Vegetable Flakes and Granules Market Share, Size, Trends, Industry Analysis Report, By Type (Onion, Tomato, Potato, Carrot, Bell Peppers and Herbs, Others), By Application, By End-user, By Region, And Segment Forecasts, 2023 - 2032

- Published Date:Aug-2023

- Pages: 115

- Format: PDF

- Report ID: PM3708

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

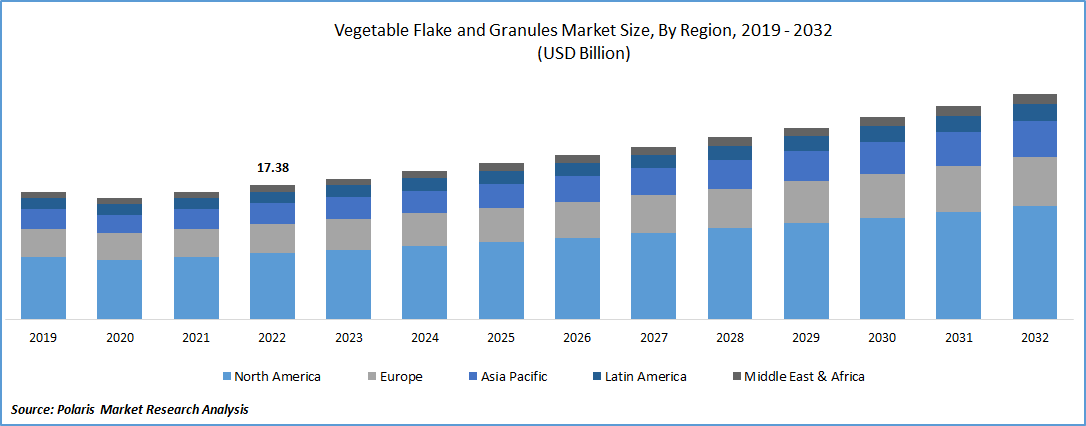

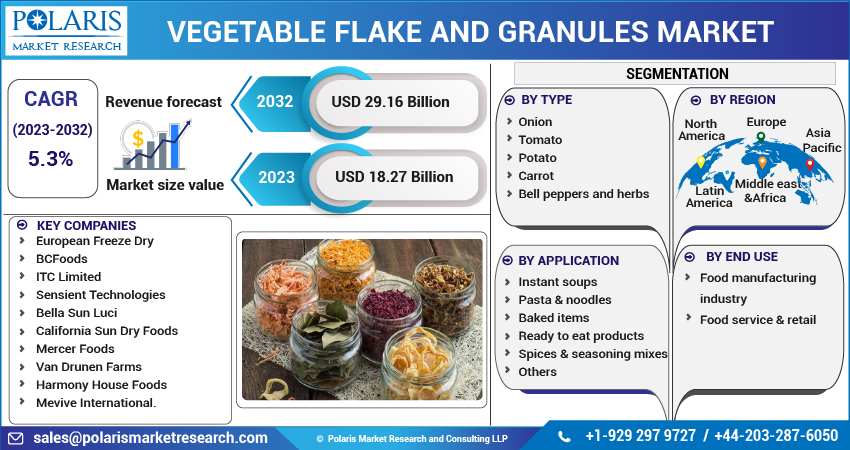

The global vegetable flakes and granules market was valued at USD 17.38 billion in 2022 and is expected to grow at a CAGR of 5.3% during the forecast period.

The market is driven by the increasing demand for ready-to-eat meals & processed food, the extended shelf-life provided by dried vegetable flakes, & ever-changing dietary patterns influenced by busy consumer lifestyles. Their versatility also drives the market as additives that enhance the flavor of various food products such as instant soups, dips & dressings, & convenience foods. As consumer preferences shift towards dehydrated vegetable alternatives, the demand for flakes and granules has grown. These products are dried to extend their shelf life and enable long-term storage. The increasing demand for processed and ready-to-eat meals further contributes to the market's growth prospects.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics

Growth Drivers

Technological Advancement drives the market

Technological advancements have played a crucial role in introducing dehydration technologies for vegetables. The increasing adoption of these innovative techniques is driven by the demand for seasonal vegetables and the need to extend their shelf life. Various dehydration technologies such as air drying, vacuum drying, infrared drying, & spray drying are utilized to produce vegetable flakes and granules. These technologies effectively remove moisture from vegetables, allowing them to be stored and consumed longer. Demand for dehydration technologies that can produce the vegetable flakes while retaining the nutritional qualities, taste, & texture of the vegetables. These flakes find applications in instant soups, ready-to-eat products, and snacks, meeting consumer preferences for convenience and flavor.

For Specific Research Requirements, Request for a Customized Report

Report Segmentation

The market is primarily segmented based on type, application, end use, and region.

|

By Type |

By Application |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type

Tomato segment held the significant market share in 2022

The tomato segment held a significant market share in 2022. This dominance can be attributed to the increasing demand for tomato flakes, particularly in instant soups and sauces. Consumers' fast-paced lifestyles, especially in developing regions, have led to a rising preference for instant and convenient food products. As a result, there is a growing demand for tomato flakes, which offer ease of use and add flavor to various dishes, including soups and sauces. This trend is driving the demand for tomato flakes in the market.

Tomatoes are highly perishable and contain a high-water content of approximately 93%. Various preservation technologies have been developed to address this issue and extend their shelf life. Tomato flakes have emerged as a popular solution, offering a processed form with an extended shelf life. The demand for tomato flakes is particularly evident in fast food chains, where they are used to prepare soups, dips, sauces, fast food items, and pasta. The dried form of tomatoes, such as flakes and granules, is preferred by consumers as the drying process intensifies the flavor.

Fast food chains specifically opt for dried tomato flakes in pasta sauces due to their rich and concentrated flavor profile. Moreover, tomato flakes are also valued for their high dietary fiber content, contributing to their nutritional value. This nutritional aspect further drives their preference for various food products. As a result, the demand for tomato flakes continues to grow, catering to the food industry's and health-conscious consumers' needs.

The onion flakes segment is anticipated to grow at a considerable growth rate over the study period. This growth is primarily attributed to the increasing support from agricultural scientists in developing technologies for the long-term storage of dried onions, which drives innovation in production methods. Punjab Agricultural University scientists in India made significant strides in this area in 2020. They developed a technology to form onion flakes with a shelf-life of around 12 months while preserving their natural & fresh-like flavor. This breakthrough allows the production of onion-based snacks by food manufacturers and enables food outlets to incorporate these flakes into curried preparations.

Developing innovative technologies and preservation methods for onion flakes opens new opportunities for the food industry. It provides extended shelf life and convenience and maintains the flavor and quality of the onions, making them suitable for various culinary applications. As a result, the market for onion flakes is expected to witness significant growth, driven by the adoption of these advancements by food manufacturers and service providers.

By End-Use

Food manufacturing industry segment is projected to hold substantial market share during forecast period

The food manufacturing industry segment is projected to account for a substantial market share in revenue over the anticipated period. Several factors drive the preference for dried flakes in the food manufacturing industry. By utilizing dried flakes, food manufacturers can stabilize their supply chain and reduce dependency on seasonal vegetables, which may experience price volatility. Additionally, using dried flakes enables the food manufacturing industry to extend the shelf life of seasonal vegetables. Preserving vegetables in dried form can be stored and utilized for a longer period, ensuring a steady supply throughout the year.

The food service & retail segment is expected to grow fastest. This growth is primarily driven by the increasing preference for vegetable flakes among fast-food chains and food service outlets, as there is a growing demand for shelf-stable products in these establishments. Fast-food chains and food service outlets recognize the benefits of using vegetable flakes as a convenient and time-saving solution. Adopting vegetable flakes, such as onion flakes and herb flakes, allows them to enhance the taste and appearance of their food items while reducing the kitchen workload and preparation time. Food service outlets can streamline their operations and serve dishes more efficiently by utilizing pre-prepared vegetable flakes.

By Application

Ready to eat segment is projected to hold substantial market share during projected year

The ready-to-eat segment is projected to account for a substantial market share in revenue over the anticipated period. This can be attributed to the increasing utilization of various vegetable flakes in the production of ready mixes & processed meals. Innovations in dehydration technologies have opened opportunities for incorporating different vegetable flakes in ready mixes & processed meals. This trend aligns with the growing consumer preference for convenient food options, driven by busy lifestyles across other regions. As consumers increasingly opt for ready-to-eat products, the demand for such flakes in the manufacturing process has experienced a positive impact.

Regional Analysis

APAC region dominated the global market in 2022

APAC region dominated the global market with a substantial share. This market dominance can be attributed to several factors, including a large population base, a well-established food manufacturing industry, and a growing demand for ready-to-eat (RTE) food products and convenience snacks in the region. The region's thriving population provides a substantial consumer base for vegetable flakes and granules, contributing to robust market growth. Moreover, the increasing popularity of RTE food products and convenience snacks has further stimulated the demand for vegetable flakes in the region.

Several macroeconomic factors have positively influenced the region's vegetable flakes and granules market, particularly in countries like China & India. These factors include the rising disposable income levels among consumers, the shift in consumer lifestyles towards convenience-oriented products, and the rapid pace of urbanization. These factors collectively create a favorable environment for market growth in the region.

Competitive Insight

The Vegetable Flakes and Granules market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- European Freeze Dry

- BCFoods

- ITC Limited

- Sensient Technologies

- Bella Sun Luci

- California Sun Dry Foods

- Mercer Foods

- Van Drunen Farms

- Harmony House Foods

- Mevive International.

Recent Developments

- In January 2021, Anuha Food Products recently introduced a new range of dehydrated onion flakes & garlic cloves. This strategic move was driven by the company's objective to expand its product portfolio of the processed flakes.

Vegetable Flakes and Granules Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 18.27 billion |

|

Revenue forecast in 2032 |

USD 29.16 billion |

|

CAGR |

5.3% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Type, By Application, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

key companies in vegetable flake and granules market European FreezeDry, BCFoods,ITC Limited,Sensient Technologies,Bella Sun Luci,California Sun Dry Foods.

The global vegetable flakes and granules market is expected to grow at a CAGR of 5.3% during the forecast period.

The vegetable flake and granules market report covering key segments are type, application, end use, and region.

key driving factors in vegetable flake and granules market Shifting consumer preferences.

The global vegetable flake and granules market size is expected to reach USD 29.16 billion by 2032