Wafer Processing Equipment Market Size, Share, Trends, Industry Analysis Report: By Process (Deposition and Etch), Application, End Users, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 125

- Format: PDF

- Report ID: PM5354

- Base Year: 2024

- Historical Data: 2020-2023

Wafer Processing Equipment Market Overview

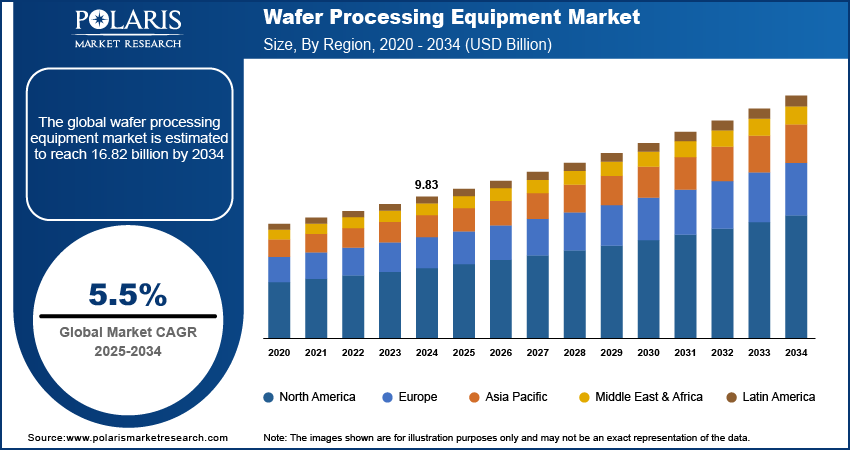

The wafer processing equipment market size was valued at USD 9.83 billion in 2024. The market is projected to grow from USD 10.37 billion in 2025 to USD 16.82 billion by 2034, exhibiting a CAGR of 5.5% during the forecast period.

Wafer processing equipment is used in the fabrication of semiconductor wafers that are essential for producing integrated circuits. This equipment includes various tools for processes such as photolithography, etching, deposition, and chemical mechanical polishing, each of which is essential for determining and shaping the circuit patterns on the wafer. The accuracy of wafer processing equipment directly impacts the yield and performance of semiconductor devices.

The wafer processing equipment market growth is driven by the rapid advancement and expansion of the Internet of Things (IoT). For instance, according to IoT Analytics, there were 16.6 billion connected IoT devices by the end of 2023, marking a remarkable 15% growth compared to 2022. This rise in connectivity has increased the demand for high-performance semiconductors, which are essential for processing the vast amounts of data generated by IoT devices.

Industries are embracing smarter technologies, from smart home systems to industrial sensors, which is driving the demand for advanced integrated circuits. These circuits require innovative wafer processing techniques to ensure they are small, efficient, and capable of handling complex tasks. Thus, the increasing adoption of advanced technologies is driving the wafer processing equipment market expansion.

To Understand More About this Research: Request a Free Sample Report

The growing supply of renewable energy is also supporting the development of the market. For instance, according to the International Energy Agency, in 2022, the supply of renewable energy increased by 8% compared to the previous year. Renewable energy solutions require advanced semiconductor technologies for efficient energy conversion, storage, and management. Systems such as photovoltaics, wind turbines, and energy storage solutions heavily rely on high-performance semiconductors, which are produced through sophisticated wafer processing techniques. This reliance is propelling the demand for wafer processing equipment.

Wafer Processing Equipment Market Dynamics

Increase in Government Investments in Electronics Device Manufacturing

Governments across many countries are announcing various incentive schemes for the expansion of electronic component manufacturing, resulting in increased demand for semiconductor products. For instance, according to Invest India, India recorded USD 30 billion in fiscal incentives for Electronics System Design and Manufacturing (ESDM) and related sectors under the production-linked incentives. This influx of investment is expected to boost the number of manufacturers in consumer electronics, subsequently increasing demand for the wafer processing equipment in the semiconductor production process. Therefore, the rise in government investment in electronic device manufacturing is propelling the wafer processing equipment market development.

Expansion of Automotive Industry

The wafer processing equipment market is growing due to the expanding automotive industry, which relies on advanced semiconductor technologies. According to the International Organization of Motor Vehicle Manufacturers, global sales of new vehicles rose by 12% from 2022 to 2023. This increase is boosting the demand for high-performance chips used in various automotive applications, such as electric vehicles and advanced driver-assistance systems. As car manufacturers aim to integrate more technology into their vehicles, they need better semiconductor manufacturing processes. This development is driving investment in wafer processing equipment as companies work to improve production capabilities and meet the rising demand for reliable and efficient automotive electronics.

Wafer Processing Equipment Market Segment Insights

Wafer Processing Equipment Market Outlook – Process Insights

The wafer processing equipment market, based on process, is segmented into deposition, etch, mass technology, and strip and clean. The etch segment is expected to register the highest CAGR in the global market from 2025 to 2034, owing to the increasing demand for advanced semiconductor devices and miniaturization trends in electronics. Semiconductor manufacturers desire precision in etching processes to enhance device performance, and innovations in equipment technology are improving efficiency and yield. Additionally, the growing adoption of semiconductors in industries such as automotive, consumer electronics, and telecommunications is further fueling investments in etch processing technologies.

Wafer Processing Equipment Market Evaluation – Application Insights

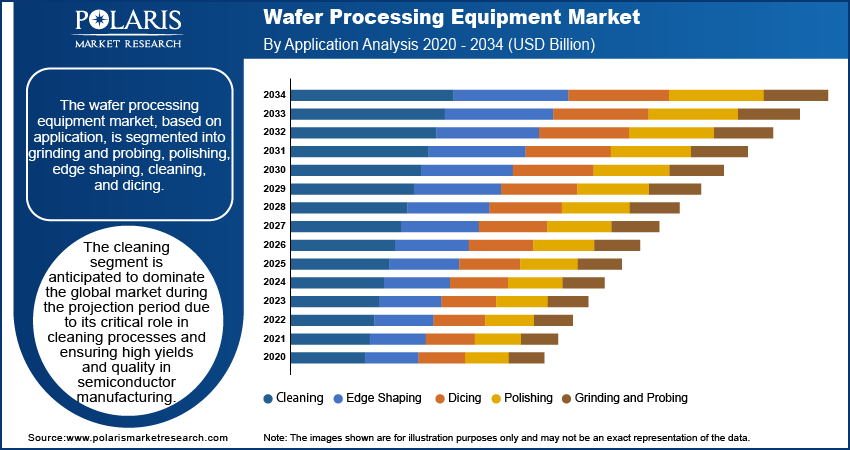

The wafer processing equipment market segmentation, based on application, includes grinding and probing, polishing, edge shaping, cleaning, and dicing. The cleaning segment is expected to dominate the market during the forecast period due to the critical role of cleaning processes in ensuring high yields and quality in semiconductor manufacturing. Advanced cleaning technologies, such as chemical and plasma cleaning, are being increasingly adopted to enhance surface purity and prevent defects in the semiconductor manufacturing process, driving growth in this segment.

Wafer Processing Equipment Market Regional Analysis

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America held the largest revenue share of the market due to the increasing demand for electric vehicle batteries. This surge has heightened the need for advanced semiconductor components essential for various vehicle systems, including battery management, power distribution, and infotainment. For instance, according to the Federal Reserve Bank of Chicago, from 2000 to 2021, battery electric vehicle sales in the US reached 400,000 units. This growth in vehicle density has increased the demand for batteries, leading to the increase need for wafer processors. Further, growing investments by automakers in EV technology are driving the growth of the wafer processing equipment market in North America.

The Asia Pacific wafer processing equipment market is projected to register a substantial CAGR during the forecast period, driven by an increase in mergers and acquisitions aimed at market expansion. Major semiconductor companies in the region are consolidating to improve their technological capabilities and expand their product offerings. This strategic shift allows them to access advanced manufacturing processes, such as sophisticated wafer processors for producing high-performance chips. By seeking to enhance synergies and operational efficiencies, the semiconductor industry in the region is expected to grow, leading to a higher demand for semiconductor wafer processing equipment.

The India wafer processing equipment market is growing, largely due to increased investments in the automotive industry. For instance, according to Invest India, from April 2000 to September 2023, the automobile industry attracted ∼USD 35.40 billion in foreign direct investment (FDI). This influx of investment is driving the demand for advanced technologies, including semiconductor wafers used in vehicle electronics. As vehicles become more digital and electric, the need for wafer processing equipment continues to rise.

Wafer Processing Equipment Market – Key Players and Competitive Insights

The wafer processing equipment market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, advanced software technologies, and significant capital to maintain a competitive edge. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are transforming the market by introducing innovative devices tailored to specific needs. The competitive landscape is becoming more intense due to ongoing advancements in product offerings. Additionally, there is a greater emphasis on sustainability and an increasing demand for customized wafer processing equipment across various industries. A few major players in the wafer processing equipment market are Nikon Corporation; Tokyo Electron Limited; Lam Research Corporation; SPTS Technologies Ltd.; Motorola Solutions, Inc.; Applied Materials, Inc.; Hitachi Kokusai Linear; Plasma-Therm; KLA Corporation; and DISCO.

Tokyo Electron Limited (TEL), established in 1963 and headquartered in Minato-ku, Tokyo, Japan, is a global supplier of semiconductor and flat panel display (FPD) production equipment. The company operates as a subsidiary of Tokyo Electron Group and is listed on the Tokyo Stock Exchange. TEL has become a pivotal player in the semiconductor manufacturing industry. Tokyo Electron manufactures a wide range of equipment essential for semiconductor fabrication processes. Its product portfolio includes wafer vacuum assembling equipment, cleaning systems, deposition systems, and etch systems. The company operates primarily in Japan, North America, Europe, Asia, and others. In December 2023, Tokyo Electron announced the launch of Ulucus G, a wafer thinning system for 300 mm wafer fabrication. The company stated that the innovative system integrates a newly developed grinding unit with the proven LITHIUS Pro Z platform. Designed to enhance wafer quality and reduce workforce, Ulucus G incorporates a scrub cleaning unit and a spin wet etch unit, allowing for precise control over each wafer's quality. The system aims to meet the growing demand for higher-quality silicon wafers in semiconductor manufacturing.

Lam Research Corporation, established in 1980, is a supplier of wafer fabrication equipment and services for the semiconductor industry. Headquarter in Fremont, California, the company is publicly traded on the NASDAQ. Its product portfolio includes etch, deposition, and cleaning systems. Lam Research serves various regions, including North America, Europe, and Asia, supporting advanced manufacturing processes for semiconductor devices and enabling the production of smaller, more powerful chips in the global market. In June 2023, the company announced the launch of Coronus DX, a solution designed to simplify advanced semiconductor manufacturing. According to Lam Research, this innovative equipment was developed to deposit a proprietary layer of protective film on both sides of the wafer edge in a single step. By addressing the complexities involved in building nanometer-sized devices, Coronus DX aims to help prevent defects and damage often associated with the manufacturing process, thereby enhancing overall yield and reliability in semiconductor production.

List of Key Players in Wafer Processing Equipment Market

- Nikon Corporation

- Tokyo Electron Limited

- Lam Research Corporation

- Spts Technologies Ltd.

- Motorola Solutions, Inc.

- Applied Materials, Inc.

- Hitachi Kokusai Linear

- Plasma-Therm

- KLA Corporation

- DISCO

Wafer Processing Equipment Industry Developments

August 2023: Nidec Instruments Corporation, a wholly owned subsidiary of Nidec Corporation, announced the release of its latest semiconductor wafer transfer robot. According to Nidec, the new technology is designed to enhance efficiency and precision in semiconductor manufacturing processes. Key features of the robot include improved speed and reliability for handling delicate wafers.

March 2021: Applied Materials, Inc. announced the introduction of its Vistara wafer manufacturing platform, marking a significant innovation in over a decade. Designed to address chipmaking challenges, Vistara is equipped with a variety of chamber types and advanced AI capabilities. The company stated that the platform aims to enhance flexibility, productivity, and sustainability in semiconductor production.

Wafer Processing Equipment Market Segmentation

By Process Outlook

- Deposition

- Etch

- Mass Technology

- Strip and Clean

By Application Outlook

- Grinding and Probing

- Polishing

- Edge Shaping

- Cleaning

- Dicing

By End Users Outlook

- Computer

- Communication

- Consumer

- Industrial

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Wafer Processing Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 9.83 billion |

|

Market Size Value in 2025 |

USD 10.37 billion |

|

Revenue Forecast by 2034 |

USD 16.82 billion |

|

CAGR |

5.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020 - 2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The wafer processing equipment market size was valued at USD 9.83 billion in 2024 and is projected to grow to USD 16.82 billion by 2034.

The global market is projected to record a CAGR of 5.5% during 2025–2034

North America held the largest share of the global market in 2024.

A few key players in the market are Nikon Corporation; Tokyo Electron Limited; Lam Research Corporation; SPTS Technologies Ltd.; Motorola Solutions, Inc.; Applied Materials, Inc.; Hitachi Kokusai Linear; Plasma-Therm; KLA Corporation and DISCO.

The etch process segment is anticipated to record a significant CAGR in the global market during the forecast period. This growth is attributed to the increasing demand for advanced semiconductor devices and miniaturization trends in electronics.

The cleaning segment is anticipated to lead the market during the forecast period due to its critical role in cleaning processes and ensuring high yields and quality in semiconductor manufacturing.