Voice-based Payments Market Share, Size, Trends, Industry Analysis Report, By Component (Hardware, Software); By End-Use (Automotive, Healthcare, BFSI, Retail, Government, Others); By Enterprise Size (Small & Medium Enterprises, Large Enterprises); By Region; Segment Forecast, 2022 - 2030

- Published Date:Feb-2022

- Pages: 110

- Format: PDF

- Report ID: PM2268

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

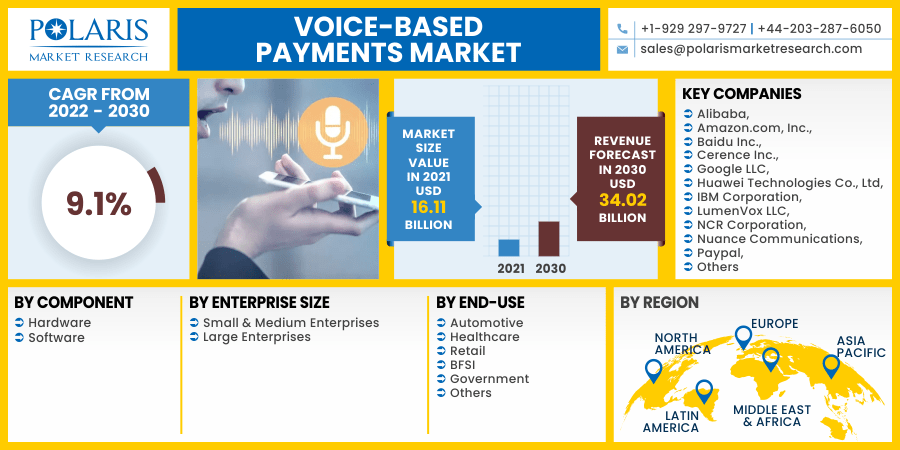

The global voice-based payments market was valued at USD 16.11 billion in 2021 and is expected to grow at a CAGR of 9.1% during the forecast period. The key factors, such as the rising adoption of voice-based payment across various verticals and the increasing use of this system in banking sectors, are driving the voice-based payments market growth.

Know more about this report: request for sample pages

Banks are rapidly integrating voice-based payment systems into their operations to expand their services, resulting in new market prospects. Voice-enabled payment systems allow bank customers to examine account details and execute financial transactions using voice requests, among other things. As a result, a growing number of banks are introducing voice-based payment solutions to improve their customers' experiences.

Further, in July 2020, U.S. Bank has added a voice assistant to its mobile app, joining a growing group of financial institutions developing or expanding their speech A.I. capabilities. The U.S. Bank Smart Assistant simulates the experience of speaking with a bank teller by allowing users to carry out regular banking transactions using appropriate vocabulary. The voice assistant is available in the U.S. Bank app for Android and iOS. Voice assistants in financial institutions are still relatively new, so it's unclear whether customers see them as a reason to join or switch banks.

However, using voice technologies to execute financial transactions is becoming more prevalent. Existing voice assistants are also being used by businesses, such as the Alexa and Google Assistant speech apps developed by ICICI Bank, India's largest private bank.

The vital role of accessibility is one of the key differentiators between those apps and U.S. Bank's voice assistant. People with various sensory, cognitive, and other challenges were engaged in the voice assistant's development and participated in the pilot programs. The bank created this voice assistant to mimic their human bank tellers. By lowering transaction time, the bank improved the client experience.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The increasing penetration of mobiles phones is raising the market demand for voice-based payment systems across the world. According to the Pew Research Center, the great majority of Americans, such as 97%, now have some form of a cellphone. In 2021, 85% of Americans will own a smartphone, up from just 35% in the assessment of smartphone ownership in 2011. Younger folks, lower-income Americans, and those with a high school degree or less rely heavily on cellphones for web access. In 2021, around 28% of the U.S. population between 18-29 yrs heavily rely on smartphones, between 30-49 years is 12%, and 50-64 years is 13%.

Further, people can use their mobile phones to take advantage of the capabilities of voice-based payments. Millennials and Generation Z primarily use phone voice features for online shopping and monetary transactions.

According to the Payments Method Report 2019, there is a lot of curiosity about what's new in e-commerce payments: e-commerce is predicted to surpass USD 4.6 trillion globally by 2022, with around 140 online payment methods in use. E-wallets have grown in popularity due to the seamless user experience they deliver.

While cash has always been king at the POS, online banking payments are in the spotlight since they are handy for consumers and retailers. As more studies like this emerge, it becomes evident that a more in-depth look at the current state of payment systems and improvements in how individuals pay would be beneficial.

Thus, the rising trend of using smartphones to make voice-based payments at online shopping centers and others boosts the market growth. Also, in emerging economies, the adoption of online payment has increased, which in turn is increasing the market demand for the voice-based payments market.

Report Segmentation

The market is primarily segmented based on component, enterprise size, end-use, and region.

|

By Component |

By Enterprise Size |

By End-Use |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Component

Based on the component segment, the software segment was the most significant revenue contributor in the global voice-based payments market in 2021 and is expected to retain its dominance during the forecast period.

As major leading corporations rapidly introduce voice payment software, revenue in the software market is likely to grow. Increased adoption of Alexa, Google Assistant, and Siri voice-based payments with traditional banking software is also expected to boost this segment's revenue growth.

Geographic Overview

In terms of geography, North America had the largest revenue share. This dominance can be attributed to the presence of major voice-based payments market players and their adoption of advanced technology across various enterprises.

Besides, the rising adoption of smartphones has increased the market demand for voice-based payment systems. For instance, in September 2021, Lynx, Canada's new high-value payment system, has received its first release, according to Payments Canada. Lynx will take the place of Canada's previous high-value payment system, the Large Value Transfer System (LVTS).

Moreover, Asia Pacific witnessed a high CAGR in the global market in 2021. The key factors responsible for the market growth include the rising adoption of voice-based payment across the various enterprises, rising government focus on the adoption of advanced technology, and increasing need for voice-based consumer electronics products such as laptops, smartphones, and smartwatches, among others.

For instance, in July 2021, the National Payments Corporation of India (NPCI) has officially launched a voice-enabled payment service for phones in remote zones, following the development of critical digital payments rails such as the Unified Payments Interface and Aadhaar Enabled Payment System. The new service would most likely be deployed utilizing the interoperable UPI system. As a result, phone users will complete transactions without using a third-party app. The "Interactive Voice Response" or IVR payments project is the project's name.

Competitive Insight

Some of the major players operating in the global voice-based payments market include Alibaba, Amazon.com, Inc., Baidu Inc., Cerence Inc., Google LLC, Huawei Technologies Co., Ltd, IBM Corporation, LumenVox LLC, NCR Corporation, Nuance Communications, Paypal, Paysafe, PCI pal, Sensory Inc., Square Cash, Inc., ToneTag Inc., and VibePay.

Voice-based Payments Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 16.11 billion |

|

Revenue forecast in 2030 |

USD 34.02 billion |

|

CAGR |

9.1% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Component, By Enterprise Size, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Alibaba, Amazon.com, Inc., Baidu Inc., Cerence Inc., Google LLC, Huawei Technologies Co., Ltd, IBM Corporation, LumenVox LLC, NCR Corporation, Nuance Communications, Paypal, Paysafe, PCI pal, Sensory Inc., Square Cash, Inc., ToneTag Inc., and VibePay |