Virtual Client Computing Software Market Size, Share, Trends, Industry Analysis Report: By Component, Deployment (Hosted and On-Premise), Enterprise Size, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 118

- Format: PDF

- Report ID: PM5305

- Base Year: 2024

- Historical Data: 2020-2023

Virtual Client Computing Software Market Overview

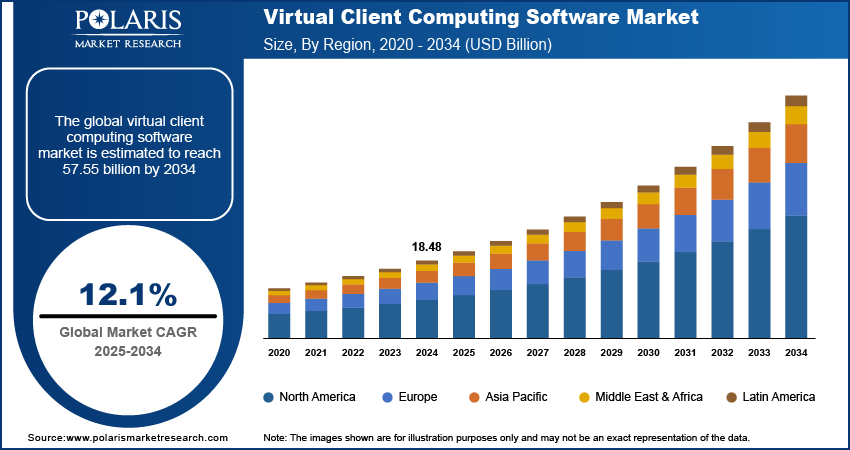

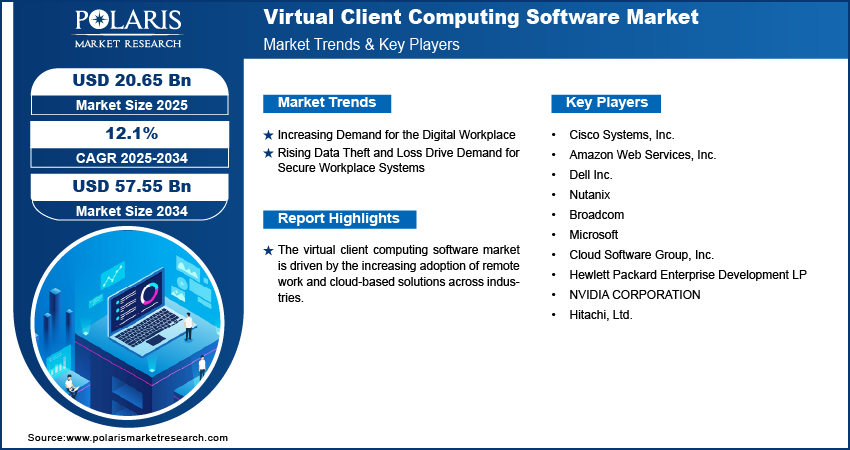

The virtual client computing software market size was valued at USD 18.48 billion in 2024. The market is projected to grow from USD 20.65 billion in 2025 to USD 57.55 billion by 2034, exhibiting a CAGR of 12.1% during the forecast period.

Virtual client computing software allows centralized management and delivery of desktop environments to end-users over a network, allowing remote access to applications and data. It enhances security, scalability, and control across various devices and locations. The virtual client computing software market is experiencing significant growth, driven by key factors such as the increasing adoption of cloud-based solutions, advancements in data-centric security, and the growing need for efficient IT infrastructure management. Organizations are prioritizing flexibility, scalability, and control in their IT environments, further fueling market expansion.

For instance, in October 2024, IBM launched the IBM Guardium Data Security Center, a platform aimed at improving data security in hybrid cloud and AI environments. It incorporates Guardium AI Security and Quantum-Safe features, which help organizations monitor data risks, manage cryptographic security, and ensure compliance against emerging threats including quantum computing. Additionally, the shift towards hybrid work models is fueling demand as companies seek centralized solutions to support remote employees. However, high implementation and maintenance costs can cause challenges for smaller organizations, impacting market growth.

To Understand More About this Research: Request a Free Sample Report

Virtual Client Computing Software Market Dynamics

Increasing Demand for Digital Workplace

The growing demand for digital workplaces is a major driver of the virtual client computing software market as organizations increasingly adopt remote and hybrid work models. This shift emphasizes the need for flexible, secure, and easily managed IT environments that virtual client computing solutions provide. For instance, in July 2020, Citrix and Microsoft entered into a partnership aimed at advancing remote work solutions by integrating Citrix Workspace with Microsoft Azure and Microsoft 365. This collaboration improves cloud transitions for businesses, enhancing application access across devices while supporting secure, flexible work environments. Furthermore, by facilitating centralized resource access across locations, virtual client computing software boosts productivity and collaboration while ensuring robust data security. As companies prioritize scalable digital solutions, this technology has become essential for managing remote access, reducing hardware dependency, and improving operational efficiency in a dispersed workforce.

Rising Data Theft and Loss

The increasing incidents of data theft and loss are driving the demand for secure workplace systems. As cyber threats become more advanced, organizations need robust security measures to safeguard sensitive data, particularly in remote and hybrid work environments. Virtual client computing software enables businesses to secure access to centralized resources, enforce strict security protocols, and monitor data flow, thereby minimizing the risk of breaches.

For instance, in November 2024, ConnectWise introduced new cybersecurity solutions designed for Managed Service Providers (MSPs), including ConnectWise Security360, which focuses on attack surface management (ASM). The solution offers integrations with ConnectWise RMM and PSA, as well as enhanced vulnerability management and Microsoft 365 protection. Moreover, these systems ensure that employees can work from any device or location without compromising data security. Thus, this makes them essential in the current landscape, where protecting information is a top priority.

Virtual Client Computing Software Market Segment Analysis

Virtual Client Computing Software Market Assessment by Component Outlook

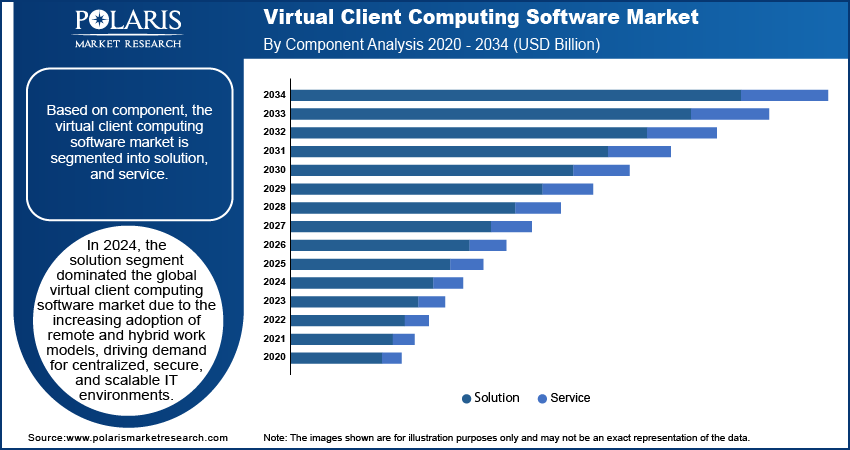

The global virtual client computing software market segmentation, based on component, includes solution and service. In 2024, the solution segment dominated the market due to the increasing adoption of remote and hybrid work models, driving demand for centralized, secure, and scalable IT environments. Virtual client computing solutions provide organizations with the ability to manage remote access efficiently, ensure data security, and reduce hardware dependency. As companies increasingly prioritize flexibility, these solutions offer seamless access to business critical applications and resources, which is crucial for maintaining productivity in a dispersed workforce. This trend, coupled with the growing need for digital transformation, has solidified the dominance of the solution segment in the market.

Virtual Client Computing Software Market Evaluation by Deployment Outlook

The global virtual client computing software market segmentation, based on deployment, includes hosted and on premise. The on-premise segment of the global virtual client computing software market is expected to witness substantial growth due to increasing concerns over data privacy and security. Many organizations prefer on premise deployments as they provide full control over their IT infrastructure, ensuring sensitive information remains within the company’s premises. Additionally, industries with strict compliance requirements, such as healthcare and finance, often opt for on premise solutions to meet regulatory standards and protect critical data. This preference for greater control, security, and customization is fueling the growth of the on-premise deployment segment.

Virtual Client Computing Software Market Regional Insights

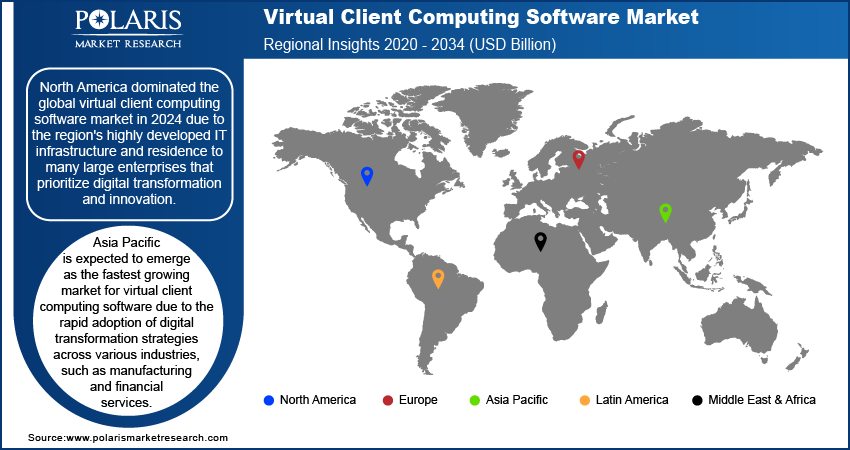

By region, the study provides virtual client computing software market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market in 2024 due to the region's highly developed IT infrastructure and residence to many large enterprises that prioritize digital transformation and innovation. The rise of remote and hybrid work models, particularly accelerated by the COVID-19 pandemic, has further increased the demand for secure, scalable, and efficient virtual workspace solutions. North America also benefits from strong government and industry support for cybersecurity initiatives, with organizations increasingly seeking solutions that enhance data protection and compliance. For instance, according to a November 2024 report by the World Economic Forum, the US introduced new regulations to limit foreign access to sensitive American data, including financial, genomic, and health information, in an effort to safeguard against cyberattacks, espionage, and blackmail. These actions were initiated by the record $12.5 billion in financial losses from cybercrime in the US in 2023. Additionally, the presence of leading software providers and early adoption of cloud and virtualization technologies are additional drivers of growth in the region, solidifying North America's leadership in the market.

Asia Pacific is expected to emerge as the fastest growing market for virtual client computing software due to the rapid adoption of digital transformation strategies across various industries, such as manufacturing and financial services. The region's increasing demand for flexible and scalable IT solutions, coupled with the growth of remote and hybrid work models, is driving the need for virtual client computing solutions. Additionally, as businesses in countries such as China, India, and Japan prioritize cost-effective, secure, and efficient IT environments, the virtual client computing software market demand is expected to accelerate over the forecast period.

Virtual Client Computing Software Market – Key Players and Competitive Analysis Report

The competitive landscape of the virtual client computing software industry is characterized by a mix of global leaders and regional players competing for market share through innovation, strategic partnerships, and geographic expansion. Major companies in the market, such as Amazon Web Services, Inc.; Dell Inc.; Hewlett Packard Enterprise Development LP; and others, capitalize on their strong R&D capabilities and expansive distribution networks to deliver advanced solutions for industries such as healthcare, finance, manufacturing, and education. These leading players focus on product innovation, improving scalability, security, and flexibility to meet the demands of remote work, cloud computing, and virtual collaboration. Meanwhile, smaller regional firms are emerging with tailored solutions that cater to specific market needs, offering niche applications for local businesses. Competitive strategies in this market include mergers and acquisitions, partnerships with cloud providers, and expanding product portfolios to strengthen their presence in key regions. A few key major players are Microsoft; Broadcom; Cloud Software Group, Inc.; Cisco Systems, Inc.; Amazon Web Services, Inc.; Dell Inc.; Hewlett Packard Enterprise Development LP; Nutanix; Hitachi, Ltd.; NVIDIA CORPORATION.

Cisco Systems, Inc. is a global technology leader specializing in networking hardware, software, and telecommunications equipment. Founded in 1984 and headquartered in San Jose, California, Cisco is renowned for its innovation in developing solutions that enable connectivity and digital transformation across various industries. The company’s core products and services include networking infrastructure, cybersecurity solutions, collaboration tools, and data center technologies. Cisco’s networking portfolio encompasses routers, switches, and wireless systems that form the backbone of modern Internet and enterprise networks. In addition to hardware, Cisco offers a range of software solutions for network management, security, and cloud computing. Their cybersecurity offerings are designed to protect against evolving threats, ensuring the integrity and privacy of data across networks. Cisco is also a key player in the realm of collaboration technology, providing tools such as WebEx for video conferencing and teleconsultation, which are integral to remote work and virtual meetings. The company's focus on innovation, combined with its broad product and service portfolio, positions Cisco as a pivotal player in shaping the future of networking and communications technology.

NVIDIA Corporation is a computer hardware manufacturing company that provides GPU-accelerated computing solutions, AI and Deep learning, gaming, self-driving cars, supercomputing, robotics, parallel computing, automotive technology, and professional graphics. The company offers a wide range of products in segments of gaming and entertainment, laptops and workstations, cloud and data centers, networking, GPUs, cloud and data center, and embedded systems. The company offers graphics cards, gaming laptops, and G-sync monitors in the gaming and entertainment segment. The company also provides various solutions for a segment like AI and Data Science, Data center and cloud computing, design and simulation, robotics and edge computing, high-performance computing, and self-driving vehicles. It delivers various application frameworks, applications and tools, infrastructure suites, and cloud services in the software segment. NVIDIA Corporation is a public limited company founded in April 1993 and is headquartered in California, United States. The company has employed around 26,196 employees in 35 countries, including research and development, sales, marketing, and operations.

Key Companies in Virtual Client Computing Software Market

- Cisco Systems, Inc.

- Amazon Web Services, Inc.

- Dell Inc.

- Nutanix

- Broadcom

- Microsoft

- Cloud Software Group, Inc.

- Hewlett Packard Enterprise Development LP

- NVIDIA CORPORATION

- Hitachi, Ltd.

Virtual Client Computing Software Market Development

August 2024: Microsoft released an updated version of Azure Virtual Desktop (AVD) with new features for security and unified endpoint management.

November 2023: Amazon Web Services (AWS) released Amazon WorkSpaces Thin Clients. These devices are designed to offer a simple and secure way to deploy virtual desktops at scale.

Virtual Client Computing Software Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Solution

- Terminal Service

- VUS

- VDI

- Others

- Service

- Integration & Deployment

- Support & Maintenance

- Training & Consulting

By Deployment Outlook (Revenue, USD Billion, 2020–2034)

- Hosted

- On-premise

By Enterprise Size Outlook (Revenue, USD Billion, 2020–2034)

- Large Enterprises

- Small Enterprises

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- BFSI

- Retail

- Government

- Healthcare

- IT & Telecom

- Manufacturing

- Media & Entertainment

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Virtual Client Computing Software Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 18.48 billion |

|

Market Size Value in 2025 |

USD 20.65 billion |

|

Revenue Forecast by 2034 |

USD 57.55 billion |

|

CAGR |

12.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global virtual client computing software market size was valued at USD 18.48 billion in 2024 and is projected to grow to USD 57.55 billion by 2034.

The global market is projected to register a CAGR of 12.1% during the forecast period.

North America dominated the global virtual client computing software market in 2024.

A few key players in the market are Microsoft; Broadcom; Cloud Software Group, Inc.; Cisco Systems, Inc.; Amazon Web Services, Inc.; Dell Inc.; Hewlett Packard Enterprise Development LP; Nutanix; Hitachi, Ltd.; NVIDIA CORPORATION.

The solution segment dominated the global virtual client computing software market in 2024.

The on-premise segment of the global virtual client computing software market is expected to witness substantial growth.