Welding Fume Extraction Equipment Market Size, Share, Trends, & Industry Analysis Report

: By Product (Mobile Units, Stationary Units, Large Centralized Systems, and Others), By Application, By Industry Vertical, and By Region – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 129

- Format: PDF

- Report ID: PM2923

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

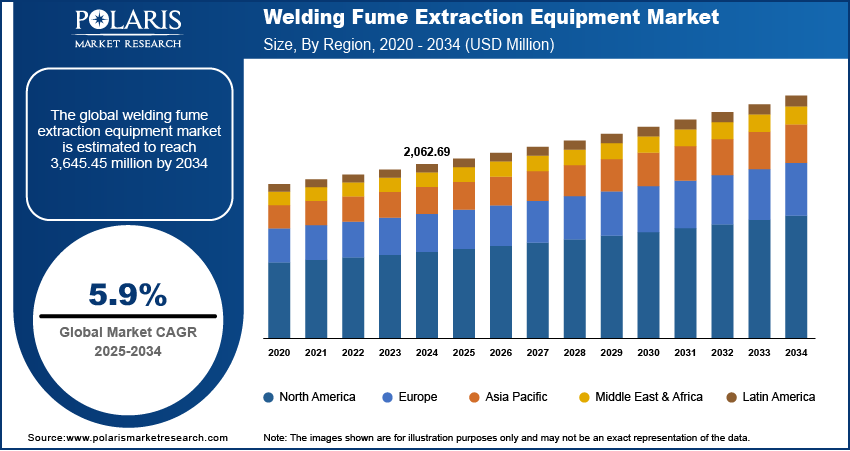

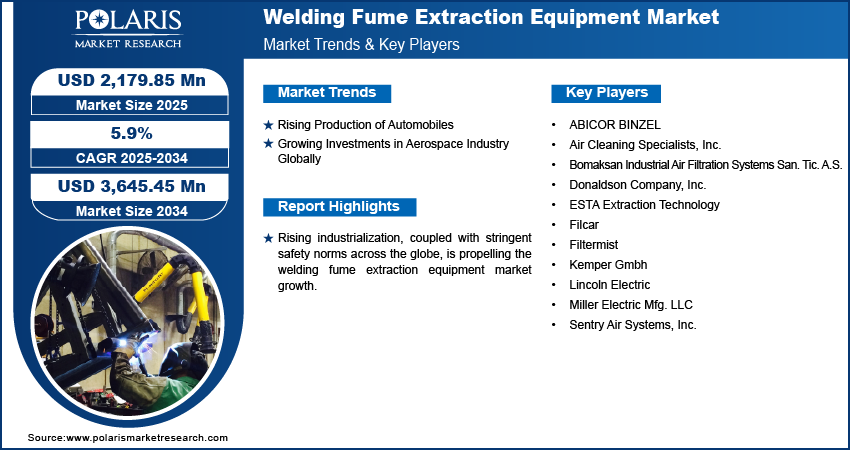

The global welding fume extraction equipment market size was valued at USD 2,062.69 million in 2024. It is projected to grow from USD 2,179.85 million in 2025 to USD 3,645.45 million by 2034, exhibiting a CAGR of 6.15% during 2025–2034.

Welding fume extraction equipment is designed to capture and remove hazardous fumes generated during welding processes, ensuring a safer and healthier workplace. Welding fumes consist of harmful gases and particles, including metal oxides, nitrogen oxides, and carbon monoxide, which pose significant health risks such as respiratory issues, cancer, and neurological disorders. The equipment improves air quality by filtering out contaminants and returning clean air to the work area, thereby reducing exposure for workers and enhancing productivity. It typically uses filters, fans, and ductwork to extract fumes directly at the source or from the surrounding work area.

The rising industrialization across the globe is propelling the welding fume extraction equipment market growth. Industrial growth of 9.5% was witnessed in India during 2023–2034 as highlighted in the Economic Survey 2023-24 and presented by the Union Minister of Finance and Corporate Affairs of India. Industrialization leads rise in welding processes to assemble, repair, and fabricate metal components. This surge in welding operations generates higher volumes of hazardous fumes, making it essential for companies to invest in effective fume extraction systems to maintain safe working environments. Industrial growth also brings stricter regulatory standards and highlights awareness of workplace safety. Governments and organizations worldwide are enforcing stringent guidelines to protect workers from harmful exposure to welding fumes, which contain toxic substances such as manganese, chromium, and nickel. Companies must comply with these regulations to avoid penalties and ensure employee well-being, driving the adoption of advanced fume extraction equipment.

To Understand More About this Research: Request a Free Sample Report

The demand for welding fume extraction equipment is driven by growing urbanization worldwide. Urbanization drives the construction of buildings, bridges, and other infrastructure projects. These projects require extensive welding processes, which generate harmful fumes and particulates. To ensure the safety of workers and comply with environmental regulations, construction companies adopt effective fume extraction systems. Moreover, urbanization leads to a higher concentration of industries and manufacturing units within cities. These industries rely heavily on welding processes, resulting in a greater need for fume extraction equipment to maintain safe working conditions and adhere to occupational health standards. United Nations published a report stating that, the total urban population is estimated to double by 2050. Hence, the demand for welding fume extraction equipment is rising with the growing urbanization.

Market Dynamics

Rising Production of Automobiles

Increased automotive production encourages automotive companies to expand their welding operations, which generate hazardous fumes containing harmful particles and gases. Strict workplace safety regulations require these companies to protect workers from respiratory risks, forcing them to install more fume extraction systems in factories. Additionally, the automotive sector’s shift toward electric vehicles introduced new welding challenges, such as handling battery enclosures and lightweight materials, further driving the need for advanced welding fume extraction equipment. The Association of European Automobile Manufacturers published a report stating that in 2022, 85.4 million motor vehicles were produced across the world, an increase of 5.7% compared to 2021. As the production of automobiles increases, the demand for welding fume extraction equipment also spurs.

Growing Investments in Aerospace Industry Globally

Increasing investments lead to a rise in production to meet rising orders for aircraft and spacecraft components. These aircraft and spacecraft components rely heavily on precision welding for assembling lightweight, high-strength materials such as aluminum, titanium, and advanced alloys, processes that generate hazardous fumes requiring efficient extraction. To ensure the safety and health of workers, companies invest in advanced welding fume extraction equipment. These systems capture and filter out hazardous fumes, preventing them from contaminating the workspace and affecting workers' health. Additionally, stringent regulations and standards for workplace safety further drive the welding fume extraction equipment market demand.

Segment Insights

Market Evaluation by Product

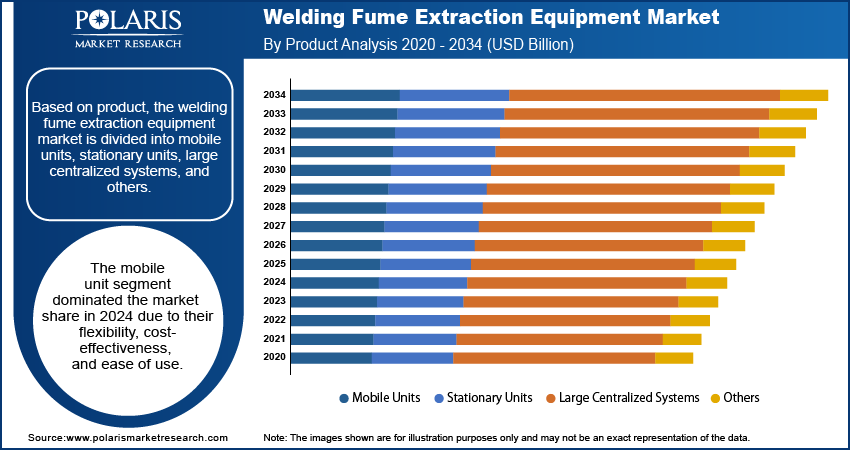

Based on product, the welding fume extraction equipment market is divided into mobile units, stationary units, large centralized systems, and others. The mobile units segment dominated the market share in 2024 due to their flexibility, cost-effectiveness, and ease of use. Industries such as automotive, shipbuilding, and construction favored these systems as they provide localized fume extraction without requiring extensive installation. Companies increasingly adopted mobile solutions to comply with stringent workplace safety regulations and minimize workers' exposure to hazardous fumes. The rising demand for portable equipment in small and medium-sized enterprises (SMEs) further contributed to their segment dominance, as these businesses look for affordable and efficient methods to maintain air quality in confined workspaces. Additionally, advancements in filter technology and energy-efficient designs enhanced the appeal of mobile units, making them a preferred choice for manufacturers and fabricators.

In the coming years, the large centralized systems segment is projected to hold a dominant market share, driven by the expanding presence of large-scale manufacturing facilities and stricter environmental regulations. Industries with high-volume welding operations, including heavy machinery, aerospace, and industrial equipment production, increasingly invest in these comprehensive systems to ensure long-term cost savings and improved worker safety. The integration of automated extraction solutions and IoT-enabled monitoring systems enhances efficiency, providing real-time data on air quality and filter performance. Companies prioritize these systems to meet stringent emission control standards while optimizing operational efficiency. The shift toward automation and Industry 4.0 further accelerates the adoption of large centralized solutions as businesses seek to integrate them seamlessly into advanced production lines.

Market Insight by Application

In terms of application, the welding fume extraction equipment market is segregated into arc welding, resistance welding, laser beam welding, oxy-fuel welding, and others. The laser beam welding segment is expected to grow at a robust pace in the coming years, owing to the increasing demand for precision welding in industries such as aerospace, electronics, and automotive manufacturing. The shift toward lightweight materials and high-strength alloys has led manufacturers to adopt laser-based welding techniques, which produce minimal distortion while maintaining superior joint quality. However, this process emits ultrafine metal particles and toxic fumes, necessitating advanced fume extraction systems equipped with high-efficiency particulate air (HEPA) filters and automated monitoring technologies. The rising adoption of automation and Industry 4.0 solutions in manufacturing has further contributed to the growth of the laser beam welding segment.

Regional Analysis

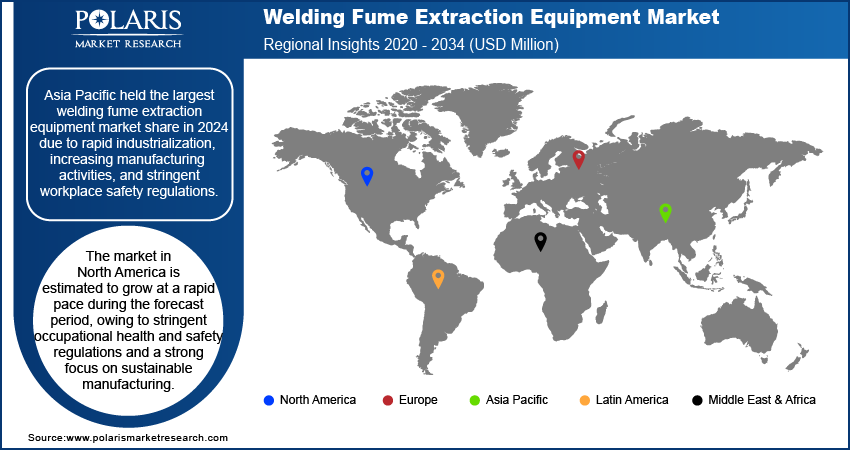

By region, the welding fume extraction equipment industry report provides insight into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific held the largest market share in 2024 due to rapid industrialization, increasing manufacturing activities, and stringent workplace safety regulations. Countries such as China, India, and Japan significantly contributed to this growth, with China emerging as the dominant country in the region. The country’s booming automotive, shipbuilding, and heavy machinery industries fueled the demand for fume extraction systems as manufacturers prioritized worker safety and compliance with national air quality regulations. Additionally, the rise in infrastructure projects and foreign investments in manufacturing further accelerated market expansion. Government initiatives promoting workplace safety, along with the growing presence of multinational corporations setting up production facilities, have strengthened the demand for advanced fume extraction equipment solutions in the region. The increasing adoption of automation and robotic welding also played a crucial role in boosting sales of welding fume extraction equipment, as businesses integrated efficient fume control systems to maintain productivity and adhere to evolving emission standards.

The market in North America is estimated to grow at a rapid pace during the forecast period, owing to stringent occupational health and safety regulations and a strong focus on sustainable manufacturing. The US is estimated to lead the regional growth, driven by the implementation of strict guidelines from the Occupational Safety and Health Administration (OSHA), the Environmental Protection Agency (EPA), and other regulatory bodies. The country’s well-established automotive, aerospace, and heavy machinery industries continue to invest in advanced fume extraction solutions to enhance workplace air quality and reduce exposure to hazardous fumes. Additionally, the rising adoption of automated welding technologies and Industry 4.0 practices has increased the need for high-performance extraction systems with real-time monitoring capabilities. The growing emphasis on worker health, coupled with government incentives for clean and energy-efficient manufacturing processes, is further projected to propel the welding fume extraction equipment market expansion in North America, making it a key region in the industry’s future growth.

Key Players and Competitive Analysis

Major players are investing heavily in research and development to expand their product portfolio, which will help the welding fume extraction equipment market grow even more. These market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The welding fume extraction equipment market is fragmented, with the presence of numerous global and regional market players. A few major players in the market are ABICOR BINZEL; Air Cleaning Specialists, Inc.; Bomaksan Industrial Air Filtration Systems San. Tic. A.S.; Donaldson Company, Inc.; ESTA Extraction Technology; Filcar; Filtermist; Kemper Gmbh; Lincoln Electric; Miller Electric Mfg. LLC; and Sentry Air Systems, Inc.

Donaldson Company, Inc., founded in 1915 and headquartered in Bloomington, Minnesota, is a global company in filtration systems and solutions. The company operates across three primary segments: Mobile Solutions, Industrial Solutions, and Life Sciences, offering products for diverse industries, including automotive, aerospace, pharmaceuticals, and alternative energy. Donaldson specializes in air and liquid filtration systems, venting solutions, and emission control systems. Its innovative technologies cater to applications ranging from industrial machinery to electric vehicles and military equipment. In the domain of welding fume extraction equipment, Donaldson provides advanced solutions under its Torit brand. The company recently introduced the Torit Downflo Ambient (DFA) weld fume extractor, designed to address challenges in capturing welding fumes without requiring ductwork or hoods.

Filtermist, established in 1969 and headquartered in Telford, UK, is a prominent manufacturer of oil mist collectors and air filtration systems. The company specializes in removing airborne contaminants such as oil mist, smoke, and dust generated during metalworking processes such as grinding, turning, and machining. The company serves diverse industries, including automotive, aerospace, medical devices, and precision engineering. In the area of welding fume extraction equipment, Filtermist offers advanced systems designed to ensure clean air in industrial environments. The company markets fume extraction solutions developed by its sister company Absolent AB, which are tailored to meet the stringent safety requirements associated with welding fumes.

List of Key Companies in Welding Fume Extraction Equipment Market

- ABICOR BINZEL

- Air Cleaning Specialists, Inc.

- Bomaksan Industrial Air Filtration Systems San. Tic. A.S.

- Donaldson Company, Inc.

- ESTA Extraction Technology

- Filcar

- Filtermist

- Kemper Gmbh

- Lincoln Electric

- Miller Electric Mfg. LLC

- Sentry Air Systems, Inc.

Welding Fume Extraction Equipment Industry Developments

February 2025: Donaldson BOFA, a major manufacturer of fume and dust filtration systems, announced the launch of a new mobile fume extraction system with articulated arms capable of filtering emissions associated with heavy-duty laser processes.

January 2025: Donaldson BOFA launched Pro OS, a new operating platform with two-way data connectivity to push the boundaries of productivity for fume extraction technology.

April 2024: Filtermist, a company that specializes in designing, manufacturing, and installing industrial air extraction and filtration solutions, announced to launch two new welding fume extraction units from its brand at MACH 2024.

Welding Fume Extraction Equipment Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- Mobile Units

- Stationary Units

- Large Centralized Systems

- Others

By Application Outlook (Revenue, USD Million, 2020–2034)

- Arc Welding

- Resistance Welding

- Laser Beam Welding

- Oxy-fuel Welding

- Others

By Industry Vertical Outlook (Revenue, USD Million, 2020–2034)

- Aerospace

- Automotive

- Building & Construction

- Energy

- Oil & Gas

- Marine

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Welding Fume Extraction Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Value in 2024 |

USD 2,062.69 Million |

|

Market Forecast in 2025 |

USD 2,179.85 Million |

|

Revenue Forecast in 2034 |

USD 3,645.45 Million |

|

CAGR |

6.15% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–s2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2,062.69 million in 2024 and is projected to grow to USD 3,645.45 million by 2034.

The global market is projected to grow at a CAGR of 6.15% during the forecast period.

Asia Pacific held the largest share of the global market in 2024.

A few of the key players in the market are ABICOR BINZEL; Air Cleaning Specialists, Inc.; Bomaksan Industrial Air Filtration Systems San. Tic. A.S.; Donaldson Company, Inc.; ESTA Extraction Technology; Filcar; Filtermist; Kemper Gmbh; Lincoln Electric; Miller Electric Mfg. LLC; and Sentry Air Systems, Inc.

The mobile units segment dominated the market revenue in 2024.

The laser beam welding segment is expected to grow at the fastest pace in the coming years.