Vessel Traffic Management Market Share, Size, Trends, Industry Analysis Report

By Component (Equipment, Solution, and Service); By Investment; By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Dec-2022

- Pages: 117

- Format: PDF

- Report ID: PM2899

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

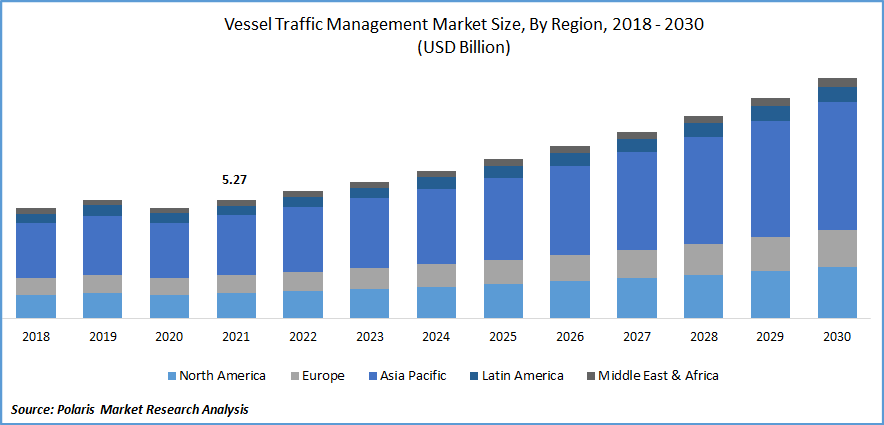

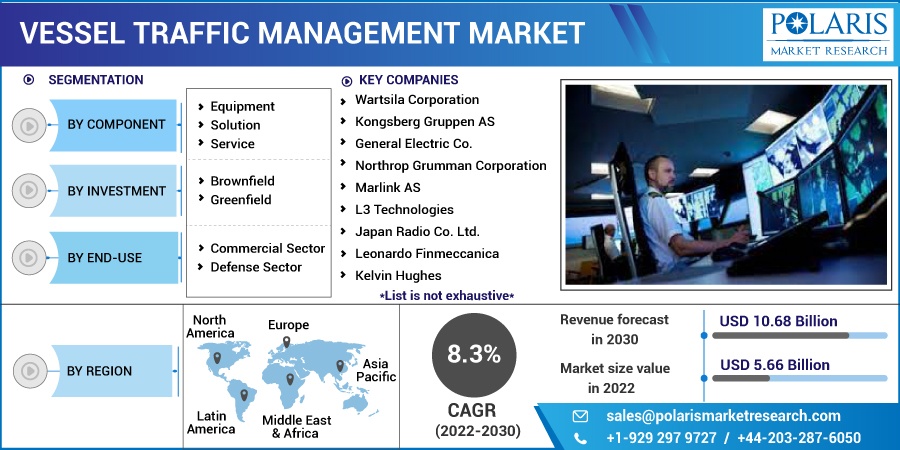

The global vessel traffic management market was valued at USD 5.27 billion in 2021 and is expected to grow at a CAGR of 8.3% during the forecast period.

The increasing adoption of vessel traffic management systems in marine transportation and an extensive rise in global cargo transport activities through sea are major factors driving the global market growth. In addition, a surge in demand for enhancing various operational functionalities in vessel traffic control systems and high penetration for encouraging several new operations, such as automatic identification of vessels and remote control, is expected to propel the growth and adoption of these systems significantly across the globe.

Know more about this report: Request for sample pages

Moreover, increasing utilization of vessel traffic management systems for gathering, storing, analyzing, isolating, and displaying crucial data in maritime transportation, coupled with the widespread usage of automated identification systems, advanced radars, CCTV security cameras, and VHF communication systems, are anticipated to provide high growth opportunities and adoption of these systems worldwide over the coming years.

However, the effects of various types of natural disasters such as hurricanes, typhoons, and earthquakes worldwide, along with high population density and climate changes, are significant factors contributing to natural catastrophes and are likely to be the key restraining factors of the global market.

The outbreak of the COVID-19 pandemic has significantly impacted the market’s growth. The rapid emergence of the deadly coronavirus has led to several challenges for industries such as marine, shipping, and aviation. Since the outbreak’s start, the shipping and maritime industry has been the top most affected sectors globally due to complete shutdown of their workforces for safety and prevention from the spread of COVID-19. For instance, India’s essential ports decreased by 10.7% from April-November 2021 to 414.2 million tons from 463.73 million tons of cargo handled during 2019-2020.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Development of advanced and efficient navigation systems, rapid growth in the marine industry, and rising prevalence of marine safety protocols coupled with the rising shipment transport activities by sea are major factors expected to drive the development of the global market over the forecast period. Growing requirements for improving port services and continuously increasing the protection of life at sea are also likely to augment market growth in the coming years significantly.

Furthermore, increased vessel congestion at various ports as a result of strong demand across the globe is another factor propelling the global market growth. Vessel traffic management systems and solutions assist ports in keeping track of vessels worldwide as they travel across the seas, better planning and efficient operations while accounting for weather conditions and bunkering costs and reviewing voyage reports to analyze performance and incidents. Charter party compliance is driving the market forward.

Report Segmentation

The market is primarily segmented based on component, investment, end-use, and region.

|

By Component |

By Investment |

By End-Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Equipment segment accounted for the largest revenue share in 2021

The equipment segment accounted for a major global revenue share in 2021 and is expected to maintain its position throughout the projected period. The growth of the segment market can be attributed to the rising adoption of various surveillance, navigation, and communication systems in vessel traffic management.

Marine radar systems, CCTV drones, and AIS systems are widely utilized to identify and track traffic, find the position of vessels, and better monitor sea traffic to navigate ships from one place to another, augmenting the market growth at a healthy growth rate. For instance, in June 2022, ShipXplorer announced the launch of its new web tracking portal and ship tracker. To develop the world’s largest AIS-based ship-tracking network.

Brownfield segment is projected to witness fastest growth.

Over the projected period, the brownfield segment will likely grow fastest due to the rising investments in expanding ports and modernization programs across the globe. Increasing efforts by various private and public institutions for the enhancement of vessel traffic management market to tackle the rising number of transport activities of multiple applications from different industries, including oil & gas, steel, FMCG, and automotive, along with the increasing need to tackle growing terrorist attacks are major factors propelling the segment market growth.

For instance, in March 2022, the United Kingdom announced its plan to invest USD 5.3 million in the shipbuilding sector. With this investment, the government enhanced the UK’s shipping office for carbon emission reductions, which is projected to provide development & research activities on achieving zero emission vessels & infrastructure.

Commercial sector is expected to hold the significant revenue share

The commercial sector is expected to emerge as fastest growing segment during the anticipated period owing to increased transportation of various supplies such as crude oil, electronic devices, steel, food items, and automobiles between many countries by commercial ships. In recent years, many private organizations have observed an increasing need to develop fleet sizes to capitalize on the import-export activities on global stage.

Also, market players are primarily focusing on improving efficiency by reducing overall travel times by providing a network to these commercial ships so that they can choose the shortest routes to their destination depending on several parameters, such as availability of ports and traffic congestion. All these factors will likely boost the segment market's growth in the coming years.

Furthermore, the defense sector is also anticipated to register considerable market growth over the study period. The increasing efforts by nations with extensive coastlines s, such as India, China, the U.S., and France, strengthen their respective navy prowess to ensure the security of their borders and safeguard their trade routes passing through their national water routes.

Asia Pacific region dominated the global market in 2021

Asia Pacific region accounted for the largest market with a significant market revenue share in 2021 and is likely to grow substantially during the projected period. The growth of the regional market is mainly driven by the presence of some of the most-busiest ports and trade routes all over the world. Furthermore, an increasing number of upcoming projects ports technological advancements in countries such as Indonesia, Philippines, and Hong Kong are further anticipated to drive market growth in the region over the coming years.

Furthermore, Europe is expected to grow at fastest CAGR throughout the forecast period owing to the high technological developments and a large number of highly developed countries, including France, Germany, and Spain along with the heavy investment in the expansion of their traffic management systems to cater the growing burden of transportation activities of various supplies efficiently in the next coming years.

Competitive Insight

Key players include Wartsila Corporation, Kongsberg Gruppen, General Electric, Northrop Grumman, Marlink AS, L3 Technologies, Japan Radio, Leonardo Finmeccanica, Kelvin Hughes, Marlan Maritime, Elcome International, Xanatos Marine, TERMA, Saab AB, Thales Group, Rolta India, and Tokyo Keiki.

Recent Developments

In June 2021, Wartsila Voyage completed the upgradation of its “Croatian National Vessel traffic Management & Information System” along with the newly developed “Sea Traffic Management.” With this completed project, the 1st STM installations in Adriatic Sea were confirmed, which has enhanced the safety & efficiency of the shipping business in Croatian waters.

In May 2021, PortLink, Tanger Med, & Wartsila partnered to develop a next-generation Management Information System”. The partnership mainly builds on an earlier deployment of PMIS in Morocco. The joint initiative includes installation & delivery of the Wartsila Navi-Harbors VTS System, IALA Advanced Coastal Surveillance Radars, VHF Radio Sub-System, Ancillary Equipment, and Automated Identification System.

Vessel Traffic Management Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 5.66 billion |

|

Revenue forecast in 2030 |

USD 10.68 billion |

|

CAGR |

8.3% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Component, By Investment, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Wartsila Corporation, Kongsberg Gruppen AS, General Electric Co., Northrop Grumman Corporation, Marlink AS, L3 Technologies, Japan Radio Co. Ltd., Leonardo Finmeccanica, Kelvin Hughes, Marlan Maritime Technologies, Elcome International LLC., Xanatos Marine Ltd., TERMA, Saab AB, Thales Group, Rolta India, and Tokyo Keiki Inc. |