Well Testing Services Market Size, Share, Trends, Industry Analysis Report: By Well Type (Horizontal and Vertical), Stages, Application, Services, and Region (North America, Europe, Asia Pacific, Middle East & Africa, And Latin America) – Market Forecast, 2024 - 2032

- Published Date:Oct-2024

- Pages: 119

- Format: PDF

- Report ID: PM2380

- Base Year: 2023

- Historical Data: 2019-2022

Well Testing Services Market Overview

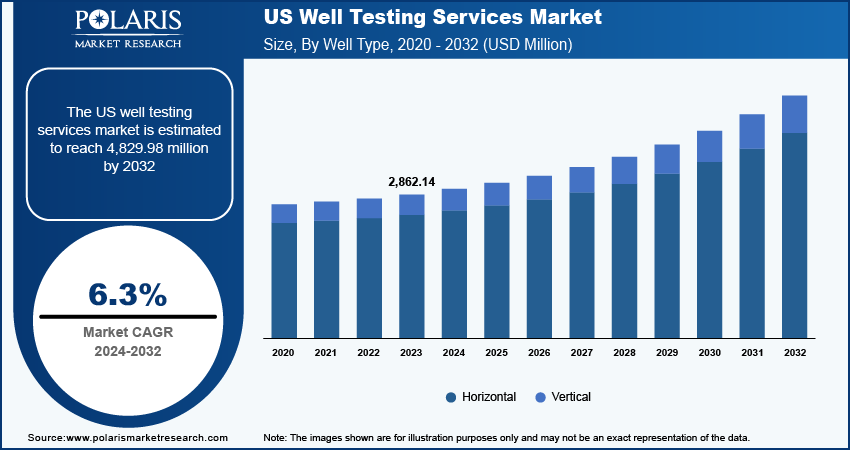

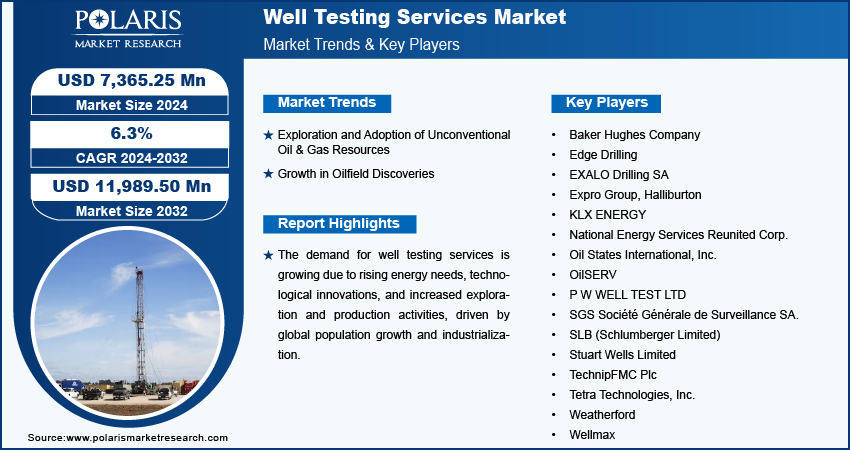

Global well testing services market size was valued at USD 7,090.15 million in 2023. The market is projected to grow from USD 7,365.25 million in 2024 to USD 11,989.50 million by 2032, exhibiting a CAGR of 6.3% during the forecast period.

The well testing service market is poised for sustained growth, driven by increasing energy demand, technological innovation, and evolving market dynamics. Emerging trends such as digitalization, data analytics, and remote monitoring are expected to reshape industry practices, enhance operational efficiency, and unlock new growth opportunities. However, market participants are likely to navigate evolving regulatory landscapes, volatile oil prices, and geopolitical uncertainties to maintain competitiveness and foster long-term sustainability in the global well testing service market growth.

To Understand More About this Research: Request a Free Sample Report

The well testing service market is driven by the continuous demand for energy resources and the need to maximize the recovery of hydrocarbons from reservoirs. As the global population grows and industrialization expands, the demand for oil and gas remains robust, fostering steady growth in exploration and production activities worldwide. Consequently, the well testing service market is expected to witness sustained expansion, supported by ongoing upstream investments and technological advancements.

Major players in the well testing service market include both multinational corporations and specialized service providers with expertise in reservoir evaluation, well testing operations, and data interpretation. These players compete based on service quality, technological innovation, geographic presence, and pricing strategies. Key market players often collaborate with oil and gas operators, drilling contractors, and reservoir engineering firms to deliver integrated solutions that address client needs comprehensively.

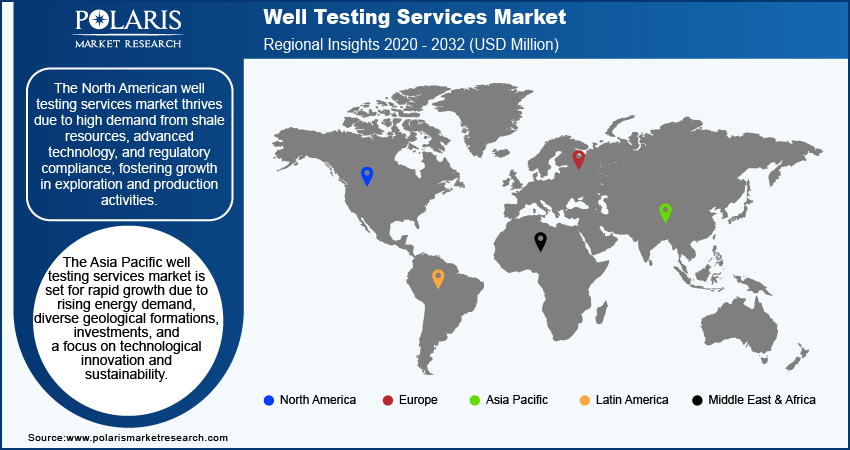

The well testing service market exhibits regional variations influenced by factors such as geological complexity, regulatory frameworks, market maturity, and investment climate. Major regions contributing to market growth include North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Each region presents unique opportunities and challenges for well testing service providers, necessitating tailored strategies to capitalize on market dynamics effectively

Well Testing Services Market Drivers and Trends

Exploration and Adoption of Unconventional Oil & Gas Resources

The exploration and adoption of unconventional oil and gas resources have emerged as significant drivers propelling the well testing services market growth. Unconventional reservoirs, including shale, tight gas, and coalbed methane formations, represent vast untapped potential for energy production worldwide. As conventional reserves become increasingly depleted and global energy demand continues to rise, the market has turned its focus towards unlocking the vast reserves trapped within unconventional formations.

One of the primary factors fueling the exploration of unconventional resources is the quest for energy security and diversification of supply sources. Unconventional reservoirs, once considered uneconomical to develop, have witnessed a paradigm shift in recent years with advancements in drilling technologies, hydraulic fracturing techniques, and reservoir characterization methods. These technological breakthroughs have enabled operators to extract hydrocarbons from previously inaccessible formations, thereby reshaping the global energy landscape.

The abundance of unconventional resources in regions such as North America, China, Argentina, and Australia has sparked a surge in exploration and production activities, driving the demand for well testing services. Well testing plays a crucial role in assessing productivity, reservoir characteristics, and optimal development strategies for unconventional reservoirs. By conducting comprehensive well tests, operators can evaluate reservoir performance, estimate recoverable reserves, and design efficient production schemes tailored to the unique properties of each formation.

Growth in Oilfield Discoveries

The growth in oilfield discoveries globally is significantly driving the expansion of the well testing services market. This expansion is propelled by increased exploration in frontier basins, deepwater regions, and unconventional plays, enhanced by technological advancements in seismic imaging, drilling, and reservoir evaluation techniques. Discoveries in established regions such as the Permian Basin, North Sea, and Santos Basin, coupled with the rise of unconventional resources such as shale oil and oil sands, are revitalizing interest and activity in mature basins. Well testing services are crucial for assessing reservoir properties and optimizing production, particularly in emerging regions such as Brazil and Guyana. Consequently, the demand for testing services is projected to rise, significantly boosting well testing services market revenue.

Well Testing Services Market Segment Insights

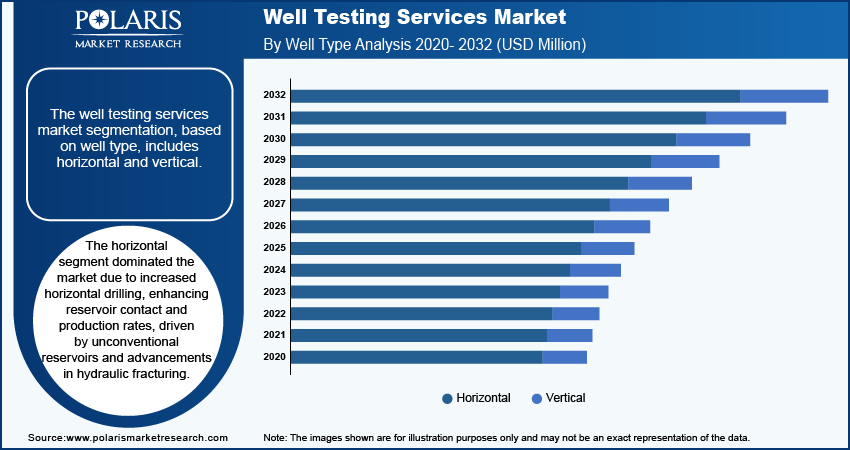

Well Testing Services Market Breakdown by Well Type Insights

The well testing services market segmentation, based on well type, includes horizontal and vertical. In 2023, the horizontal segment dominated the market, accounting for 84.7% of market revenue (6,013.75 million). The increasing adoption of horizontal drilling in the oil and gas sector is driving demand for horizontal well testing services due to the advantages in reservoir contact, production rates, and resource recovery. The trend is closely linked to the focus on unconventional reservoirs, such as shale formations, tight gas plays, and coalbed methane deposits. Advancements in hydraulic fracturing and reservoir stimulation have propelled the development of these resources, necessitating specialized horizontal well testing services to assess reservoir characteristics, fluid properties, and production behavior. Consequently, horizontal well testing services are essential for optimizing production and maximizing hydrocarbon recovery in these complex formations.

Well Testing Services Market Breakdown by Stage Insights

The well testing services market segmentation, based on stage, includes exploration, appraisal, & development, and production. The production is expected to register at a 6.4% CAGR over the forecast period. The production stage segment accounted for the largest share in 2023. The growth in this segment can be attributed to the need for continuous production monitoring, asset integrity management, and reservoir surveillance. Operators rely on well testing to optimize production rates, ensure asset integrity, and prevent downtime by detecting potential issues. Additionally, well testing services enable monitoring of reservoir dynamics and fluid behavior, facilitating effective production optimization strategies, thereby driving the well testing services market growth.

Well Testing Services Market Breakdown by Regional Insights

By region, the study provides market insights into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. North American well testing services market held the largest share in 2023, driven by significant demand from vast unconventional resources, particularly shale gas, and tight oil formations in the Permian Basin, Eagle Ford, Marcellus, and Bakken. Exploration and production activities in these prolific shale plays require comprehensive well testing to optimize production and ensure regulatory compliance. The region benefits from advanced technological capabilities and a competitive market environment, emphasizing real-time monitoring, multi-phase flow metering, and HPHT testing. Stringent environmental regulations, safety standards, and a focus on energy independence, infrastructure development, and sustainability create opportunities for well testing service providers to expand their presence and contribute to the North American oil and gas industry's growth.

Europe well testing services market accounts for the second-largest market share, driven by mature field management, exploration of unconventional resources, offshore wind projects, and a strong focus on technological innovation and sustainability. In Europe, the well testing services market thrives on a balance of mature and emerging oil fields, coupled with increasing activities in unconventional resources and offshore exploration. Stable demand persists in mature areas such as the North Sea, driven by ongoing reservoir management and decommissioning. The rise of shale gas and tight oil in the UK, Poland, and Germany offers growth opportunities. Additionally, there's a shift towards renewable energy, fostering demand for testing in offshore wind projects emphasizing innovation, digitalization, and sustainability in operations.

Asia Pacific well testing services market is expected to grow at the highest CAGR from 2024 to 2032. In Asia Pacific, the well testing services market is driven by diverse geological formations, rising energy demand, and exploration activities in mature and emerging basins. Significant investments in China, India, and Indonesia boost demand, while Australia's CSG and China's shale gas offer new opportunities. The region emphasizes technological innovation, sustainability, and regulatory compliance, shaping well testing services market opportunities.

Well Testing Services Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the well testing services market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, well testing services market must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global well testing services market to benefit clients and increase the market sector. In recent years, the well testing services industry has offered some technological advancements. Major players in the well testing services market includes Baker Hughes Company; Edge Drilling; EXALO Drilling SA; National Energy Services Reunited Corp.; OilSERV, SLB (Schlumberger Limited); SGS Société Générale de Surveillance SA.; Halliburton; KLX ENERGY; Expro Group; Stuart Wells Limited; TechnipFMC Plc; Tetra Technologies, Inc.; Weatherford; Wellmax; P W WELL TEST LTD; and Oil States International, Inc.

Baker Hughes, headquartered in Texas, USA, offers a wide range of industrial products and digital solutions globally, focusing on energy sector services and solutions across diverse regions and sectors. In October 2023, Baker Hughes announced the completion of the test well for the geothermal energy consortium Wells2Watts.

National Energy Services Reunited Corp. provides extensive oilfield services globally, focusing on the Middle East and North Africa, offering production services such as coiled tubing and hydraulic fracturing and comprehensive drilling and evaluation services, including well testing and flow control equipment. In September 2021, National Energy Services Reunited Corp. and Cactus, Inc. announced that they have signed an agreement to provide and deploy Cactus frac rental equipment in the Middle East and other initiatives in key markets.

List of Key Companies in Well Testing Services market

- Baker Hughes Company

- Edge Drilling

- EXALO Drilling SA

- Expro Group

- Halliburton

- KLX ENERGY

- National Energy Services Reunited Corp.

- Oil States International, Inc.

- OilSERV

- P W WELL TEST LTD

- SGS Société Générale de Surveillance SA.

- SLB (Schlumberger Limited)

- Stuart Wells Limited

- TechnipFMC Plc

- Tetra Technologies, Inc.

- Weatherford

- Wellmax

Well Testing Services Industry Developments

January 2024: Halliburton Company announced Reservoir Xaminer, a new service that provides more accurate formation pressure measurements and representative reservoir fluid samples in less time.

December 2023: KLX Energy Services (KLX) unveiled its VISION Suite of downhole completion tools. This suite includes the OraclE-Smart Reach Tool (SRT), SpectrA PDC, and PhantM Dissolvables.

December 2023: Expro announced the renewal and expansion of its strategic partnership agreement with Di Drill Survey Services Inc., a provider of high-end HPHT logging, Gyro survey services, and magnetic ranging for complex abandonment services to the oil & gas and geothermal sectors.

Well Testing Services Market Segmentation

By Well Type Outlook

- Horizontal

- Vertical

By Stages Outlook

- Exploration, Appraisal and Development

- Production

By Application Outlook

- Onshore

- Offshore

By Services Outlook

- Downhole Testing

- Surface Testing

- Reservoir Sampling

- Real Time Testing

- Hydraulic Fracturing Method Testing

- Multi-Phase Flow Meter (Real Time)

- High-Pressure High-Temperature (HPHT)

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Well Testing Services Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 7,090.15 million |

|

Market Size Value in 2024 |

USD 7,365.25 million |

|

Revenue Forecast in 2032 |

USD 11,989.50 million |

|

CAGR |

6.3% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2020 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global well testing services market size was valued at USD 7,090.15 million in 2023 and is projected to grow to USD 11,989.50 million in 2032

The global market registers a CAGR of 6.3% during the forecast period, 2023-2032.

North America had the largest share of the global market

The key players in the market are Baker Hughes Company; Edge Drilling; EXALO Drilling SA; National Energy Services Reunited Corp.; OilSERV; SLB (Schlumberger Limited); SGS Société Générale de Surveillance SA.; Halliburton; KLX ENERGY; Expro Group; Stuart Wells Limited; TechnipFMC Plc; Tetra Technologies, Inc.; Weatherford; Wellmax; P W WELL TEST LTD; and Oil States International, Inc.

The horizontal category dominated the market in 2023.

The exploration, appraisal and development had the largest share in the global market.