Waterborne Coatings Market Share, Size, Trends, Industry Analysis Report: By Resin Type (Acrylic, Polyester, Alkyd, Epoxy, Polyurethane, PTFE, PVDF, PVDC, and Others), Application Industry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 118

- Format: PDF

- Report ID: PM1482

- Base Year: 2023

- Historical Data: 2019-2022

Waterborne Coatings Market Overview

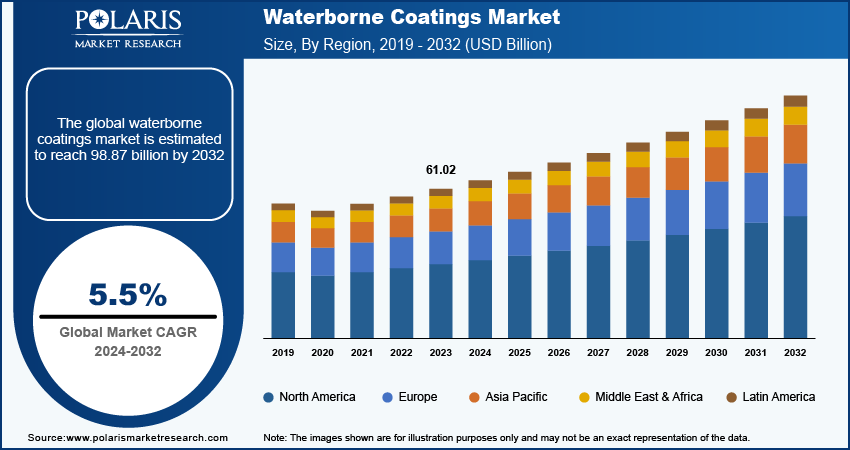

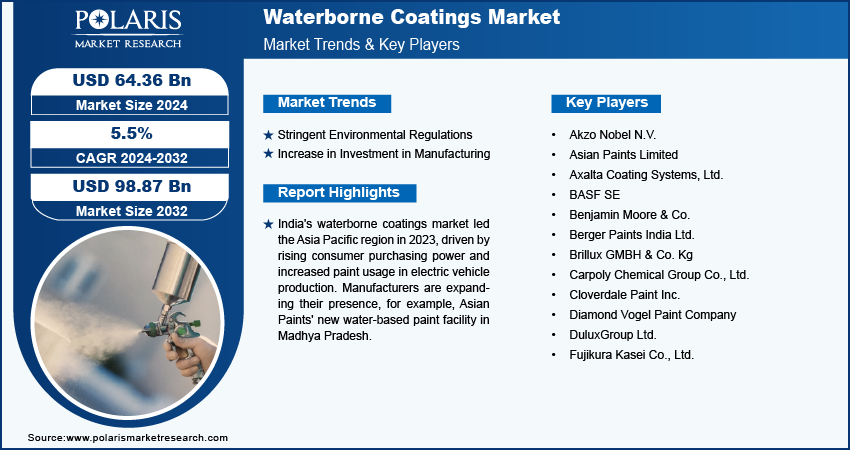

The global waterborne coatings market size was valued at USD 61.02 billion in 2023. The market is projected to grow from USD 64.36 billion in 2024 to USD 98.87 billion by 2032, exhibiting a CAGR of 5.5 % during 2024–2032.

The waterborne coatings market encompasses eco-friendly paint and coating solutions primarily composed of water as a solvent. These coatings are favored for their low volatile organic compounds (VOCs), making them safer for the environment and human health while providing effective surface protection. The increasing demand for coatings in the automotive industry, particularly in the electric vehicle (EV) segment, is driving the growth of the waterborne coating market. Government initiatives aimed at environmental protection, such as incentivizing the purchase of EVs and promoting sustainable manufacturing practices, are further propelling this growth.

Additionally, the ability of waterborne coatings to emit lower levels of volatile organic compounds (VOCs) is encouraging their adoption by original equipment manufacturers (OEMs) to ensure compliance with strict environmental regulations, thereby contributing to the waterborne coatings market growth.

To Understand More About this Research: Request a Free Sample Report

The increase in demand for waterborne coatings in metal industries is significantly driving the growth of the waterborne coatings market. Waterborne coating offers unique properties such as exceptional durability, mechanical strength, and resistance to chemicals, corrosion, and abrasion. These characteristics enhance the longevity and aesthetic appeal of metal surfaces, making waterborne coatings an attractive choice for manufacturers. Leading companies are investing in advanced waterborne manufacturing technologies to create innovative waterproof and fire-resistant coatings, further expanding their application potential and solidifying their role in protecting metal products. Thus, an increase in demand for durable coatings is boosting the growth of waterborne coatings market growth.

Waterborne Coatings

Stringent Environmental Regulations

Stringent environmental regulations are a significant driving factor for the waterborne coatings market. Manufacturers are increasingly shifting towards waterborne formulations as governments worldwide impose stricter guidelines to reduce volatile organic compounds (VOCs) and promote sustainable practices. These coatings comply with regulatory standards while offering enhanced safety and lower environmental impact. The push for greener alternatives in industries such as automotive, construction, and furniture further accelerates market growth. Additionally, consumers' growing awareness of environmental issues fuels demand for eco-friendly products, reinforcing the transition towards waterborne coatings as a viable solution in a rapidly evolving regulatory landscape.

Increase in Investment in Manufacturing

Increased investment in manufacturing is expected to fuel the number of players in the waterborne coating market. As companies seek to enhance their product offerings and meet rising demand for eco-friendly solutions, they are allocating resources toward advanced production technologies and innovative formulations. This influx of investment not only supports the development of high-performance waterborne coatings but also drives competition among manufacturers, leading to the advancement in technology. Therefore, an increase in investment in manufacturing is expected to fuel the growth of the waterborne coatings market revenue.

Waterborne Coatings Market Segment Insights

Waterborne Coatings Market Breakdown – by Resin Type Insights

The global waterborne coatings market segmentation, based on resin type, includes acrylic, polyester, alkyd, epoxy, polyurethane, PTFE, PVDF, PVDC, and others. In 2023, the Alkyd segment dominated the market due to rise in application of alkyd-based coatings in architectural, residential, and commercial buildings. Additionally, the alkyd-based coatings are made with emulsion technology, which enables it to alter traditional solvents with water, promoting sustainability and safety associated with the final painting. In November 2023, a study showcased in the Journal of Coatings Technology and Research synthesized the potential of organosilane monomer such as corrosion resistance and the adhesive properties associated with the acrylic-modified water-reducible alkyd resin.

Waterborne Coatings Market Breakdown – Application Industry Insights

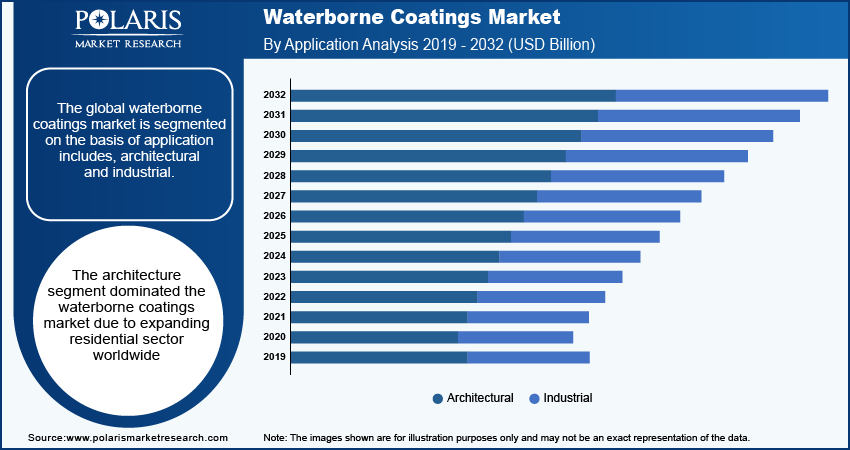

The global waterborne coatings market, based on application industry, is bifurcated into architectural and industrial. The architectural segment held a larger revenue share in 2023. The demand for waterborne coatings in this segment is driven by the rising emphasis on residential and commercial space remodeling and allied renovation activities. According to the National Association of Home Builders (NAHB) Remodelers survey in 2024, the demand for complete house remodeling is 50%, while window or door renewal is 22%. Further, the growing focus on reducing power consumption is expected to stimulate the adoption of these coatings, driven by their benefits such as faster drying and enhanced air quality.

Waterborne Coatings Market – Regional Insights

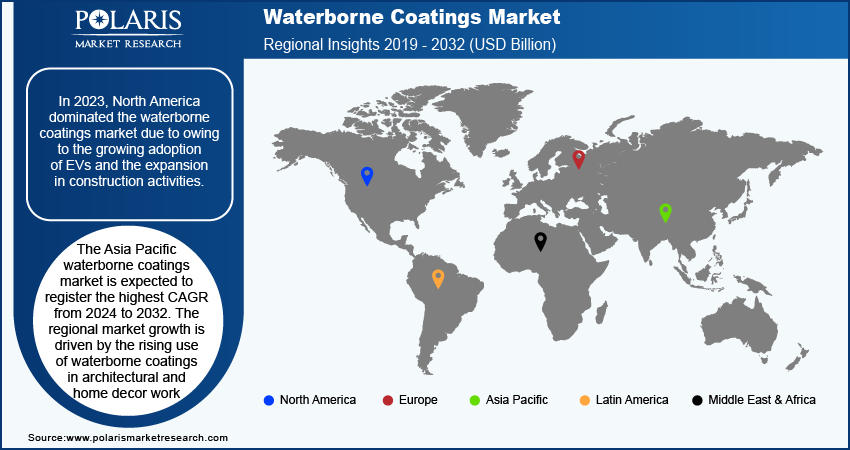

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominates the global waterborne coatings market, owing to the growing adoption of EVs and the expansion in construction activities.

The presence of key companies such as Axalta Coating Systems, Benjamin Moore, and Diamond Vogel Paint, focusing on providing advanced waterborne coatings, strengthens the market landscape in North America. The players are also focusing on various strategic initiatives such as acquisitions, mergers, and collaborations to strengthen their market presence and serve better offerings in North America.

Europe accounts for the second-largest waterborne coatings market share due to stringent environmental regulations. Rising air pollution levels and increasing hazardous waste production are further driving the shift towards waterborne coatings, as these solutions offer lower volatile organic compounds (VOCs) and reduced environmental impact. Additionally, governments and industries are actively seeking sustainable practices to comply with regulations, which enhances the adoption of waterborne coatings across various applications in the region.

The Asia Pacific waterborne coatings market is expected to register the highest CAGR from 2024 to 2032. This growth is largely driven by the increasing use of waterborne coatings in architectural and home decor projects, fueled by a rising middle-income population and growing disposable incomes. The demand for eco-friendly and aesthetically appealing coatings is increasing as consumers invest more in home improvement and renovation. Additionally, increased disposable income is encouraging more architectural projects, further propelling the adoption of waterborne coatings in the region.

India held the largest share of the Asia Pacific waterborne coatings market in 2023. The market growth in the country is driven by factors such as the rising purchasing power of consumers, growing use of paint in electric vehicle production, and increasing initiatives by manufacturers to expand their industrial presence in India. In January 2024, Asian Paints announced its strategy to introduced water-based paint production in Madhya Pradesh with a capacity of 400,000 kiloliters per year.

Waterborne Coatings Market – Key Players and Competitive Insights

Leading market players are investing hugely in research and development to innovate new products and expand their product portfolio, which will assist them in acquiring a competitive share in waterborne coatings by enhancing accessibility to their products. Key participants in the waterborne coatings industry are adopting intensive strategies to enhance their global footprint. A few of the major market developments are mergers and acquisitions, collaborations, and partnership agreements. They are working on developing affordable waterborne coatings to attain a larger chunk of the consumer base globally.

In the global waterborne coatings industry, producing locally is one of the main business tactics that is adopted by the major players in the marketplace to limit production costs and augment profits. The waterborne coatings industry is significantly upgrading technologies with changing global conditions.

Akzo Nobel, Asian Paints, Axalta Coating Systems, BASF SE, Benjamin Moore, Berger Paints India, Brillux GMBH, Carpoly Chemical Group, Cloverdale Paint, Diamond Vogel Paint, DuluxGroup, and Fujikura Kasei Co are among the major players in the waterborne coating market.

BASF SE is a global chemical corporation with seven distinct business segments: chemicals, industrial solutions, materials, surface technologies, nutrition & care, agricultural solutions, and others. The chemical segment supplies petrochemicals and their intermediates. Advanced materials and their precursors for applications such as polyamides and isocyanates are available through the Materials section, inorganic basic products and specialties for the plastic and plastic processing industries. The industrial solutions sector deals with the development and sale of various ingredients and additives such as polymer dispersions, resins, electronic materials, pigments, light stabilizers, antioxidants, mineral processing, oilfield chemicals, and hydrometallurgical chemicals. On the other hand, Surface Technologies provides chemical solutions and automotive OEM services to the automotive and chemical sectors. This includes surface treatment, battery materials, refinishing coatings, catalysts, and base metal services. The Nutrition and Care sector provides ingredients for food and feed producers, pharmaceutical, detergent, cosmetics, and cleaner industries. Lastly, the Agricultural Solutions segment offers seeds and crop protection products, such as herbicides, fungicides, insecticides, seed treatment products, and biological crop protection products.

Arkema SA is a chemical company engaged in offering coating solutions, adhesives, and advanced materials. It provides coating resins, additives, adhesives, and polymers to aeronautics, sporting products, cosmetics, electrics, and automobile industries across the globe. In April 2024, Arkema widened its sustainable offering by introducing a range of products focused on circularity, decarbonization, and others at the American Coatings Show 2024 in Indiana to meet changing consumer interests.

Key Companies in Waterborne Coatings Market

- Akzo Nobel N.V.

- Asian Paints Limited

- Axalta Coating Systems, Ltd.

- BASF SE

- Benjamin Moore & Co.

- Berger Paints India Ltd.

- Brillux GMBH & Co. Kg

- Carpoly Chemical Group Co., Ltd.

- Cloverdale Paint Inc.

- Diamond Vogel Paint Company

- DuluxGroup Ltd.

- Fujikura Kasei Co., Ltd.

Waterborne Coatings Industry Developments

August 2024: AkzoNobel, a chemical company, unveiled its plan to exhibit its new range of wood coating solutions at the International Woodworking Fair (IWF) 2024 in Atlanta. It includes Chemcraft’s acrylic systems and Selva Pro 2K polyurethane.

August 2023: Covestro completed the construction of its new manufacturing plant in Shanghai, China, to develop polyurethane dispersions. This is to meet the demand for sustainable coatings and adhesives in Asia Pacific, primarily for the automotive, packaging, furniture, and construction industries.

Waterborne Coatings Market Segmentation

By Resin Type Outlook

- Acrylic

- Polyester

- Alkyd

- Epoxy

- Polyurethane

- PTFE

- PVDF

- PVDC

- Others

By Application Industry Outlook

- Architectural

- Industrial

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Waterborne Coatings

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 61.02 Billion |

|

Market Size Value in 2024 |

USD 64.36 Billion |

|

Revenue Forecast by 2032 |

USD 98.87 Billion |

|

CAGR |

5.5% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global waterborne coatings market size was valued at USD 61.02 billion in 2023 and is projected to grow to USD 98.87 billion by 2032.

The global market is projected to register a CAGR of 5.5% during the forecast period.

North America accounted for the largest share of the global market in 2023.

Akzo Nobel N.V.; Asian Paints Limited; Axalta Coating Systems, Ltd.; BASF SE; Benjamin Moore & Co.; Berger Paints India Ltd.; Brillux GMBH & Co. Kg; Carpoly Chemical Group Co., Ltd.; Cloverdale Paint Inc.; Diamond Vogel Paint Company; DuluxGroup Ltd.; and Fujikura Kasei Co., Ltd. are among the key players in the market.

The alkyd segment dominated the market in 2023 due to rise in application of alkyd-based coatings in architectural, residential, and commercial buildings.

The architectural segment had a larger share of the global market in 2023 due to expanding residential sector worldwide.