Global Veterinary Clinical Trials Market Size, Share, Trends, Industry Analysis Report: Information By Animal Type (Livestock Animal, Companion Animal, Other Animal), By Intervention, By Indication, By End User, and By Region (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Jul-2024

- Pages: 118

- Format: PDF

- Report ID: PM4994

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

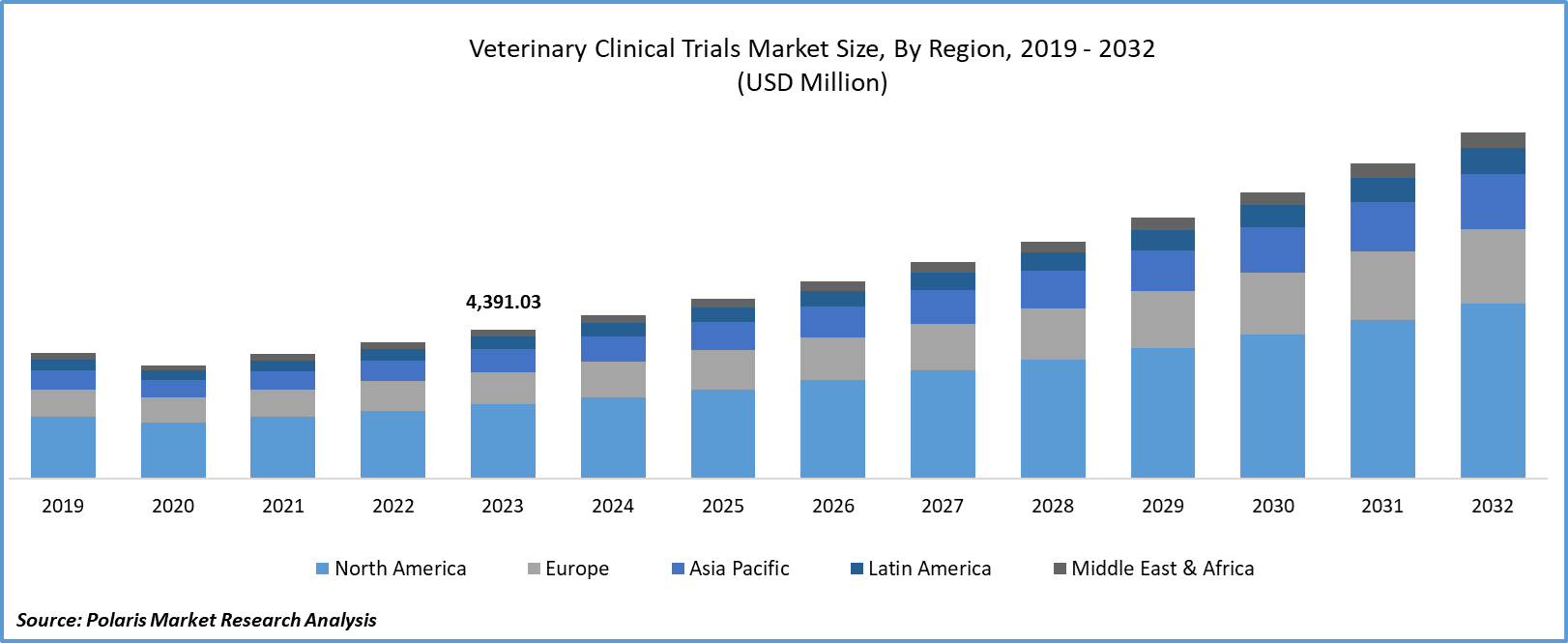

Global veterinary clinical trials market size was valued at USD 4,391.03 million in 2023. The veterinary clinical trials industry is projected to grow from USD 4,813.44 million in 2024 to USD 10,168.89 million by 2032, exhibiting a compound annual growth rate (CAGR) of 9.8% during the forecast period (2024 - 2032).

The rising number of pet owners, coupled with increased spending on pet healthcare, boosted veterinary clinical trials market growth. Additionally, growing awareness and focus on animal health and welfare drive investment in clinical research and contribute to the expansion and development of the veterinary clinical trials market.

The field of veterinary medicine continues to advance due to rising global awareness and concern for animal welfare. The increased investments in research and development are improving veterinary treatments and therapies. This includes the development of new drugs, vaccines, and medical devices tailored to the specific needs of companion animals and livestock.

The globalization of veterinary healthcare has opened up new markets and opportunities for veterinary products and services. This expansion requires compliance with diverse regulatory standards, thereby increasing the demand for rigorous clinical trials to demonstrate safety, efficacy, and compliance.

Digital health solutions, genetic testing, and personalized medicine are transforming veterinary care. These not only drive the need for validation through clinical trials but also create new avenues for targeted therapies and precision medicine in veterinary practice.

To Understand More About this Research:Request a Free Sample Report

The outsourcing of veterinary clinical trials is increasing as organizations seek specialized expertise, access to advanced facilities, and expedited research processes. Pharmaceutical companies, biotech firms, and academic institutions are increasingly relying on contract research organizations (CROs) to conduct these trials with efficiency and effectiveness. These factors collectively contribute to the growing demand for the veterinary clinical trials market.

Veterinary Clinical Trials Market Trends

Rise in Veterinary R&D is Driving the Market Growth

Market CAGR for veterinary clinical trials is being driven by the rise in veterinary research and development (R&D). As veterinary medicine evolves, there is an increasing emphasis on developing new treatments, therapies, and healthcare solutions for animals. With more households adopting pets and spending more on their healthcare, there is a growing demand for effective and specialized veterinary treatments. This drives the need for rigorous clinical trials to validate the safety, efficacy, and quality of these treatments.

Companies' investments in veterinary research and development are pivotal in driving the growth of the veterinary clinical trials market. These investments reflect a strategic commitment to advancing veterinary medicine and addressing emerging healthcare challenges in animals.

For instance, in April 2024, Boehringer Ingelheim experienced significant progress in its pipeline in 2023, with pivotal trials advancing as scheduled in key research areas. The company boosted its Research & Development (R&D) investments by 14.2% to reach EUR 5.8 billion. Additionally, Boehringer Ingelheim achieved a 9.7% increase in group net sales, reaching EUR 25.6 billion for 2023, primarily driven by a 6.9% growth in the animal health sector.

Increasing Number of Pet Ownership Globally

The veterinary clinical trials market is experiencing significant growth due to the rising number of pet owners globally, coupled with higher spending on pet healthcare. This boosts the demand for improved veterinary treatments and drives clinical trial activities. With more households adopting pets, there is a parallel increase in the demand for veterinary services, including preventive care, treatments, and therapeutic interventions. This heightened demand necessitates the development and testing of new veterinary drugs, vaccines, and medical devices through clinical trials. As pet owners increasingly view their pets as family members, they are more willing to invest in their healthcare. This includes spending on advanced treatments and therapies, which drives the need for clinical trials to validate the safety and efficacy of these healthcare solutions.

For instance, in December 2021, the American Veterinary Medical Association (AVMA) reported an increase in pet populations, with more households owning dogs and cats. Animal shelters played a significant role in acquiring new pets, accounting for 40% of cats and 38% of dogs in 2020. Despite a trend of fewer pets per household, there's been a rise in overall pet ownership, driving the veterinary clinical trials market revenue.

Veterinary Clinical Trials Market Segment Insights

Veterinary Clinical Trials Animal Type Insights:

The global veterinary clinical trials market segmentation, based on animal type, includes companion animals, livestock animals, and other animals. In 2023, the companion animal segment accounted for the largest market share. Pet owners are increasingly willing to invest in advanced healthcare options for their pets, including specialized treatments and therapies. This trend necessitates the development of new drugs, vaccines, and medical devices, which are rigorously tested in clinical trials before reaching the market.

Regulatory agencies require comprehensive testing and documentation of veterinary products before they can be approved for market release. Clinical trials are essential for meeting these regulatory standards, ensuring that products meet safety, efficacy, and quality requirements.

In November 2023, the American Veterinary Medical Association highlighted that veterinary clinical studies involve a patient population incapable of providing informed consent or comprehending study risks. Presently, no federal laws, including the Animal Welfare Act, handle the informed consent procedure or address the ethical management of clinical studies involving pets. In September 2021, the U.S. FDA introduced draft guidance aimed at helping animal owners understand the risks and benefits of clinical study participation for their companion animals. This guidance recommends specific content for informed consent forms (ICFs) to assist researchers conducting clinical studies with client-owned companion animals, such as cats, dogs, and horses, which boosts the veterinary clinical trials market share.

Veterinary Clinical Trials Indication Insights

The global veterinary clinical trials market segmentation, based on indication, includes orthopedics, oncology, cardiology, ophthalmology, neurology, dermatology, internal medicine, and other indications. The oncology segment accounted for the largest market share in 2023 due to the rising number of cancer cases in pets, particularly dogs and cats, which has heightened the need for effective cancer treatments. This increase in cancer incidence drives demand for veterinary oncology services and research.

Organizations like the Veterinary Cancer Society play a pivotal role in promoting research and collaboration in veterinary oncology. As a nonprofit educational group, the Veterinary Cancer Society fosters advancements in animal cancer treatment and supports the growth of the oncology segment.

Moreover, according to the National Cancer Institute, there are approximately 32 million cats and 65 million dogs in the United States. The study suggests that around 6 million new cancer diagnoses are produced in dogs per year, with a similar number in cats. This substantial population of pets with cancer offers a practical opportunity to study spontaneous cancers that closely resemble those found in humans. These factors are driving a significant shift towards more robust and comprehensive veterinary research, increasing the demand for veterinary clinical trials market.

Veterinary Clinical Trials Regional Insights

By region, the study provides market insights into North America, Europe, Asia-Pacific and Latin America, and Middle East & Africa. The North America veterinary clinical trials market accounted for the largest share in 2023. The region boasts a highly developed veterinary healthcare infrastructure, with numerous advanced veterinary clinics, hospitals, and research institutions capable of conducting sophisticated clinical trials. In addition, the presence of major companies such as Charles River Laboratory and IDEXX Laboratories, Inc. offering their services further strengthens the market landscape in North America.

The key market players are merging, acquiring, and collaborating to strengthen their market presence and serve better offerings in North America, further driving the market during the forecast period.

Further, the major countries studied in the market report are the US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

The U.S. veterinary clinical trials market accounts for the largest market share due to the highest rates of pet ownership in the world, with a significant percentage of households owning pets. Pet owners in the U.S. are also willing to invest in advanced healthcare options for their animals, increasing the demand for new and innovative veterinary treatments. The increasing prevalence of chronic diseases such as cancer, diabetes, and arthritis in pets necessitates the development of new treatments and therapies. This drives the need for extensive clinical trials to validate these new solutions.

The U.S. boasts a highly developed veterinary healthcare system, including numerous advanced veterinary clinics, hospitals, and research institutions. This infrastructure supports the execution of sophisticated clinical trials. Various organizations contribute funding for research and development in the U.S., thereby enhancing veterinary clinical trials.

For instance, in August 2023, the University of Nebraska-Lincoln received $248 million in research and development funding from the United States Department of Agriculture's National Institute of Food and Agriculture (USDA-NIFA) for swine-focused research aimed at combating viral diseases, enhancing farm sustainability and addressing antimicrobial resistance. These factors collectively contribute to the growing demand for veterinary clinical trials in the U.S.

The Canadian veterinary clinical trials market held a significant market share due to its well-developed veterinary healthcare system, with numerous advanced veterinary clinics, hospitals, and research institutions capable of conducting complex clinical trials. Increasing awareness and concern for animal welfare among pet owners and the general public drive demand for high-quality veterinary care and treatments. This supports the growth of clinical trials aimed at improving animal health outcomes.

The Asia-Pacific veterinary clinical trials market is expected to grow at a significant CAGR from 2024 to 2032. This is due to the region's growing livestock industry demanding effective treatments for various diseases affecting farm animals. The expansion of veterinary pharmaceutical companies in the region has led to increased investment in research and development. Moreover, China’s veterinary clinical trials market accounted for the largest market share in 2023, driven by factors like rapid economic growth and urbanization have improved living standards, allowing pet owners to spend more on their pets' healthcare.

On the other hand, India's veterinary clinical trials market is expected to continue its significant growth during the forecast period, driven by the entry of new key players. These new entrants bring advanced technologies, expertise, and investments into the sector, thereby expanding the capabilities and capacity for conducting veterinary clinical trials in the country.

For instance, in 2024, Vetnation Pharma, a new veterinary pharmaceutical company launched in India, based in Panchkula, Haryana. It is founded by experienced professionals from the pharmaceutical and veterinary sectors; this venture aims to bring a new approach to animal health and wellness. Their combined expertise is expected to significantly contribute to the growth of the veterinary clinical trials market in India during the forecast period.

Veterinary Clinical Trials Key Market Players & Competitive Insights

Leading market players drive innovation and competitiveness in the veterinary clinical trials market through their investments in research and development, strategic partnerships, market development, and commitment to advancing animal health globally. Companies invest in market research to gather insights into veterinary practices, pet owner preferences, and market trends that raise the veterinary clinical trials industry.

Key players strive to expand their geographic footprint to tap into emerging markets with growing pet populations and livestock industries. They tailor their clinical trial strategies to local regulatory requirements and veterinary clinical trials industry dynamics to effectively penetrate new regions. Major players in the veterinary clinical trials market, including Argenta, Bioagile Therapeutics Pvt. Ltd., Boehringer Ingelheim International GmbH., Charles River Laboratory, Clinvet, IDEXX Laboratories, Inc., Labcorp Drug Development, Merck & Co., Inc., Ondax Scientific, and Vivesto AB.

Merck & Co., Inc. is a major research-driven biopharmaceutical company pioneering health solutions that advance disease prevention and treatment for both humans and animals. The company offers a wide range of products tailored for companion animals, equines, swine, poultry, ruminants, and aquaculture. In 2024, Merck Animal Health received approval from the European Commission for BRAVECTO injection for dogs, providing immediate and sustained protection against fleas and ticks.

Vivesto is a research and development company specializing in creating new treatment options for patients with challenging cancers. The company focuses on projects that promise innovative treatments for cancer patients with critical medical needs. Vivesto possesses the expertise and capability to advance drugs from early preclinical stages through clinical trials. Currently, Vivesto is developing the cancer therapies Cantrixil and Docetaxel micellar, along with Paccal Vet (paclitaxel micellar) for veterinary oncology. Pascal Vet aims to treat malignant melanoma and hemangiosarcoma in dogs. In December 2023, Vivesto AB, an oncology-immersed research and development corporation, announced that the US Veterinary Review Board Clinical Studies Committee approved its scheduled Paccal Vet open-label pilot clinical study in dogs with splenic hemangiosarcoma post-splenectomy.

Key Companies in the veterinary clinical trials market include

- Argenta

- Bioagile Therapeutics Pvt. Ltd.

- Boehringer Ingelheim International GmbH.

- Charles River Laboratory

- Clinvet

- IDEXX Laboratories, Inc.

- Labcorp Drug Development

- Merck & Co., Inc.

- Ondax Scientific

- Vivesto AB

Veterinary Clinical Trials Industry Developments

- June 2024: Merck Animal Health, a division of Merck & Co., Inc., announced USDA approval for NOBIVAC NXT Canine Flu H3N2, an advanced solution aimed at protecting dogs from canine influenza. The product is set to be accessible at veterinary clinics and hospitals across the United States.

- April 2024: VETBIOLIX announced positive results from the proof-of-concept clinical study of its drug candidate VBX-1000 for periodontal disease in dogs.

- April 2022: Charles River Laboratories International, Inc. acquired Explora BioLabs Holdings, Inc., to broaden Charles River's Accelerator and Development Lab (CRADL), a part of its Insourcing Solutions business which offers fully equipped, AAALAC-accredited vivarium rental spaces, supported by Charles River's extensive technical, vivarium, and veterinary capabilities.

Veterinary Clinical Trials Market Segmentation:

Veterinary Clinical Trials Animal Type Outlook

- Livestock Animal

- Companion Animal

- Other Animals

Veterinary Clinical Trials Intervention Outlook

- Medicines

- Medical Device

- Others

Veterinary Clinical Trials, Indication Outlook

- Orthopedics

- Oncology

- Cardiology

- Ophthalmology

- Neurology

- Dermatology

- Internal Medicine

- Other Indication

Veterinary Clinical Trials End User Outlook

- Academics And Research Centers

- Pharmaceutical And Biopharmaceutical Companies

- Others

Veterinary Clinical Trials Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Veterinary Clinical Trials Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 4,391.03 million |

|

Market size value in 2024 |

USD 4,813.44 million |

|

Revenue Forecast in 2032 |

USD 10,168.89 million |

|

CAGR |

9.8% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global veterinary clinical trials market size was valued at USD 4,391.03 million in 2023 and is expected to grow to USD 10,168.89 million in 2032.

The global market is projected to grow at a CAGR of 9.8% during the forecast period.

The North America veterinary clinical trials market accounted for the largest market share in 2023.

The key players in the veterinary clinical trials market are Argenta, Bioagile Therapeutics Pvt. Ltd., Boehringer Ingelheim International GmbH., Charles River Laboratory, Clinvet, IDEXX Laboratories, Inc., Labcorp Drug Development, Merck & Co., Inc., Ondax Scientific, and Vivesto AB.

In 2023, the companion animal segment accounted for the largest market share.

The oncology segment accounted for the largest market share in 2023.