Warehouse Management System Market Size, Share, Trends, Industry Analysis Report: By Component (Software and Services), Deployment, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Nov-2024

- Pages: 120

- Format: PDF

- Report ID: PM5246

- Base Year: 2024

- Historical Data: 2020-2023

Warehouse Management System Market Overview

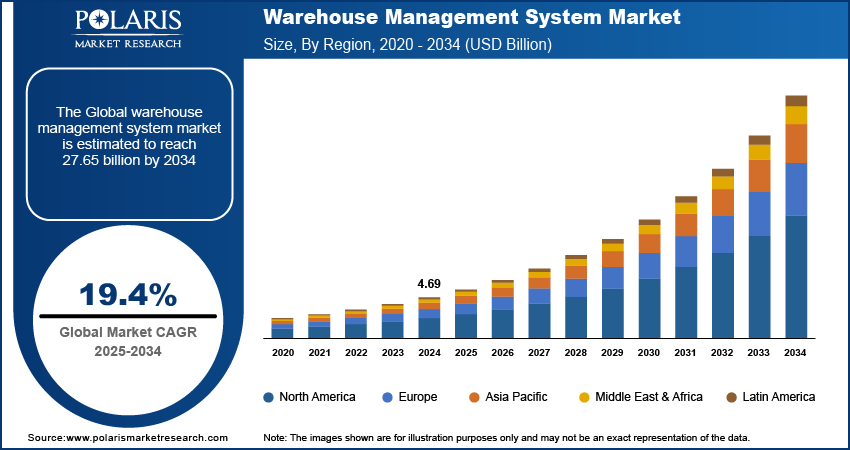

Global warehouse management system market size was valued at USD 4.69 billion in 2024. The market is projected to grow from USD 5.59 billion in 2025 to USD 27.65 billion by 2034, exhibiting a CAGR of 19.4% during the forecast period.

The warehouse management system (WMS) market refers to the industry involved in providing software solutions and related services that optimize and manage the operations within warehouses and distribution centers. WMS software systems are designed to control and manage the movement and storage of materials within a warehouse, including tasks such as receiving, put-away, picking, packing, and shipping of goods.

In the warehouse management system market, the rapid growth of e-commerce has transformed the landscape of retail and supply chain management, driving a surge in demand for efficient warehouse operations. Also, online shopping continues to thrive, and businesses are increasingly turning to warehouse management systems (WMS) to meet the challenges posed by the volume and complexity of online orders. To overcome these challenges, some of the market players are offering solutions for e-commerce. For instance, in January 2022, FedEx and Microsoft collaborated to offer a cross-platform logistics solution to enhance e-commerce operations and customer experiences.

WMS plays a pivotal role in enabling companies to effectively manage inventory, streamline order fulfillment processes, and optimize warehouse layouts. By leveraging advanced functionalities such as real-time inventory tracking, automated picking and packing, and integration with transportation management systems, WMS enhances operational efficiency and reduces fulfillment times.

To Understand More About this Research: Request a Free Sample Report

The adoption of automation technologies within warehouses is driving the growth of the warehouse management system market. WMS software enhances operational efficiency by minimizing errors and streamlining critical processes such as inventory control, picking, and shipping.

The integration of advanced technologies such as artificial intelligence (AI), the Internet of Things (IoT), and cloud computing into WMS is transforming warehouse operations, making them more responsive, data-driven, and productive. Automated storage and retrieval systems (AS/RS), autonomous mobile robots (AMRs), voice picking, and wearables are some of the innovative automation solutions being adopted by warehouses to optimize workflows and improve accuracy, which drives the market growth.

Warehouse Management System Market Drivers and Trends Analysis

Rising Adoption of Cloud-Based Solutions

The adoption of cloud-based WMS solutions has surged due to their scalability, flexibility, and cost-effectiveness when compared to traditional on-premises systems. This shift has been particularly pronounced among small and medium-sized enterprises (SMEs) aiming to minimize upfront investments in IT infrastructure. For instance, in April 2022, LIS AG launched LIS Warehouse Management (LWM), a cloud-based WMS tailored for 3PL providers, enhancing logistics efficiency and flexibility.

Cloud-based WMS platforms allow businesses to scale operations more efficiently, adjust to fluctuating demands, and integrate seamlessly with other cloud-based applications and services. They also offer real-time data accessibility, enabling improved decision-making and operational agility across distributed warehouse networks.

Rising Demand for Omnichannel Distribution

The demand for omnichannel distribution has reshaped retailers' and logistics providers' approaches to inventory management and order fulfillment. Consumers now expect seamless experiences, whether shopping online, in-store, or via mobile platforms. This shift requires WMS that can synchronize inventory across these diverse channels in real-time, ensuring that products are available where and when customers want them.

WMS solutions tailored for omnichannel distribution integrate inventory data across all sales channels, enabling businesses to optimize stock levels, reduce out-of-stock, and improve order accuracy. By centralizing operations and providing a unified view of inventory, these systems enhance efficiency, reduce costs associated with excess inventory and missed sales opportunities, and ultimately deliver a superior customer experience across all touchpoints.

Warehouse Management System Market Segment Analysis

Warehouse Management System Market Assessment by Component

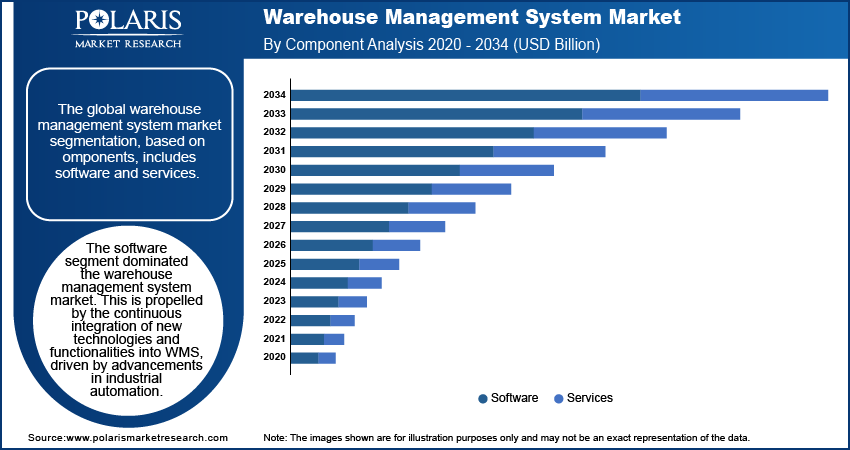

The global warehouse management system market segmentation, based on components, includes software and services. The software segment dominated the warehouse management system market. This is propelled by the continuous integration of new technologies and functionalities into WMS, driven by advancements in industrial automation. The increasing complexity of global supply chain networks underscores the necessity for advanced WMS software solutions. In August 2024, Bar Code India (BCI) launched modular and customizable software solutions, including rain-to-cloud RFID reader and IoT sensors, aiming to enhance warehouse management capabilities.

Factors such as heightened awareness of WMS software among small and medium-sized enterprises (SMEs), the expansion of global supply chain operations, and the growing preference for cloud-based WMS platforms are pivotal in driving this demand. Furthermore, the escalating requirement for advanced warehousing and logistics infrastructure further amplifies the adoption of WMS-related software solutions.

Warehouse Management System Market Evaluation by Deployment

The global warehouse management system market segmentation, based on deployment, includes on-premises and cloud-based. The on-premises segment is anticipated to hold the largest share of the warehouse management system market. On-premise WMS software operates on servers located at warehouse facilities, providing robust computing power locally. This setup offers advantages such as heightened control over server infrastructure, enhanced security, and optimized performance. However, the adoption of on-premise WMS entails substantial costs, including investments in hardware components and software licenses necessary for WMS operation. Additionally, there are ongoing expenses associated with IT personnel for maintenance and periodic data backups.

Warehouse Management System Market Breakdown by Regional Insights

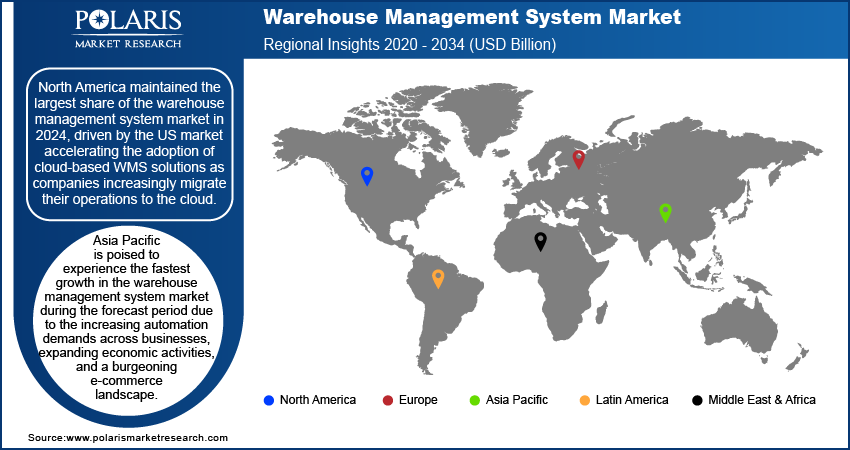

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America maintained the largest share of the warehouse management system market in 2024, driven by the US market accelerating the adoption of cloud-based WMS solutions as companies increasingly migrate their operations to the cloud.

Key growth factors include the robust expansion of the e-commerce sector, a well-developed manufacturing ecosystem, and the presence of leading companies in automotive, pharmaceuticals, chemicals, and food & beverages. These industries are progressively embracing advanced WMS solutions over traditional legacy systems. Furthermore, the third-party logistics (3PL) sector plays a significant role in fueling the expansion of the warehouse management system market across North America.

Asia Pacific is poised to experience the fastest growth in the warehouse management system market during the forecast period. This acceleration is driven by increasing automation demands across businesses, expanding economic activities, and a burgeoning e-commerce landscape supported by high Internet penetration rates. In countries such as China and India, the market growth is further propelled by rising consumer purchasing power, leading to heightened demand for consumer goods and necessitating efficient WMS solutions for streamlined handling and delivery.

Government initiatives in China, such as the "Made in China 2025" plan aimed at advancing manufacturing capabilities through technology adoption, are pivotal in fostering the adoption of advanced technologies like WMS. Similarly, in India, initiatives like "Make in India" and efforts towards digital transformation are incentivizing businesses to invest in WMS technologies, aiming to optimize operations and enhance overall competitiveness.

Warehouse Management System Key Market Players & Competitive Analysis Report

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the warehouse management system market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the warehouse management system industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global warehouse management system market to benefit clients and increase the market sector. In recent years, the market has offered some technological advancements. Major players in the warehouse management system market includes Blue Yonder Group, Inc.; Datapel Systems; Dematic; ecovium Holding GmbH; Ehrhardt Partner Group; Epicor Software Corporation; Extensiv; Generix Group; IBM; Infor; Körber AG; Made4net; Manhattan Associates; Mecalux; S.A.; Microlistics; Microsoft; Oracle; PTC Inc.; Reply; SAP; Softeon; SSI SCHAEFER Group; Synergy Logistics Ltd.; Tecsys Inc.; and Vinculum Solutions Pvt. Ltd.

Blue Yonder Inc., a part of Panasonic Holdings Corp, specializes in supply chain solutions encompassing planning, omnichannel commerce, execution, and network design. The company also provides discovery, education, enablement, customer success, and expansion services. Its solutions serve various industries, such as manufacturing, logistics, retail, technology, automotive, and consumer goods. In January 2024, Blue Yonder launched its largest product update, featuring interoperable solutions across the supply chain on the Luminate Cognitive Platform, aiming to enhance productivity and resilience.

Dematic designs, constructs, and supports intelligent automated solutions to empower and sustain commerce in manufacturing, warehousing, and distribution, with a global network spanning over 26 countries and more than 10,000 employees. In May 2024, Dematic was recognized as a Niche Player in the 2024 Gartner Magic Quadrant for Warehouse Management Systems, offering integrated solutions for enhanced warehouse operations across diverse industries.

Key Companies in the Warehouse Management System Market

- Blue Yonder Group, Inc.

- Datapel Systems

- Dematic

- ecovium Holding GmbH

- Ehrhardt Partner Group

- Epicor Software Corporation

- Extensiv

- Generix Group

- IBM

- Infor

- Körber AG

- Made4net

- Manhattan Associates

- Mecalux, S.A.

- Microlistics

- Microsoft

- Oracle

- PTC Inc.

- Reply

- SAP

- Softeon

- SSI SCHAEFER Group

- Synergy Logistics Ltd.

- Tecsys Inc.

- Vinculum Solutions Pvt. Ltd.

Warehouse Management System Market Developments

July 2024: Cart.com launched standalone warehouse and transportation management systems, Constellation WMS and Constellation TMS, alongside its distributed order management system, Constellation OMS, as SaaS offerings for enhanced operational efficiency and customer experience.

May 2024: Softeon upgraded its Warehouse Management System with new capabilities in its Spring 2024 Release, emphasizing greater integration, customization, and usability through an updated interface.

September 2023: Honeywell introduced MesonX WMS, optimizing warehouse operations with rapid deployment, deep configurability, and seamless integration across global markets.

Warehouse Management System Market Segmentation

By Component Outlook (Revenue - USD Billion, 2020-2034)

- Software

- Services

By Deployment Outlook (Revenue - USD Billion, 2020-2034)

- On-premises

- Cloud-based

By End User Outlook (Revenue - USD Billion, 2020-2034)

- Automotive

- Chemicals

- E-commerce

- Electricals & Electronics

- Food & Beverages

- Healthcare

- Metals & Machinery

- Third-party Logistics (3PL)

- Others

By Regional Outlook (Revenue - USD Billion, 2020-2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Warehouse Management System Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 4.69 billion |

|

Market Size Value in 2025 |

USD 5.59 billion |

|

Revenue Forecast in 2034 |

USD 27.65 billion |

|

CAGR |

19.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global warehouse management system market size was valued at USD 4.69 billion in 2024 and is anticipated to reach USD 27.65 billion in 2034

The global market registers a CAGR of 19.4% during the forecast period, 2025-2034.

North America had the largest share of the global market.

The key players in the market are Blue Yonder Group, Inc.; Datapel Systems; Dematic; ecovium Holding GmbH; Ehrhardt Partner Group; Epicor Software Corporation; Extensiv; Generix Group; IBM; Infor; Körber AG; Made4net; Manhattan Associates; Mecalux; S.A.; Microlistics; Microsoft; Oracle; PTC Inc.; Reply; SAP; Softeon; SSI SCHAEFER Group; Synergy Logistics Ltd.; Tecsys Inc.; Vinculum Solutions Pvt. Ltd.

The software category dominated the market in 2024.

The on-premises had the largest share of the global market.