Well Intervention Market Size, Share, Trends, Industry Analysis Report: By Service (Logging & Bottom Hole Survey, Tubing Failure and Repair, Stimulation, Remedial Cementing, Zonal Isolation, Sand Control Services, Artificial Lift, Fishing, Re-Perforation, and Others), Application, Intervention, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 120

- Format: PDF

- Report ID: PM1562

- Base Year: 2024

- Historical Data: 2020-2023

Well Intervention Market Overview

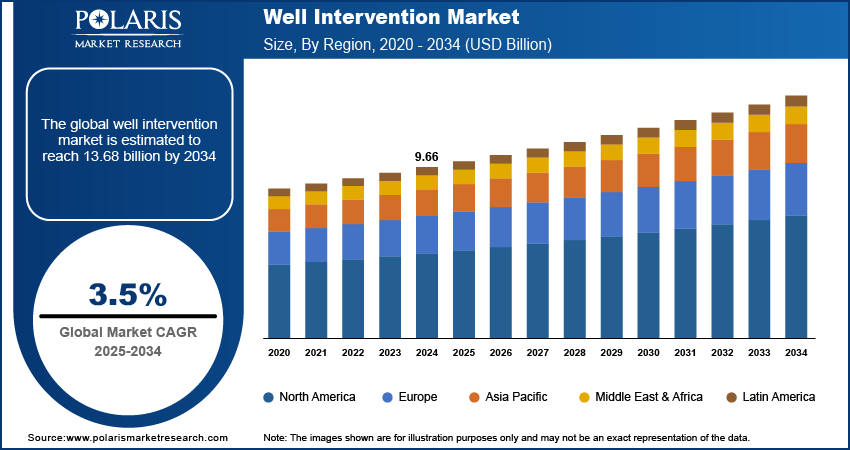

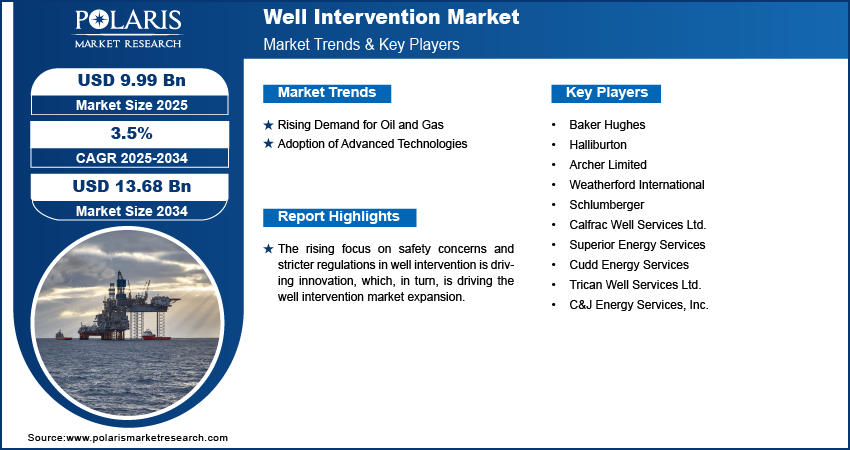

The global well intervention market size was valued at USD 9.66 billion in 2024. The market is projected to grow from USD 9.99 billion in 2025 to USD 13.68 billion by 2034, exhibiting a CAGR of 3.5% from 2025 to 2034.

The expansion of the offshore exploration & production (E&P) industry propels the well intervention market demand. The offshore E&P industry is vital for meeting energy needs and advancing resource development. Well intervention services play a key role in the industry by maintaining operational stability and optimizing well production. Further, technological advancements in well intervention are improving efficiency, reducing costs, and helping address environmental challenges, further driving the well intervention market growth.

To Understand More About this Research: Request a Free Sample Report

The rising focus on safety and the implementation of stringent regulations regarding well intervention is driving innovation, which is promoting the well intervention market expansion. Companies are adopting advanced techniques to enhance safety and ensure compliance with evolving regulations. This emphasis on advanced technology enables the industry to balance operational efficiency with the highest safety standards.

Well Intervention Market Dynamics

Rising Demand for Oil and Gas

The successful exploration of new oil and gas reserves is a major driver of well intervention market demand. When new hydrocarbon reserves are discovered, the need for efficient extraction and production services increases. Along with creating opportunities for extraction, these discoveries also drive advancements in drilling and intervention techniques. Ultimately, these innovations enhance industry efficiency and productivity, allowing it to adapt and thrive in the ever-changing global energy landscape. For instance, Saudi Aramco’s $18 billion investment in oilfield services is expected to increase production by 550,000 BPD, leading to a significant rise in global demand for well intervention, completion, and offshore drilling technologies. Thus, increasing demand for oil and gas boosts the well intervention market growth.

Adoption of Advanced Technologies

Technological advancements have significantly enhanced the digitalization and automation of intervention services, leading to innovations that improve the recovery of oil and gas reserves. In addition, the shift of upstream operators from traditional methods to digital slackline techniques has contributed to this progress. Digital wireline logging (e-line) provides operators with real-time downhole data, reducing the need for expensive re-runs and enhancing the success rate of complex operations. These advancements have opened up new growth opportunities in the market, providing more efficient and reliable solutions for oil and gas extraction, thereby driving the well intervention market development.

Well Intervention Market Segment Insights

Well Intervention Market Outlook by Service Insights

The well Intervention market, based on service, is segmented into tubing failure & repair, logging & bottom hole survey, stimulation, zonal isolation, remedial cementing, sand control services, artificial lift, fishing, re-perforation, and others. The tubing failure & repair segment held the largest well intervention market revenue share in 2024, owing to its critical role in well intervention. The frequent failures caused by harsh environments necessitate constant repairs, which are essential for maintaining well integrity and preventing production and safety issues.

The stimulation service segment is expected to witness the fastest growth during the forecast period. This service is used to enhance the flow of hydrocarbons into the reservoir from the drainage area, ultimately increasing the production of oil and gas resources.

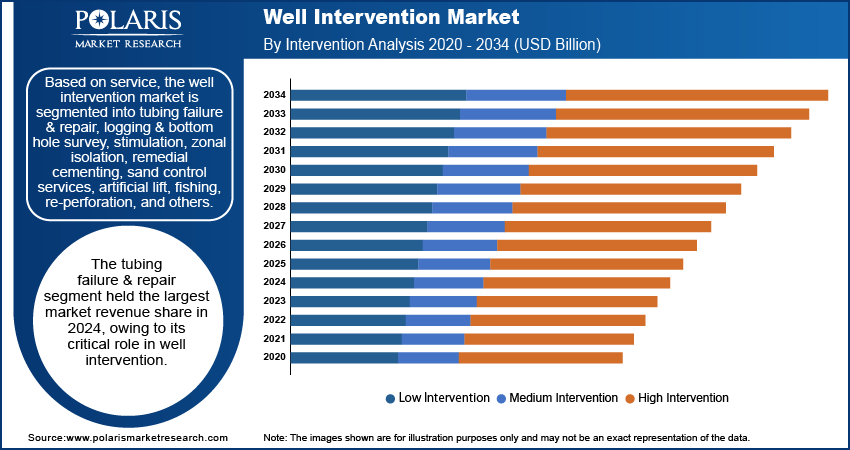

Well Intervention Market Outlook by Intervention Insights

The well intervention market, based on intervention, is segmented into low intervention, medium intervention, and high intervention. The high intervention segment is expected to grow in the future due to its critical role in enhancing the functionality and longevity of wells. As global oil demand continues to rise, there will be an increased need to optimize production from existing wells. Expertise in high intervention for well completion, component replacement, and integrity maintenance will be in greater demand. In addition, advancements in optimization techniques will drive the growth of this segment as market participants focus on maximizing efficiency from existing resources.

Well Intervention Market Regional Analysis

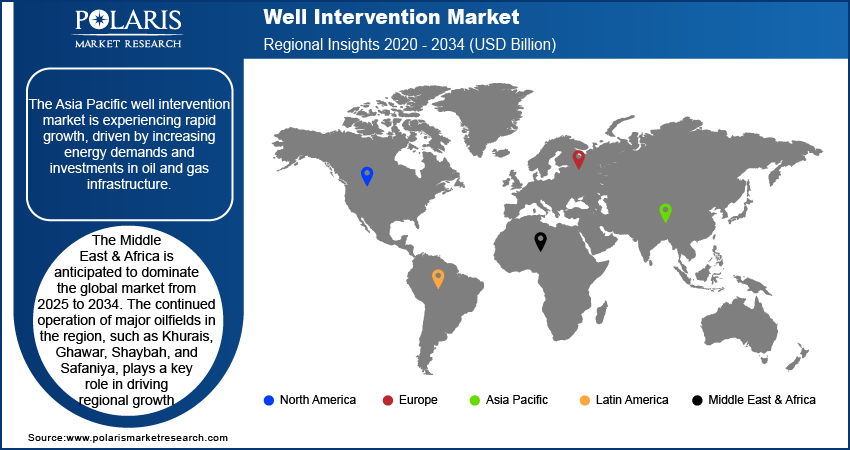

The market report offers well intervention market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. The Asia Pacific well intervention market is experiencing rapid growth owing to increasing energy demands and investments in oil and gas infrastructure. The market in China is expanding due to growing exploration and production activities, rising energy consumption, and the development of new oil and gas fields. The market for well intervention in Japan is expected to continue its steady growth during the forecast period.

The Middle East & Africa is anticipated to dominate the global well intervention market share from 2025 to 2034. The continued operation of major oilfields in the region, such as Khurais, Ghawar, Shaybah, and Safaniya, plays a key role in driving regional growth. Qatar is witnessing a surge in natural gas development and export projects, particularly for downstream industries that utilize gas as a feedstock. The well intervention market growth in the region will be supported by major LNG projects undertaken by industry giants such as Total, Shell, ExxonMobil, and ConocoPhillips.

The Europe well intervention market is projected to grow significantly in the coming years, primarily fueled by the adoption of advanced, eco-friendly well intervention technologies. Key contributors such as the UK, Norway, and the Netherlands, with their extensive offshore drilling activities and innovative solutions, ensure efficient and minimally impactful interventions. Further, Germany held the largest market share and is expected to be the fastest-growing country in Europe. The country’s strict environmental regulations promote advanced, eco-friendly intervention technologies, mainly for optimizing onshore oil and gas fields.

Well Intervention Market – Key Players and Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will help the well intervention market grow even more. Market participants are also undertaking numerous strategic activities to expand their global footprint, with important market developments such as new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market environment, market participants must offer innovative solutions.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global market to benefit clients. Major players in the well intervention market, including Baker Hughes, Schlumberger, Archer Limited, Weatherford International, and Halliburton, have achieved forward integration by establishing their presence in the manufacturing and service-providing sectors. Service providers such as Calfrac Well Services Ltd., Superior Energy Services, Cudd Energy Services, Trican Well Services Ltd., and C&J Energy Services, Inc. offer well intervention services for end-use applications.

Baker Hughes, a leading energy technology company, offers innovative solutions for the oil & gas industry, particularly in well intervention, as well as in emerging sectors. Their OFSE segment addresses the entire lifecycle of wells, while IET focuses on improving industrial efficiency and reducing emissions. Through this commitment to sustainability, they are well-positioned for the energy transition.

Halliburton operates in the oilfield services industry, offering an extensive portfolio of well-intervention services. The company’s primary focus is on maximizing well productivity and extending the lifespan of oil and gas wells. Halliburton places a strong emphasis on technological advancements and endeavors to minimize environmental impact through well-intervention practices and the development of low-carbon solutions.

List of Key Companies in Well Intervention Market

- Baker Hughes

- Halliburton

- Archer Limited

- Weatherford International

- Schlumberger

- Calfrac Well Services Ltd.

- Superior Energy Services

- Cudd Energy Services

- Trican Well Services Ltd.

- C&J Energy Services, Inc.

Well Intervention Industry Developments

Feb 2024: Baker Hughes signed a major contract with Petrobras to establish its presence in Brazil’s offshore industry. The company stated that the deal involves providing integrated well construction services for the Buzios field, highlighting the company’s expanding role in the region.

Jan 2024: Halliburton demonstrated its commitment to sustainable solutions by introducing the CorrosaLock Cement System. This innovative technology tackles CO2 storage challenges with its corrosion-resistant design. Combining Portland cement with their WellLock resin, it offers superior CO2 resistance, lower permeability, and increased flexibility compared to traditional options. This development positions Halliburton as a leader in advancing CCUS technologies.

May 2023: TechnipFMC solidified its presence in the North Sea market by securing a significant RLWI services contract with Equinor. According to TechnipFMC, this multi-year agreement, starting in 2024, focuses on production enhancement, data acquisition, and pre-abandonment services for wells on the Norwegian Continental Shelf.

Well Intervention Market Segmentation

By Service Outlook

- Logging & Bottom Hole Survey

- Tubing Failure & Repair

- Stimulation

- Remedial Cementing

- Zonal Isolation

- Sand Control Services

- Artificial Lift

- Fishing

- Re-Perforation

- Others

By Intervention Outlook

- Low Intervention

- Medium Intervention

- High Intervention

By Application Outlook

- Onshore

- Offshore

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Well Intervention Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 9.66 billion |

|

Market Size Value in 2025 |

USD 9.99 billion |

|

Revenue Forecast by 2034 |

USD 13.68 billion |

|

CAGR |

3.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 9.66 billion in 2024 and is projected to grow to USD 13.68 billion by 2034.

The market is projected to register a CAGR of 3.5% from 2025 to 2034.

The Middle East & Africa is anticipated to dominate the market during the forecast period.

A few of the key players in the market are Baker Hughes, Schlumberger, Archer Limited, Weatherford International, Halliburton, Calfrac Well Services Ltd., Superior Energy Services, Cudd Energy Services, Trican Well Services Ltd., and C&J Energy Services, Inc

The tubing failure & repair segment dominated the market in 2024.

The high intervention segment is projected to grow at the highest rate in the well intervention market.