Wi-Fi as a Service Market Share, Size, Trends, Industry Analysis Report, By Solution (Access Points, WLAN Controllers); By Service (Professional Services, Managed Services); By Organization Size; By Vertical; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jul-2022

- Pages: 114

- Format: PDF

- Report ID: PM2499

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

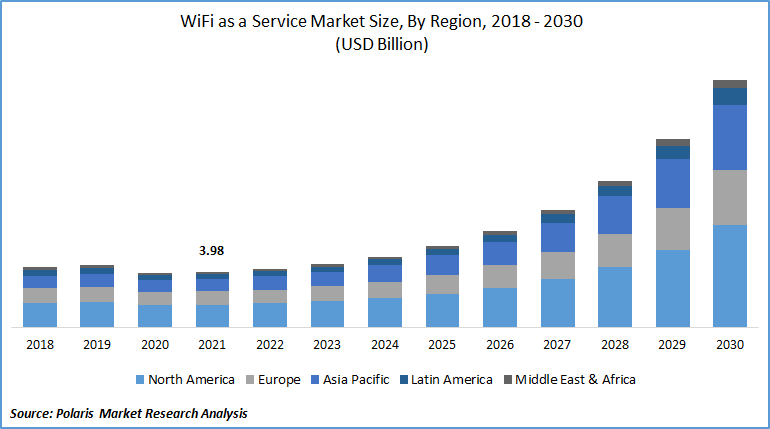

The global Wi-Fi as a service market was valued at USD 3.98 billion in 2021 and is expected to grow at a CAGR of 19.8% during the forecast period. The market demand is being driven by stringent government regulations requiring the deployment in the face of a pandemic, Wi-Fi networks were critical to national resilience. With the growing number of connected devices and people working remotely, there has been a global increase in in-home Wi-Fi activity.

Know more about this report: Request for sample pages

Major corporations are also developing and providing advanced apps and services. For instance, in March 2021, Extreme Networks produced unique and consumable solutions like the Portable Branch Kit. The system lets users connect to emergency remote office sites quickly and securely.

During the COVID-19 pandemic, the company is committed to assisting its global client base. Government agencies use COVID-19 tracking dashboards from IBM Corporation, Covidvisualizer.com, Microsoft, and others. These solutions are used to monitor and control the disease's spread. As a result of the COVID–19 pandemic, manufacturers have begun to consider automation options to reduce human reliance, creating a demand for IoT technology suppliers, which will impact the growth of WaaS networking devices.

However, due to the shelter-in-place orders, internet use in public places such as coffee shops, hotels, and airports has decreased. As the global remote workforce grows, so does the use of Wi-Fi for enterprise connectivity networks, which has harmed the Wi-Fi as a service market. In post-pandemic scenarios, it is expected that the adoption of enterprise-class and high-density Wi-Fi solutions will continue to rise.

Organizations worldwide are eager to implement technologically advanced applications across their verticals to engage customers in new and engaging ways, necessitating the use of high-quality wireless network connectivity, such as Wi-Fi. Additionally, maintaining organizational data privacy and confidentiality is critical for businesses.

Industry Dynamics

Growth Drivers

The rapid adoption of digital solutions has paved the way for Wi-Fi as a service market development. As per the "Mobile Economy 2021" report from the "Global System for Mobile Communications (GSMA)," there will be approximately 5.2 Bn mobile-based subscriptions by 2020. Smartphone users are growing, and the more younger generation can use their cell phones to connect with their peers remotely. Organizations worldwide are eager to implement technologically advanced applications across their verticals.

Additionally, to fully meet an organization's needs, these new applications must be deployed in an agile environment, allowing for rapid and responsive development while maintaining optimal network performance and cost-effectiveness. Also, the convenience of operating Wi-Fi infrastructure via the cloud is moving the WaaS industry forward. WaaS allows businesses to control their wireless fidelity networks from anywhere in the world. The cloud-based centralized administration enables network managers to remotely monitor Wi-Fi infrastructure problems from a distant location via a managed facilities interface, conserving money and time.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on solution, service, organization size, vertical and region.

|

By Solution |

By Service |

By Vertical |

By Organization Size |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Insight by vertical

The public sector segment is expected to be the most significant revenue contributor based on the vertical segment. The demand for internet connectivity in high-density areas, including malls, education centers, public parks, and parking spaces, is increasing due to the market penetration of innovative consumer electronics such as smartphones, laptops, and tablets, among others.

Furthermore, governments worldwide are increasingly investing in providing free Wi-Fi connectivity in public transportation facilities to ensure traveler safety. With the increasing reliance on IoT-connected devices, the emergence of smart cities in various developed countries is projected to positively impact the W-Fi as a service market growth over the forecast period.

Geographic Overview

In terms of geography, North America had the largest revenue share. Because of the early implementation of progressive technologies and the highly competitive landscape, the Wi-Fi as a service market is growing. In the region, there has been significant investment in wireless technologies. In addition, the rapid adoption of BYOD policies and Wi-Fi-enabled smart devices for increased productivity, employee satisfaction, and cost-effectiveness have aided the region's market growth. Increased adoption of integrated enterprise and business solutions for more flexible and agile business processes and operations is driving market growth in the North American region.

Moreover, Asia Pacific is expected to witness a high CAGR in the global market. Many cities in the region have significant deployments of wireless hotspots. Many government initiatives aim to encourage the use of the internet and smart devices. A large number of businesses are implementing managed Wi-Fi solutions and facilities to provide internet access to their employees and visitors. These factors are helping to drive the market for managed Wi-Fi solutions forward in some categories of communications services.

Setting up challenging targets for high-speed Internet access has much value, especially in the urban areas of emerging areas. For instance, as per the ITU, ASEAN markets could agree on a common broadband goal in significant cities, such as universal residential broadband of 30 Mbps and a mandate that all households in major cities be connected to 100 Mbps broadband facilities by 2025, with the option to upgrade further.

Competitive Insight

Some of the major players operating in the global market include 4ipnet, Alcatel-Lucent Enterprise, Allied Telesis, Arista, Aruba – a Hewlett Packard Enterprise Company, Cambium Networks, CommScope Inc., Cucumber, Datto, D-Link, Edgecore, Extreme Networks, Huawei Technologies Co., iPass, Juniper Networks, LANCOM Systems, Redway Networks, Rogers Communication, Ruijie Networks, Singtel, Superloop, Tata Communications, Telstra, Ubiquiti, and Viasat.

Wi-Fi as a Service Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 3.98 billion |

|

Revenue forecast in 2030 |

USD 17.78 billion |

|

CAGR |

19.8% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Solution, By Service, By Organization Size, By Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

4ipnet, Alcatel-Lucent Enterprise, Allied Telesis, Arista, Aruba – a Hewlett Packard Enterprise Company, Cambium Networks, CommScope Inc., Cucumber, Datto, D-Link, Edgecore, Extreme Networks, Huawei Technologies Co., iPass, Juniper Networks, LANCOM Systems, Redway Networks, Rogers Communication, Ruijie Networks, Singtel, Superloop, Tata Communications, Telstra, Ubiquiti, and Viasat. |