Veterinary Surgical Procedures Market Size, Share, Trends, Industry Analysis Report: By Procedure Type, Animal Type (Small Animals and Large Animals), End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 120

- Format: PDF

- Report ID: PM5207

- Base Year: 2024

- Historical Data: 2020-2023

Veterinary Surgical Procedures Market Overview

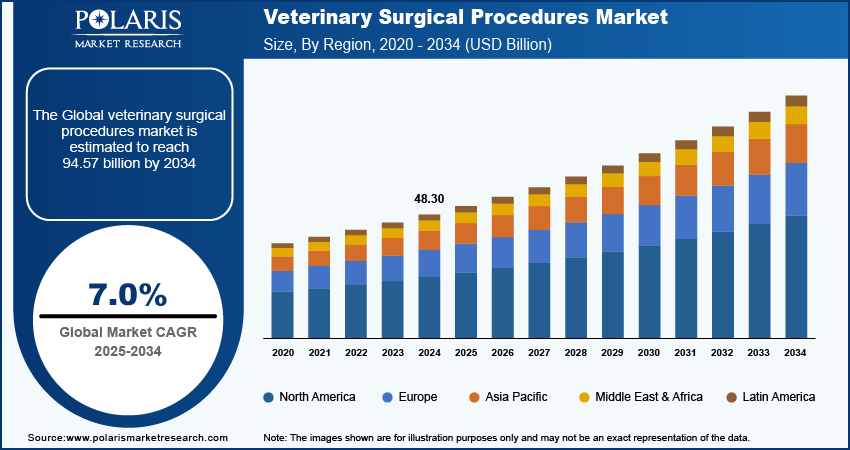

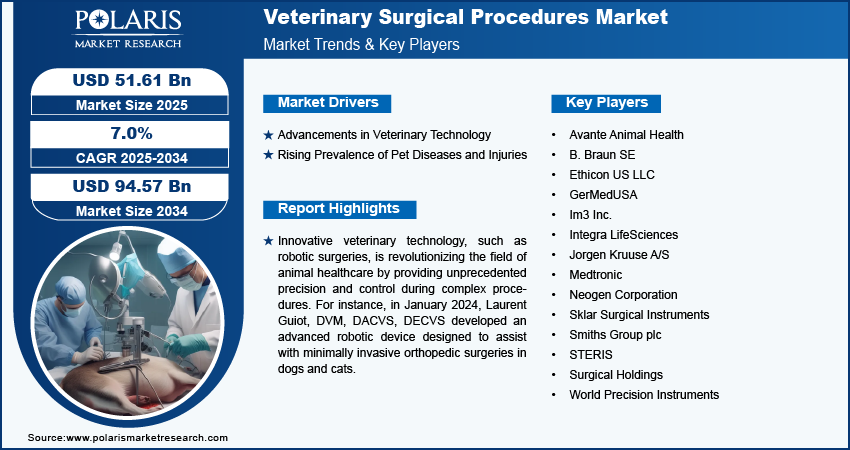

The global veterinary surgical procedures market size was valued at USD 48.30 billion in 2024. The market is projected to grow from USD 51.61 billion in 2025 to USD 94.57 billion by 2034, exhibiting a CAGR of 7.0% during 2025–2034.

Veterinary surgical procedures are medical operations performed by veterinarians to treat injuries, diseases, and other health conditions in animals. These procedures range from routine surgeries, such as spaying or neutering, to more complex operations, including orthopedic repairs, tumor removals, and soft tissue surgeries. The rise in pet ownership, particularly in urban areas, has led to higher spending on animal healthcare. Owners are willing to pay a high amount for advanced surgical procedures to improve their pets' quality of life, which is driving demand for veterinary surgeries. Additionally, the proliferation of veterinary clinics and animal hospitals in emerging markets is enhancing the availability of surgical services. This geographic diversification of veterinary care facilities is boosting market expansion by facilitating increased access to essential surgical procedures for a greater number of pets.

To Understand More About this Research: Request a Free Sample Report

The increased awareness among pet owners about preventive healthcare and the benefits of surgical procedures for pets has led to greater acceptance of elective surgeries such as spaying, neutering, and dental treatments, thereby propelling the veterinary surgical procedures market growth. Moreover, the rise of veterinary specialization, with more veterinarians pursuing advanced training in fields such as orthopedics, oncology, and neurology, is expanding the scope and quality of surgical procedures available, which is driving the market expansion.

Veterinary Surgical Procedures Market Trends

Advancements in Veterinary Technology

Advancements in veterinary technology have significantly transformed the field of veterinary surgery, enhancing precision, safety, and overall success rates. The development of sophisticated surgical tools such as precision scalpels, laser devices, and energy-based instruments enables veterinarians to perform delicate procedures with greater control, minimizing tissue damage and reducing recovery times. Additionally, the integration of advanced imaging technologies such as MRI and CT scans has revolutionized diagnostic capabilities, allowing veterinarians to accurately visualize internal structures before surgery. This leads to better planning and improved outcomes, particularly in complex cases such as orthopedic and neurological surgeries. Minimally invasive techniques, such as laparoscopy and arthroscopy, have also become more prevalent, offering reduced pain, quicker recovery times, and shorter hospital stays compared to traditional surgeries. Furthermore, emerging technologies, including robotic-assisted surgery and 3D printing, enhance precision, with robotic systems enabling more intricate procedures and 3D printing providing customized implants and surgical models. Thus, the continuous technological advancements in veterinary care are expected to boost the veterinary surgical procedures market growth during the forecast period.

Rising Prevalence of Pet Diseases and Injuries

Chronic conditions such as cancer, orthopedic disorders, and dental problems are becoming more common in pets, particularly as advances in veterinary care and nutrition contribute to longer lifespans. The rising age of pets leads to increased risks of these ailments, which propels the demand for surgeries such as tumor removals, joint replacements, and dental extractions. Additionally, orthopedic conditions such as hip dysplasia and ligament tears often require surgical intervention, especially in larger breeds prone to these conditions. Further, the need for emergency surgeries due to accidents, trauma, or ingestion of foreign objects is on the rise. Pets, especially those with active lifestyles or free access to outdoor spaces, are susceptible to injuries such as fractures or internal bleeding that necessitate immediate surgical attention. The growing awareness of these conditions and the availability of advanced veterinary care fuel this trend, making surgical procedures a crucial component of modern pet healthcare. Therefore, the rising prevalence of pet diseases and injuries is projected to drive the growth of the veterinary surgical procedures market in the coming years.

Veterinary Surgical Procedures Market Segment Insights

Veterinary Surgical Procedures Market Breakdown by Animal Type Insights

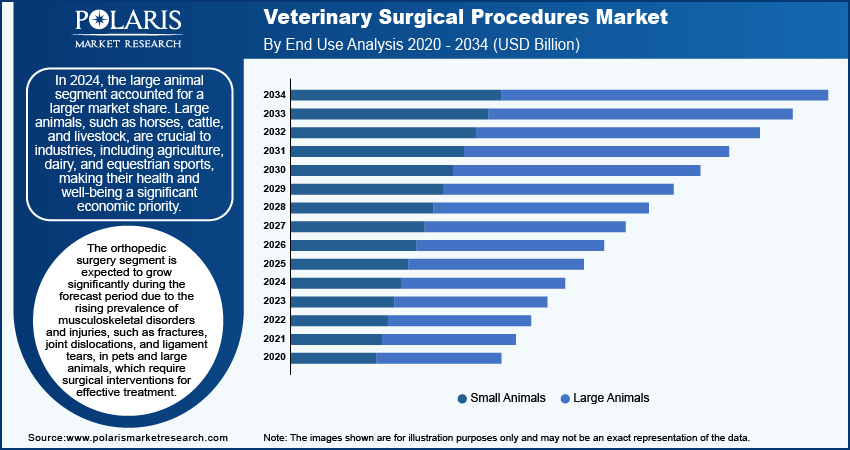

The global veterinary surgical procedures market, based on animal type, is bifurcated into small animals and large animals. In 2024, the large animal segment accounted for a larger market share. Horses, cattle, livestock, and other large animals are crucial to industries such as agriculture, dairy, and equestrian sports, making their health and well-being a significant economic priority. As a result, the demand for advanced veterinary surgical procedures for large animals has risen, particularly for conditions such as fractures, colic surgeries in horses, and reproductive health interventions in livestock. The high economic value associated with these animals justifies the investments in expensive surgeries and post-operative care, further driving the market growth.

Veterinary Surgical Procedures Market Breakdown by Procedure Type Insights

The global veterinary surgical procedures market segmentation, based on procedure type, includes spaying/neutering, dental procedures, soft tissue surgeries, orthopedic surgeries, ophthalmic surgeries, neurological surgeries, and other specialized surgeries. The orthopedic surgery segment is expected to grow significantly during the forecast period due to the rising prevalence of musculoskeletal disorders and the increasing incidence of injuries in pets and large animals, such as fractures, joint dislocations, and ligament tears, which require surgical interventions for effective treatment. Furthermore, innovative veterinary technology, such as robotic surgeries, is revolutionizing the field of animal healthcare by providing unprecedented precision and control during complex procedures. For instance, in January 2024, Laurent Guiot, DVM, DACVS, DECVS developed an advanced robotic device designed to assist with minimally invasive orthopedic surgeries in dogs and cats. Thus, technological advancements in veterinary orthopedic surgery are expected to drive the orthopedic surgery segment during 2025–2034.

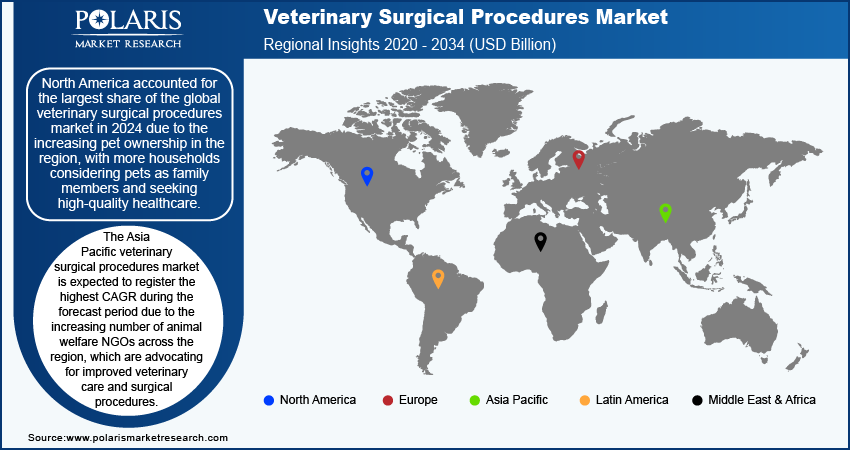

Veterinary Surgical Procedures Market Regional Insights

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest veterinary surgical procedures market share in 2024 due to the increasing pet ownership in the region, with more households considering pets as family members and seeking high-quality healthcare. For instance, in August 2024, according to Mosquito Joe, New York State leads in pet expenditures, with annual spending reaching ∼USD 29,000 per household on pet-related essentials such as food, healthcare, and hygiene. Additionally, the growing awareness among pet owners about the benefits of timely surgeries for conditions such as orthopedic issues, cancer, and dental diseases has fueled the demand for advanced veterinary services, including surgical interventions. This significant investment highlights the growing prioritization of pet welfare, driving demand for high-quality veterinary services and products in the region.

The US veterinary surgical procedures market held the largest market share in 2024. The availability of advanced diagnostic tools, such as MRI and CT scans, has improved pre-surgical planning, leading to better outcomes and fueling the adoption of surgical treatments in the country.

The Asia Pacific veterinary surgical procedures market is expected to register the highest CAGR during the forecast period due to the increasing number of animal welfare NGOs across the region, which are advocating for improved veterinary care and surgical procedures. Organizations such as the World Animal Protection and the Humane Society International (HSI) are active in promoting better treatment standards for animals. Additionally, local NGOs such as the Animal Welfare Association of Singapore and the Indian Animal Welfare Organization are making strides in raising awareness and supporting veterinary initiatives. These NGOs help in enhancing public awareness about animal health and focus on improving access to quality veterinary services. Their efforts contribute to a more supportive environment for veterinary care, which drives the demand for advanced surgical procedures in Asia Pacific.

The India veterinary surgical procedures market is expected to grow significantly during the forecast period due to the rising pet ownership trend, driven by increasing disposable incomes and growing awareness of animal welfare. This trend is accompanied by an enhanced focus on preventive healthcare and advanced treatments for pets, leading to a higher demand for sophisticated veterinary surgical procedures.

Veterinary Surgical Procedures Market – Key Players and Competitive Insights

The competitive landscape of the veterinary surgical procedures market is characterized by a diverse array of players ranging from large multinational corporations to specialized local firms. Major global companies such as Zoetis Inc., Merck Animal Health, and Elanco Animal Health dominate the market with their extensive portfolios of surgical instruments, diagnostic tools, and advanced veterinary surgical solutions. These companies leverage their strong research and development capabilities to innovate and offer advanced technologies that cater to various animal surgical needs. In addition to these giants, regional players and specialized firms, such as IDEXX Laboratories and Heska Corporation, contribute significantly by offering niche products and services tailored to specific veterinary requirements. The market is also witnessing increased activities from emerging players who are focusing on providing cost-effective solutions and adopting new technologies to enhance surgical outcomes. The competitive dynamics are further shaped by strategic partnerships, mergers and acquisitions, and collaborations between veterinary clinics and technology providers, all of which aim to improve the quality of care and expand market reach. A few major players are Avante Animal Health, B. Braun SE, Ethicon US LLC, GerMedUSA, Im3 Inc., Integra LifeSciences, Jorgen Kruuse A/S, Medtronic, Neogen Corporation, Sklar Surgical Instruments, Smiths Group plc, STERIS, Surgical Holdings, and World Precision Instruments.

Medtronic plc is a developer, manufacturer, and seller of device-based medical therapies. The company's business operations are divided into cardiovascular portfolio, medical surgical portfolio, neuroscience portfolio, and diabetes operating unit. Medtronic's cardiovascular portfolio segment specializes in implantable cardiac devices such as defibrillators, pacemakers, and resynchronization therapy devices. Additionally, it offers insertable cardiac monitor systems, cardiac ablation products, TYRX products, and remote patient-centered and monitoring software. In March 2023, Medtronic plc announced its plans to integrate NVIDIA's AI technologies into the GI Genius intelligent endoscopy module, the first FDA-cleared, AI-assisted colonoscopy tool to help detect polyps linked to colorectal cancer.

B. Braun SE is a medical technology company that produces a wide range of medical devices and pharmaceutical products. These include surgical instruments; infusion pumps and systems; suture materials; dialysis equipment and accessories; hip and knee implants; and products for disinfection, ostomy, and wound care. The company operates through Hospital Care, Avitum, and Aesculap. The Hospital Care division specializes in providing nutrition, infusion, and pain therapy products. Its system solutions include single-use products, drugs, and smart medical device systems for infusion therapy. The division also offers parenteral and enteral nutrition products and drink solutions for nutritional therapy. In May 2022, Aesculap, a surgery division of B. Braun, partnered with True Digital Surgery, a Californian company specializing in robotically controlled 3D digital visualization, through a new distribution agreement.

Key Companies in Veterinary Surgical Procedures Market

- Avante Animal Health

- B. Braun SE

- Ethicon US LLC

- GerMedUSA

- Im3 Inc.

- Integra LifeSciences

- Jorgen Kruuse A/S

- Medtronic

- Neogen Corporation

- Sklar Surgical Instruments

- Smiths Group plc

- STERIS

- Surgical Holdings

- World Precision Instruments

Veterinary Surgical Procedures Industry Developments

In May 2024, Ethicon introduced the ECHELON LINEAR Cutter, a surgical stapler that has demonstrated a 47% reduction in leaks at the staple line compared to traditional staplers. This innovative tool aims to minimize surgical risks and improve patient outcomes by providing a more secure and reliable staple line during surgical procedures.

In January 2023, Avante Animal Health collaborated with the Nashville Zoo at Grassmere to supply advanced medical equipment and services for the HCA Healthcare Veterinary Center as part of our commitment to advancing animal healthcare.

In July 2022, Medtronic and the American Society for Gastrointestinal Endoscopy improved colon cancer screening in the Health Equity Assistance Program with support from Amazon Web Services. The program has successfully introduced the first donated GI Genius intelligent endoscopy modules.

Veterinary Surgical Procedures Market Segmentation

By Procedure Type Outlook (Revenue – USD Billion, 2020–2034)

- Spaying/Neutering

- Dental Procedures

- Soft Tissue Surgeries

- Orthopedic Surgeries

- Ophthalmic Surgeries

- Neurological Surgeries

- Other Specialized Surgeries

By Animal Type Outlook (Revenue – USD Billion, 2020–2034)

- Small Animals

- Dogs

- Cats

- Rodents

- Large Animals

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Veterinary Hospitals

- Veterinary Clinics

- Other End Use

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Veterinary Surgical Procedures Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 48.30 billion |

|

Market Size Value in 2025 |

USD 51.61 billion |

|

Revenue Forecast by 2034 |

USD 94.57 billion |

|

CAGR |

7.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global veterinary surgical procedures market size was valued at USD 48.30 billion in 2024 and is projected to grow to USD 94.57 billion by 2034.

The global market is projected to register a CAGR of 7.0% during the forecast period.

North America held the largest share of the global market in 2024 due to the increasing pet ownership in the region.

A few key players in the market are Avante Animal Health; B. Braun SE; Ethicon US LLC; GerMedUSA; Im3 Inc.; Integra LifeSciences; Jorgen Kruuse A/S; Medtronic; Neogen Corporation; Sklar Surgical Instruments; Smiths Group plc; STERIS; Surgical Holdings; World Precision Instruments.

The large animals segment dominated the market in 2024 due to their vital role in industries such as agriculture and dairy.

The orthopedic surgery segment held a significant share due to the rising prevalence of musculoskeletal disorders and injuries in animals.