Vertical Farming Market Size, Share, Trends, Industry Analysis Report

By Growth Mechanism (Aeroponics, Hydroponics, Aquaponics), By Structure (Building-based Vertical Farms, Shipping Container-based Vertical Farms), By Components, By Crops, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 129

- Format: PDF

- Report ID: PM1019

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

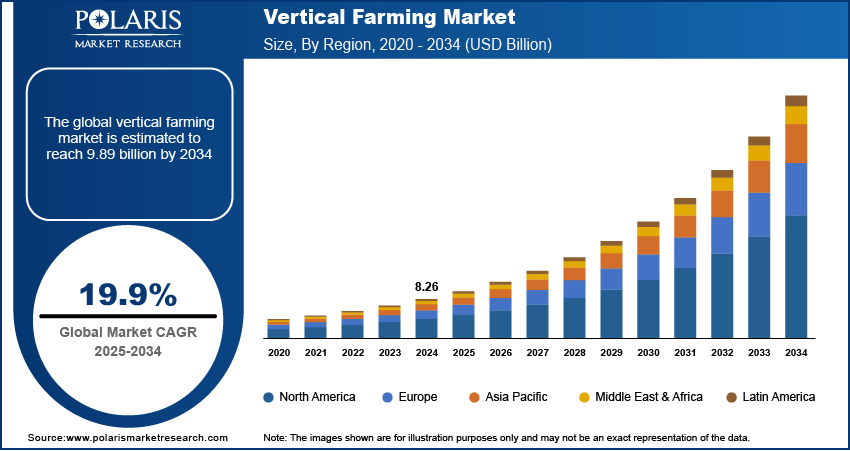

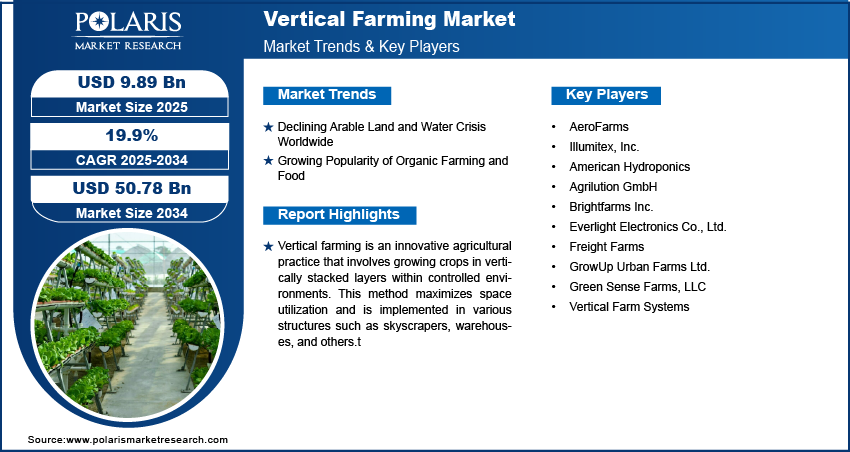

The global vertical farming market size was valued at USD 8.26 billion in 2024, exhibiting a CAGR of 19.9 % from 2025 to 2034. Demand is driven by increasing food demand worldwide, reducing available land for cultivation, an increase in interest in organics, and technological improvements in sustainable, high-tech farming techniques that increase output and efficiency per given area.

Key Insights

- The hydroponics segment accounted for a considerable market share in 2024 due to its water efficiency as compared to conventional farming practices.

- The building-based vertical farms segment accounted for the maximum market share in 2024 owing to their scalability, city integration, and potential for high crop yields.

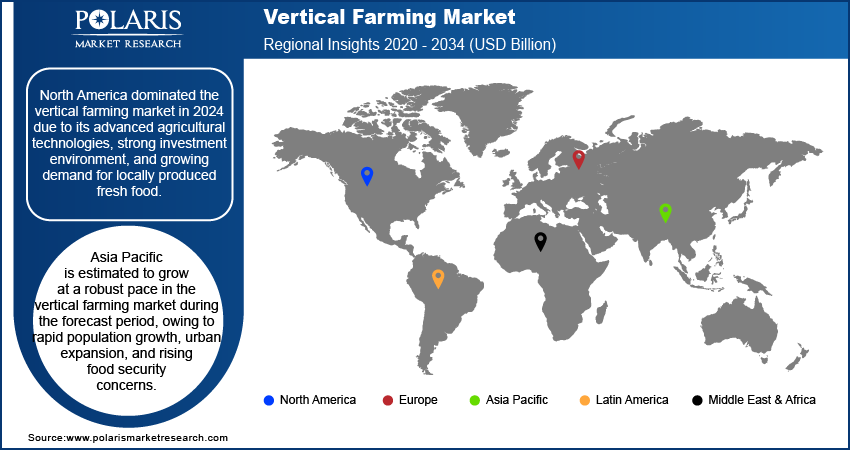

- North America dominated the global market in 2024, driven by its advanced agricultural technologies, favorable investment climate, and increasing demand for locally grown, fresh foods.

- North America captured the global market in 2024 through the use of superior agricultural technologies, substantial investment support, and increased demand for fresh, locally produced goods.

- Asia Pacific is expected to expand at a high growth rate throughout the forecast period, driven by population growth, urbanization, and increasing concerns about food security.

Industry Dynamics

- The increasing global population and growing food needs are driving the need for vertical farming, which employs high-tech methods to optimize yields in limited areas.

- The reduction of arable land due to erosion, desertification, and urbanization is driving the development of vertical farming as a space-saving solution for agriculture.

- The increasing demand for organic, pesticide-free fruits and vegetables is driving the growth of vertical farming, which offers controlled, eco-friendly growing conditions ideal for organic farming.

- The high initial capital requirements and the energy consumption issues are major constraints that are curbing the development of the vertical farming market.

Market Statistics

2024 Market Size: USD 8.26 billion

2034 Projected Market Size: USD 50.78 billion

CAGR (2025-2034): 19.9%

North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

Vertical farming is an innovative agricultural practice that involves growing crops in vertically stacked layers within controlled environments. This farming method maximizes space utilization and is implemented in various structures such as skyscrapers, warehouses, and shipping containers. It uses technologies, including aquaponics, hydroponics, and aeroponics, to provide plants with the necessary nutrients, water, and light for growth.

Vertical farming is done year-round, regardless of weather conditions or seasonal changes. The method allows for precise control of growing conditions, such as temperature, humidity, and light, resulting in higher yields and faster growth times. Vertical farming also uses significantly less water than traditional farming methods, making it an attractive option for water-scarce areas.

The increasing global population is driving the vertical farming market demand. The Food and Agriculture Organization (FAO) estimates that the agriculture sector must produce about 50% more food, biofuel, and livestock fodder by 2050 than in 2012 to meet the global demand and achieve zero hunger by 2030. As the population grows, food demand rises, making vertical farming an essential solution. This method utilizes innovative techniques to grow crops in controlled environments, maximizing output in limited spaces.

The increasing demand for fresh, locally grown produce, advancements in technology and automation, and the growing awareness of the benefits of sustainable farming are expected to drive the vertical farming market expansion during the forecast period.

The primary challenge facing the market is the high initial investment required to set up and operate a vertical farm. Contributing factors to these higher costs include equipment and technology, facility, energy consumption, and labor. Additionally, regulatory challenges are projected to hinder the vertical farming market growth.

Market Dynamics

Declining Arable Land

Arable land is suitable for growing crops, and it is estimated that approximately one-third of the world's arable land has been lost to erosion, desertification, and urbanization. It has created a need for alternative methods of agriculture, such as vertical farming, that produce crops in smaller spaces. The vertical farming method allows for the efficient use of space and resources, as crops are grown in vertically stacked layers, requiring less land than traditional farming methods. Thus, the declining arable land is contributing to the vertical farming market development.

Growing Popularity of Organic Farming and Food

The growing popularity of organic farming is driving demand for vertical farming, as it aligns with consumer preferences for pesticide-free, sustainably grown produce while leveraging advanced agricultural techniques. According to data published by the National Centre for Organic and Natural Farming, organic agriculture is practiced in 187 countries, with 72.3 million hectares of agricultural land managed organically by at least 3.1 million farmers in 2021. Vertical farming allows for precise control over growing conditions, eliminating the need for complex fertilizers and herbicides commonly used in traditional farming. This makes it an ideal solution for organic farming, meeting the increasing consumer demand for healthier and environmentally friendly food options. Additionally, vertical farming minimizes exposure to soil-borne diseases and contaminants, ensuring the purity of organic food and beverages.

Market Segmentation

Market Assessment Based on Growth Mechanism

The vertical farming market, based on the growth mechanism, is segmented into aeroponics, hydroponics, and aquaponics. The hydroponics segment held a significant market share in 2024 due to its ability to use less water than traditional farming methods. This method leads to up to 90% water savings, making it a more sustainable and environmentally friendly method of growing crops. Additionally, hydroponics accelerates plant growth, resulting in quicker harvest times and higher crop yields per year. These advantages are driving increased adoption of hydroponics in vertical farming among farmers and agriculture enthusiasts.

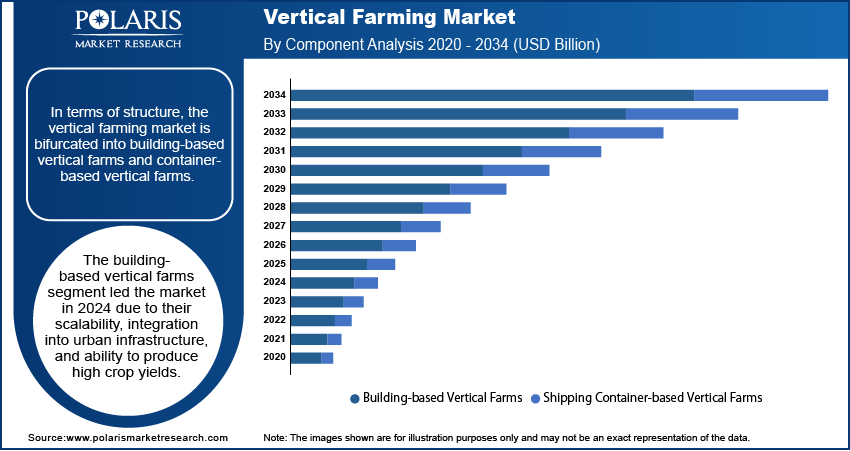

Market Evaluation Based on Structure

In terms of structure, the vertical farming market is bifurcated into building-based vertical farms and container-based vertical farms. The building-based vertical farms segment accounted for the largest vertical farming market share in 2024, driven by their scalability, integration into urban infrastructure, and ability to produce high crop yields. These farms efficiently utilize existing structures such as warehouses, commercial buildings, and abandoned facilities, which reduces the need for additional construction costs. The ability of building-based vertical farms to cater to dense urban populations makes them an ideal solution for addressing food security concerns in cities. Furthermore, advancements in LED lighting, automation, and IoT-driven systems have significantly enhanced productivity and energy efficiency, further driving the dominance of the segment. The growing consumer demand for fresh, locally sourced produce has also encouraged the adoption of building-based systems by businesses seeking to capitalize on urban markets.

Market Assessment Based on Component

The vertical farming market, based on component, is bifurcated into hardware and software. The software segment is projected to grow at a robust pace from 2025 to 2034, owing to the increasing adoption of data-driven farming techniques. Advanced software solutions enable real-time monitoring, analytics, and automation, empowering farmers to optimize resources such as water, nutrients, and energy. Predictive analytics and deep learning algorithms enhance decision-making by identifying patterns and forecasting crop performance. IoT-enabled software platforms integrate hardware components with centralized control systems, allowing seamless operation and reducing human intervention. The rising emphasis on sustainability, precision farming, and cost-effective production methods further accelerates the adoption of software solutions.

Regional Insights

By region, the report offers vertical farming market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the global market in 2024 due to its advanced agricultural technologies, favorable investment environment, and growing demand for locally produced fresh food. Urbanization and the depletion of arable land have accelerated the adoption of innovative farming methods, such as vertical farming in the region. The presence of major companies, extensive R&D activities, and supportive government policies promoting sustainable agriculture have also contributed significantly to the regional market growth. In the US, consumer preferences for pesticide-free, high-quality produce and the growing popularity of farm-to-table dining experiences have fueled the demand for vertical farming.

The Asia Pacific vertical farming market is estimated to grow at a robust pace during the forecast period, driven by rapid population growth, urban expansion, and rising food security concerns. China and Japan lead the region, with China holding a significant market share due to government initiatives supporting innovation and the growing private investment in controlled-environment farming projects. Japan contributes to the regional market growth with its early adoption of hydroponics and advanced automation technologies.

The need to reduce dependence on food imports and address challenges such as extreme weather conditions and shrinking farmland has accelerated the adoption of precision farming and advance fatming systems in the Asia Pacific. Growing awareness about sustainable agriculture, combined with a rising population, has driven demand for staple foods and fruits, leading to increased adoption of vertical farming. For instance, according to the Asia Pacific Population and Development Report 2023, Asia Pacific is home to 60 percent of the global population.

Key Players and Competitive Analysis Report

Major market players are investing heavily in research and development in order to expand their offerings, which will help the vertical farming market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The vertical farming market is fragmented, with the presence of numerous global and regional market players. Major players in the vertical farming market include AeroFarms; Illumitex, Inc.; American Hydroponics; Agrilution GmbH; Brightfarms Inc.; Everlight Electronics Co., Ltd.; Freight Farms; GrowUp Urban Farms Ltd.; Green Sense Farms, LLC; and Vertical Farm Systems.

AeroFarms stands at the forefront of the vertical farming revolution, pioneering sustainable indoor agriculture through innovative aeroponic technology. Founded in 2004 in the Finger Lakes region of New York, the company has evolved significantly, relocating its headquarters to Newark, New Jersey, and establishing itself as a prominent player in the industry. AeroFarms utilizes a patented aeroponic system that allows plants to grow in a mist environment, delivering nutrients directly to the roots while eliminating the need for soil. This method not only conserves water but also maximizes space efficiency, producing 390 times more produce per square foot compared to conventional agriculture. The company's flagship facility, opened in 2016 in Newark, is recognized as one of the largest indoor vertical farms globally, capable of producing up to two million pounds of leafy greens annually.

Brightfarms Inc., founded in 2010 by Ted Caplow and Paul Lightfoot. The company operates hydroponic greenhouses that grow fresh, non-GMO, and pesticide-free salad greens. Headquartered in Irvington, New York, BrightFarms has developed a scalable model that integrates local farming with supermarket supply chains, thereby reducing the time and distance food travels from farm to table.

List of Key Companies:

- AeroFarms

- Illumitex, Inc.

- American Hydroponics

- Agrilution GmbH

- Brightfarms Inc

- Everlight Electronics Co., Ltd.

- Freight Farms

- GrowUp Urban Farms Ltd.

- Green Sense Farms, LLC

- Vertical Farm Systems

Vertical Farming Industry Developments

- February 2023: Aerofarms and PIF signed a joint venture agreement to build and operate the largest indoor vertical farm in Saudi Arabia and the MENA region.

- October 2022: Urban Crop Solutions (UCS) and Rudi Pauwels agreed to establish a research center for indoor farming applications in Southern Spain,

- February 2021: iFarm with Yasai AG and Logiqs B.V. announced a strategic partnership to establish the first Zürich vertical farm.

Vertical Farming Market Segmentation

By Growth Mechanism Outlook (Revenue, USD Billion, 2020 - 2034)

- Aeroponics

- Hydroponics

- Aquaponics

By Structure Outlook (Revenue, USD Billion, 2020 - 2034)

- Building-based Vertical Farms

- Shipping Container-based Vertical Farms

By Component Outlook (Revenue, USD Billion, 2020 - 2034)

- Hardware

- Lighting

- Hydroponic components

- Climate control

- Services

By Crop Type Outlook (Revenue, USD Billion, 2020 - 2034)

- Fruits, Vegetables, & Herbs

- Tomato

- Lettuce

- Strawberry

- Cucumber

- Herbs

- Others

- Flowers & Ornamentals

- Perennials

- Annuals

- Ornamentals

- Others

By Regional Outlook (Revenue, USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 8.26 billion |

|

Market Value in 2025 |

USD 9.89 billion |

|

Revenue Forecast by 2034 |

USD 50.78 billion |

|

CAGR |

19.9% from 2025–2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

Vertical Farming Industry Trend Analysis (2024) Company Profiles/Industry participants profiling includes company overview, financial information, product/service benchmarking, and recent developments |

|

Report Format |

PDF + Excel |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The key segments covered in the market report are growth mechanism, structure, components, crops, and region.

The market was valued at USD 8.26 billion in 2024 and is projected to grow to USD 50.78 billion by 2034.

The global market is projected to register a CAGR of 19.9 % from 2025 to 2034.

North America led the market for vertical farming in 2024.

The hydroponics segment led the market in 2024.