Veterinary Pharmacovigilance Market Size, Share, Trends, Industry Analysis Report: By Solution (Software and Services), Type, Product, Animal Type, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 120

- Format: PDF

- Report ID: PM5525

- Base Year: 2024

- Historical Data: 2020-2034

Veterinary Pharmacovigilance Market Overview

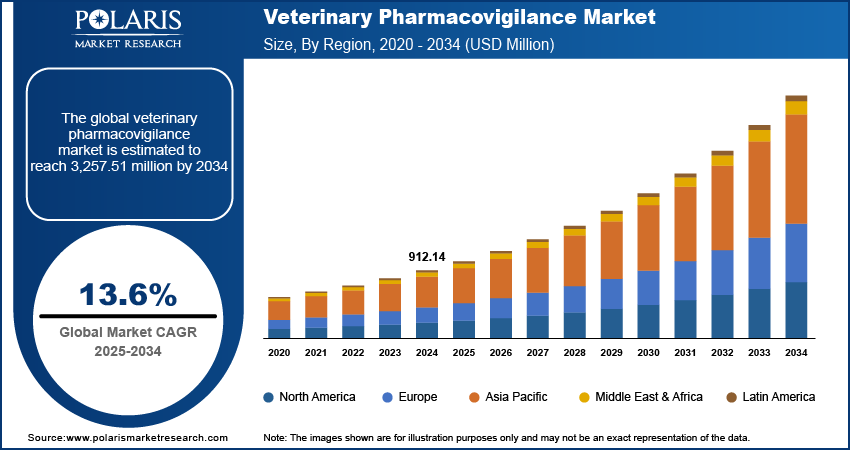

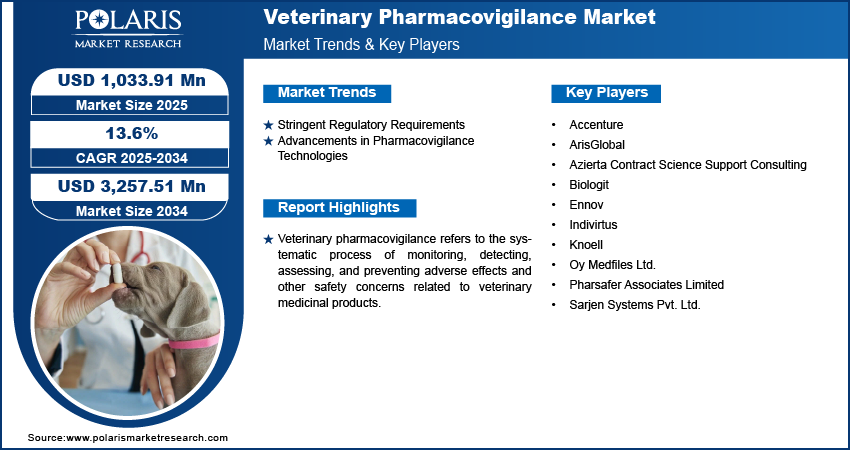

The global veterinary pharmacovigilance market size was valued at USD 912.14 million in 2024. The market is projected to grow from USD 1,033.91 million in 2025 to USD 3,257.51 million by 2034, exhibiting a CAGR of 13.6% during 2025–2034.

The veterinary pharmacovigilance market involves the monitoring, detection, assessment, and prevention of adverse effects or any other drug-related problems associated with veterinary medicinal products. This market is driven by stringent regulatory frameworks established by government agencies to ensure the safety and efficacy of veterinary drugs. The increasing adoption of companion animals and the rising prevalence of zoonotic diseases further contribute to market growth. Additionally, advancements in pharmacovigilance technologies, such as artificial intelligence and data analytics, are improving the efficiency of adverse event reporting and risk assessment in veterinary medicine.

Key drivers of the veterinary pharmacovigilance market growth include the expanding livestock industry, which necessitates stringent drug safety monitoring to prevent antimicrobial resistance and ensure food safety. Growing awareness among veterinarians and pet owners regarding the potential side effects of veterinary drugs is also fueling demand for robust pharmacovigilance systems.

To Understand More About this Research: Request a Free Sample Report

Veterinary Pharmacovigilance Market Dynamics

Stringent Regulatory Requirements

The veterinary pharmacovigilance market trends are significantly influenced by the enforcement of stringent regulatory requirements aimed at ensuring the safety and efficacy of veterinary medicinal products. Government agencies worldwide have implemented comprehensive guidelines mandating the monitoring and reporting of adverse drug reactions in animals. For instance, in 2023, the European Medicines Agency (EMA) introduced guidelines on veterinary good pharmacovigilance practices, emphasizing continuous signal management and the maintenance of a pharmacovigilance master file by marketing authorization holders. Such regulatory requirements compel pharmaceutical companies to enhance their pharmacovigilance systems, thereby driving market demand.

Advancements in Pharmacovigilance Technologies

Technological advancements are revolutionizing pharmacovigilance processes, improving the efficiency and accuracy of adverse event reporting and data analysis in veterinary medicine. The adoption of electronic reporting systems and data analytics tools enables more effective monitoring of adverse events, facilitating the early identification of potential safety issues. These technological innovations are pivotal in strengthening pharmacovigilance frameworks, thereby supporting veterinary pharmacovigilance market development.

Veterinary Pharmacovigilance Market Segment Insights

Veterinary Pharmacovigilance Market Assessment – by Solution

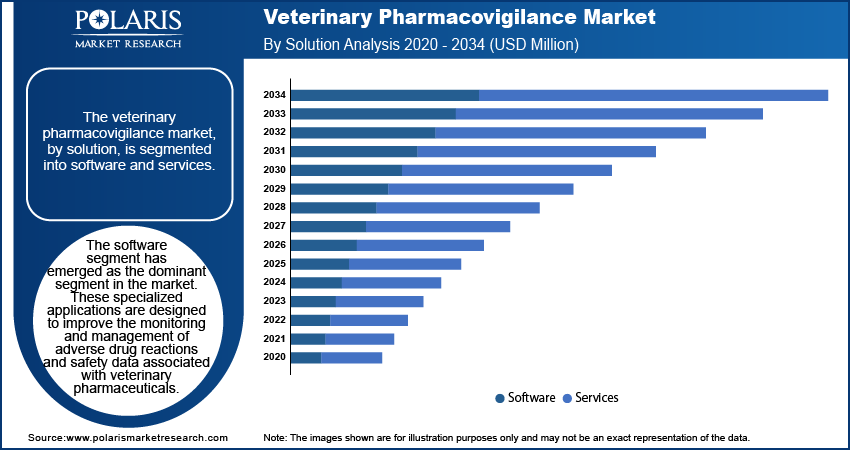

The veterinary pharmacovigilance market, by solution, is segmented into software and services. The software segment dominated the veterinary pharmacovigilance market share in 2024. These specialized applications are designed to improve the monitoring and management of adverse drug reactions and safety data associated with veterinary pharmaceuticals. These software solutions significantly improve the efficiency and accuracy of pharmacovigilance activities by streamlining data collection, analysis, and reporting processes. Recent trends indicate a growing integration of artificial intelligence and machine learning technologies, enabling predictive analytics for the early detection of potential safety issues. Additionally, the adoption of cloud-based platforms is on the rise, offering real-time data access and facilitating seamless collaboration among stakeholders, thereby strengthening the overall effectiveness of veterinary pharmacovigilance efforts.

Veterinary Pharmacovigilance Market Evaluation – by Type

The veterinary pharmacovigilance market, by type, is segmented into in-house and contract outsourcing. The in-house segment held the largest market share in 2024. These services involve pharmaceutical companies and animal health organizations managing their pharmacovigilance activities internally, from data collection to adverse event reporting and regulatory compliance. This approach allows for greater control over processes, direct oversight of data, and the ability to tailor pharmacovigilance activities to specific organizational needs. Companies investing in in-house teams often focus on developing specialized expertise and integrating advanced data management systems to enhance the efficiency of their pharmacovigilance operations.

Veterinary Pharmacovigilance Market Regional Insights

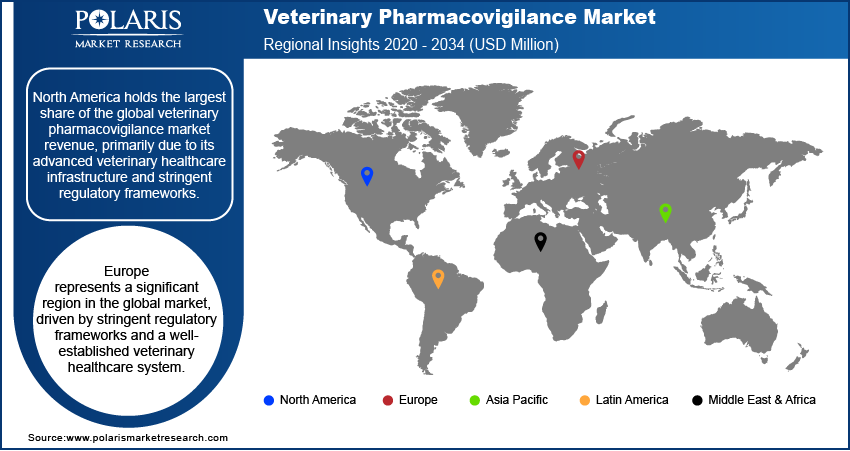

By region, the study provides veterinary pharmacovigilance market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of the veterinary pharmacovigilance market revenue, primarily due to its advanced veterinary healthcare infrastructure and stringent regulatory frameworks. The region's high awareness of animal health and safety, coupled with significant investments in veterinary pharmacovigilance systems, contributes to its market dominance. Furthermore, the presence of major pharmaceutical companies and contract research organizations specializing in pharmacovigilance services enhances the region's capacity to monitor and ensure drug safety effectively.

Europe represents a significant region in the global veterinary pharmacovigilance market, driven by stringent regulatory frameworks and a well-established veterinary healthcare system. The European Medicines Agency (EMA) plays a pivotal role in overseeing pharmacovigilance activities, ensuring the safety and efficacy of veterinary medicinal products. The region's commitment to animal health and welfare, coupled with robust reporting systems, contributes to the veterinary pharmacovigilance market expansion in Europe.

The Asia Pacific veterinary pharmacovigilance market is experiencing rapid growth, propelled by increasing awareness of animal health and the expansion of the veterinary pharmaceutical industry. Countries such as China, Japan, and India are witnessing a surge in demand for veterinary services, leading to a heightened focus on monitoring adverse drug reactions in animals. The adoption of advanced technologies and the establishment of regulatory frameworks are further enhancing pharmacovigilance activities in the region. Additionally, the growing pet ownership and livestock industries contribute to the need for effective pharmacovigilance systems to ensure the safety of veterinary medicinal products.

Veterinary Pharmacovigilance Market – Key Players and Competitive Insights

The veterinary pharmacovigilance market comprises several active companies dedicated to ensuring the safety and efficacy of veterinary medicinal products. A few notable market players are Accenture, ArisGlobal, Azierta Contract Science Support Consulting, Biologit, Ennov, Indivirtus, Knoell, Oy Medfiles Ltd., Pharsafer Associates Limited, and Sarjen Systems Pvt. Ltd.

The competitive landscape is characterized by a focus on innovation and technological integration. Companies are increasingly adopting advanced technologies, such as artificial intelligence and machine learning, to enhance data analysis and signal detection capabilities. Additionally, there is a growing emphasis on expanding service portfolios to cater to a broader range of animal species and therapeutic areas. Collaborations and partnerships among these companies are also prevalent, aiming to harmonize international standards and regulations within the industry. This dynamic environment underscores the commitment to advancing animal healthcare and pharmaceutical safety.

Accenture PLC is a global professional services company offering a range of services and solutions in strategy, consulting, digital, technology, and operations. Within the veterinary pharmacovigilance sector, Accenture provides comprehensive services to pharmaceutical companies, including those manufacturing veterinary medicines. Their offerings encompass end-to-end safety solutions, such as consulting, technology integration, and operational support, aimed at enhancing drug safety and regulatory compliance.

Ennov SAS specializes in software solutions for regulated content management, catering to sectors like life sciences, health authorities, and manufacturers. In the realm of veterinary pharmacovigilance, Ennov delivers electronic data capture and management systems that facilitate efficient monitoring and reporting of adverse drug reactions. Their solutions are designed to streamline processes, ensuring compliance with regulatory standards and improving overall pharmacovigilance efficiency.

List of Key Companies in Veterinary Pharmacovigilance Market

- Accenture

- ArisGlobal

- Azierta Contract Science Support Consulting

- Biologit

- Ennov

- Indivirtus

- Knoell

- Oy Medfiles Ltd.

- Pharsafer Associates Limited

- Sarjen Systems Pvt. Ltd.

Veterinary Pharmacovigilance Industry Developments

- March 2023: Ennov introduced Ennov PV-Analytics, a new module designed to provide advanced analytics and visualization capabilities for pharmacovigilance data. This product launch aims to help organizations, including those in veterinary medicine, gain deeper insights into safety data, improve signal detection, and enhance regulatory reporting efficiency.

- August 2022: Accenture expanded its capabilities in automation and digital manufacturing by acquiring Eclipse Automation, a provider of customized automation and robotics solutions. This acquisition aims to enhance Accenture's ability to assist clients in the life sciences sector, including veterinary pharmacovigilance, by integrating advanced automation into their operations.

Veterinary Pharmacovigilance Market Segmentation

By Solution Outlook (Revenue – USD Million, 2020–2034)

- Software

- Services

By Type Outlook (Revenue – USD Million, 2020–2034)

- In-house

- Contract Outsourcing

By Product Outlook (Revenue – USD Million, 2020–2034)

- Biologics

- Anti-Infective

- Other Product

By Animal Type Outlook (Revenue – USD Million, 2020–2034)

- Dogs

- Cats

- Other Animal Types

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest f Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest f Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest f Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest f Latin America

Veterinary Pharmacovigilance Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 912.14 million |

|

Market Size Value in 2025 |

USD 1,033.91 million |

|

Revenue Forecast by 2034 |

USD 3,257.51 million |

|

CAGR |

13.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 912.14 million in 2024 and is projected to grow to USD 3,257.51 million by 2034.

The market is projected to register a CAGR of 13.6% during the forecast period.

North America held the largest share of the market in 2024.

The market comprises several active companies dedicated to ensuring the safety and efficacy of veterinary medicinal products. A few notable companies are Accenture, ArisGlobal, Azierta Contract Science Support Consulting, Biologit, Ennov, Indivirtus, Knoell, Oy Medfiles Ltd., Pharsafer Associates Limited, and Sarjen Systems Pvt. Ltd.

The software segment dominated the market share in 2024.

Veterinary pharmacovigilance refers to the monitoring, detection, assessment, and prevention of adverse events and other safety-related issues associated with veterinary medicinal products.