Virtual Payment (POS) Terminals Market Share, Size, Trends, Industry Analysis Report, By Solution (Software Platform, Service); By Vertical (Retail, Hospitality, Consumer Electronics, Food & Beverages, Healthcare, Entertainment, Others); By Region; Segment Forecast, 2022 - 2030

- Published Date:Mar-2022

- Pages: 117

- Format: PDF

- Report ID: PM2359

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

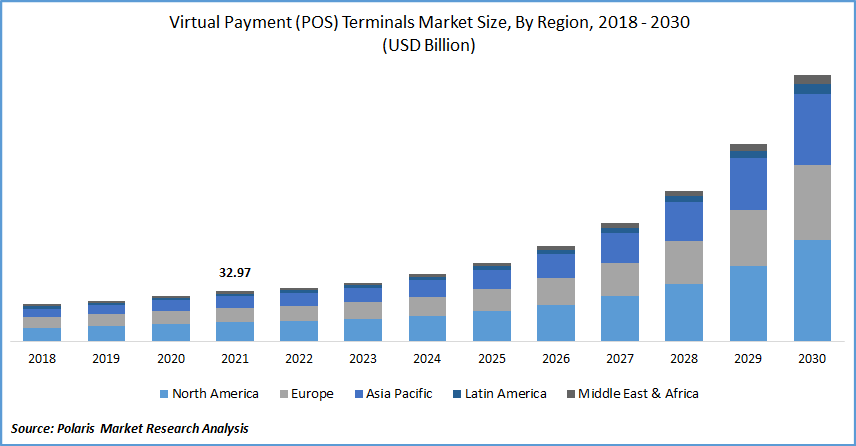

The global Virtual Payment (POS) Terminals market was valued at USD 32.97 billion in 2021 and is expected to grow at a CAGR of 22.3% during the forecast period. Virtual terminals are a web-based version of a credit card swipe device that enables retailers to process orders received via mail, phone, or online.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Virtual terminals make transactions easier for small businesses that might otherwise struggle to accept credit card bills. After signing up for the virtual terminals service, the seller enters client bill details for transactions in a form similar to those used for online retail, including fields for name, address, credit card type and number, Card Verification Value (CVV), and so on.

Industry Outlook

Growth Drivers

Demand for the Virtual Payment (POS) terminals market is growing because virtual terminals make things easier for merchants because they do not necessitate specific gear or software. As transactions are processed through the virtual payment provider's website, the third-party provider is responsible for maintaining compliance with Payment Card Industry Data Security Standard (PCI DSS) regulations rather than the merchant. Unless the merchant stores, processes, or transmits a primary account number, the retailer is exempt from PCI DSS regulations.

The growing trend of a cashless economy is propelling market growth. Mobile banking and digital commerce are increasing the demand for virtual terminals. Online transactions simplify the electronic process and make it more comfortable for consumers, who benefit from shorter lines, the elimination of cash-on-hand issues, and faster moving queues. The COVID-19 pandemic had a favorable effect on Virtual Payment (POS) terminals market growth. This can be due to increased internet usage, which has boosted the use of these softwares.

Increasing government measures, as well as BFSI sector activities, are pushing the adoption of digital payments in order to minimize operating costs and improve transaction visibility. As a result, demand for such terminals is expected to rise over the projection period as more digitalized payment systems are integrated.

Know more about this report: request for sample pages

Report Segmentation

The market is primarily segmented based on solution, vertical, and region.

|

By Solution |

By Vertical |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Vertical

Based on vertical, the retail market segment accounted for the largest revenue over the forecasted period. In the retail industry, users are increasingly using virtual payment terminals systems for mail orders or telephone orders.

The healthcare sector, on the other hand, is predicted to grow significantly during the forecast period. Due to the widespread acceptance of non-cash systems, the use of the virtual payment (POS) terminals market in the healthcare sector is likely to rise at a rapid pace over the forecast period.

Geographical Overview

North America accounted for the largest share in the global market in 2021 because of technological advancement and awareness of virtual payment terminals among the population. The growing healthcare and retail industry in the region are the major drivers of the market growth.

In 2025, total retail sales in the U.S. are expected to reach 5.35 trillion dollars, up from 4.85 trillion dollars in 2019. In the United States, there are around four million retail enterprises. In the United States, the domestic retail industry is fiercely competitive, with numerous enterprises reporting significant retail sales.

Walmart is the most popular retailer in the U.S., with low pricing and a large assortment of goods. Other major retailers in the United States include Amazon, The Kroger Company, Costco, and Target. Many of the world's largest merchants are based in the United States. Walmart and Amazon are two examples of American retailers operating internationally.

Many of the world's largest merchants are based in the United States. Walmart and Amazon are two examples of American retailers operating internationally. The performance of US retailers in online retail can also be considered as a measure of their success. Amazon is a good illustration of this, as the company's sales revenue has been increasing in recent years. Therefore, with the rising end-use industry in the country, the demand for the market is expected to grow the country.

Competitive Insight

Major market players are BBPOS Limited, Castles Technology, CitiXsys Technologies, Diebold Nixdorf, EGIDE, Elavon Inc., First Data Corporation, Incorporated, Ingenico Group., NCR Corporation, Newland Payment Technology, Panasonic Corporation, PAX Technology, Shenzhen Xinguodu Technology Co. Ltd, Squirrel Systems, VeriFone Inc.

Virtual Payment (POS) Terminals Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 32.97 Billion |

|

Revenue forecast in 2030 |

USD 176.52 Billion |

|

CAGR |

22.3% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD Million/Billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Solution, By Vertical, By Region. |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

BBPOS Limited, Castles Technology, CitiXsys Technologies, Diebold Nixdorf, EGIDE, Elavon Inc., First Data Corporation, Incorporated, Ingenico Group., NCR Corporation, Newland Payment Technology, Panasonic Corporation, PAX Technology, Shenzhen Xinguodu Technology Co. Ltd, Squirrel Systems, VeriFone Inc. |