Virtual Data Room Market Size, Share, Trends, Industry Analysis Report: By Component (Solutions and Services), Deployment Type, Enterprise Size, Business Function, Vertical, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM3107

- Base Year: 2024

- Historical Data: 2020-2023

Virtual Data Room Market Overview

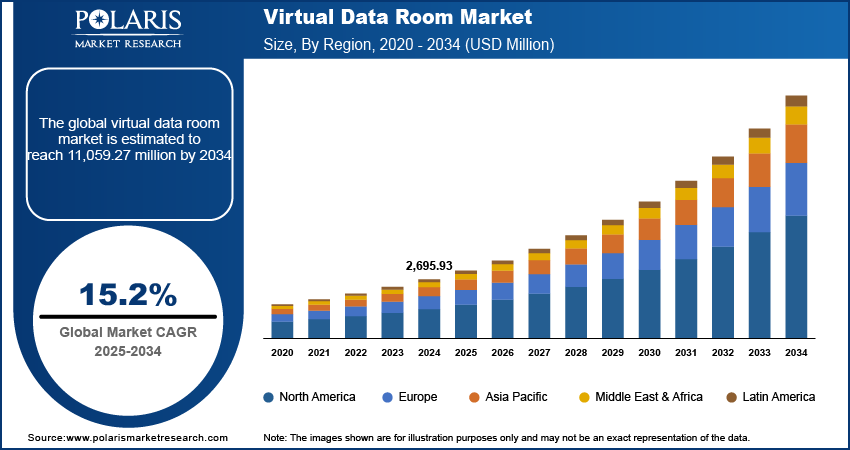

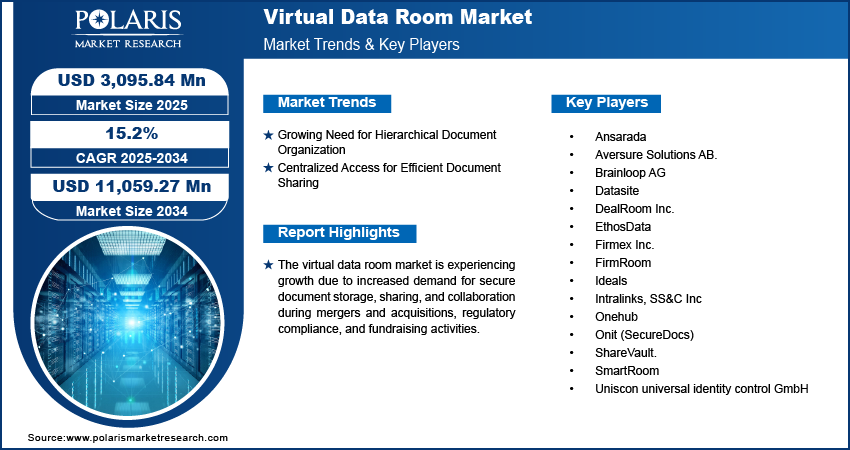

The global virtual data room market size was valued at USD 2,695.93 million in 2024. It is expected to grow from USD 3,095.84 million in 2025 to USD 11,059.27 million by 2034, at a CAGR of 15.2% from 2025 to 2034.

A virtual data room (VDR) is a secure digital platform designed to facilitate the storage, organization, and distribution of sensitive business information. VDAs are widely used for mergers and acquisitions, legal documentation, and secure collaboration. They ensure confidentiality and efficiency in managing critical business processes.

The growing frequency and value of mergers and acquisitions (M&A) worldwide are the primary factors driving the virtual data room (VDR) market growth. These M&A transactions, often involving millions of dollars and sensitive information, require highly secure and efficient platforms to share critical documents. For instance, during World Investor Week 2023, the Securities and Exchange Commission underscored the importance of investor education and protection, emphasizing due diligence to prevent fraud and enhance decision-making. VDRs meet these demands by providing advanced features such as encrypted data storage, role-based access control, and real-time collaboration tools. The ability of VDR platforms to streamline due diligence processes, reduce transaction timelines, and minimize security risks makes them essential for high-stakes transactions. Industries such as banking, financial services, and insurance (BFSI), healthcare, and technology particularly depend on these platforms to facilitate seamless data exchanges among geographically dispersed stakeholders.

To Understand More About this Research: Request a Free Sample Report

The implementation of strict data privacy regulations, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the US, has accelerated the adoption of VDR solutions. These regulations require organizations to implement robust data management practices and ensure compliance in handling sensitive information. For instance, in April 2024, Salesforce announced implementation and data governance bundles for safe and secure AI rollouts. VDR platforms, equipped with features such as automated compliance workflows, detailed audit trails, and customizable access permissions, help organizations adhere to such laws while ensuring secure collaboration. Non-compliance with these regulations often results in substantial penalties, creating a pressing need for reliable master data management. Furthermore, sectors such as legal, healthcare, and government agencies increasingly depend on VDRs to ensure the confidentiality of client and patient data while maintaining regulatory compliance. VDRs have become critical tools for secure and compliant operations in an evolving legal landscape as data protection becomes a priority for businesses.

Virtual Data Room Market Dynamics

Growing Need for Hierarchical Document Organization

Organizations involved in M&A, legal proceedings, and financial audits require a structured approach to manage large volumes of sensitive data. VDR platforms enable users to organize documents in a logical, multi-level hierarchy, facilitating easy navigation and retrieval. This structured organization reduces the risk of errors, ensures compliance with regulatory standards, and enhances productivity by streamlining the review process. Industries such as BFSI and healthcare rely heavily on this feature to handle complex transactions and adhere to strict document management protocols. For instance, in August 2023, Datasite acquired MergerLinks, a London-based financial data platform, to enhance its offerings for M&A professionals with an aim to streamline deal facilitation and expand Datasite's network capabilities for dealmakers globally. Thus, the growing importance of innovative technology in facilitating faster and more effective deals within the M&A ecosystem is driving the virtual data room market expansion.

Centralized Access for Efficient Document Sharing

In high-stakes scenarios such as due diligence and cross-border partnerships, centralized VDR platforms allow stakeholders to access and share documents securely in real-time. For instance, in September 2024, Bloomberg Finance L.P. launched a virtual data room to streamline the discovery and acquisition of data licenses. This initiative helps clients efficiently evaluate the usability and quality of datasets, reflecting the growing role of virtual data rooms in complex transactions. VDR features such as permission-based access controls, instant notifications, and activity tracking ensure that sensitive data is handled securely while improving decision-making speed. VDRs also enable businesses to maintain control over critical information by eliminating the inefficiencies of traditional file-sharing methods. This capability is especially valuable for global enterprises managing diverse teams and stakeholders across multiple locations. As a result, centralized access has become a cornerstone of virtual data room market growth as businesses increasingly prioritize efficiency and security in document sharing.

Virtual Data Room Market Segment Insights

Virtual Data Room Market Assessment by Component Outlook

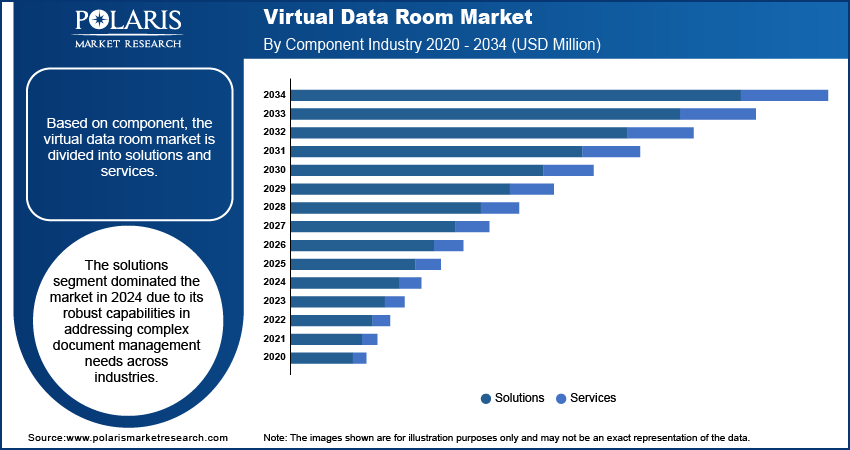

The global virtual data room market segmentation, based on component, includes solutions and services. The solutions segment dominated the market in 2024 due to its robust capabilities in addressing complex document management needs across industries. The growing adoption of these solutions in high-stakes activities such as mergers and acquisitions, legal proceedings, and financial audits has been a major contributor to the segment’s leading position. Additionally, businesses prefer solution-based VDR platforms for their scalability, integration with existing systems, and compliance with stringent data protection regulations. This dominance is particularly evident in sectors such as BFSI and healthcare, where secure and efficient document handling is essential.

Virtual Data Room Market Evaluation by Enterprise Size Outlook

The global virtual data room market evaluation, based on enterprise size, includes large enterprises and SMEs. The SMEs segment is expected to witness the fastest growth during the forecast period, driven by increasing digital transformation and the need for cost-effective solutions. Small and medium-sized enterprises are leveraging VDR platforms to enhance data security, streamline operations, and meet regulatory compliance standards. The growing trend of cross-border collaborations and partnerships among SMEs has further fueled the demand for centralized and secure data-sharing platforms. VDR providers are also offering tailored solutions with affordable pricing models, making them more accessible to smaller organizations. This segment is expected to witness substantial expansion as SMEs increasingly adopt VDR technologies to remain competitive.

Virtual Data Room Market Regional Analysis

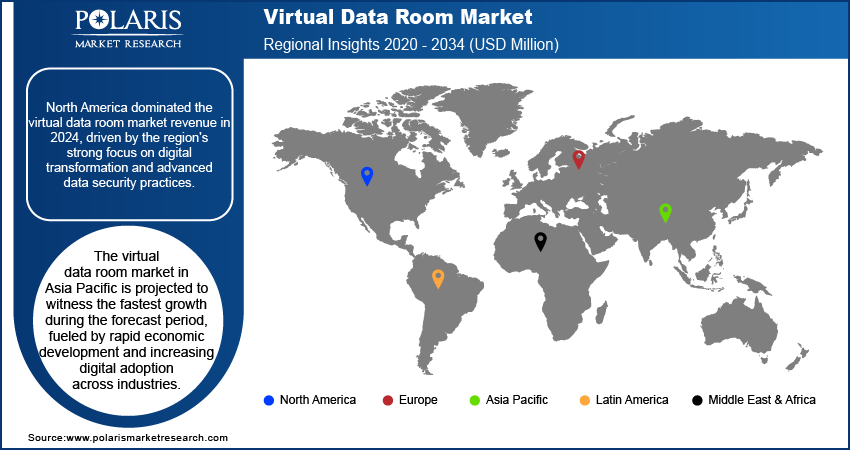

By region, the report provides the virtual data room market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the virtual data room market revenue in 2024, driven by the region's strong focus on digital transformation and advanced data security practices. The high adoption of VDRs in sectors such as BFSI and legal services, where secure and efficient document management is critical, has been a major factor in driving regional market dominance. For instance, in October 2024, Intralinks announced VDRPro, DealVault, and InView enhancements to improve user experience and efficiency. Additionally, the rising M&A activities in the US and Canada have created a robust demand for VDR platforms to facilitate due diligence and streamline complex transactions. The region's regulatory landscape, including stringent data privacy laws such as the California Consumer Privacy Act (CCPA), has also propelled the adoption of secure VDR solutions. The presence of leading VDR providers and continuous technological innovations further drive the regional market expansion.

The Asia Pacific virtual data room market is projected to witness the fastest growth during the forecast period, fueled by rapid economic development and increasing digital adoption across industries. Countries such as China, India, and Southeast Asian nations are witnessing a surge in M&A activity, cross-border collaborations, and infrastructure projects, driving the need for secure and efficient data management solutions. The region's growing focus on regulatory compliance, particularly with the introduction of data privacy laws in countries such as India and Singapore, has further accelerated VDR adoption. SMEs in the Asia Pacific are also increasingly embracing digital tools like VDRs to enhance operational efficiency and expand their global footprint. The rising investments in IT infrastructure and government initiatives supporting digitalization further underscore the region's growth potential in the virtual data room market.

Virtual Data Room Market – Key Players and Competitive Insights

Major market players are investing heavily in research and development to enhance their offerings, propelling the growth of the virtual data room (VDR) market. The market remains highly competitive, with leading players prioritizing innovation and strategic partnerships. Companies such as Firmex and Intralinks are advancing AI-powered features to improve document automation and security, while Datasite is focusing on tailored solutions for mergers and acquisitions. Additionally, iDeals is leveraging cost-effective, user-friendly platforms to address the needs of SMEs in emerging markets. Collectively, these companies maintain significant market share through regional expansions, continuous innovation, and investments in advanced VDR technologies.

Datasite is a virtual data room (VDR) platform designed to facilitate secure document management and collaboration, primarily for M&A professionals and legal teams. It offers a range of features, including AI-powered redaction, which automates the removal of sensitive information, and smart file upload capabilities that allow users to easily drag and drop multiple file types into the platform, supporting over 200 formats. The VDR enhances security through granular user permissions, enabling administrators to control access at the document level, and employs multi-factor authentication for added protection. Additionally, Datasite provides real-time analytics to track user engagement and document activity, ensuring comprehensive oversight during transactions. Its integration of a Q&A management system streamlines communication among stakeholders, while cross-platform compatibility ensures accessibility on various devices. Overall, Datasite aims to accelerate deal processes while maintaining high standards of data security and user efficiency.

Ansarada Group Limited, founded in 2005 and headquartered in Sydney, Australia, is a publicly listed company specializing in AI-powered virtual data rooms (VDRs) and deal management solutions. The company provides secure software designed to facilitate critical strategic projects such as mergers and acquisitions (M&A), capital raising, and compliance management. Ansarada's VDRs are particularly known for their advanced security features and intuitive workflows, which enhance collaboration among stakeholders while ensuring regulatory compliance throughout the deal lifecycle. Ansarada has established itself as a trusted partner for companies, advisors, and governments globally. The introduction of AI-driven tools such as the Bidder Engagement Score and Ansarada Intelligent Data Assistant (AiDA) further empowers users by offering insights and automating processes, thereby streamlining transaction management and improving decision-making efficiency.

List of Key Companies in Virtual Data Room Market

- Ansarada

- Aversure Solutions AB.

- Brainloop AG

- Datasite

- DealRoom Inc.

- EthosData

- Firmex Inc.

- FirmRoom

- Ideals

- Intralinks, SS&C Inc

- Onehub

- Onit (SecureDocs)

- ShareVault.

- SmartRoom

- Uniscon universal identity control GmbH

Virtual Data Room Industry Developments

In October 2024, iDeals VDR acquired EthosData to capitalize on the growing mergers and acquisitions (M&A) market in India.

In November 2024, Bite Investments, a leading provider of technology solutions for the alternative investments sector, launched its Virtual Data Room 2.0 (VDR) as part of Bite Stream, the company’s investor relations and fundraising platform.

Virtual Data Room Market Segmentation

By Component Outlook (Revenue, USD Million, 2020–2034)

- Solution

- AI-Powered

- Non-AI-Powered

- Services

- Consulting

- Implementation & Integration

- Training and Support & Maintenance

By Deployment Type Outlook (Revenue, USD Million, 2020–2034)

- Cloud-Based

- On-Premises

By Enterprise Size Outlook (Revenue, USD Million, 2020–2034)

- Large Enterprises

- SMEs

By Business Function Outlook (Revenue, USD Million, 2020–2034)

- Marketing and Sales

- Legal and Compliance

- Finance

- Workforce Management

By Vertical Outlook (Revenue, USD Million, 2020–2034)

- BFSI

- Corporates

- Healthcare & Life Sciences

- Government & Legal and Compliance Agencies

- Real Estate

- Industrial

- Energy & Utility

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Virtual Data Room Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,695.93 million |

|

Market Size Value in 2025 |

USD 3,095.84 million |

|

Revenue Forecast by 2034 |

USD 11,059.27 million |

|

CAGR |

15.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global virtual data room market size was valued at USD 2,695.93 million in 2024 and is projected to grow to USD 11,059.27 million by 2034.

• The global market is projected to register a CAGR of 15.2% during the forecast period.

• North America dominated the virtual data room market revenue in 2024.

• Some of the key players in the market are Ansarada; Aversure Solutions AB; Brainloop AG; Datasite; DealRoom Inc.; EthosData; Firmex Inc.; FirmRoom; Ideals; and Intralinks, SS&C Inc.

• The solutions segment dominated the virtual data room market expansion in 2024.