White Oil Market Size, Share, Trends, Industry Analysis Report: By Application (Adhesives, Agriculture, Food, Pharmaceutical, Personal Care, Textile, Polymers, and Others) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM3153

- Base Year: 2024

- Historical Data: 2020-2023

White Oil Market Overview

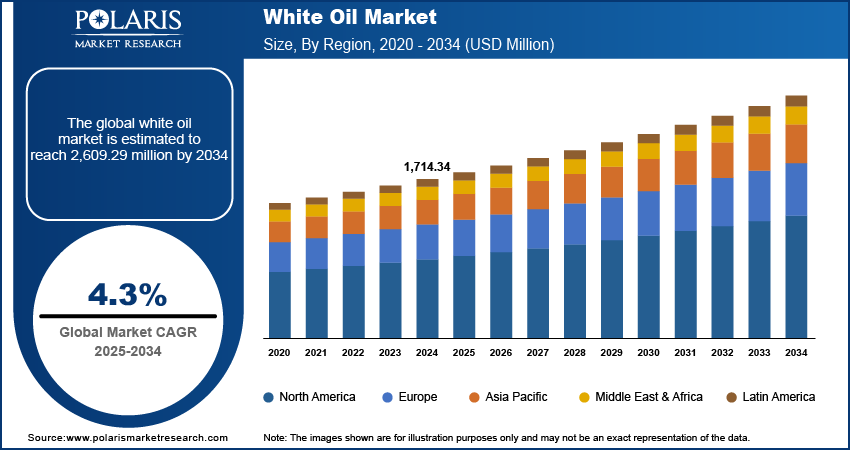

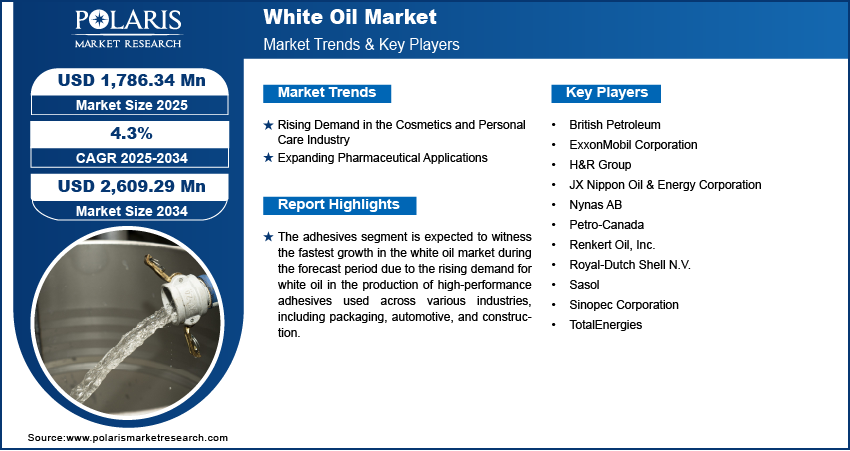

White oil market size was valued at USD 1,714.34 million in 2024 and is expected to reach USD 1,786.34 million by 2025 and 2,609.29 million by 2034, exhibiting a CAGR of 4.3% during the forecast period.

White oil, also known as mineral white oil or paraffinic white oil, is a highly refined, clear, and odorless oil derived from petroleum. It is free from impurities, colorants, and toxic substances, making it suitable for a wide range of applications. White oil is commonly used in the cosmetic, pharmaceutical, food, and plastic industries as a base ingredient or lubricant due to its stability, non-reactive nature, and high purity. White oil is also utilized in industrial applications such as textile manufacturing and as a release agent in rubber and polymer production. The growing food and beverage industry is driving demand for white oil, thereby fueling the market expansion. Furthermore, white oil is widely utilized as a plasticizer and lubricant in the production of polymers such as PVC and thermoplastics which is further propelling the white oil market growth.

To Understand More About this Research: Request a Free Sample Report

Rapid industrialization and urbanization in developing regions, such as Asia Pacific, have led to increased consumption of white oil in diverse applications, from textiles to machinery. Moreover, white oil's utility in rubber processing, adhesives, and specialty lubricants has led to its growing adoption across various industrial sectors, thereby increasing the white oil market demand.

White Oil Market Dynamics

Rising Demand in Cosmetics and Personal Care Industry

White oil plays a crucial role as a base ingredient in cosmetics and personal care products, such as lotions, creams, and baby oils, due to its high purity, stability, and ability to blend seamlessly with other ingredients. White oil’s odorless and colorless nature ensures that it does not interfere with the fragrance or appearance of the final product, making it a preferred choice for formulators. The rising consumer awareness of skincare and hygiene, coupled with the growing demand for mild and safe products suitable for all skin types, has further fueled its adoption. For instance, according to the Food and Drug Administration (FDA), individuals typically use 6 to 12 cosmetic products on a daily basis. Additionally, the trend toward premium personal care products and the increasing focus on infant care has boosted the white oil market expansion.

Expanding Pharmaceutical Applications

The increasing global focus on healthcare and the rising prevalence of skin conditions and gastrointestinal disorders expands the demand for white oil in pharmaceutical applications. For instance, according to Oshi Health Inc., approximately 70 million Americans are impacted by gastrointestinal (GI) disorders annually, which is twice the number of individuals diagnosed with diabetes. The pharmaceutical industry extensively uses white oil due to its non-toxic and hypoallergenic properties, making it safe for ingestion and external application. White oil serves as a critical component in various formulations, such as ointments, where it provides a smooth texture and acts as an emollient to soothe the skin. Moreover, in laxatives, white oil functions as a lubricant, aiding in intestinal movement without causing irritation. Furthermore, white oil use in capsule manufacturing enhances the smoothness and ease of swallowing which is further increasing the white oil market demand.

White Oil Market Segment Insights

White Oil Market Assessment by Application Outlook

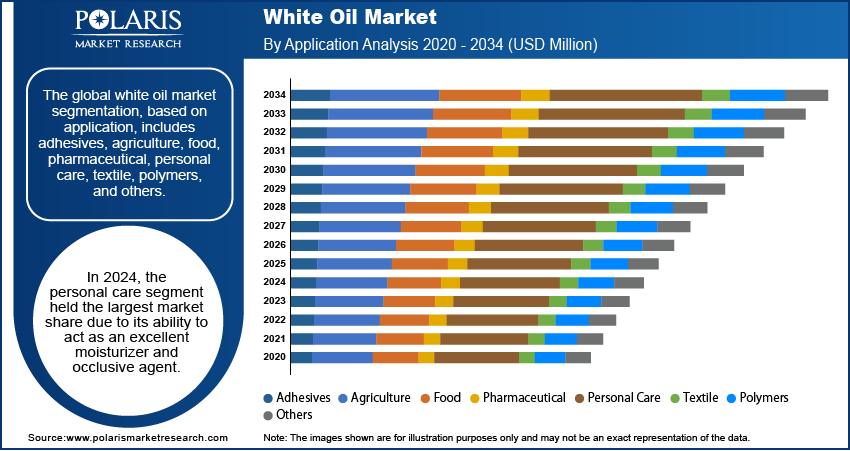

The global white oil market segmentation, based on application, includes adhesives, agriculture, food, pharmaceutical, personal care, textile, polymers, and others. In 2024, the personal care segment held the largest white oil market share due to its ability to act as an excellent moisturizer and occlusive agent. White oil creates a protective barrier on the skin, preventing water loss and improving hydration. This feature is particularly valuable in products targeting dry and sensitive skin, which are witnessing growing demand due to shifting consumer preferences toward specialized skincare solutions. Furthermore, the rising trend of clean-label and chemical-free personal care products has propelled manufacturers to incorporate white oil, which is free of harmful additives, into their formulations. The segment's growth is further supported by innovations in product delivery mechanisms, such as sprays and gels, which control white oil's viscosity and compatibility with active ingredients for better performance.

The adhesives segment is also expected to witness the fastest growth during the forecast period. The growth is attributed to the rising demand for white oil in the production of high-performance adhesives used across various industries, including packaging, automotive, and construction. White oil is widely used as a plasticizer and processing aid in adhesives due to its excellent lubricating properties, high thermal stability, and compatibility with other formulation ingredients. The increasing demand for flexible and durable adhesives in industrial and consumer applications, coupled with advancements in adhesive technologies, has accelerated the adoption of white oil in this segment. Additionally, the growing focus on environmentally friendly and non-toxic adhesives has further fueled the use of white oil as a preferred ingredient in adhesive formulations.

White Oil Market Share Regional Insights

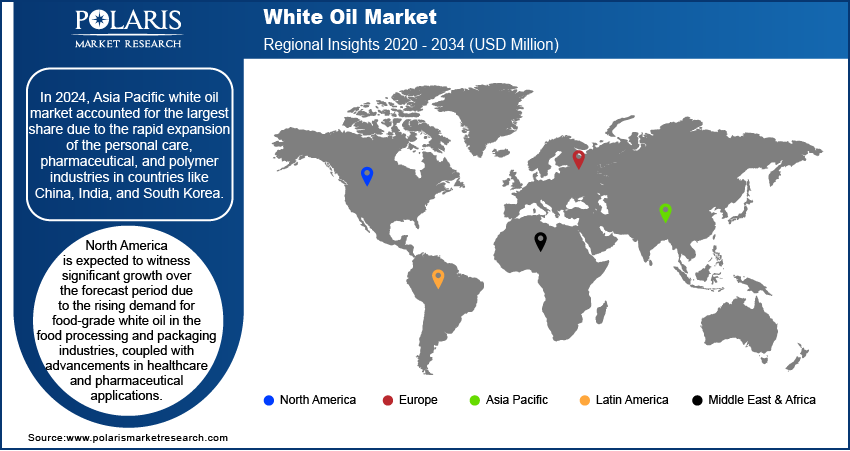

By region, the study provides white oil market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific accounted for the largest market share due to the rapid expansion of the personal care, pharmaceutical, and polymer industries in countries such as China, India, and South Korea. For instance, in the fiscal year 2023-2024, the Indian pharmaceutical industry reported a turnover of approximately USD 50.08 billion USD, reflecting a 10% growth compared to USD 45.53 billion USD in 2022-2023. The region's large population base, increasing disposable incomes, and growing awareness of health and skincare have driven the demand for white oil across various applications. Additionally, the presence of cost-effective manufacturing facilities and a strong supply chain network in the region further boosted its market dominance.

North America is expected to witness significant white oil market growth over the forecast period. This growth is due to the rising demand for food-grade white oil in the food processing and packaging industries, coupled with advancements in healthcare and pharmaceutical applications. The region's strict regulatory framework promoting the use of high-purity, non-toxic products has also encouraged the adoption of white oil in industrial and consumer applications. Moreover, the increasing use of white oil in the production of adhesives and polymers for the growing construction and automotive sectors is expected to drive market growth further. For instance, according to the International Trade Administration, in 2022, the US sold 11.5 million light vehicles, making it the second-largest global market for vehicle sales and production.

White Oil Key Market Players & Competitive Analysis Report

The white oil market is highly competitive, with key players focusing on product innovation, capacity expansions, and strategic partnerships to strengthen their market position. Major companies such as ExxonMobil Corporation, Sinopec Corporation, Royal Dutch Shell, BP PLC, and TotalEnergies dominate the market, leveraging their extensive distribution networks and advanced refining technologies. These players are increasingly investing in the production of high-purity white oils to meet stringent regulatory standards and growing demand from industries like pharmaceuticals, personal care, and polymers. Regional players, particularly in Asia Pacific, are also emerging as strong competitors, benefiting from cost-effective manufacturing processes and proximity to high-demand markets. Additionally, the white oil industry is witnessing consolidation through mergers and acquisitions as companies aim to expand their global footprint and enhance their product portfolios. The focus on sustainability and eco-friendly formulations is becoming a key differentiator, with manufacturers exploring bio-based alternatives to traditional white oil products.

Exxon Mobil Corporation is a multinational oil and gas corporation. It was formed in 1999 through the merger of Exxon Corporation and Mobil Corporation, two of the most prominent oil companies in the United States. ExxonMobil is headquartered in Irving, Texas. Exxon Mobil is primarily engaged in the exploration, production, refining, and marketing of oil and natural gas, as well as the manufacturing and marketing of petrochemicals and other chemical products. Its core operations span the entire energy value chain. Exxon Mobil is a global energy company with operations in over 70 countries.

Royal Dutch Shell, commonly referred to as Shell, is a global energy and petrochemical industry specializing in oil and gas, chemicals, and energy solutions. The company operates as one of the mobility networks; Shell serves approximately 33 million customers daily across more than 47,000 retail stations worldwide. The company has over 54,000 public electric vehicle (EV) charging points at Shell stations, on-street locations, and key destinations. The company's main operations include oil and natural gas exploration, liquefied natural gas (LNG), gas-to-liquids (GTL) technology, methane emissions management, deep-water exploration, and the development of shale oil and gas. Additionally, Shell is involved in renewable energy, carbon capture and storage (CCS), and nature-based solutions.

Key Companies in White Oil Market

- British Petroleum

- ExxonMobil Corporation

- H&R Group

- JX Nippon Oil & Energy Corporation

- Nynas AB

- Petro-Canada

- Renkert Oil, Inc.

- Royal-Dutch Shell N.V.

- Sasol

- Sinopec Corporation

- TotalEnergies

White Oil Market Developments

January 2024: Chevron Lummus Global LLC successfully commissioned the world's largest white oil hydroprocessing unit at Hongrun Petrochemical Co., Ltd. in Shandong Province, China. This facility is designed to enhance the conversion of heavy hydrocarbons into high-value products, showcasing CLG's advanced refining technology.

August 2022: Palmer Holland, a North American specialty chemical distributor, entered into a distribution agreement with Petro-Canada Lubricants. This agreement positions Palmer Holland as the U.S. distributor for Petro-Canada’s PURETOL and KRYSTOL lines of high-purity white mineral oils.

White Oil Market Segmentation

By Application Outlook (Revenue, USD Million; Volume, Kilotons; 2020 - 2034)

- Adhesives

- Agriculture

- Food

- Pharmaceutical

- Personal Care

- Textile

- Polymers

- Others

By Regional Outlook (Revenue, USD Million; Volume, Kilotons; 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

White Oil Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,714.34 million |

|

Market Size Value in 2025 |

USD 1,786.34 million |

|

Revenue Forecast in 2034 |

USD 2,609.29 million |

|

CAGR |

4.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Million, Volume in Kilotons, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global white oil market size was valued at USD 1,714.34 million in 2024 and is projected to grow to USD 2,609.29 million by 2034.

The global market is projected to grow at a CAGR of 4.3% during the forecast period

In 2024, Asia Pacific white oil market accounted for the largest share due to the rapid expansion of the personal care, pharmaceutical, and polymer industries in countries like China, India, and South Korea.

Some of the key players in the market are British Petroleum; ExxonMobil Corporation; H&R Group; JX Nippon Oil & Energy Corporation; Nynas AB; Petro-Canada; Renkert Oil, Inc.; Royal-Dutch Shell N.V.; Sasol, Sinopec Corporation; and TotalEnergies

In 2024, the personal care segment held the largest market share due to its ability to act as an excellent moisturizer and occlusive agent.