Veterinary Antibiotics Market Share, Size, Trends, Industry Analysis Report: By Animal Type (Pigs, Cattle, Sheep & Goats, Poultry, and Others), Drug Class, Dosage Form, and Region (North America, Europe, Asia Pacific, Middle East & Africa and Latin America) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 122

- Format: PDF

- Report ID: PM5317

- Base Year: 2024

- Historical Data: 2020-2023

Veterinary Antibiotics Market Overview

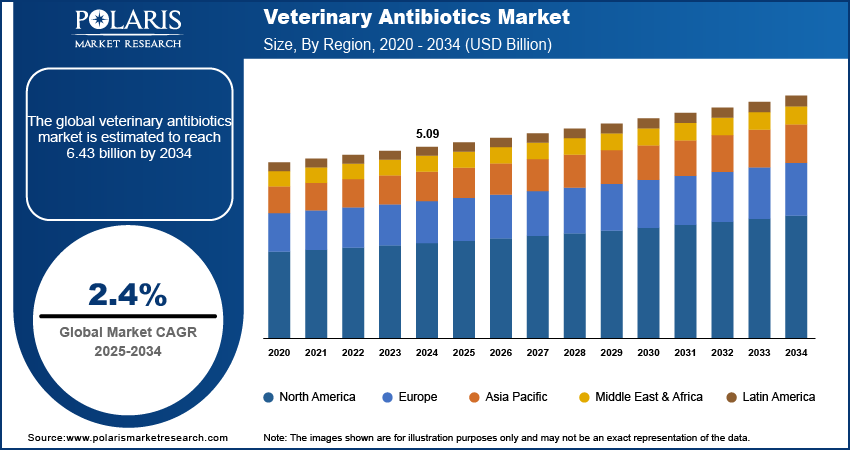

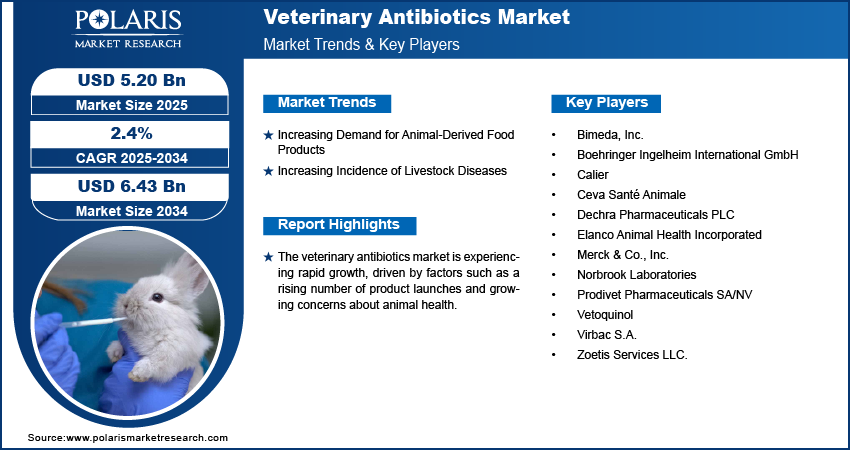

The veterinary antibiotics market size was valued at USD 5.09 billion in 2024. The market is projected to grow from USD 5.20 billion in 2025 to USD 6.43 billion by 2034, exhibiting a CAGR of 2.4% during 2025–2034.

Veterinary antibiotics are medications specifically designed for animals to combat bacterial infections. The drugs work by eliminating harmful bacteria or inhibiting their growth, thus assisting in the animal's recovery.

The veterinary antibiotics market is experiencing rapid growth, driven by factors such as a rising number of product launches and growing concerns about animal health. Industry leaders are prioritizing the development of animal-specific medicines to combat antibiotic resistance while safeguarding animal welfare. For example, Elanco Animal Health Incorporated has introduced a global antibiotic stewardship strategy focused on expanding the development of antibiotics exclusively for animals while minimizing the use of antibiotics that are shared with humans.

To Understand More About this Research: Request a Free Sample Report

The demand for veterinary antibiotics is driven by the growing emphasis on controlling and preventing zoonotic diseases such as rabies, blastomycosis, psittacosis, trichinosis, cat scratch disease, histoplasmosis, and coccidioidomycosis. Effective disease management is critical, as zoonotic infections can spread between animals and humans, posing significant public health risks.

In June 2024, the World Health Organization (WHO) highlighted the ongoing threat of rabies, a viral disease that affects over 150 countries and causes tens of thousands of deaths each year, with 40% of victims being children. While rabies is fatal once symptoms appear, it is preventable through measures such as dog vaccination and post-exposure prophylaxis (PEP). WHO has set a goal to eliminate rabies-related deaths by enhancing vaccination programs, raising awareness, and improving access to preventive treatments. These global initiatives underscore the importance of veterinary antibiotics and vaccines in safeguarding both animal and human health, further driving market growth.

Veterinary Antibiotics Market Drivers and Trends Analysis

Increasing Demand for Animal-Derived Food Products

There is a rising demand for animal-derived food products, such as beef, pork, poultry, and dairy, which are essential sources of protein. Countries such as China and India have seen particularly high demand for animal-derived foods, which propels the veterinary antibiotics market growth. Veterinary antibiotics play a critical role in preventing and treating bacterial infections and minimizing disease outbreaks in animal-derived foods such as chicken, meat, eggs, and others.

Increasing Incidence of Livestock Diseases

The increasing incidence of livestock diseases is significantly boosting the demand for veterinary antibiotics. Outbreaks of bacterial infections and other diseases lead to substantial economic losses, reduced productivity, and compromised food safety. Veterinary antibiotics are crucial for treating infections, preventing the spread of disease, and mitigating potential outbreaks within herds and flocks. Therefore, as livestock disease risks intensify due to factors such as intensified farming practices and climate change, the reliance on veterinary antibiotics to safeguard animal health becomes more critical.

Veterinary Antibiotics Market Segment Analysis

Veterinary Antibiotics Market Assessment by Animal Type

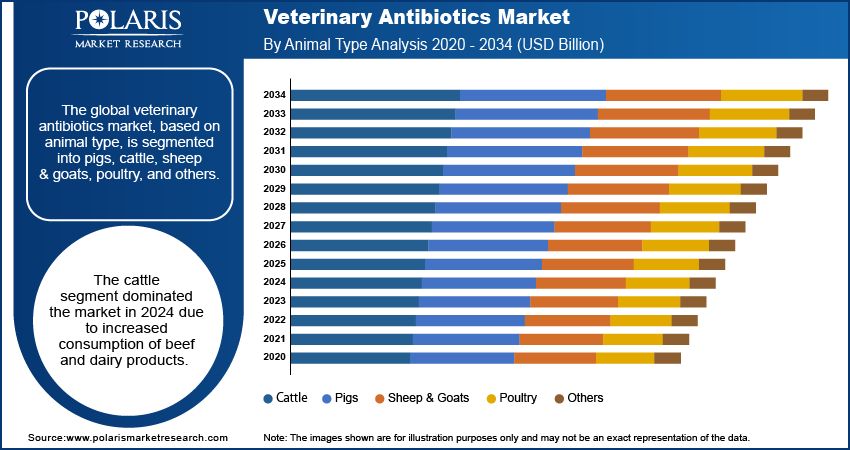

The global veterinary antibiotics market, based on animal type, is segmented into pigs, cattle, sheep & goats, poultry, and others. The cattle segment dominated the market in 2024 due to increased consumption of beef and dairy products. For instance, in 2022, milk production in the European Union's 27 Member States is projected to rise by 0.2% to 150.45 million metric tons compared to 2021. Additionally, increased awareness among farmers and consumers regarding cattle diseases has led to greater use of antibiotics for disease prevention, further fueling the veterinary antibiotic market expansion.

Veterinary Antibiotics Market Evaluation by Drug Class

The global veterinary antibiotics market, based on drug class, is segmented into tetracyclines, penicillins, sulfonamides, macrolides, trimethoprim, lincosamides, polymyxins, aminoglycosides, fluoroquinolones, pleuromutilins, and other. In 2024, the tetracyclines segment dominated the veterinary antibiotics market due to their therapeutic applications. These antibiotics are widely used as first-line treatments for food-producing animals and are also frequently administered to companion animals, including dogs, cats, and horses. Tetracycline-based medications such as Achromycin, Sumycin, Medicycline, and Tetracyn are specifically used in veterinary medicine to address bacterial infections and inflammatory skin conditions in animals. For instance, according to the World Organization for Animal Health, almost half of antimicrobial agents used in animal health are tetracyclines, accounting for 35.6% globally.

Veterinary Antibiotics Market Outlook by Regional Insights

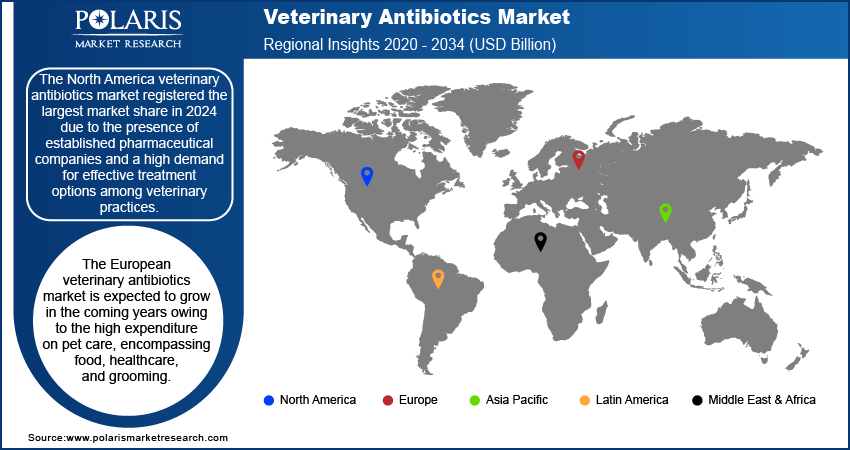

By region, the study provides the market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The North America veterinary antibiotics market registered the largest market share in 2024 due to the presence of established pharmaceutical companies and a high demand for effective treatment options among veterinary practices. The region benefits from advanced healthcare infrastructure, a growing pet population, and increasing awareness regarding animal health and welfare. Additionally, the prevalence of infectious diseases in livestock and pets has driven the need for effective therapeutic solutions, further contributing to North America's major position.

The European veterinary antibiotics market is expected to grow in the coming years owing to the high expenditure on pet care, encompassing food, healthcare, and grooming. Furthermore, technological advancements such as smart pet devices and pet wearables are contributing to this growth. Shifting consumer preferences, particularly the increasing demand for dietary and vegan pet food, also supports the growth of the veterinary antibiotics market in the region.

In 2021, the European Pet Food Industry Association (FEDIAF) reported that 90 million households in the European Union, accounting for 46% of the population, owned pets. This data highlights the significant demand for veterinary antibiotics for dogs, cats, and other pet animals.

Veterinary Antibiotics Market Key Players and Competitive Analysis Report

Major market players are investing heavily in research and development to expand their offerings, which will drive the veterinary antibiotics market in the coming years. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments such as innovative product launches, international collaborations, higher investments, and mergers and acquisitions between organizations. To expand and survive in a more competitive and rising market climate, the market must offer cost-effective solutions.

The veterinary antibiotics market witnesses competition from major global players, fueled by rising demand from the steel and cast iron industries. The major players dominate the market with their extensive production capacities and advanced technologies. Competition is further heightened by fluctuating raw material prices, stringent environmental regulations, and the necessity for technological advancements to improve efficiency and reduce emissions. Major players in the market are Merck & Co., Inc.; Ceva Santé Animale; Vetoquinol; Zoetis Services LLC; Boehringer Ingelheim International GmbH; Dechra Pharmaceuticals PLC; Elanco Animal Health Incorporated; Virbac S.A.; Calier; Bimeda, Inc.; Prodivet Pharmaceuticals SA/NV; and Norbrook Laboratories.

Zoetis Services LLC is a global animal health company that is committed to advancing veterinary care through the Zoetis Foundation. The foundation prioritizes diversity and mental health and supports these goals through grants and colleague-driven community initiatives. In July 2024, the Zoetis Foundation announced the CRG Philanthropy Grants Program, which aims to empower community impact through diverse grant-making initiatives supporting veterinarians and farmers worldwide.

Bimeda USA is headquartered in Schaumburg, Illinois, and operates four manufacturing sites across the US, including locations in Texas and California. Specializing in veterinary pharmaceuticals, Bimeda offers products for livestock, equine, and companion animals, as well as aquaculture solutions. The company supports innovation through its state-of-the-art R&D facilities and dedicated teams. In July 2023, Bimeda US introduced SpectoGard (spectinomycin sulfate) Sterile Solution, which received FDA approval in September 2022. This product is designed for the treatment of bacterial infections in livestock.

Key Companies in the Veterinary Antibiotics Market

- Bimeda, Inc.

- Boehringer Ingelheim International GmbH

- Calier

- Ceva Santé Animale

- Dechra Pharmaceuticals PLC

- Elanco Animal Health Incorporated

- Merck & Co., Inc.

- Norbrook Laboratories

- Prodivet Pharmaceuticals SA/NV

- Vetoquinol

- Virbac S.A.

- Zoetis Services LLC

Veterinary Antibiotics Market Development

June 2024: Bimeda US introduced Bimasone (flumethasone), the first FDA-approved generic bioequivalent for corticosteroid flumethasone, used to treat inflammation in horses, dogs, and cats.

May 2023: Virbac acquired GS Partners, its distributor in the Czech Republic and Slovakia. This acquisition, Virbac’s 35th subsidiary, strengthens its presence in Central Europe and enhances its ability to address health needs for pets and ruminants in the region.

Veterinary Antibiotics Market Segmentation

By Animal Type Outlook (Revenue, USD Billion, 2020–2034)

- Pigs

- Cattle

- Sheep & Goats

- Poultry

- Others

By Drug Class Outlook (Revenue, USD Billion, 2020–2034)

- Tetracyclines

- Penicillins

- Sulfonamides

- Macrolides

- Trimethoprim

- Lincosamides

- Polymyxins

- Aminoglycosides

- Fluoroquinolones

- Pleuromutilins

- Other

By Dosage Form Outlook (Revenue, USD Billion, 2020–2034)

- Oral Powders

- Oral Solutions

- Injections

- Other

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Veterinary Antibiotics Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 5.09 billion |

|

Market Size Value in 2025 |

USD 5.20 billion |

|

Revenue Forecast By 2034 |

USD 6.43 billion |

|

CAGR |

2.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global veterinary antibiotics market size was valued at USD 5.09 billion in 2024 and is projected to grow to USD 6.43 billion by 2034.

The global market is projected to register a CAGR of 2.4% during 2025–2034.

North America accounted for the largest share of the global market in 2024

A few key players in the market are Merck & Co., Inc.; Ceva Santé Animale; Vetoquinol; Zoetis Services LLC; Boehringer Ingelheim International GmbH; Dechra Pharmaceuticals PLC; Elanco Animal Health Incorporated; Virbac S.A.; Calier; Bimeda, Inc.; Prodivet Pharmaceuticals SA/NV; and Norbrook Laboratories.

The cattle segment accounted for the largest share of the market in 2024.

The tetracyclines segment would record the highest CAGR in the global market during the forecast period.