Video Management Software Market Share, Size, Trends, Industry Analysis Report, By Component (Solution, and Services); By Deployment Mode; By Technology; By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Nov-2022

- Pages: 118

- Format: PDF

- Report ID: PM2818

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

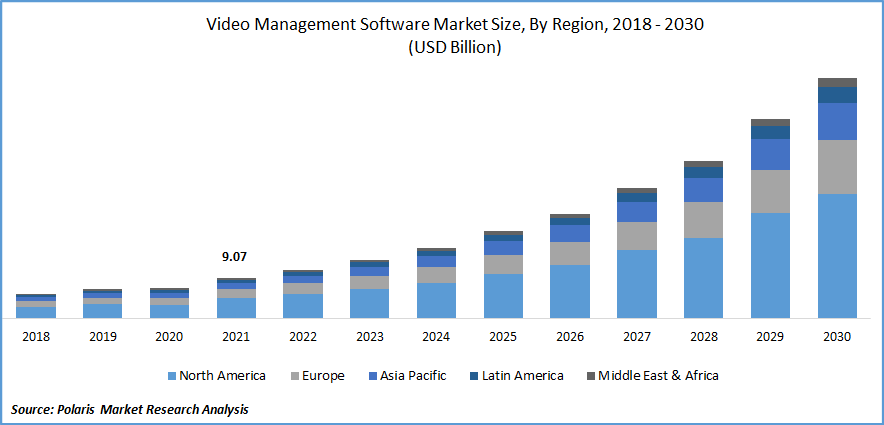

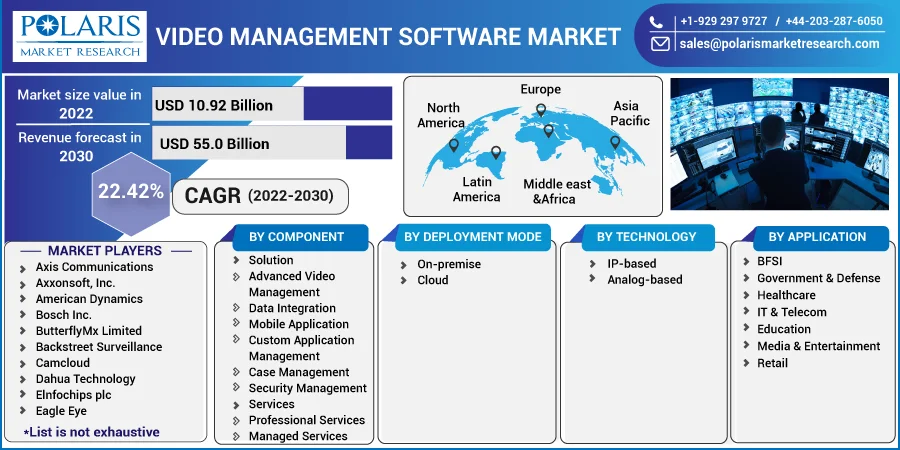

The global video management software market was valued at USD 9.07 billion in 2021 and is expected to grow at a CAGR of 22.42% during the forecast period.

The core feature of the video management system includes gathering videos and processing recordings, routing, controlling events, and integrating other functionalities. Globally, video security and surveillance have become widely used. Even though security cameras have been available for a long time, current advancements in IP video technology have significantly increased the use of IP video technology in access control. The ability to save and broadcast video from the web makes the technology more cost-effective and appealing for the majority of operations that focus on costs in enterprises. The research emphasizes the widespread use of video management software worldwide.

Know more about this report: Request for sample pages

Video management software uses and displays analytical data from cameras in the retail environment when deciding where to place items in a store. It can also be used in conjunction with artificial intelligence (Al) facial recognition technology to identify known criminals and can also be used in access-controlled concerts to bolster admissions controls or alert attendees to possible problems. Big businesses and academic institutions frequently use it for corporate training, executive communication, event streaming, and knowledge management. Solutions for video content management (VCM) provide a low-cost infrastructure for dealing with video buffering problems. VCM routinely shares clips of collected videos. The video content sinks better due to cache proxies set up across the WANs.

The COVID-19 pandemic has caused significant economic changes in some industry sectors. Despite the epidemic, the growing global demand for video management systems drives market prices. Industrialized nations used a lot of facial recognition systems, thermal imaging cameras, and mask detection algorithms once the Coronavirus became common. Because of the pandemic's rising desire for contactless technologies, the market value of video management software has grown recently. Due to AI-driven cloud systems and video management software, security forces in countries with high infection rates can now keep an eye on patients and lawbreakers.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Security agencies continue to use caution when making public disclosures about the breadth of their surveillance operations. Various monitoring technologies have been a topic of discussion for the past 20 years due to several big terrorist attacks. Few studies have focused on the general public, but the scientific community has explored and condemned the use of new technologies for proactive security and surveillance. Public-targeted studies frequently assume that security and privacy must be traded off.

The security and surveillance market is evolving, and this development suggests a higher reliance on new technology. Another sign that security and surveillance concerns are growing is the increased demand for CCTV cameras. Leading companies offer a range of goods, such as 8-megapixel CCTV cameras. The wide range of CCTV security & surveillance cameras includes night vision cameras or colored vision during night, in addition to IP-powered cameras. As a result, the market for video management software is expanding.

Report Segmentation

The market is primarily segmented based on component, deployment mode, technology, application, and region.

|

By Component |

By Deployment mode |

By Technology |

By Application |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

The solution segment industry accounted for the highest market share in 2021

The component segment consists of solutions & services. The solution subsegment includes advanced video management, data integration, mobile application, custom application management, case management, and security management. The data integration segment held the largest share and is expected to grow faster during the forecast period owing to the rising adoption of security solutions like vehicle plate identification & Radio Frequency Identification (RFID) observation, which are integrated with such software, propelling the segment growth. In addition, video analytics is widely used in fields like facial recognition, motion detection, and retail consumer analytics; mobile application segments are also anticipated to record a quick revenue CAGR over the projection year.

The IP-Based technology segment is expected to witness the fastest growth

IP cameras are revolutionizing video surveillance because they offer various advantages, such as low cost, outstanding image quality, and scalability. The growing adoption of IP cameras by end-use enterprises and sectors is one of the key factors driving the market’s revenue growth. By enabling IP cameras with built-in analytics, the open platform video management software allows the surveillance system to gain more business knowledge. For instance, in May 2021, NxtGen Datacenter & Cloud Technologies Private Limited introduced a video analytics-as-a-service approach to help enterprises.

A single operational fee can be used to access the complete end-to-end solution, which includes cutting-edge infrastructure and software expertise from a single company. AI/ML powers it. High-performance real-time video analytics can help transform conventional surveillance networks into intelligent detection and alert systems for moving or stationary objects, cars, or people. Real-time detection has aided in reducing thefts, crimes, and other criminal activity while also improving social conditions generally and the state of global trade, which has fueled market expansion throughout the evaluation period.

The demand in North America is expected to witness significant growth

North America dominated the market for video management software. This can be linked to the region's growing adoption of high-end IP-based oversight and surveillance technology, as well as the presence of significant industry players. Along with the rising acceptance of technological innovations like big data analysis, cloud technology, IoT, AI, and other analysis techniques, the presence of a robust collaboration platform made up of resellers, marketers, consultants, and developers is one of the essential elements driving the demand.

Additionally, developing countries in the Asia Pacific are anticipated to have the fastest development in the market for video management software because of the rising utilization of cloud-based VMS. It is projected that keeping a high level of technology in smart city initiatives for automated transportation systems, surveillance cameras, and traffic surveillance cameras, among other technologies, will drive market expansion in the Asia Pacific region. The government of India's ambition to build 100 smart cities with separate and centralized command and control centers are anticipated to be a major factor in the market's expansion.

Competitive Insight

Some of the major players operating in the global market include Axis Communications, Axxonsoft., Avigilon Corporation, Arcules Corporation, Bosch Inc., ButterflyMx Limited, Backstreet Surveillance, Camcloud, Dahua Technology, Elnfochips plc, Eagle Eye, Exacq technologies, Hanwha Techwin, Honeywell International, Hikvision Digital, Identiv L.P., IndigoVision Limited, Johnson Controls, Kedacom, Mindtree, Milestone Systems, March Networks, Netapp, Panasonic i-PRO Sensing Solutions, Panopto, Pelco, Qumulex, Qognify, Rhombus, Schneider Electric, Sighthound, Senstar, Verint Systems, and Verkada Ltd.

Recent Developments

In April 2021: Bosch unveiled its new FLEXIDOME multi/0001 camera family, which includes IR and non-IR variants with 12- or 20-megapixel resolution. It produces incredibly detailed multidirectional overviews.

In April 2021: TagMaster, acquired Citilog, a subsidiary of Axis Communications based in France. The deal is anticipated to be finalized on April 30, and Axis is anticipated to continue working as partners with Citilog and LaglMaster.

In February 2021: Honeywell announced the expansion of its MAXPRO Cloud portfolio. This improvement is anticipated to increase security and control over the company, increase production, and lower the cost of ownership.

In January 2021: Hanwha Techwin introduced six new “PTZ PLUS” cameras, which are 65% lighter than traditional PIZ cameras and have a small and lightweight design.

Video Management Software Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 10.92 billion |

|

Revenue forecast in 2030 |

USD 55.0 billion |

|

CAGR |

22.42% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Component, By Deployment Mode, By Technology, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Axis Communications, Axxonsoft, Inc., Avigilon Corporation Arcules Corporation, American Dynamics,Bosch Inc., ButterflyMx Limited, Backstreet Surveillance, Camcloud, Dahua Technology, Elnfochips plc, Eagle Eye, Exacq technologies, Genetec Limited, Hanwha lechwin Co, Honeywell International, Hikvision Digital Inc., Identiv L.P., IndigoVision Limited, Johnson Controls International, Kedacom, Mindtree, Milestone Systems, March Networks, Netapp, Panasonic i-PRO Sensing Solutions, Panopto, Pelco, Qumulex, Qognify, Rhombus, Schneider Electric, Sighthound, Senstar, Verint Systems and Verkada Ltd. |