Wafer Vacuum Assembling Equipment Market Size, Share, Trends, Industry Analysis Report: By Product (Manual Vacuum Assembling Equipment, Semi-Automatic Vacuum Assembling Equipment, and Fully Automatic Vacuum Assembling Equipment), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 117

- Format: PDF

- Report ID: PM5118

- Base Year: 2023

- Historical Data: 2019-2022

Wafer Vacuum Assembling Equipment Market Overview

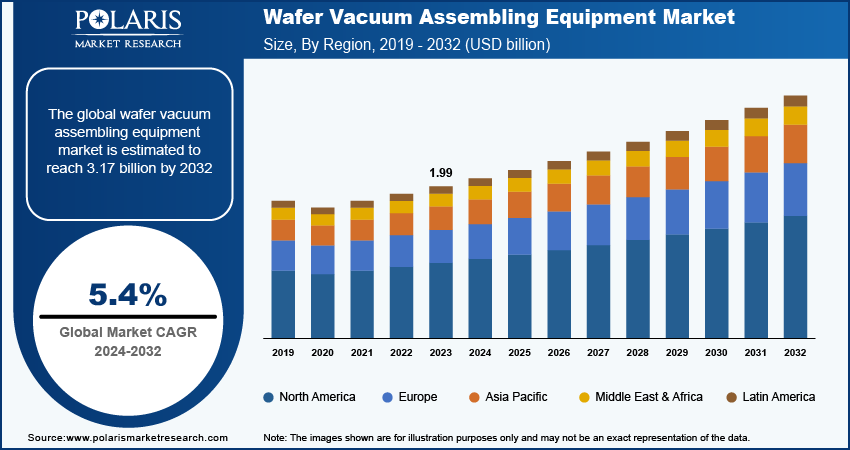

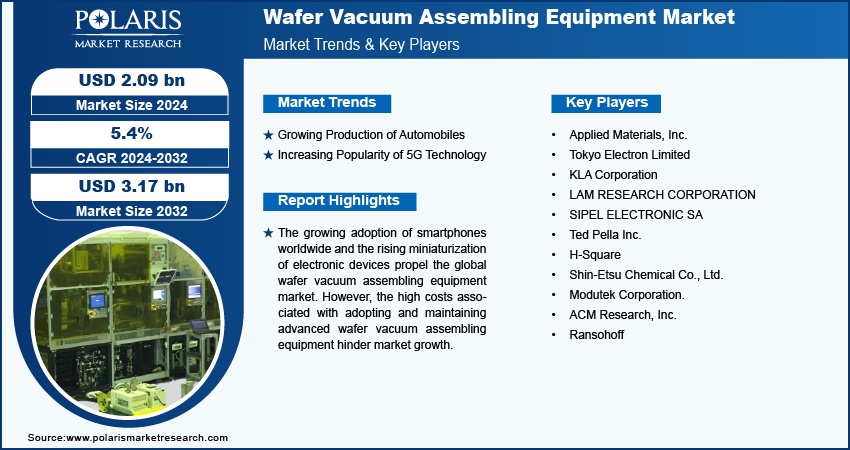

The wafer vacuum assembling equipment market size was valued at USD 1.99 billion in 2023. The market is projected to grow from USD 2.09 billion in 2024 to USD 3.17 billion by 2032, exhibiting a CAGR of 5.4 % during 2024–2032.

Wafer vacuum assembling equipment plays a crucial role in the semiconductor manufacturing process, enabling the precise handling and assembly of silicon wafers. This equipment is designed to create a controlled vacuum environment, which is essential for achieving high levels of cleanliness and precision during the fabrication of semiconductor devices.

The growing adoption of smartphones worldwide drives the global wafer vacuum assembling equipment market. According to the GSMA’s annual State of Mobile Internet Connectivity Report 2023, over 54% of the global population, some 4.3 billion people, own a smartphone. Smartphone adoption leads to a higher demand for semiconductor components, which, in turn, drives the need for wafer fabrication and assembly equipment. Wafer fabrication and assembly equipment are required to perform intricate processes in semiconductor manufacturing, including photolithography, etching, doping, and deposition, accurately and efficiently.

To Understand More About this Research: Request a Free Sample Report

The wafer vacuum assembling equipment market is driven by the rising miniaturization of electronic devices. Miniaturized devices often require more complex circuits and functionalities within a limited space. Wafer vacuum assembling equipment is essential for accurately handling and assembling these tiny parts, ensuring they fit together properly.

Wafer Vacuum Assembling Equipment Market Driver Analysis

Growing Production of Automobiles

The production of automobiles is rising across the globe. In 2022, 85.4 million motor vehicles were produced around the world, an increase of 5.7% compared to 2021. Automobiles are equipped with numerous electronic components, including advanced driver-assistance systems (ADAS), infotainment systems, sensors, and electric vehicle (EV) technologies. The high demand for these electronic components due to growing automobile production propels the requirement for semiconductor components and wafer processing equipment. Thus, the rising automobile production drives the growth of the wafer vacuum assembling equipment market.

Increasing Popularity of 5G Technology

5G technology requires a vast range of semiconductor components for infrastructure such as base stations and devices, including smartphones and IoT devices. This surge in the adoption of 5G technology necessitates advanced fabrication and assembly equipment to produce related semiconductor components efficiently. Therefore, the rising popularity of 5G technology propels the global wafer vacuum assembling equipment market growth.

Wafer Vacuum Assembling Equipment Market Segment Insights

Wafer Vacuum Assembling Equipment Market Breakdown By Product

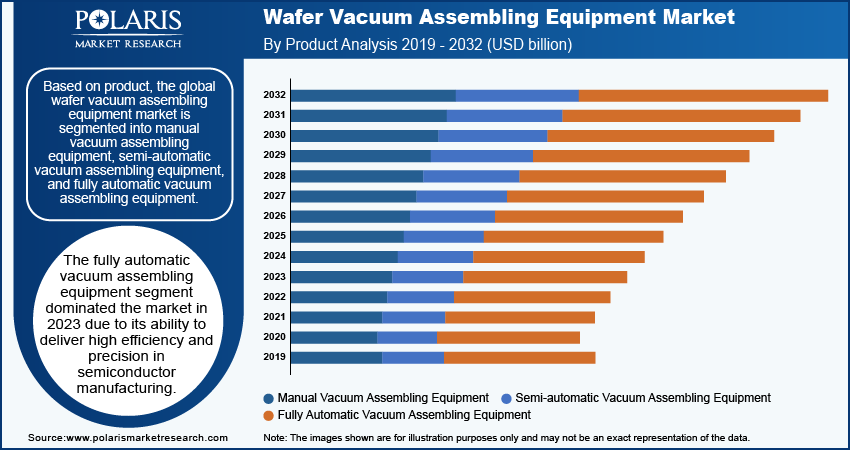

Based on product, the global wafer vacuum assembling equipment market is segmented into manual vacuum assembling equipment, semi-automatic vacuum assembling equipment, and fully automatic vacuum assembling equipment. The fully automatic vacuum assembling equipment segment dominated the market in 2023 due to its ability to deliver high efficiency and precision in semiconductor manufacturing. Manufacturers increasingly favored fully automatic systems as they significantly reduce labor costs and enhance production throughput. These advanced systems leverage robotics and sophisticated automation technologies to streamline processes, ensuring consistent quality and minimizing human error.

The manual segment is estimated to grow at a robust pace in the coming years. This is attributed to the rising interest among small to medium-sized enterprises that seek cost-effective solutions without compromising quality. Manual systems provide flexibility and allow operators to maintain direct oversight of the assembly process, which is particularly valuable for manufacturers producing smaller batches or custom applications. Manual equipment further facilitates hands-on quality control, positioning it as an increasingly popular choice among manufacturers aiming to balance efficiency with customization.

Wafer Vacuum Assembling Equipment Market Breakdown By Application

In terms of application, the global wafer vacuum assembling equipment market is segmented into semiconductor industry, solar panel manufacturing, and electronics manufacturing. The semiconductor industry segment held the largest market share in 2023 due to the rising demand for advanced chips across various applications, including smartphones, automotive technologies, and IoT devices. The rapid evolution of technology has pushed manufacturers to invest heavily in semiconductor fabrication, which relies on precise and efficient assembly processes. Innovations such as 5G and AI have further fueled this growth, necessitating sophisticated semiconductor solutions.

The electronics manufacturing segment is projected to grow at a rapid pace during the forecast period owing to the increasing integration of electronics in everyday products, from consumer gadgets to industrial machinery. The rise of smart devices and wearable technology pushes companies to seek vacuum assembling solutions that accommodate rapid design changes and smaller component sizes. Moreover, the rising emphasis on sustainable practices in electronics manufacturing supports the growth of this segment, as manufacturers aim to enhance efficiency and reduce waste through improved assembly processes.

Wafer Vacuum Assembling Equipment Market Regional Insights

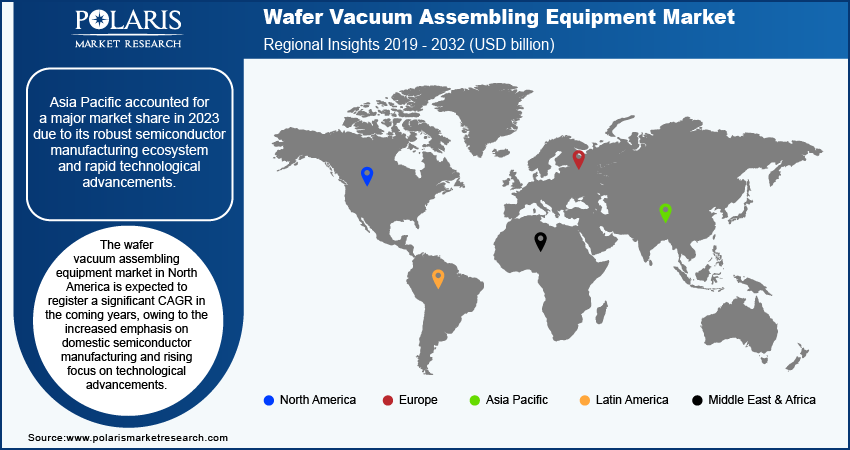

By region, the study provides the wafer vacuum assembling equipment market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific accounted for a major market share in 2023 due to its robust semiconductor manufacturing ecosystem and rapid technological advancements. Countries such as Taiwan and South Korea significantly contribute to this dominance, with Taiwan being a key country in semiconductor fabrication and assembly. The region benefits from a well-established supply chain, substantial investments in research and development, and government support for the semiconductor industry. Moreover, the increasing production and adoption of smartphones and automobiles in Asia Pacific propels the market. For instance, according to data published by Asian Automotive Analysis, automobile production in Asia increased by 13.3% in the first half of 2023 compared to the same period in 2022. This growth reflects a recovering demand in the automotive sector and highlights the region's significant role in global production.

The wafer vacuum assembling equipment market in North America is expected to register a significant CAGR in the coming years, owing to the increased emphasis on domestic semiconductor manufacturing and a commitment to technological advancement. The rising emphasis on creating a more resilient and self-sufficient semiconductor ecosystem has prompted significant investments in advanced assembly technologies. Moreover, the increasing focus on developing new applications in artificial intelligence (AI), 5G communications, and EVs fuels the demand for efficient assembly solutions in the region.

Wafer Vacuum Assembling Equipment Market – Key Players and Competitive Insights

Prominent market players are investing heavily in research and development to expand their offerings, which will fuel the wafer vacuum assembling equipment market growth. Market participants are also undertaking a variety of strategic activities, including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations, to expand their global footprint. To expand and survive in a more competitive and rising market environment, the market players must offer innovative solutions.

The wafer vacuum assembling equipment market is fragmented, with the presence of numerous global and regional market players. A few major players in the market are Applied Materials, Inc.; Tokyo Electron Limited; KLA Corporation; LAM RESEARCH CORPORATION; SIPEL ELECTRONIC SA; Ted Pella Inc.; H-Square; Shin-Etsu Chemical Co., Ltd.; Modutek Corporation.; ACM Research, Inc.; and Ransohoff.

KLA Corporation, Established in 1975, is a prominent capital equipment company headquartered in Milpitas, California. The company specializes in providing process control and yield management systems primarily for the semiconductor industry and related nanoelectronics sectors. KLA's solutions encompass all phases of wafer, reticle, integrated circuit (IC), and packaging production, from research and development to high-volume manufacturing. In June 2022, KLA Corporation announced the launch of four new products for automotive chip manufacturing—the 8935 high productivity patterned wafer inspection system, the C205 broadband plasma patterned wafer inspection system, the Surfscan SP A2/A3 unpatterned wafer inspection systems, and I-PAT inline defect part average testing screening solution.

Tokyo Electron Limited, established on November 11, 1963, and headquartered in Minato-ku, Tokyo, Japan, is a major global supplier of semiconductor and flat panel display (FPD) production equipment. Tokyo Electron manufactures a wide range of equipment essential for semiconductor fabrication processes. This includes wafer vacuum assembling equipment, cleaning systems, deposition systems, and etch systems. In December, Tokyo Electron announced the launch of Ulucus G, a wafer thinning system for 300mm wafer fabrication.

Key Companies in Wafer Vacuum Assembling Equipment Market

- Applied Materials, Inc.

- Tokyo Electron Limited

- KLA Corporation

- LAM RESEARCH CORPORATION

- SIPEL ELECTRONIC SA

- Ted Pella Inc.

- H-Square

- Shin-Etsu Chemical Co., Ltd.

- Modutek Corporation.

- ACM Research, Inc.

- Ransohoff

Wafer Vacuum Assembling Equipment Industry Developments

July 2023: Applied Materials, Inc. introduced the most significant wafer manufacturing platform, Vistara, designed to provide chipmakers with the flexibility, intelligence, and sustainability needed to tackle growing chipmaking challenges.

December 2020: KLA Corporation announced two new products: the PWG5 wafer geometry system and the Surfscan SP7XP wafer defect inspection system. The new systems are designed to address exceedingly difficult issues in the manufacture of advanced memory and logic integrated circuits.

Wafer Vacuum Assembling Equipment Market Segmentation

By Product Outlook (Revenue, USD billion, 2019–2032)

- Manual Vacuum Assembling Equipment

- Semi-Automatic Vacuum Assembling Equipment

- Fully Automatic Vacuum Assembling Equipment

By Application Outlook (Revenue, USD billion, 2019–2032)

- Semiconductor Industry

- Solar Panel Manufacturing

- Electronics Manufacturing

By Regional Outlook (Revenue, USD billion, 2019–2032)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Wafer Vacuum Assembling Equipment Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 1.99 billion |

|

Market Size Value in 2024 |

USD 2.09 billion |

|

Revenue Forecast by 2032 |

USD 3.17 billion |

|

CAGR |

5.4 % from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global wafer vacuum assembling equipment market size was valued at USD 1.99 billion in 2023 and is projected to grow to USD 3.17 billion by 2032.

The global market is projected to register a CAGR of 5.4 % during the forecast period.

Asia Pacific accounted for the largest share of the global market on 2023.

Applied Materials, Inc.; Tokyo Electron Limited; KLA Corporation; LAM RESEARCH CORPORATION; SIPEL ELECTRONIC SA; Ted Pella Inc.; H-Square; Shin-Etsu Chemical Co., Ltd.; Modutek Corporation.; ACM Research, Inc.; and Ransohoff are a few key players in the wafer vacuum assembling equipment market.

The fully automatic vacuum assembling equipment segment is projected for significant growth in the global market during the forecast period.

The semiconductor industry segment dominated the market in 2023.