel in wind turbine casting, particularly for applications requiring strength and reliability.

Wind Turbine Casting Market Regional Analysis

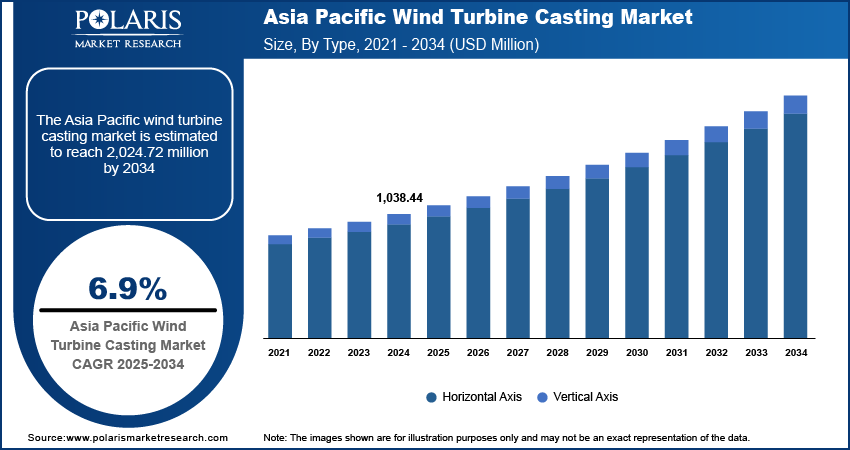

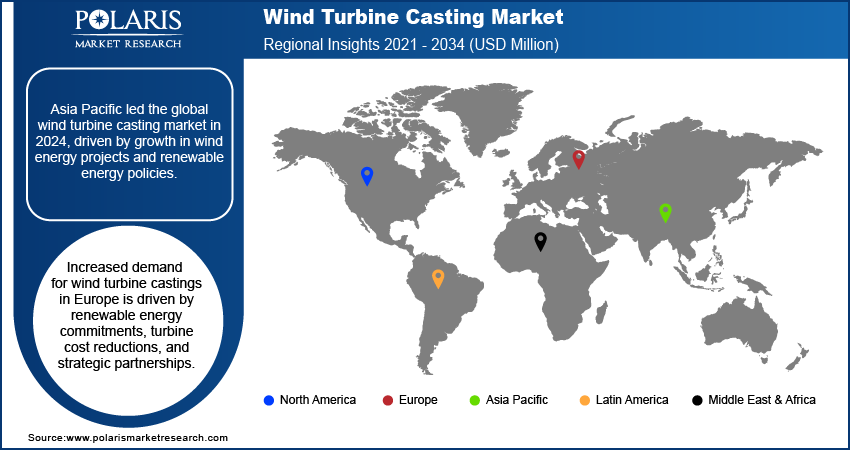

By region, the study provides wind turbine casting market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the market share in 2024, driven by the rapid growth of wind energy projects across China, Japan, and Australia. China plays a pivotal role, with ambitious renewable energy goals and substantial investments in wind power infrastructure. Notably, the agreement between GE Renewable Energy and China Huaneng Group to construct a 715 MW wind farm in Henan Province highlights the region's growing demand for wind turbine components and turbine castings. Government policies promoting renewable energy, declining wind power generation costs, and advancements in turbine design are fueling the regional market growth. Additionally, the shift to cleaner energy and efforts to reduce fossil fuel dependence drive the wind turbine casting market demand in Asia Pacific.

The demand for wind turbine casting in Europe is steadily increasing, driven by the region’s commitment to boost renewable energy projects and reduce carbon emissions. Wind power is a key component of European energy strategies, leading to higher demand for wind turbine components, including castings, to support expanding infrastructure. Factors such as supportive government policies, declining wind power generation costs, and advancements in turbine technology are boosting this growth. Additionally, concerns about energy security and the need for diverse energy sources fuel investments in wind energy projects. Strategic partnerships, such as Vestas' collaboration with ArcelorMittal, are advancing low-emission steel development for wind turbine towers, enhancing competitiveness in the European market.

Wind Turbine Casting Market – Key Players and Competitive Analysis Report

The competitive landscape of the wind turbine casting market is characterized by a mix of global leaders and regional players competing for market share through innovation, strategic partnerships, and regional expansion. Key players such as Vestas, ABB Ltd, and others in the market leverage their robust research and development (R&D) capabilities along with extensive distribution networks to offer advanced wind turbine casting solutions tailored for various applications. These major companies focus on continuous product innovation to improve efficiency, reliability, and scalability to meet the evolving needs of industries that require advanced power management solutions. At the same time, smaller regional firms are entering the market with specialized wind turbine casting solutions targeting local market demands, often focusing on customized and cost-effective applications. A few competitive strategies in the wind turbine casting market include mergers and acquisitions, collaborations with technology firms, and expanding product portfolios to enhance market presence and cater to the growing demand for advanced grid solutions. Sinovel Wind Group Co., Ltd.; Dean Group International; Vestas; ABB Ltd; Goldwind Science and Technology Co., Ltd.; Enercon GmbH; Dalian Huarui Heavy Industry Group Co., Ltd.; Suzlon Energy Limited; JS Auto Cast Foundry Pvt Ltd; and Sakana Group are among the key major players.

Sinovel Wind Group specializes in designing, developing, and manufacturing offshore, onshore, and intertidal wind turbines, including 5MW and 6MW models. The company’s National Offshore Wind Power Technology R&D Center focuses on advanced turbine technologies, supported by a skilled team and innovative solutions such as the Internet+ Smart Wind Energy Cloud Platform.

ABB Ltd is a global manufacturer of electrification, automation, robotics, and motion products. It offers solutions in renewable power, industrial robotics, process automation, and others. The company serves diverse industries, including wind power, oil & gas, automotive, and energy, promoting a low-carbon future.

List of Key Companies in Wind Turbine Casting Market

- Sinovel Wind Group Co., Ltd.

- Dean Group International

- Vestas

- ABB Ltd

- Goldwind Science and Technology Co., Ltd.

- Enercon GmbH

- Dalian Huarui Heavy Industry Group Co., Ltd.

- Suzlon Energy Limited

- JS Auto Cast Foundry Pvt Ltd

- Sakana Group

Wind Turbine Casting Industry Development

In January 2024, Vestas revealed its intention to set up a new blade manufacturing facility in Szczecin, Poland. The facility will cater to its offshore wind turbine, the V236-15.0 MW. It is scheduled to commence operations in 2026 and is expected to generate over 1,000 direct employment opportunities.

In January 2024, Vestas teamed up with ArcelorMittal, a steel producer, to introduce a new low-emission steel solution for wind turbine towers.

In November 2022, Vestas announced a multi-year framework agreement with TPI Composites Inc. (TPI), a supplier of wind turbine blades and services. The agreement aims to enhance and expand the company’s global supply chain network for blades.

Wind Turbine Casting Market Segmentation

By Type Outlook (Revenue, USD Million, 2021–2034)

- Horizontal Axis

- Vertical Axis

By Material Type Outlook (Revenue, USD Million, 2021–2034)

- Steel

- Cast Iron

- Aluminum Alloy

- Glass-Reinforced Plastic

- Copper

- Others

By Application Outlook (Revenue, USD Million, 2021–2034)

- Onshore

- Offshore

By Casting Technology Outlook (Revenue, USD Million, 2021–2034)

- Sand Casting

- Chill Casting

- Others

By End Use Outlook (Revenue, USD Million, 2021–2034)

- Industrial

- Commercial

- Residential

By Regional Outlook (Revenue, USD Million, 2021–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Wind Turbine Casting Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,418.35 million |

|

Market Size Value in 2025 |

USD 2,577.72 million |

|

Revenue Forecast by 2034 |

USD 4,597.45 million |

|

CAGR |

6.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global wind turbine casting market size was valued at USD 2,418.35 million in 2024 and is projected to grow to USD 4,597.45 million by 2034.

The global market is projected to register a CAGR of 6.6% during the forecast period.

Asia Pacific dominated the wind turbine casting market in 2024

A few key players in the market are Sinovel Wind Group Co., Ltd.; Dean Group International; Vestas; ABB Ltd; Goldwind Science and Technology Co., Ltd.; Enercon GmbH; Dalian Huarui Heavy Industry Group Co., Ltd.; Suzlon Energy Limited;JS Auto Cast Foundry Pvt Ltd; and Sakana Group.

The horizontal axis segment led the market share in 2024.

The steel segment of the wind turbine casting market is anticipated to register the highest growth rate during the forecast period.