Vertical Urban Mobility Infrastructure Solutions Market Size, Share, Trends, Industry Analysis Report: By Vehicle Type, Application, End Use (Military, Commercial, and Others) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5451

- Base Year: 2024

- Historical Data: 2020-2023

Vertical Urban Mobility Infrastructure Solutions Market Overview

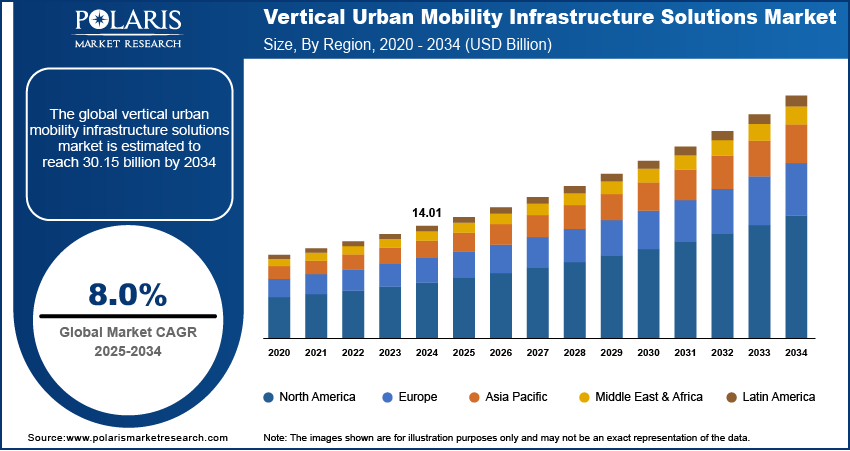

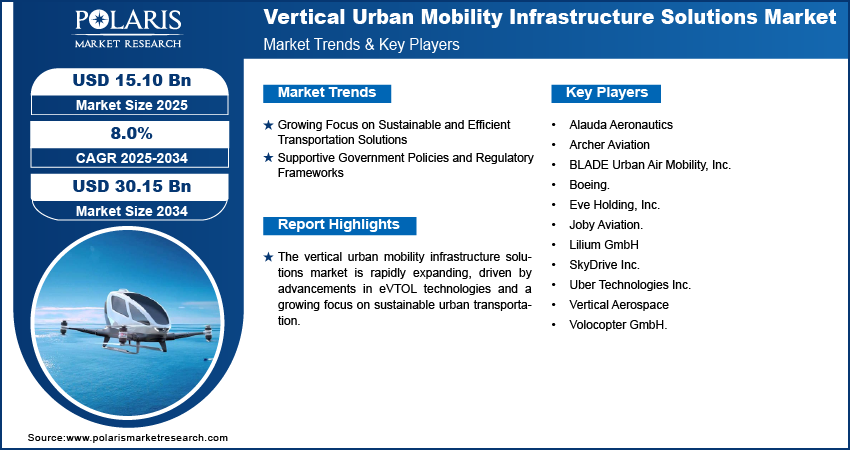

The global vertical urban mobility infrastructure solutions market size was valued at USD 14.01 billion in 2024. It is expected to grow from USD 15.10 billion in 2025 to USD 30.15 billion by 2034, at a CAGR of 8.0% during 2025–2034.

Vertical urban mobility infrastructure solutions refer to the network of facilities, technologies, and systems that allow efficient vertical transportation of people and goods within urban environments, primarily through air-based modes such as eVTOL (electric Vertical Take-Off and Landing) aircraft. The increasing urbanization and traffic congestion are driving the vertical urban mobility infrastructure solutions market demand. According to the World Bank Group, 57% of the total population lives in urban areas. Traditional ground-based transportation systems are struggling to cope with rising traffic volumes, leading to longer commutes and higher emissions as cities expand both in population and size. Vertical urban mobility offers a promising alternative by reducing dependency on congested road networks and providing a faster and more efficient mode of transportation. The integration of sports, vertiports, and advanced traffic management systems is essential in facilitating seamless vertical transit, addressing urban sprawl challenges, and improving overall urban mobility efficiency.

To Understand More About this Research: Request a Free Sample Report

Advancements in eVTOL and autonomous flight technologies are transforming the feasibility and scalability of vertical urban mobility solutions. Lightweight materials, efficient battery systems, and autonomous navigation have accelerated eVTOL deployment, making them safer, quieter, and more energy-efficient. In December 2021, NEOM and Volocopter formed a joint venture to create the world’s first public vertical mobility system in NEOM, Saudi Arabia, integrating air taxis, logistics, and emergency services with 15 Volocopter eVTOL aircraft. This initiative highlights how technological advancements are driving sustainable urban air mobility. Autonomous flight technologies further minimize human intervention, improving safety, operational efficiency, and cost-effectiveness. Therefore, as these technologies evolve, they are expected to integrate seamlessly with urban infrastructure, promoting vertical transit solutions that alleviate traffic congestion and support sustainable urban development.

Vertical Urban Mobility Infrastructure Solutions Market Dynamics

Growing Focus on Sustainable and Efficient Transportation Solutions

Traditional ground transportation methods contribute to urban pollution and traffic congestion, making air-based mobility an attractive alternative as cities worldwide seek to reduce carbon emissions and enhance energy efficiency. In 2024, the State of Global Air reported that over 700,000 deaths in children under 5 years old were linked to air pollution in 2021. Vertical urban mobility solutions, such as eVTOL aircraft, offer a cleaner and faster mode of transit by leveraging electric propulsion systems that produce minimal emissions. Additionally, the integration of smart traffic management systems and optimized flight paths can further reduce energy consumption and operational inefficiencies. This focus aligns with global sustainability goals, driving investments and advancements in vertical mobility infrastructure. Thus, the growing focus on sustainable and efficient transportation solutions is boosting the vertical urban mobility infrastructure solutions market development.

Supportive Government Policies and Regulatory Frameworks

Governments are increasingly recognizing the potential of vertical mobility to transform urban transportation and are implementing policies that facilitate the development and deployment of eVTOL technologies. In January 2025, CII urged the Indian government to expand the PLI scheme to include eVTOL manufacturing, supporting startups such as ePlane Company and Sarla Aviation. InterGlobe partnered with Archer Aviation, ordering USD 1 billion worth of eVTOLs, aiming to advance India’s urban air mobility sector. This includes establishing safety standards, air traffic regulations, and funding incentives for research and infrastructure development. Regulatory clarity and support are crucial for attracting investments and assuring the safe integration of vertical mobility solutions into urban airspaces. As a result, the supportive government policies and regulatory frameworks accelerate the vertical urban mobility infrastructure solutions market growth by reducing regulatory uncertainties and promoting innovation in sustainable urban transportation.

Vertical Urban Mobility Infrastructure Solutions Market Segment Assessment

Vertical Urban Mobility Infrastructure Solutions Market Assessment by Vehicle Type Outlook

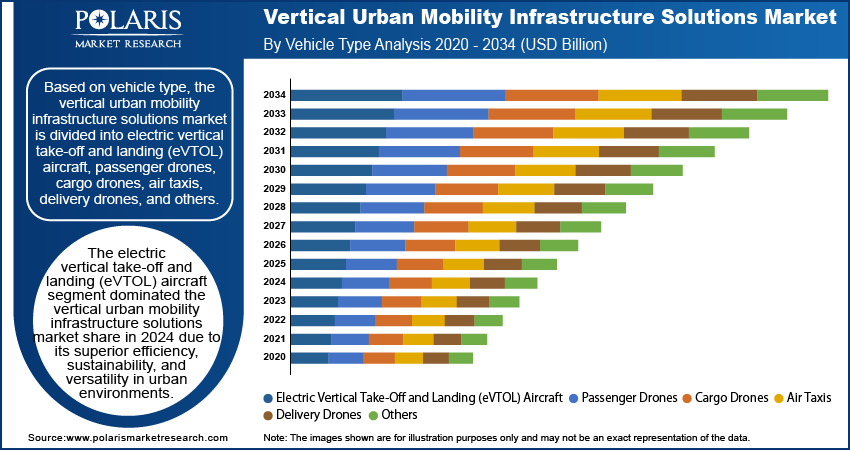

The global vertical urban mobility infrastructure solutions market segment, based on vehicle type, includes electric vertical take-off and landing (eVTOL) aircraft, passenger drones, cargo drones, air taxis, delivery drones, and others. The electric vertical take-off and landing (eVTOL) aircraft segment dominated the vertical urban mobility infrastructure solutions market share in 2024 due to its superior efficiency, sustainability, and versatility in urban environments. eVTOL aircraft leverage electric propulsion systems, which offer reduced noise levels and lower emissions compared to traditional helicopters, making them ideal for densely populated urban areas. Their ability to perform vertical take-offs and landings without extensive runway infrastructure allows seamless integration into cityscapes through vertiports and skyports. Additionally, advancements in battery technology and autonomous flight capabilities have enhanced the operational range and safety of eVTOLs, positioning them as the cornerstone of the vertical urban mobility solutions market outlook.

Vertical Urban Mobility Infrastructure Solutions Market Evaluation by Application Outlook

The global vertical urban mobility infrastructure solutions market segment, based on application, includes passenger transportation, cargo delivery, inspection & maintenance, emergency services, and others. The passenger transportation segment is expected to witness the fastest growth during the forecast period, driven by rising urbanization and the need to alleviate ground traffic congestion. Traditional transportation networks face significant pressure, making air-based passenger transit an attractive alternative as city populations expand. eVTOLs and air taxis offer faster and more efficient travel over short and medium distances within cities, especially reducing commute times. Furthermore, the growing consumer preference for sustainable and time-efficient transportation modes is accelerating investments in passenger-centric urban air mobility solutions, thereby propelling the vertical urban mobility infrastructure solutions market expansion.

Vertical Urban Mobility Infrastructure Solutions Market Regional Analysis

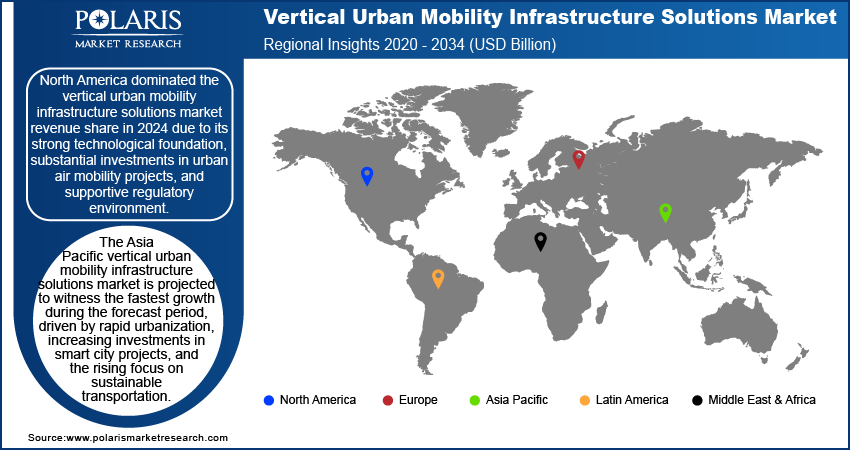

By region, the report provides the vertical urban mobility infrastructure solutions market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the vertical urban mobility infrastructure solutions market revenue in 2024 due to its strong technological foundation, substantial investments in urban air mobility projects, and supportive regulatory environment. The presence of leading eVTOL manufacturers, coupled with proactive initiatives by regulatory bodies such as the FAA, has facilitated rapid technological advancements in infrastructure and technology. In October 2023, the FAA, through CLEEN and ASCENT programs, supported R&D for quieter, fuel-efficient, and low-emission aircraft technologies. The FAST grant program, under the Inflation Reduction Act, funded SAF production and low-emission aviation tech to advance US aviation sustainability goals. Moreover, the region's high adoption rate of innovative transportation solutions and well-established urban air traffic management systems have created a conducive ecosystem for the deployment of vertical urban mobility solutions, thereby solidifying North America's market leadership.

The Asia Pacific vertical urban mobility infrastructure solutions market is projected to witness the fastest growth during the forecast period driven by rapid urbanization, increasing investments in smart city projects, and the rising focus on sustainable transportation. Cities in countries such as China, Japan, and South Korea are experiencing population growth, leading to severe traffic congestion and environmental challenges. As a result, there is a growing demand for alternative transportation modes that improve urban mobility efficiency. Additionally, supportive government policies and strategic collaborations between local governments and eVTOL manufacturers are accelerating infrastructure development, positioning Asia Pacific as a high-potential market for vertical urban mobility solutions.

Vertical Urban Mobility Infrastructure Solutions Market Players & Competitive Analysis Report

The competitive landscape in the vertical urban mobility infrastructure solutions market features global leaders and regional players competing for market share through innovation, strategic alliances, and regional expansion. Global players leverage strong R&D capabilities, technological advancements, and extensive networks to deliver innovative solutions, meeting the growing demand for sustainable and efficient urban mobility systems. Vertical urban mobility infrastructure solutions market trends highlight rising demand for disruptive technologies such as eVTOLs, autonomous flight systems, and digitalization, driven by urbanization, environmental concerns, and economic growth. Global companies focus on strategic investments, mergers and acquisitions, and joint ventures to strengthen their market position. Post-merger integration and strategic alliances are key strategies to improve competitive positioning and expand regional footprints. Regional players address domestic needs by offering cost-effective solutions and leveraging regional economic landscapes. Competitive benchmarking includes market entry assessments, expansion opportunities, and partnership ecosystems to meet the demand for innovative and future-ready mobility solutions. The market is experiencing rapid technological advancements, such as AI-driven navigation, lightweight materials, and energy-efficient systems, reshaping urban mobility ecosystems. Companies are investing in supply chain optimization, procurement strategies, and sustainability transformations to align with market demands and future development strategies. Pricing insights, revenue growth analysis, and competitive intelligence are critical for identifying opportunities and driving long-term profitability. In conclusion, the vertical urban mobility infrastructure solutions market development is driven by technological innovation, market adaptability, and regional investments. Major players focus on strategic developments, market penetration, and competitive benchmarking to address urbanization, environmental challenges, and geopolitical shifts, ensuring sustained growth in a hypercompetitive global market. A few key major players are Alauda Aeronautics; Archer Aviation; BLADE Urban Air Mobility, Inc.; Boeing; Eve Holding, Inc.; Joby Aviation; Lilium GmbH; SkyDrive Inc.; Uber Technologies Inc.; Vertical Aerospace; and Volocopter GmbH.

Archer Aviation, headquartered in San Jose, California, is a developer of electric vertical takeoff and landing (eVTOL) aircraft. Its flagship eVTOL models, such as the Maker and Midnight, are designed to transform urban transportation with air taxi services capable of speeds up to 150 mph and ranges of 20-100 miles. Archer's Midnight aircraft, optimized for short, back-to-back trips, is set for FAA certification by late 2024, with commercial operations planned for 2025. The company has secured significant partnerships with United Airlines, Stellantis, and others, alongside substantial investments exceeding USD 1.1 billion. Archer is also collaborating with cities, such as Miami and Los Angeles, to develop vertical urban mobility infrastructure. Its high-capacity manufacturing facility in Georgia aims to produce up to 650 aircraft annually, supporting its vision of revolutionizing urban transit. Strategic global expansions into markets such as Japan, South Korea, and Abu Dhabi further highlight its ambition.

Boeing, a global aerospace company, is actively advancing its role in vertical urban mobility through significant investments in eVTOL (electric vertical takeoff and landing) aircraft. A key initiative is its partnership with Wisk Aero, a joint venture with Kitty Hawk, where Boeing has invested USD 450 million to develop autonomous, zero-emission eVTOL vehicles aimed at revolutionizing urban air mobility. Wisk has already conducted over 1,500 test flights and is working on its sixth-generation aircraft, designed for broader public accessibility rather than premium services. These aircraft are tailored to alleviate congestion in metropolitan areas with a range of 25 miles, targeting 14 million annual flights across 20 cities within five years of launch. Boeing contributes its expertise in certification, manufacturing scalability, and global policy support to accelerate Wisk's development. This aligns with Boeing’s sustainability goals of decarbonizing aviation through advanced electric propulsion technologies. The company also leverages its vast intellectual property and technical resources to ensure safety and efficiency in eVTOL designs.

List of Key Companies in Vertical Urban Mobility Infrastructure Solutions Market

- Alauda Aeronautics

- Archer Aviation

- BLADE Urban Air Mobility, Inc.

- Boeing.

- Eve Holding, Inc.

- Joby Aviation.

- Lilium GmbH

- SkyDrive Inc.

- Uber Technologies Inc.

- Vertical Aerospace

- Volocopter GmbH.

Vertical Urban Mobility Infrastructure Solutions Industry Development

May 2024: Archer Aviation partnered with Etihad Aviation Training to establish eVTOL pilot training operations in Abu Dhabi. The collaboration aims to recruit and train pilots for Archer’s Midnight aircraft, supporting urban air mobility operations in the UAE by 2025.

January 2024: Joby Aviation collaborated with Atlantic Aviation to electrify infrastructure in New York and Southern California, preparing for Joby’s eVTOL air taxi service. The collaboration includes installing charging systems and integrating air taxis with traditional aircraft for sustainable urban mobility.

Vertical Urban Mobility Infrastructure Solutions Market Segmentation

By Vehicle Type Outlook (Revenue, USD Billion, 2020–2034)

- Electric Vertical Take-Off and Landing (eVTOL) Aircraft

- Passenger Drones

- Cargo Drones

- Air Taxis

- Delivery Drones

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Passenger Transportation

- Cargo Delivery

- Inspection & Maintenance

- Emergency Services

- Others

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Military

- Commercial

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Vertical Urban Mobility Infrastructure Solutions Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 14.01 billion |

|

Market Size Value in 2025 |

USD 15.10 billion |

|

Revenue Forecast in 2034 |

USD 30.15 billion |

|

CAGR |

8.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global vertical urban mobility infrastructure solutions market size was valued at USD 14.01 billion in 2024 and is projected to grow to USD 30.15 billion by 2034.

The global market is projected to register a CAGR of 8.0% during the forecast period.

North America dominated the global market share in 2024.

A few of the key players in the market are Alauda Aeronautics; Archer Aviation; BLADE Urban Air Mobility, Inc.; Boeing; Eve Holding, Inc.; Joby Aviation; Lilium GmbH; SkyDrive Inc.; Uber Technologies Inc.; Vertical Aerospace; and Volocopter GmbH.

The electric vertical take-off and landing (eVTOL) aircraft segment dominated the market share in 2024.

The passenger transportation segment is expected to witness the fastest vertical urban mobility infrastructure solutions market growth during the forecast period.