Veterinary Rapid Test Market Share, Size, Trends, Industry Analysis Report, By Product (Rapid Test Kits, Rapid Test Readers); By Animal Type; By Application; By Region; Segment Forecast, 2024- 2032

- Published Date:Mar-2024

- Pages: 117

- Format: PDF

- Report ID: PM4703

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

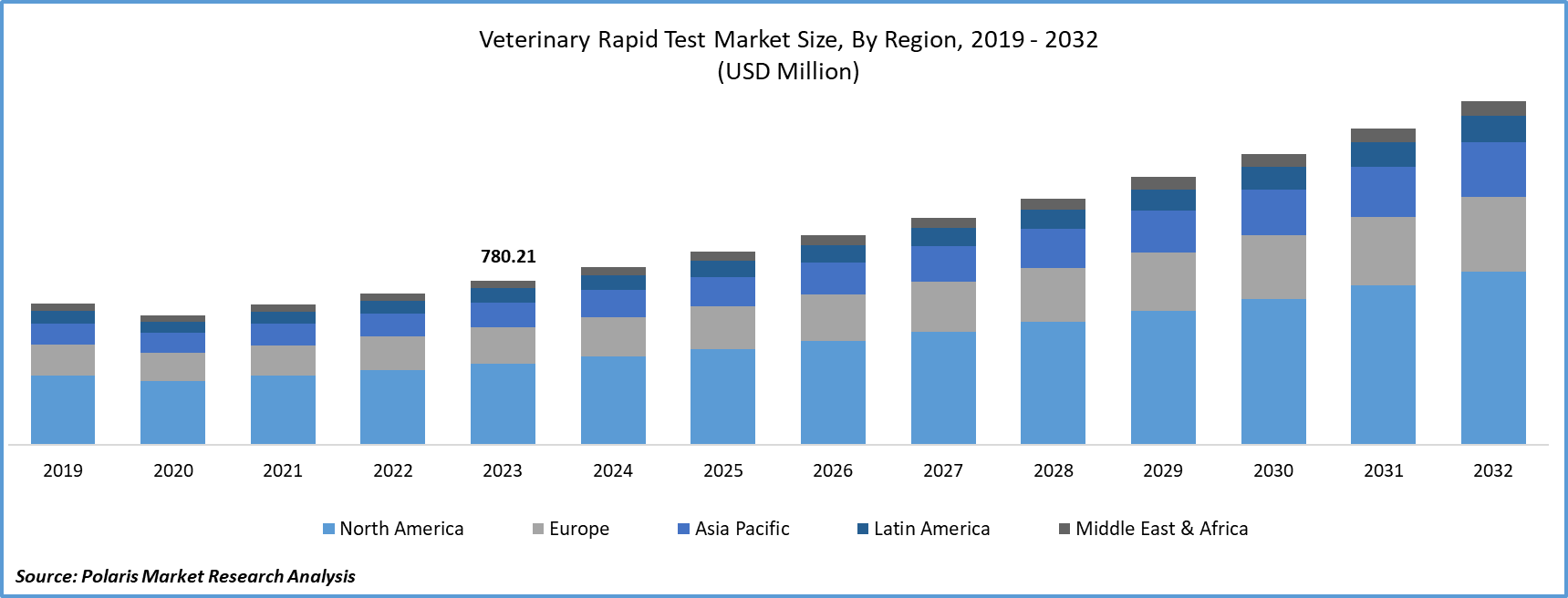

- Global veterinary rapid test market size was valued at USD 780.21 million in 2023.

- The market is anticipated to grow from USD 845.36 million in 2024 to USD 1,632.59 million by 2032, exhibiting the CAGR of 8.6% during the forecast period.

Market Introduction

The veterinary rapid test market size is thriving due to the increasing focus on food safety and security. With rising concerns about foodborne illnesses and contaminants such as antibiotics, hormones, pesticides, and pathogens, ensuring the safety of animal-derived food products is essential. Rapid testing methods are crucial for detecting these contaminants throughout the production and supply chain. Veterinary rapid tests offer quick and reliable solutions for screening animals for various contaminants, enabling prompt identification of potential hazards and implementation of necessary interventions. These tests help ensure compliance with food safety regulations, bolster public health, and maintain consumer confidence in the food supply, driving market growth.

In addition, companies operating in the market are introducing new products to expand market reach and strengthen presence.

To Understand More About this Research: Request a Free Sample Report

- For instance, in August 2021, HORIBA UK Limited revealed the introduction of new pathogen PCR tests for its in-house veterinary PCR analyzer, POCKIT Central.

Heightened awareness of zoonotic diseases is fueling the market growth. The urgency to detect pathogens, particularly emphasized by the COVID-19 pandemic, drives demand for rapid and accurate diagnostics. These tests enable prompt treatment and containment, reducing the risk of transmission to humans. Consequently, veterinary clinics, laboratories, and research institutions are increasingly adopting these tests. Stringent regulations on animal health and food safety further boost market growth. Additionally, ongoing technological advancements enhance the sensitivity and specificity of rapid test solutions. As stakeholders prioritize proactive disease management, the demand for reliable rapid testing technologies continues to rise, ensuring better surveillance and control of zoonotic diseases.

Industry Growth Drivers

Increasing pet ownership is projected to spur the product demand

The market size is growing due to increasing pet ownership globally. With more households adopting pets, there's a greater focus on their health, driving demand for veterinary services and diagnostic tests. Pet owners are increasingly proactive in monitoring their pets' health, leading to more frequent veterinary visits and rapid testing. These tests offer quick and accurate results, aiding veterinarians in diagnosing and treating various conditions promptly. Additionally, pet owners are investing in advanced diagnostic tools for early detection and management of health issues. Technological advancements further enhance the efficiency and accuracy of veterinary diagnostics, driving market growth.

Prevalence of infectious diseases is expected to drive veterinary rapid test market growth

The market share is expanding due to the prevalence of infectious diseases in animals, posing significant threats to animal health and the livestock industry. Timely diagnosis is crucial for treatment and outbreak containment. These diseases, including canine parvovirus and avian influenza, require quick and accurate identification. Veterinary rapid tests offer prompt and reliable diagnostic solutions, aiding veterinarians in identifying infectious agents swiftly. With minimal sample preparation and rapid results, these tests facilitate timely intervention and disease management. Increased pet ownership, livestock production, and awareness of zoonotic diseases further drive market growth, emphasizing the importance of veterinary rapid testing in protecting animal and public health.

Industry Challenges

Cost constraints are likely to impede the market growth

Cost constraints hinder the rapid veterinary test market growth. Despite benefits like speed and portability, affordability remains a key issue for clinics, especially in developing regions. Initial investment and ongoing expenses for test kits strain budgets, dissuading adoption. Moreover, some prioritize traditional methods for perceived cost-effectiveness over rapid tests. Refund and insurance coverage should be addressed. Innovative pricing strategies, cost-effective manufacturing, and improved reimbursement policies are necessary to overcome these challenges.

Report Segmentation

The veterinary rapid test market analysis is primarily segmented based on product, animal type, application, and region.

|

By Product |

By Animal Type |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

Rapid test kits segment held significant revenue share in 2023

The rapid test kits segment held a significant revenue share in 2023 due to their speed, convenience, and on-site testing capabilities. These kits provide quick results, aiding timely decisions on animal health management and reducing the need for centralized laboratory services. Their portability extends their use to remote areas, while their simplicity makes them accessible to various veterinary professionals. The growing demand for immediate diagnostics drives their adoption despite potential initial costs. Rapid test kits are perceived as cost-effective, preventing disease outbreaks and improving animal health outcomes.

By Animal Type Analysis

Companion animals segment held significant revenue share in 2023

The companion animals segment held a significant revenue share in 2023. Increasing pet ownership globally propels demand for veterinary services, including rapid tests. Owners prioritize pet health, driving the need for advanced diagnostics like rapid tests for early disease detection. Continuous technological advancements make rapid tests more accessible and accurate. Companion animals' susceptibility to diverse diseases necessitates frequent testing, further boosting demand. Urbanization and changing lifestyles foster stronger human-animal bonds, resulting in increased spending on pet healthcare, including rapid tests. Additionally, veterinary awareness programs highlight preventive care's importance, driving rapid test adoption.

By Application Analysis

Viral diseases segment held significant revenue share in 2023

The viral diseases segment held a significant revenue share in 2023. Viral diseases are widespread among animals, driving demand for rapid diagnostics to control outbreaks and prevent zoonotic transmission. Economic losses in the livestock industry further fuel the need for effective diagnostic tools. Stringent regulations mandate rapid testing for disease control and food safety. Advancements in viral detection technologies, like PCR-based assays, improve test accuracy. Globalization increases disease spread risk, necessitating efficient diagnostics for monitoring and control.

Regional Insights

Asia-Pacific is expected to experience significant growth during the forecast period

Asia-Pacific is expected to experience growth during the forecast period due to rising pet ownership, driven by increased disposable incomes and changing lifestyles. The region's substantial livestock population necessitates efficient disease management, increasing rapid test adoption. Moreover, rapid urbanization and industrialization intensify animal production, emphasizing the need for accurate diagnostics to maintain health and food safety standards. Government initiatives targeting animal health and disease prevention, alongside growing awareness among farmers and livestock owners, contribute to rising demand.

In 2023, the North American region accounted for a significant market share. High rates of pet ownership increase demand for advanced diagnostics, while the region's well-established healthcare infrastructure facilitates their adoption. Stringent regulatory standards for animal health and food safety mandate regular testing, boosting demand for rapid tests. Continuous technological innovation, supported by leading companies and research institutions, enhances test accuracy and accessibility. Moreover, heightened awareness among pet owners and veterinary professionals about preventive care drives rapid test adoption.

Key Market Players & Competitive Insights

The veterinary rapid test market players encompass a varied range of players, and the anticipated arrival of new contenders is set to enhance competitive dynamics. Key firms within the sector consistently enhance their technologies, aiming to sustain a competitive edge through a focus on efficacy, dependability, and security. These entities emphasize strategic maneuvers such as forging partnerships, enhancing product arrays, and engaging in cooperative endeavors. Their foremost aim is to surpass rivals within the domain, consolidating their market share.

Some of the major players operating in the global veterinary rapid test market include:

- Anigen

- BioMérieux SA

- BioNote, Inc.

- Biopanda Reagents Ltd.

- Boster Biological Technology

- Cenogenics Corporation

- Fassisi GmbH

- Heska Corporation

- IDEXX Laboratories, Inc.

- Neogen Corporation

- Prometheus Bio Inc.

- Thermo Fisher Scientific Inc.

- Virbac

- Woodley Equipment Company

- Zoetis Inc.

Recent Developments

- In November 2023, Antech revealed the establishment of a new veterinary diagnostics facility in Warwick, UK, marking an expansion of its network within the country. This move broadens Antech's presence in the UK laboratory domain, complementing its range of offerings which encompass reference laboratory services, in-house diagnostic capabilities, comprehensive imaging and technological solutions, advanced telemedicine services, and cutting-edge rapid diagnostics innovations.

- In July 2023, EPiQ Animal Health unveiled the promotion and distribution of OraStripdx, a rapid test designed to detect periodontal disease in pets within a 10-second timeframe.

- In December 2022, Virbac launched its research and development facility in Pingtung Agricultural Biotechnology Park (PABP) in Taiwan, aiming to bolster its product lineup and solidify its position in the market.

Report Coverage

The veterinary rapid test market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, products, animal types, applications, and their futuristic growth opportunities.

Veterinary Rapid Test Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 845.36 million |

|

Revenue forecast in 2032 |

USD 1,632.59 million |

|

CAGR |

8.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

key companies in Veterinary Rapid Test Market are BioNote, Inc., Fassisi GmbH, Heska Corporation, IDEXX Laboratories, Inc., Virbac

Veterinary Rapid Test Market exhibiting the CAGR of 8.6% during the forecast period.

The Veterinary Rapid Test Market report covering key segments are product, animal type, application, and region.

key driving factors in Veterinary Rapid Test Market are Increasing pet ownership

The global Veterinary Rapid Test market size is expected to reach USD 1,632.59 million by 2032