Warehouse Automation Market Share, Size, Trends, Industry Analysis Report

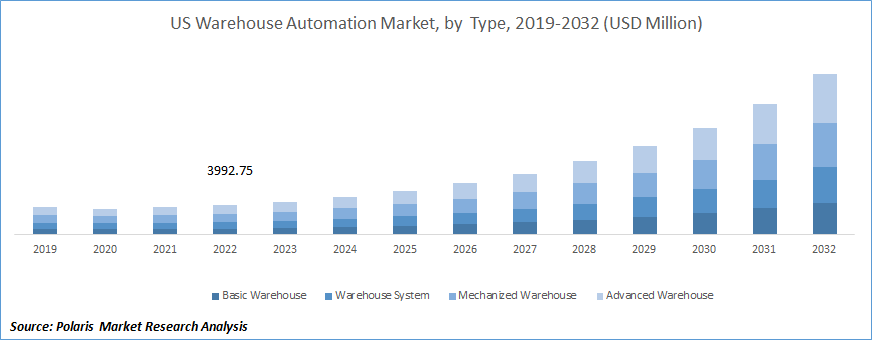

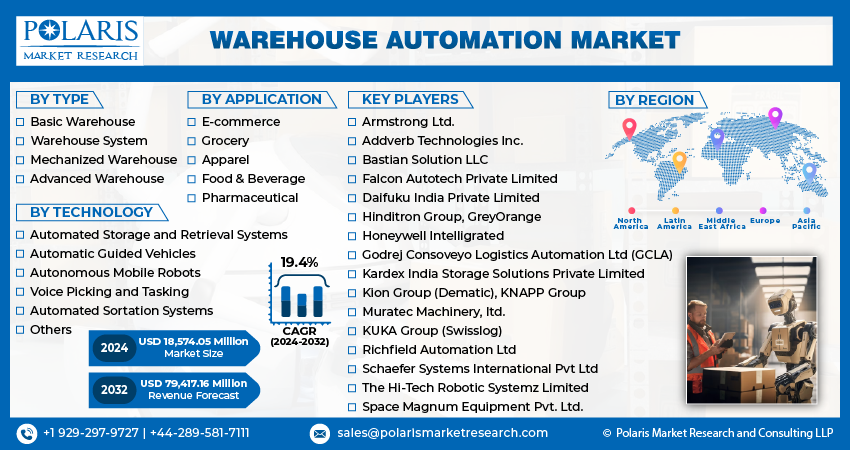

By Type (Basic Warehouse, Warehouse System, Mechanized Warehouse, Advanced Warehouse); By Technology; By Application; By Region, And Segment Forecasts, 2024-2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM2010

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

The global warehouse automation market was valued at USD 16,154.16 million in 2023 and is expected to grow at a CAGR of 19.4% during the forecast period.

Warehouse automation refers to automating warehouse inventory movement, including entry, internal operations, and outbound delivery to customers. This automation is achieved through software and advanced technologies like robotics and sensors. Warehouse automation enhances efficiency and effectiveness by integrating with existing tools, such as inventory management software. It enables businesses to optimize critical processes within their facilities, meet consumer demand more effectively, and streamline operations.

To Understand More About this Research: Request a Free Sample Report

A warehouse management system (WMS) is an essential component that automates warehouse data collection, inventory control, and manual tasks. These systems integrate with other solutions to manage and automate processes across various business and supply chain functions. Warehouse automation can vary in complexity, ranging from simple to highly advanced. At a basic level, automation eliminates repetitive work through planning, equipment, and transportation, streamlining operations and improving efficiency.

Implementing warehouse automation offers several advantages, such as reducing reliance on manual labor, freeing workers to focus on more critical activities, and improving safety by automating hazardous tasks like heavy lifting. Real-time inventory tracking is another advantage that enables businesses to make informed decisions. Furthermore, warehouse automation helps organizations optimize their operations, increasing their competitiveness in the market.

The demand for enhanced efficiency, productivity, and cost savings fuels the growing adoption of robotics in warehousing. Robotic technology enables warehouses to automate repetitive and physically demanding tasks, reducing labor costs and improving accuracy. It offers a highly efficient and flexible solution for automating warehouse activities, including material handling, order picking, and packing.

The implementation of robots in warehouses not only improves safety by allowing them to perform dangerous tasks like heavy lifting and handling hazardous materials and enhances operational efficiency. Robots can work continuously without breaks, resulting in increased productivity and reduced periods of inactivity. It contributes to the growth of the market by maximizing output and minimizing downtime.

Industry Dynamics

Growth Drivers

Increasing Investments in Research and Development

The growth of warehouse automation is driven by several factors, including increased investments in research and development, high labor costs, the shortage of skilled workers, and growing awareness of the benefits associated with warehouse automation. Additionally, the widespread adoption of automation and robotics technology in the industrial sector contributes to the global demand for warehouse automation.

Companies increasingly opt for advanced technological components like RFID tags, sensors, and scanners to enhance operational efficiency and improve worker safety. These technologies enable real-time inventory tracking and streamline logistics, reducing manual errors. As a result, this technological breakthrough is fueling significant growth in the market by supporting improved efficiency and safety measures.

According to the International Federation of Robotics (IFR), the adoption of warehouse automation has been steadily increasing over the past decades. It is expected to experience double-digit growth in the coming years. Notably, countries such as the U.S., the U.K., Germany, India, and China have witnessed significant expansion in industrial automation and robotic technology, further contributing to the growth of the warehouse automation market.

Report Segmentation

The market is primarily segmented based on type, technology, application, and region.

|

By Type |

By Technology |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

The Automatic Guided Vehicles (Agvs) Segment Held the Largest Market Share in 2022

In 2022, the automatic guided vehicles (AGVs) segment held the largest market share. These are a type of mobile robot designed to move materials within a warehouse or manufacturing facility without human intervention. They are equipped with various sensors, cameras, and navigation systems that enable them to navigate the warehouse and perform tasks autonomously.

AGVs can operate 24/7 without breaks, fatigue, or human limitations. They can continuously move goods from one location to another, ensuring smooth and efficient material flow in the warehouse. It conducts higher productivity and throughput.

It can be programmed to perform a wide range of tasks, including material handling, palletizing, and transporting goods to various points in the warehouse. They can easily adapt to changing warehouse layouts or operational needs, making them versatile in different environments.

Although the initial investment in AGVs may be significant, they offer long-term cost savings by reducing the reliance on manual labor, minimizing errors, and optimizing the use of warehouse space.

The E-Commerce Segment Expected to Witness the Fastest Revenue Share in 2022

In 2022, the e-commerce segment expected to experience the fastest revenue share in the global market. It is attributed to the widespread adoption of warehouse automation in e-commerce facilities, driven by increased awareness among vendors about the benefits of robotics in various aspects of e-commerce fulfillment. The use of warehouse automation in e-commerce applications is becoming increasingly popular, fueled by the growth of e-commerce activities and the rapid integration of robotics technology in e-commerce warehouses.

Hence, the advantages provided by warehouse automation to e-commerce fulfillment centers are anticipated to generate a considerable revenue share that boosts segmental growth in the projected period. On the other hand, the grocery segment is expected to witness a substantial CAGR in the market during the projection period. Grocery distribution is the most labor-intensive sector in the retail enterprise. The increasing trend of online grocery retailing is driving higher automation, and micro-fulfillment centers are anticipated to present the most significant opportunity in the market.

The North America Holds the Largest Market Share over the Forecast Period

North America in the warehouse automation market hold the largest share, and this trend is expected to continue throughout the forecast period. It can be attributed to several factors, including technological advancements, a strong emphasis on improving efficiency and productivity, and the increasing availability and affordability of automated systems in the region.

The market in this region is experiencing significant growth, due to local robot manufacturers such as Fetch Robotics Inc., Destaco, RobotWorx, Inc, and Applied Robotics Inc. These companies have embraced product launches as a key strategy for their development, thereby contributing to the market's expansion. An illustrative example is Fetch Robotics, which introduced the PalletTransport1500 in January 2021. This advanced autonomous mobile robot (AMR) was specifically designed to substitute forklift trucks in storehouses. With its impressive capabilities, the robot can effortlessly handle loaded pallets weighing up to 1136 kg, eliminating the need for human involvement in pallet movement tasks.

Furthermore, the Asia Pacific region will experience a substantial compound annual growth rate (CAGR) in the global market in 2022. This growth can be attributed to the rising demand for warehouse automation, which is expected to increase over the forecast period. The thriving e-commerce industry drives the expansion in developing countries within the Asia Pacific region. This surge in e-commerce is particularly driving the adoption of warehouse automation solutions for efficient inventory management.

Competitive Insight

The major global market players include Armstrong Ltd., Addverb Technologies Inc., Godrej Consoveyo Logistics Automation Ltd (GCLA)., Bastian Solution LLC, Falcon Autotech Private Limited, Daifuku India Private Limited, Kardex India Storage Solutions Private Limited, Hinditron Group, GreyOrange, Honeywell Intelligrated, Kion Group (Dematic), KNAPP Group, Muratec Machinery, ltd., KUKA Group (Swisslog), Richfield Automation Ltd, Schaefer Systems International Pvt Ltd, The Hi-Tech Robotic Systemz Limited, Space Magnum Equipment Pvt. Ltd.

Recent Developments

- In December 2022, ABB unveiled the "ABB SWIFT CRB 1300" industrial collaborative robot. This innovative robot is designed to handle various tasks, including machine tending, palletizing, and pick-and-place operations within warehouses. Its versatility makes it a suitable choice for multiple applications across different industries.

- In April 2022, a cutting-edge automatic selecting robot was introduced by Vanderlande as part of its Smart Item Robotics (SIR) warehouse key portfolio. This robot showcases advanced gripping technology coupled with sophisticated vision and control systems. It is specifically designed for warehouses and distribution centers that deal with a wide range of general merchandise products.

Warehouse Automation Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 18,574.05 million |

|

Revenue forecast in 2032 |

USD 79,417.16 million |

|

CAGR |

19.4% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Technology, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Armstrong Ltd., Addverb Technologies Inc., Godrej Consoveyo Logistics Automation Ltd (GCLA)., Bastian Solution LLC, Falcon Autotech Private Limited, Daifuku India Private Limited, Kardex India Storage Solutions Private Limited, Hinditron Group, GreyOrange, Honeywell Intelligrated, Kion Group (Dematic), KNAPP Group, Muratec Machinery, ltd., KUKA Group (Swisslog), Richfield Automation Ltd, Schaefer Systems International Pvt Ltd, The Hi-Tech Robotic Systemz Limited, Space Magnum Equipment Pvt. Ltd. |

FAQ's

The warehouse automation market report covering key segments are type, technology, application, and region.

Warehouse Automation Market Size Worth $79,417.16 Million By 2032.

The global warehouse automation market is expected to grow at a CAGR of 19.4% during the forecast period.

North America is leading the global market.

key driving factors in warehouse automation market are increasing investments in research and development.