Welding Materials Market Size, Share, Trends, Industry Analysis Report: By Type (Electrodes & Fillers, Fluxes & Wires, and Gases), Technology, End-Use Industry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 119

- Format: PDF

- Report ID: PM1612

- Base Year: 2024

- Historical Data: 2020-2023

Welding Materials Market Overview

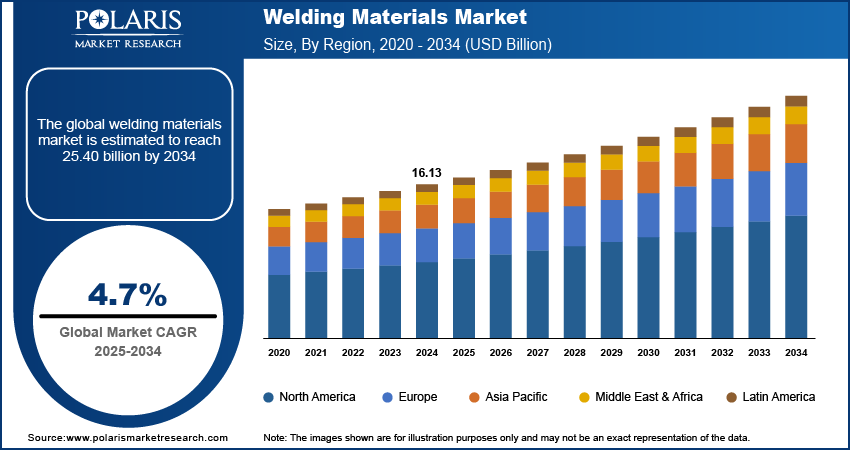

The global welding materials market size was valued at USD 16.13 billion in 2024. The market is projected to grow from USD 16.86 billion in 2025 to USD 25.40 billion by 2034, exhibiting a CAGR of 4.7% during 2025–2034.

The global welding materials market encompasses consumables and equipment used in welding processes across various industries, including automotive, construction, aerospace, and manufacturing. The market is driven by growing demand for infrastructure development, rising manufacturing activities, and advancements in welding technologies. A significant welding materials market trend includes the adoption of automation and robotics in welding, which enhances precision and efficiency. Additionally, the increasing use of lightweight materials in automotive and aerospace applications promotes demand for specialized welding materials. Environmental regulations encouraging sustainable and energy-efficient welding processes also shape the market landscape, supporting growth in eco-friendly welding products.

To Understand More About this Research: Request a Free Sample Report

Welding Materials Market Drivers and Trends

Rising Demand for Automation and Robotics in Welding

The integration of automation and robotics in welding processes is a prominent trend driven by the rising need for improved productivity, efficiency, and precision in manufacturing. Automated welding systems reduce human error, enhance consistency, and improve production speeds, making them ideal for high-volume industries such as automotive and electronics. According to a report from the International Federation of Robotics, over 3 million industrial robots were operating globally in 2023, many of which were in welding applications, reflecting a significant shift toward robotic integration in manufacturing. Further, labor shortages in skilled welding roles, particularly in North America and Europe, intensify the adoption of automated welding solutions.

Growing Preference for Eco-Friendly Welding Materials

Environmental concerns and regulations are increasingly influencing the choice of welding materials, with industries seeking alternatives that produce lower emissions and adhere to sustainability standards. Many companies are investing in eco-friendly welding consumables, such as low-fume welding electrodes, to reduce the harmful effects on both workers and the environment. Data from the American Welding Society indicates that low-fume welding electrodes can reduce fume emissions by 40% compared to traditional electrodes, addressing health and environmental concerns. Governments worldwide are implementing stricter emission standards in industrial sectors, compelling manufacturers to adopt cleaner materials and technologies. This shift toward sustainable products is especially relevant in Europe, where environmental regulations are often stricter than in other regions. Hence, the growth of eco-friendly welding materials boosts the welding materials market demand.

Demand for Lightweight Welding Materials in Automotive and Aerospace

The use of lightweight materials such as aluminum and composites is growing in automotive and aerospace applications due to the rising emphasis on fuel efficiency and reducing emissions of toxic gases. Welding these materials requires specialized consumables and techniques, driving demand for advanced welding solutions. For example, in 2023, the European Aluminum Association reported that the demand for aluminum in the automotive sector increased by 6% as manufacturers aimed to produce lighter and more efficient vehicles. This trend extends to the aerospace industry, where composite materials and alloys are increasingly used in aircraft structures. Consequently, manufacturers are investing in high-performance welding consumables and techniques that can handle the unique requirements of these materials, fueling innovation in welding technology. Therefore, the rising demand for lightweight welding materials in automotive and aerospace industries drives the welding materials market expansion.

Welding Materials Market Segment Insights

Welding Materials Market Outlook – by Type-Based Insights

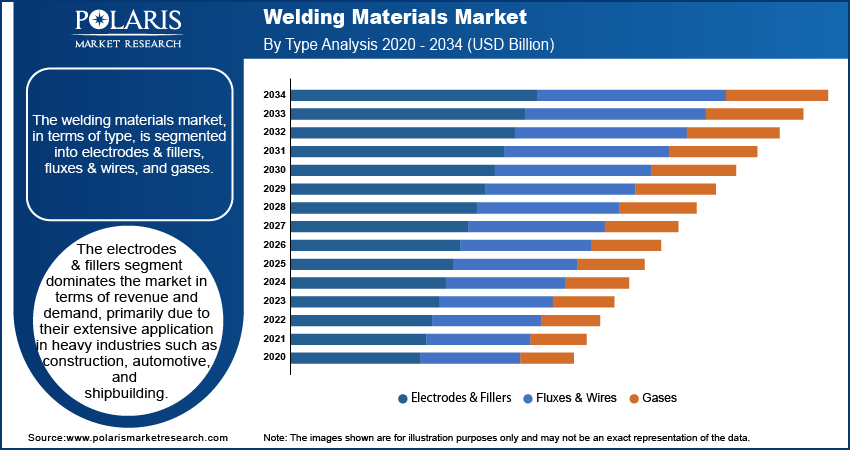

The welding materials market, by type, is segmented into electrodes & fillers, fluxes & wires, and gases. The electrodes & fillers segment dominates the market in terms of revenue and demand, primarily due to their extensive application in heavy industries such as construction, automotive, and shipbuilding. As consumables, they provide the essential filler materials for joining metals, making them indispensable in most welding processes. The high durability and adaptability of electrodes and fillers contribute to their widespread use across manual and automated welding applications. Additionally, advancements in alloy composition and coating technologies are enhancing their efficiency and reducing material waste, further fueling their demand in industrial sectors.

The fluxes & wires segment is also seeing notable growth, supported by increasing automation in the welding process, where flux-cored and solid wires are widely preferred for their compatibility with robotic welding systems. This segment is particularly growing in applications requiring high strength and precision, such as aerospace and automotive manufacturing. Meanwhile, the gases segment, although comparatively smaller in share, is experiencing steady growth due to the rise in gas-shielded welding processes such as MIG and TIG welding. The adoption of argon, carbon dioxide, and helium gases in these processes has become essential for achieving cleaner welds, especially in sensitive applications such as food processing and electronics, where weld quality is paramount.

Welding Materials Market Outlook – by Technology-Based Insights

The welding materials market, by technology, is segmented into arc welding, resistance welding, and oxy-fuel welding. The arc welding segment holds the largest market share, driven by its versatility and widespread application across industries such as construction, automotive, and oil & gas. This technology’s capability to handle diverse materials, from carbon steel to aluminum, makes it suitable for heavy-duty tasks and large-scale manufacturing. The continual development of advanced arc welding equipment, along with high compatibility with automation systems, reinforces its dominant position. Additionally, its lower operational cost and adaptability to various welding positions and environments make it an attractive choice for industries focused on high productivity and reliability.

The resistance welding segment is experiencing the highest growth rate, fueled by the expansion of the automotive and electronics sectors, where precision and speed are critical. The technology is particularly valued for its ability to join thin sheets and create strong, consistent welds without filler material, making it ideal for automated production lines. The trend toward lightweight vehicle manufacturing in the automotive industry further supports the demand for resistance welding, as it is highly effective in joining lightweight materials such as aluminum. Meanwhile, the oxy-fuel welding segment, though traditionally favored for its simplicity in metal cutting and repair applications, is observing stable demand, especially in the maintenance and repair sectors, where portability and cost-effectiveness are prioritized.

Welding Materials Market Outlook– End-Use Industry-Based Insights

By end-use industry, the welding materials market is segmented into automotive & transportation, building & construction, marine, oil & gas. The building & construction segment holds the largest market share, driven by infrastructure development, urbanization, and investments in residential and commercial projects globally. Welding is essential in constructing steel structures, pipelines, and frameworks, which are critical components in large-scale building projects. With growing investments in smart cities and sustainable infrastructure, demand for welding materials remains strong, especially in emerging economies across Asia-Pacific and the Middle East. The adoption of automated and advanced welding techniques enhances productivity and safety on construction sites, which propels the market growth.

The automotive and transportation segment is registering the highest growth rate, fueled by the increasing demand for lightweight and energy-efficient vehicles. Welding is integral to automotive manufacturing, particularly in assembling body structures, chassis, and specialized components. The industry’s transition to electric vehicles (EVs) further drives demand for advanced welding materials, as EV production often requires specialized welding techniques for battery and motor assembly. The shift toward robotics and automated welding systems within automotive manufacturing is also enhancing the welding materials market growth for this segment, as these systems improve speed, precision, and quality, which are essential in high-volume automotive production lines.

Welding Materials Market Regional Insights

By region, the study provides welding materials market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific holds the largest share of the global market, primarily due to rapid industrialization, urbanization, and infrastructure development in countries such as China, India, and Japan. The region’s robust automotive, construction, and manufacturing sectors drive significant demand for welding materials, as these industries rely heavily on welding for fabrication and assembly. Additionally, government initiatives and investments in infrastructure projects, such as China’s Belt and Road Initiative, further stimulate market growth by increasing the need for welding consumables and equipment. North America and Europe also contribute considerably, supported by advancements in welding technologies and high demand from the automotive and oil & gas sectors. However, large-scale industrial activities and labor-intensive industries in Asia Pacific secure its dominant position in the global welding materials market share.

In Europe, the welding materials market development is primarily driven by advancements in automotive manufacturing, a rise in construction activities, and an increase in renewable energy projects. Countries such as Germany, France, and Italy have well-established automotive and aerospace industries that require precise, high-quality welding materials, especially with the growing shift toward EVs. Europe’s strict environmental regulations also encourage the adoption of eco-friendly welding consumables and technologies, especially in sectors focused on reducing emissions. Furthermore, the region’s push for renewable energy infrastructure, such as offshore wind projects, has heightened demand for robust welding materials designed for challenging environments, strengthening the region's position in the market.

Welding Materials Market – Key Players and Competitive Insights

Lincoln Electric, ESAB (part of Colfax Corporation), Air Liquide, Linde plc, Illinois Tool Works, and Panasonic Corporation are a few key players in the welding materials market. The players have a strong global presence across multiple segments. Voestalpine Böhler Welding, Praxair (now part of Linde), and Kobe Steel are prominent in specific regions, particularly in high-performance welding applications. Other active companies include Fronius International, Ador Welding Limited, and EWM Group, each providing specialized equipment and consumables. Hyundai Welding Co., Denyo Co., Miller Electric (a subsidiary of Illinois Tool Works), and Hobart Brothers (also under Illinois Tool Works) focus on welding solutions for sectors ranging from construction and automotive to oil & gas.

These companies maintain competitiveness through continuous innovation, extensive product portfolios, and strategic partnerships to expand market reach. For instance, Lincoln Electric and ESAB have invested significantly in robotic welding and automated systems, targeting the rising demand for precision and efficiency in industries such as automotive and aerospace. Companies such as Linde and Air Liquide, with their extensive resources in industrial gases, play a crucial role in advancing gas-shielded welding processes, a critical technology in manufacturing and fabrication. Additionally, Voestalpine Böhler Welding focuses on highly specialized applications for demanding environments, such as offshore and heavy-duty welding, which allows it to maintain a niche competitive edge.

Competitive strategies also emphasize regional expansion, environmental compliance, and digital integration. With environmental regulations intensifying, many companies are now investing in low-emission and eco-friendly welding consumables to address sustainability concerns. Digital innovations, such as remote monitoring and predictive maintenance solutions, have been a focal point for companies such as Fronius International and EWM Group, enabling users to improve weld quality and productivity. Overall, the market remains dynamic, with established players continuously adapting to technological advancements and shifting regulatory landscapes to meet evolving customer needs.

Lincoln Electric provides a broad range of welding solutions, including equipment, consumables, and automation systems. Headquartered in Cleveland, Ohio, the company has a global footprint, serving industries such as automotive, construction, and energy. Lincoln Electric has focused on advancing its digital welding solutions to meet evolving industrial needs.

ESAB, part of Colfax Corporation, is known for its comprehensive offerings in welding and cutting equipment and consumables, with operations in North America, Europe, and Asia. ESAB provides equipment used in various applications, from heavy manufacturing to precision welding in automotive and aerospace. The company has been enhancing its product line with innovations in gas-shielded welding and automation.

Key Companies in Welding Materials Market

- Lincoln Electric

- ESAB (Colfax Corporation)

- Air Liquide

- Linde plc

- Illinois Tool Works

- Panasonic Corporation

- Voestalpine Böhler Welding

- Praxair (now part of Linde)

- Kobe Steel

- Fronius International

- Ador Welding Limited

- EWM Group

- Hyundai Welding Co.

- Denyo Co.

- Miller Electric (subsidiary of Illinois Tool Works)

Welding Materials Industry Developments

- In August 2023, Lincoln Electric announced a strategic partnership with the software firm Authentise to integrate digital tools for real-time tracking and quality control in welding processes, which supports industrial clients seeking improved efficiency and transparency in production.

- In March 2023, ESAB introduced its new Rebel EMP 215ic, a portable multi-process welder designed for ease of use in both industrial and smaller workshop settings, addressing the need for adaptable, high-quality welding solutions across different scales.

Welding Materials Market Segmentation

By Type Outlook

- Electrodes & Fillers

- Fluxes & Wires

- Gases

By Technology Outlook

- Arc Welding

- Resistance Welding

- Oxy-Fuel Welding

By End-Use Industry Outlook

- Automotive & Transportation

- Building & Construction

- Marine

- Oil & Gas

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Welding Materials Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 16.13 billion |

|

Market Size Value in 2025 |

USD 16.86 billion |

|

Revenue Forecast by 2034 |

USD 25.40 billion |

|

CAGR |

4.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 16.13 billion in 2024 and is projected to grow to USD 25.40 billion by 2034.

The global market is projected to register a CAGR of 4.7% during 2025–2034.

Asia Pacific held the largest share of the global market in 2024.

A few key players in the welding materials market are Lincoln Electric, ESAB (part of Colfax Corporation), Air Liquide, Linde plc, Illinois Tool Works, and Panasonic Corporation, which have a strong global presence across multiple segments. Voestalpine Böhler Welding, Praxair (now part of Linde), and Kobe Steel are prominent in specific regions, particularly in high-performance welding applications.

The electrodes & fillers segment accounted for the largest share of the global market in 2024.

The arc welding segment accounted for the largest market share in 2024.

Welding materials are the consumables and equipment used in the process of joining metals or thermoplastics through welding techniques. These materials include electrodes, fillers, fluxes, wires, and gases, each of which plays a specific role in ensuring the quality, strength, and durability of welded joints. Electrodes and fillers provide the material needed to form a strong bond between the base metals. Fluxes are used to remove impurities and protect the weld from contamination during the process, while welding gases, such as argon or carbon dioxide, shield the molten weld pool from atmospheric elements.

A few key welding materials market trends are described below: Automation and Robotics Integration: Increasing use of automated and robotic welding systems to enhance precision, speed, and productivity across industries. Eco-Friendly Welding Solutions: Growing demand for low-emission and sustainable welding materials, driven by environmental regulations and a shift toward greener practices. Advancements in Digital Welding Technologies: Adoption of smart welding solutions, such as real-time tracking, data analytics, and remote monitoring, to improve quality and efficiency. Growth in Lightweight Material Welding: The rising use of lightweight materials such as aluminum and composites in automotive and aerospace industries drives demand for specialized welding consumables.

A new company entering the welding materials market could focus on developing eco-friendly and sustainable welding solutions, catering to the growing demand for low-emission and energy-efficient materials. Emphasizing innovation in automated and robotic welding technologies would also provide a competitive edge, given the increasing demand for precision and speed in industries such as automotive and aerospace. Additionally, offering specialized materials for emerging sectors such as renewable energy projects and lightweight materials welding could capture niche market segments.

Companies manufacturing, distributing, or purchasing welding materials and related products and other consulting firms must buy the report.