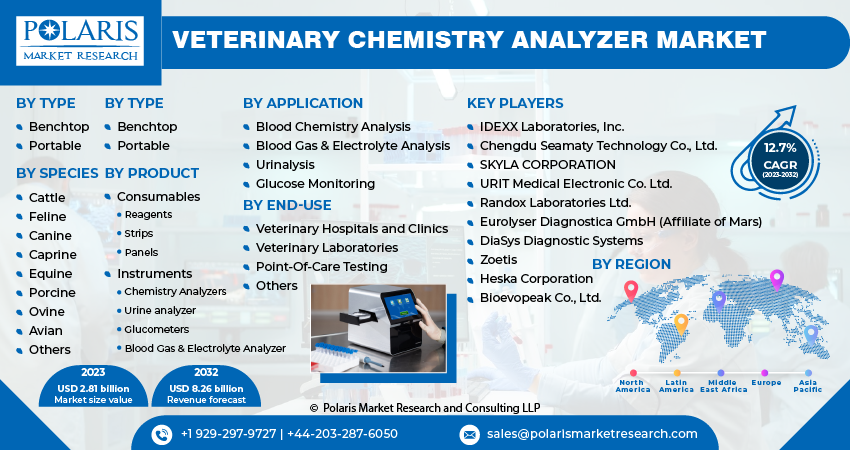

Veterinary Chemistry Analyzer Market Share, Size, Trends, Industry Analysis Report, By Type (Benchtop, Portable), By Product, By Species, By Application, By End-use, By Region, And Segment Forecasts, 2023 - 2032

- Published Date:Oct-2023

- Pages: 119

- Format: PDF

- Report ID: PM3837

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

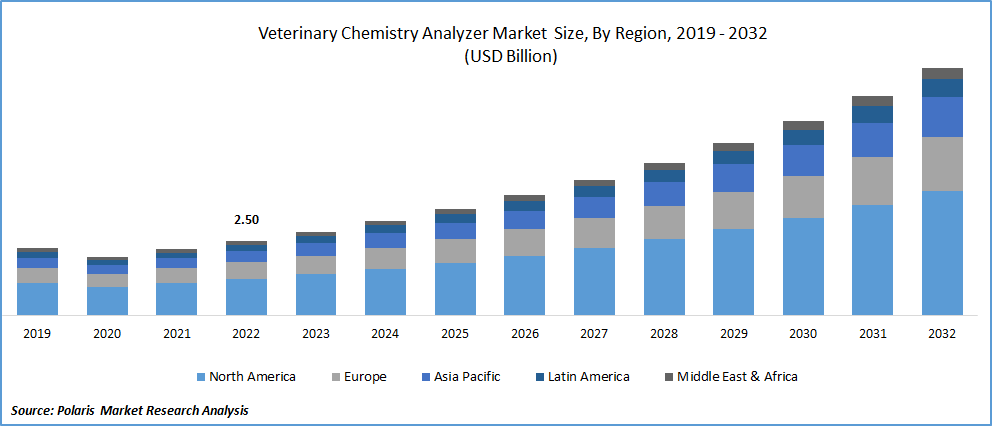

The global veterinary chemistry analyzer market was valued at USD 2.50 billion in 2022 and is expected to grow at a CAGR of 12.7% during the forecast period.

The market is expected to grow due to the global trend of treating pets as family members, greater investment in animal healthcare, advancements in Point of Care (POC) testing technologies, rising veterinary hospital visits, and the expanded adoption of POC diagnostics.

To Understand More About this Research: Request a Free Sample Report

During the pandemic, the adoption of domestic pets saw a significant surge, with Germany witnessing an increase of one million pets, totaling around 35 million, as reported by Deutsche Welle. Similarly, The American Society for the Prevention of Cruelty to Animals (ASPCA) data indicates that roughly 1 in 5 households in the U.S. acquired a dog/cat since the start of the COVID-19 pandemic. Additionally, the rising occurrence of diseases transmitted from animals to humans and the heightened demand for animal-derived protein sources may potentially drive the need for veterinary chemistry analyzers.

Furthermore, the veterinary chemistry analyzer market is expected to expand due to the growing popularity of pet insurance and the increasing global pet adoption rates. The demand for pet insurance has risen significantly in response to the escalating costs of veterinary care. Diagnostic tests for pets can be costly, deterring some pet owners from seeking necessary treatments. Many pet insurance policies now cover diagnostics and treatments for eligible accidents and illnesses. For instance, by adding the "Preventative and Wellness" package to a Lemonade pet health insurance policy, annual wellness checkups, pet diagnostics like x-rays, cytology, bloodwork, lab work, urinalysis, heartworm tests, and more can be included.

For Specific Research Requirements: Request for Customized Report

Various aspects of business and financial conditions have been negatively affected by the pandemic. During the initial months of the novel coronavirus outbreak, veterinary facilities experienced a significant drop in compliance with animal healthcare. Public health organizations imposed restrictions on veterinary services, limiting them to emergency care, and advised pet owners to postpone elective surgeries. The veterinary industry's dynamics are expected to suffer due to the disruptions caused by the COVID-19 pandemic in the provision of animal wellness services and reduced business demand.

Growth Drivers

Point-of-care testing empowers early disease detection, including veterinary medicine.

The advent of point-of-care testing has revolutionized clinical diagnostics by making them accessible, cost-effective, rapid, and user-friendly. The significance of this platform lies in its ability to empower individuals to monitor their health status regularly, even in the convenience of their homes, enabling early disease detection. For instance, a veterinary glucometer is highly valued for its simplicity in clinical, workplace, or home settings. Zoetis offers AlphaTRAK, an effortless veterinary blood glucose monitoring system designed for both cats and dogs. Furthermore, the increasing prevalence of diabetes in animals is a driving factor behind the rising demand for such analyzers.

In the field of veterinary medicine, the excessive and improper use of antimicrobial drugs has played a significant role in the emergence of antibiotic resistance, a pressing global public health issue. Chemistry analyzer tests offer veterinarians the ability to detect bacterial infections earlier in a patient's treatment, leading to fewer antibiotic prescriptions when they are not warranted. This proactive approach helps reduce the unnecessary use of antibiotics and promotes responsible antimicrobial stewardship, thereby contributing significantly to the overall growth of the veterinary chemistry analyzer market.

Report Segmentation

The market is primarily segmented based on type, product, species, application, end-use, and region.

|

By Type |

By Product |

By Species |

By Application |

By End-Use |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Benchtop analyzers segment accounted for the largest market share in 2022

Benchtop analyzers segment held the largest revenue share. The popularity of benchtop analyzers is driven by their numerous advantages, including task automation, reduced potential for manual errors, and high levels of accuracy and precision. These analyzers are particularly effective in diagnosing certain diseases in companion animals, which contributes significantly to this segment's dominant position.

Portable analyzers are expected to register a steady growth rate. These analyzers offer the advantage of bedside monitoring and are highly mobile. Their ease of use, the ability to monitor pets at home, portability, immediate results, and reduced training requirements are key factors driving the growth of this segment. Additionally, the increasing demand for point-of-care analyzers is contributing to the segment's expansion.

By Application Analysis

The blood chemistry segment held the largest share in 2022.

The blood chemistry segment garnered the largest share. This dominance is attributed to the growing occurrence of zoonotic diseases and the increasing population of veterinary practitioners. Globally, as per WHO, zoonotic diseases are responsible for approximately one billion cases of illness and millions of deaths annually. Zoonoses also make up more than 60.0% of newly reported infectious diseases worldwide.

The blood & electrolyte segment will grow at a significant pace. This growth is driven by the introduction of point-of-care analyzers, which are increasing the demand for blood gas and electrolyte analysis. There is a growing requirement for comprehensive analysis that can provide test results for both electrolyte levels and blood count in a single sample of serum, plasma, or urine, and this is expected to contribute to the segment's expansion.

Regional Insights

North America region dominated the global market in 2022

North America emerged as the largest region. This region boasts a plethora of animal health and diagnostics companies. Additionally, there has been a substantial increase in veterinary healthcare spending in the region, which is projected to drive market growth. Furthermore, the region's well-established infrastructure and substantial R&D investments are factors that are expected to provide a boost to the market.

Asia Pacific region will grow rapidly. This growth can be attributed to the expanding animal population, heightened awareness of animal health, and a growing trend of pet adoption. Countries like China & India are poised to see significant market expansion due to the establishment of more manufacturing facilities in the region. Furthermore, increased R&D investments by market players aiming to create value-added devices are anticipated to be a driving force for market growth in the region.

Key Market Players & Competitive Insights

The global veterinary chemistry analyzer market is poised for substantial growth, driven by major players' strategic actions, including the introduction of new products, mergers and acquisitions, and expansion into different geographical regions.

Some of the major players operating in the global market include:

- IDEXX Laboratories, Inc.

- Zoetis

- Heska Corporation

- URIT Medical Electronic Co. Ltd.

- Randox Laboratories Ltd.

- Eurolyser Diagnostica GmbH (Affiliate of Mars)

- DiaSys Diagnostic Systems

- Chengdu Seamaty Technology Co., Ltd.

- SKYLA CORPORATION

- Bioevopeak Co., Ltd.

Recent Developments

- In June 2023, IDEXX Laboratories introduced the first veterinary diagnostic test designed to detect kidney injury in cats and dogs. This new IDEXX Cystatin B Test will become part of test panels used to evaluate renal health, aiding veterinarians in diagnosing cases of kidney injury that can be difficult to detect due to subtle or nonspecific symptoms.

- In April 2022, Carolina Liquid agreed to the distribution of Seamaty's SMT-120VP Veterinary Automated Chemistry Analyzer in the U.S. geography.

Veterinary Chemistry Analyzer Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 2.81 billion |

|

Revenue Forecast in 2032 |

USD 8.26 billion |

|

CAGR |

12.7% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments Covered |

By Type, By Product, By Species, By Application, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The veterinary chemistry analyzer market report covering key segments are type, product, species, application, end-use, and region.

Veterinary Chemistry Analyzers Market Size Worth $8.26 Billion By 2032.

The global veterinary chemistry analyzer market is expected to grow at a CAGR of 12.7% during the forecast period.

North America is leading the global market

key driving factors in veterinary chemistry analyzer market are point-of-care testing empowers early disease detection, including veterinary medicine