Voice and Speech Recognition Market Size, Share, Trends, Industry Analysis Report

By Component (Hardware, Software), By Interface, By End User, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 128

- Format: PDF

- Report ID: PM1407

- Base Year: 2024

- Historical Data: 2020-2023

What is Voice and Speech Recognition Market Size?

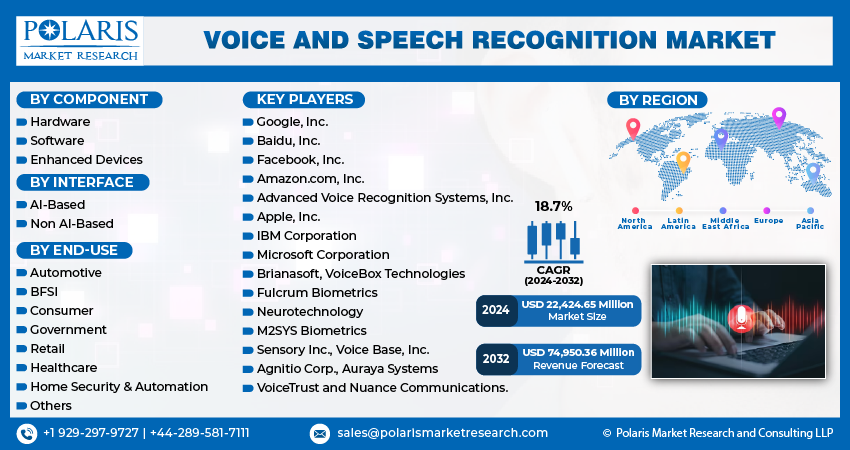

The global voice and speech recognition market size was valued at USD 22.24 billion in 2024, growing at a CAGR of 18.8% from 2025 to 2034. Key factors driving growth is the growth of speech recognition in car voice recognition systems and ability to streamline workflow.

Key Insights

- The enhanced devices segment is projected to register a CAGR of 20.2% over the forecast period due to rising adoption of smart devices such as smartphones, wearables, and IoT gadgets with built-in voice assistants.

- The healthcare segment held a significant revenue share in 2024, holding 36.54% fueled by the increasing need for efficient clinical documentation and improved patient interaction.

- The North America voice and speech recognition market accounted for 47.60% of global revenue share in 2024 due to early technology adoption, robust R&D infrastructure, and the strong presence of key tech players such as Apple, Google, Amazon, and Microsoft.

- The U.S. held a significant revenue share within North America in 2024, driven by strong investments in artificial intelligence, natural language processing, and voice biometrics.

- The market in Asia Pacific is expected to register a CAGR of 9.0% during the forecast period due to the expanding digital ecosystem, rising smartphone use, and increasing internet penetration.

Industry Dynamics

- The growth of speech recognition in car voice recognition systems is driving the demand.

- The ability of voice and speech recognition to streamline workflow is driving its appeal.

- An increasing number of data breaches such as security attacks gives notable credence to voice recognition systems that are more reliable authentication methods.

- Rising data privacy and security concerns associated with storing and processing sensitive voice data restrain the voice and speech recognition market growth.

Market Statistics

- 2024 Market Size: USD 22.24 Billion

- 2034 Projected Market Size: USD 123.70 Billion

- CAGR (2025–2034): 18.8%

- North America: Largest Market Share

AI Impact on Voice and Speech Recognition Market

- Improves speech recognition accuracy by adapting to diverse accents, dialects, and speaking styles in real-time.

- Enables more human-like interactions with natural language processing (NLP), which improve user experience in voice assistants and chatbots.

- Enable continuous learning from user input, making voice systems smarter and more personalized over time.

- Automates transcription and translation services, and significantly reduce time and cost for businesses across sectors.

Voice or speech recognition is the ability of a program to receive, interpret, and perform spoken commands. These solutions are the perfect filler that fills in with voice commands between consumers and technology for being helped with reminders and simple tasks. Voice recognition operates devices, performs commands at fingertips without the use of a keyboard. From a security standpoint, there is an inevitable need for voice recognition solutions, driving growth in global market.

A few applications of voice and speech recognition include automobiles, smartphones, and intelligent virtual assistants such as Amazon’s Alexa, Apple’s Siri, and Microsoft’s Cortana. The different type voice recognition software solutions include speaker dependent solution, speaker independent solution, discrete speech recognition, continuous speech recognition, and natural language recognition.

An increasing demand for voice and speech recognition solutions came from the automobiles sector, and the increasing modernization of vehicles drove market growth. The adoption of voice recognition solutions decreases human errors while improving production efficiency, supplementing the market growth. These systems increase the scale of efficiency because while 120 words can be spoken in a minute, only 60 words can be typed on an average in the same time.

An increasing number of data breaches such as security attacks gives notable credence to voice recognition systems that are more reliable authentication methods. Growing number of security concerns drives market. After demonetization in India, a 400–1,000% increase in digital transactions was witnessed. The increasing number of online transactions will augment growth in better authentications services such as voice and speech recognition market. Many major companies such as Google and Microsoft reported an error rate of 8%, and Apple has also been reporting lesser error rates in voice recognition that indicates growth for market in the future.

Drivers & Opportunities

How Integration of Voice Recognition is Driving the Industry Growth?

The integration of voice recognition systems in cars is gaining worldwide popularity as more countries initiate “hands-free” regulations governing the use of mobile phones while driving vehicles. Polaris analysis and a study of 450 auto owners with installed in-car voice-recognition systems through our primary respondents revealed that 78% of car owners with working voice-recognition systems always or frequently place call using voice commands. In addition to this, voice commands help drivers to keep their eyes on the road. The usage of manual interfaces to enter data into a navigation system results in significant safety risks; whereas, speech destination entry helps drivers follow the route correctly while keeping their eye on the road. The manufacturers focusing on innovations in their products through voice recognition is expected to accelerate the growth over the forecast period.

What Benefits of Voice Recognition is Fueling the Market Adoption?

The voice recognition technology provides options for customizing voice commands that enable hands-free dictation. It eradicates the need for an individual to open, edit, or send a specific file and send it through a simple voice command. This voice dictation software learns an individual’s preferences, words, and phrases, which are mostly used. Apple’s Siri software in the phones can place order for goods online, book a medical appointment, and perform myriad of things by voice recognition system. The voice recognition software is not only meant for professionals, but busy parents use them as well. It does not require one to hold the device in hand to use it, which enables busy parents to send an email while performing other tasks as well. Thus, the capabilities of voice recognition software to enhance and ease daily workflow are expected to drive the market demand over the forecast period.

Segmental Insights

Which Segment by Component Register Significant Growth Rate?

Based on component, the segmentation includes hardware, software, and enhanced devices. The enhanced devices segment is projected to register a CAGR of 20.2% during the forecast period due to rising adoption of smart health device and smart devices such as smartphones, wearables, and IoT gadgets with built-in voice assistants. Increasing consumer preference for hands-free operations and voice-controlled applications is pushing manufacturers to embed voice recognition technology in a wide range of devices. This trend is further driven by the need for improved user experiences and accessibility features, especially for elderly and differently-abled users. The growing demand for real-time voice interaction in consumer electronics is further accelerating this segment’s rapid growth.

Why AI Based Segment Held Significant Revenue Share?

The AI-based segment held 35.24% of revenue share in 2024, driven by the rapid improvements in machine learning and neural networks. AI improves voice recognition accuracy, even in noisy environments or with diverse accents, making it more reliable for real-world applications. It further enables features like voice biometrics and sentiment analysis, expanding its use in areas such as security, personalized marketing, and customer engagement. The growing need for intelligent voice interfaces in smart homes, cars, and virtual agents is accelerating the adoption of AI-driven voice recognition technology.

How Healthcare Segment Captured Significant Revenue Share?

The healthcare segment held a significant revenue share in 2024, holding 36.54% fueled by the increasing need for efficient clinical documentation and improved patient interaction. Voice recognition tools help reduce administrative workload by enabling doctors to dictate notes, access patient records hands-free, and streamline data entry. The growing demand for telemedicine and remote healthcare services further supports the adoption of voice interfaces. Healthcare providers are investing in accurate, AI-powered speech recognition to enhance productivity and patient care with patient safety and compliance being critical.

What are the Regional Statistics of Voice and Speech Recognition Market?

The North America voice and speech recognition market accounted for 47.60% of global revenue share in 2024. The dominance is attributed to early technology adoption, robust R&D infrastructure, and the strong presence of key tech players such as Apple, Google, Amazon, and Microsoft. Increasing use of smart assistants, voice-enabled apps, and AI-based customer service solutions is driving widespread adoption. The region also benefits from rising demand in healthcare, banking, and government sectors, where voice solutions help improve security, accessibility, and operational efficiency. High smartphone penetration, investment in smart homes automation, and growing preference for hands-free interaction are further fueling market growth across both consumer and enterprise sectors.

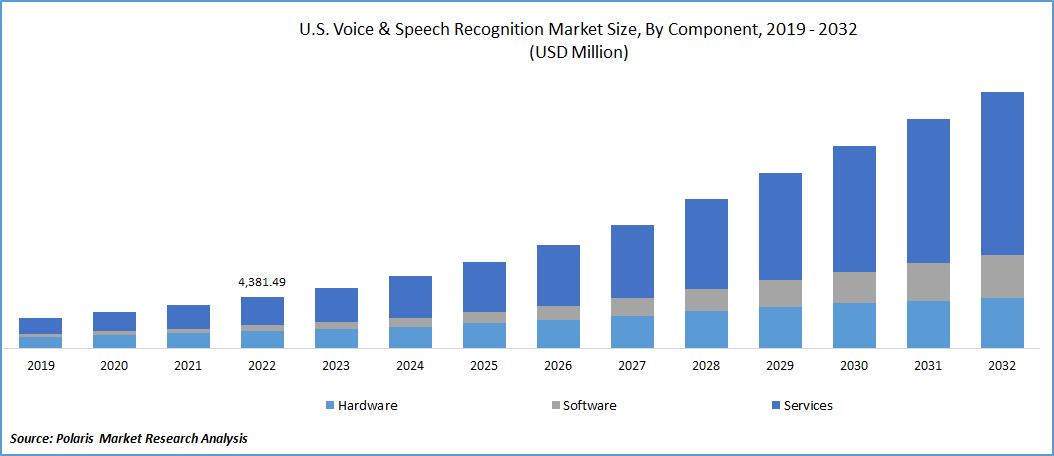

U.S. Voice and Speech Recognition Market Insights

The U.S. held a significant revenue share in North America in 2024, driven by strong investments in artificial intelligence, natural language processing, and voice biometrics. Enterprises are rapidly integrating voice recognition in customer service, healthcare, and automotive applications to enhance user experiences and streamline operations. The U.S. healthcare sector, in particular, is leveraging speech recognition for electronic health records (EHR) and remote diagnostics. High adoption of virtual assistants such as Siri, Alexa, and Google Assistant among consumers, combined with innovation by domestic tech giants, continues to boost growth. Government support for AI innovation also strengthens the market outlook.

Asia Pacific Voice and Speech Recognition Market Trends

The market in Asia Pacific is expected to register a CAGR of 9.0% during the forecast period due to the expanding digital ecosystem, rising smartphone use, and increasing internet penetration. The region’s large population and growing middle class are driving demand for smart devices with voice capabilities. Industries such as retail, banking, and education are adopting voice-enabled services to improve customer engagement and accessibility. Additionally, government-led digitalization initiatives, especially in countries such as India, Japan, and South Korea, are boosting AI and voice technology adoption. Local startups and regional players are also innovating rapidly to meet diverse linguistic and cultural needs.

China Voice and Speech Recognition Market Overview

The demand in China is rising due to strong government support for AI development and rapid technological advancements. Local tech giants such as Baidu, iFlytek, and Alibaba are investing heavily in voice AI for applications such as smart speakers, virtual assistants, and call center automation. China’s emphasis on smart city development and digital infrastructure has led to increased deployment of voice-enabled technologies in transportation, public services, and healthcare. The country’s vast linguistic diversity is further encouraging innovation in multi-language and dialect recognition, which gives China a unique edge in the global voice tech landscape.

Europe Voice and Speech Recognition Market Overview

The industry in Europe is projected to register a CAGR of 8.6% from 2025 to 2034, driven by strong regulatory support for digital transformation and data security. The region is emphasizing AI adoption in sectors such as healthcare, automotive, and finance, where voice solutions improve efficiency, accessibility, and compliance. Smart home adoption is rising, along with increased demand for voice-enabled virtual assistants. European companies are also investing in multilingual speech systems to address linguistic diversity across the EU. EU digital policies and funding programs are encouraging innovation, while industries seek voice tech for automation, accessibility, and customer interaction across various languages and demographics.

Germany Voice and Speech Recognition Market Assessment

The industry in Germany is projected to register a CAGR of 9.1% from 2025 to 2034, driven by its strong automotive industry and focus on Industry 4.0. German automakers are integrating voice assistants in connected vehicles to improve driver experience and safety. The healthcare sector is adopting speech recognition for clinical documentation and EHRs, improving workflow efficiency. Germany’s manufacturing sector is further leveraging voice interfaces in automation and robotics. Government initiatives promoting AI research and digital transformation are boosting innovation. Additionally, high smartphone penetration and demand for smart home devices are driving consumer-level growth in voice-controlled technology across the country.

Who are the Major Players Operating in the Market?

A few of the leading players in the voice and speech recognition market include Advanced Voice Recognition Systems, Inc. (AVRS); Agnitio S.L.; Nuance Communications, Inc.; Amazon.com, Inc.; Anhui USTCiFlytekCo., Ltd.; Apple Inc.; Baidu Inc.; Google, Inc.; International Business Machines (IBM) Corporation; M2Sys; LumenVox LLC; Microsoft Corporation; The Raytheon Company; Sensory Inc; ValidSoft UK Limited; VoiceBox Technologies Corporation (Cerence); and VoiceVault Inc. These players are expanding their presence across various geographies and entering new markets in developing regions to expand their customer base and strengthen presence in the market. The companies are also introducing new innovative products in the market to cater to the growing consumer demands.

Key Players

- Advanced Voice Recognition Systems, Inc.

- Agnitio S.L.

- Amazon.com, Inc.

- Anhui USTC iFlytek Co., Ltd.

- Apple Inc.

- Baidu, Inc.

- Google Inc.

- International Business Machines Corporation (IBM)

- LumenVox LLC

- M2Sys LLC

- Microsoft Corporation

- Nuance Communication, Inc.

- Raytheon Company

- Sensory Inc.

- ValidSoft UK Limited (ElephantTalk Communications Corp.)

- VoiceBox Technologies Corporation (Cerence)

- VoiceVault Inc.

Voice and Speech Recognition Industry Developments

In March 2025, OpenAI launched next-generation audio models, enhancing its API with advanced speech-to-text and text-to-speech capabilities. These models improved accuracy, language support, and customization, enabling developers to build smarter, more expressive voice-driven applications worldwide.

In June 2025, Amplify launched a custom AI-powered speech recognition system, enabling voice interaction in educational software. The ASR supports reading assessments, tutoring, and classroom monitoring, replacing Soapbox in mCLASS and Boost Reading programs for the 2025–2026 school year.

Voice and Speech Recognition Market Segmentation

By Component Outlook (Revenue, USD Billion, 2021–2034)

- Hardware

- Software

- Enhanced Devices

By Interface Outlook (Revenue, USD Billion, 2021–2034)

- AI-Based

- Non-AI-Based

By End User Outlook (Revenue, USD Billion, 2021–2034)

- Automotive

- BFSI

- Consumer

- Government

- Retail

- Healthcare

- Home security & Automation

- Others

By Regional Outlook (Revenue, USD Billion, 2021–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Voice and Speech Recognition Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 22.24 Billion |

|

Market Size in 2025 |

USD 26.31 Billion |

|

Revenue Forecast by 2034 |

USD 123.70 Billion |

|

CAGR |

18.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 22.24 billion in 2024 and is projected to grow to USD 123.70 billion by 2034.

The global market is projected to register a CAGR of 18.8% during the forecast period.

Asia Pacific dominated the market in 2024

A few of the key players in the market are Advanced Voice Recognition Systems, Inc.; Agnitio S.L.; Amazon.com, Inc.; Anhui USTC iFlytek Co., Ltd.; Apple Inc.; Baidu, Inc.; Google Inc.; International Business Machines Corporation (IBM); LumenVox LLC; M2Sys LLC; Microsoft Corporation; Nuance Communication, Inc.; Raytheon Company; Sensory Inc.; ValidSoft UK Limited (ElephantTalk Communications Corp.); VoiceBox Technologies Corporation (Cerence); and VoiceVault Inc.

The enhanced devices segment dominated the market revenue share in 2024.

The healthcare segment is projected to witness the fastest growth during the forecast period.