Video Processing Platform Market Share, Size, Trends, Industry Analysis Report, By Component (Hardware, Platform, Services); By Application; By Content Type; By Vertical; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 119

- Format: PDF

- Report ID: PM4099

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

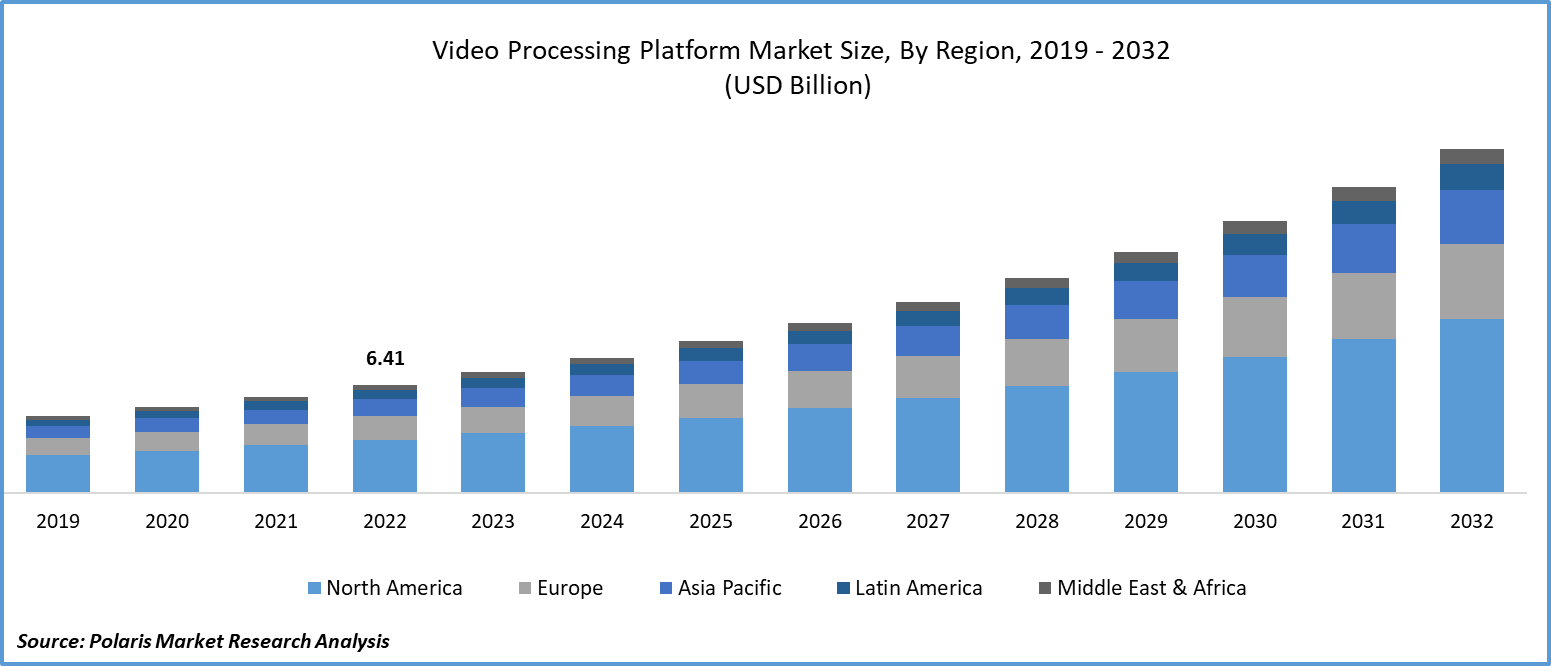

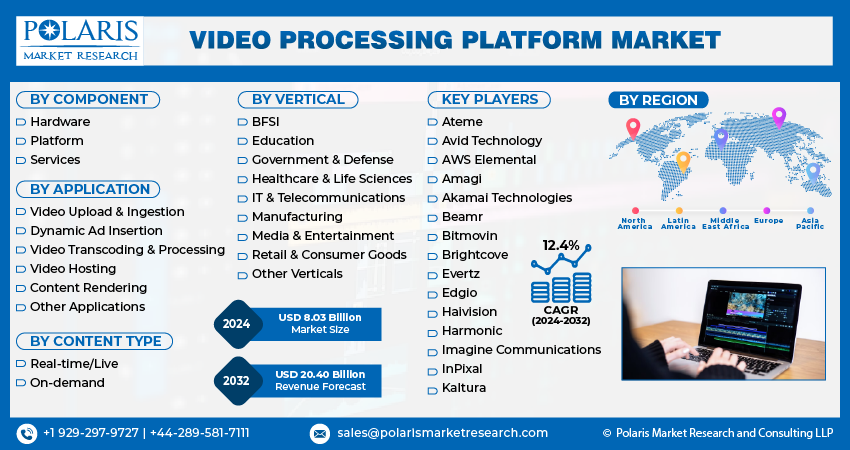

The global video processing platform market was valued at USD 7.17 billion in 2023 and is expected to grow at a CAGR of 12.4% during the forecast period.

The widespread use of video processing platforms in various disciplines, including gaming, media and entertainment, online streaming platforms, advertising, and more, is expanding the growth of the global market. For manipulating the visuals and sound included in video files, video processing employs hardware, software, and combos of the two. Multiple filters can be used for editing activities due to the extensive algorithms in the processing software and associated equipment. Companies in this field are working effectively to innovate new technology to meet ongoing consumer needs.

To Understand More About this Research: Request a Free Sample Report

- For instance, in August 2023, NVIDIA expanded its product line Maxine for video editing. It enables the use of AI power to create quality audio and video effects by using standard webcams and microphones.

Moreover, video processing platforms are used in military applications, including uncrewed aerial vehicles and drones, for the identification of potential threats, as they have the capability of capturing, processing, and analyzing information for strategic decision-making.

However, the higher initial costs associated with the video processing platform installation, as it involves both hardware and software, may hamper its adoption rate among small companies and start-ups.

Growth Drivers

- Rising quality concerns in online streaming services are boosting the demand for video-processing platforms.

The growing popularity of streaming platforms like OTT and YouTube necessitates the need for efficient video processing platforms, as people prefer shows or videos with smooth flow and higher picture quality. According to the study published in the CMU School of Computer Science, there is a significant correlation between video quality and user engagement. The study revealed that the user impact is highly dependent on the content type, including live streaming and video on demand; however, buffering is the primary issue with live content. To tackle this, video processing platforms assist content providers by optimizing the size of the file with video encoding. Furthermore, the existence of adaptive streaming technologies like Dynamic Adaptive Streaming in most of the video processing platforms over HTTP live streaming can improve the video quality and limit the video buffering, making it an ideal option for video creators.

The increasing partnerships among video processing platform market players are widening the expansion of the global market. For instance, ITV Studios' international production arm extended its partnership with Avid in 2023 to standardize & streamline post-production workflows across its international studios in Europe & Australia. As companies step forward to increase consumer satisfaction, this will further enhance the demand for video processing platforms in the next few years. With the coding technology, Netflix can stream 450,000 hours of content per minute. Streaming services are using both new and tried-and-true codecs to enable users to stream from various devices, driving demand for video processing platforms as it enables codec technology.

Report Segmentation

The market is primarily segmented based on component, application, content type, vertical, and region.

|

By Component |

By Application |

By Content Type |

By Vertical |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Component Analysis

- The platform segment is expected to witness the highest growth during the forecast period.

The platform segment is projected to grow at a CAGR during the projected period, mainly driven by growing innovation among the companies fueled by competition in the marketplace. Various platforms are introducing key market players with real-time video editing, AI-powered features, and more. Platforms provide a single place for all the actions, starting from video uploading to transcoding, making them more widely adopted by video creators with their user-friendly interfaces.

By Application Analysis

- Dynamic ad insertion segment accounted for the largest market share in 2022

The dynamic ad insertion segment accounted for the largest market share in 2022 and is likely to retain its market position throughout the forecast period. It is becoming a major part of modern advertising and monetization strategies as it can provide a better time to post the ad to reach the target audience. It provides monetization facilities to broadcasters and content creators, along with advanced real-time analytics. The growing demand for advertising services will further create new growth opportunities for dynamic ad insertion in the coming years.

By Content Type Analysis

- The real-time/ live segment held a significant market revenue share in 2022

The real-time/live segment held a significant market share in revenue share in 2022, which is highly attributable to the growing popularity of live streaming services on YouTube. Specifically, educational institutions are facilitating live classes to clarify students' queries instantly. Educational coaching centers are increasing the number of free live classes to increase their brand coverage. As more educational institutions come forward to improve their market presence, the demand for video-processing platforms will increase in the coming years.

By Vertical Analysis

- The manufacturing segment registered significant growth in 2022

The manufacturing segment held significant growth in 2022, which is highly influenced by the growing company initiatives to establish strong engagement with its audience in the form of video clips to explore various features and applications of its products. They are used for automation of quality control, inspection of products, process monitoring, and optimization in the manufacturing industries. Furthermore, they are also used to train workers with the rising adoption of new technologies in the workplace to increase productivity. Video processing platforms can identify worker actions and be used to give signals for violating safety protocols, enhancing workspace safety.

Regional Insights

- North America region witnessed the largest share of the global market in 2022

The North American region dominated the global market. The growing entertainment and media industry in this region is driving the demand for video processing platforms, as they are highly used in streaming platforms, including Amazon Prime Video, Netflix, and more, driven by consumer interest in home entertainment in free time. According to an article published by the International Trade Administration, the U.S. media and entertainment industry is the largest in the world, with $600 billion in 2020. The pandemic surged the demand for streaming services as most people are at home due to stringent regulations.

The Asia Pacific will grow rapidly, owing to the growing penetration of internet users, which is driving demand for online streaming services in the region, primarily in India and China. The rapid surge in internet access to a wider audience is expanding the growth opportunities for telecom providers in the region. Based on the article published in the Times of India, India is expected to consume 62 GB per user by 2028, which is a step forward for developed markets, including the US, Western Europe, South Korea, & China. The existence of lower data costs in the region, along with the rising adoption of 5G networks, are fueling the demand for live streaming services, which is encouraging content creators to adopt the latest video processing technologies as they improve video quality.

Key Market Players & Competitive Insights

The video processing platform market is expected to have higher competition owing to the increasing evolution of companies with the latest innovations in the marketplace. The rising product innovations, partnerships, collaborations, mergers, and acquisitions among the market players are expanding the growth potential and contributing to the market's outreach to a wider population.

Some of the major players operating in the global market include:

- Ateme

- Avid Technology

- AWS Elemental

- Amagi

- Akamai Technologies

- Beamr

- Bitmovin

- Brightcove

- Evertz

- Edgio

- Haivision

- Harmonic

- Imagine Communications

- InPixal

- Kaltura

Recent Developments

- In September 2022, Ateme introduced a cloud-agnostic SaaS tool, Atem +. It offers the reliability, accuracy, and dependability of the company’s top-notch video compression & delivery software. There are now commercial cloud service providers and solutions available, including pay-as-you-go and subscription models.

Video Processing Platform Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 8.03 billion |

|

Revenue Forecast in 2032 |

USD 20.40 billion |

|

CAGR |

12.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Component, By Application, By Content Type, By Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |