Vascular Stent Market Size, Share, Trends, Industry Analysis Report: By Technology, Product, Mode of Delivery, Material, End User (Hospitals and Cardiac Centers), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 128

- Format: PDF

- Report ID: PM5377

- Base Year: 2024

- Historical Data: 2020-2023

Vascular Stent Market Overview

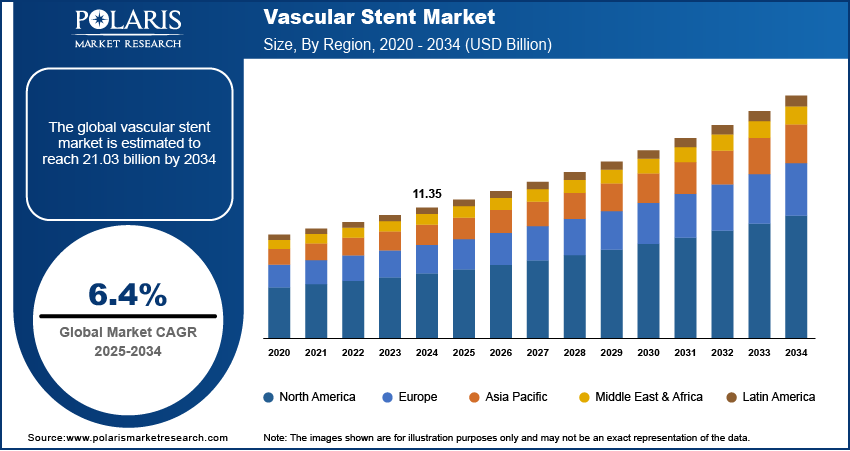

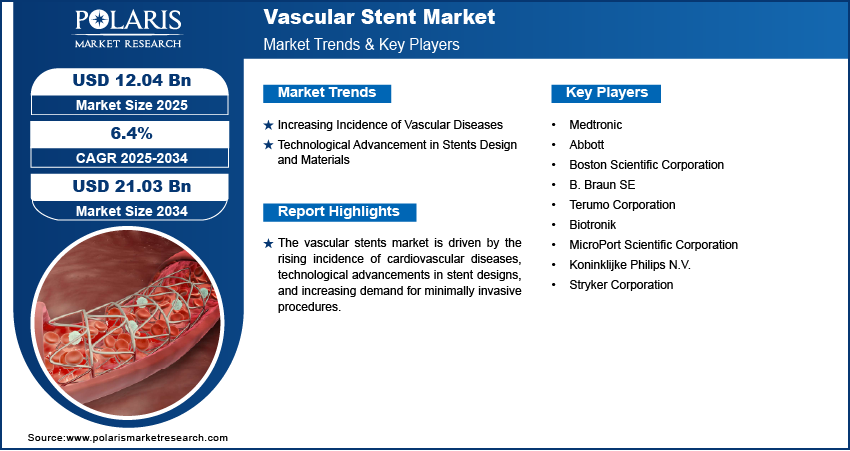

The global vascular stent market size was valued at USD 11.35 billion in 2024. The market is projected to grow from USD 12.04 billion in 2025 to USD 21.03 billion by 2034, exhibiting a CAGR of 6.4% from 2025 to 2034.

Vascular stent is a small, tube-like medical device inserted into blood vessels to keep them open and ensure proper blood flow. It is commonly used in patients with narrowed or blocked arteries. Stents are designed to support weakened vessel walls, prevent further obstruction, and improve circulation, thereby reducing symptoms such as chest pain, shortness of breath, leg pain, and fatigue. The market includes diverse stent types, such as drug-eluting stents (DES), bare-metal stents (BMS), and bio-resorbable stents, each offering specific benefits based on patient needs.

The vascular stent market is expanding rapidly, driven by factors such as the rising prevalence of cardiovascular diseases, increasing aging populations, and advances in minimally invasive procedures. For instance, a 2023 report published by the World Heart Federation highlighted that over half a billion people globally continue to be affected by cardiovascular diseases (CVD). The disease also led to 20.5 billion deaths in 2021. Major players are focusing on product innovation and regional expansion to meet the growing global demand for vascular stents. Factors such as increased healthcare spending and ongoing R&D investments further support market expansion.

To Understand More About this Research: Request a Free Sample Report

Vascular Stent Market Dynamics

Increasing Incidence of Vascular Diseases

Vascular conditions such as coronary artery disease (CAD) are becoming more prevalent, driven by factors such as aging populations, sedentary lifestyles, and rising obesity rates. This has led to an increase in angioplasty procedures, which involve the insertion of stents to restore blood flow. The increasing popularity of angioplasty procedures is driving demand for vascular stents due to their effectiveness in treating arterial blockages, particularly in high-risk patients. Additionally, advancements in stent technology, such as drug-eluting stents (DES), have made these procedures safer and more successful. For instance, in May 2024, Abbott introduced the XIENCE Sierra Everolimus Eluting Coronary Stent System (DES) in India. This advanced stent is a part of the XIENCE family, designed for patients with blocked coronary arteries. The global push for early diagnosis and treatment of cardiovascular diseases also contributes to the growing need for stents, thereby fueling vascular stent market expansion.

Technological Advancement in Stents Design and Materials

Technological advancements such as drug-eluting stents (DES) have enhanced treatment outcomes by reducing restenosis rates and improving long-term patient recovery. Additionally, advancements in biocompatible materials, such as bioresorbable stents, have led to safer, more effective solutions that reduce complications. For instance, in July 2024, Shanghai MicroPort Medical (Group) Co., Ltd., received market approval from the National Medical Products Administration (NMPA) for Firesorb, which is recognized as the world's first next-generation fully bioresorbable cardiac stent. New delivery systems and minimally invasive techniques, such as the use of balloon angioplasty and catheter-based stent delivery systems, are also improving the ease and precision of stent placement, making procedures quicker and safer. Thus, these technological improvements, combined with ongoing research and development, are increasing the adoption of stents in the treatment of vascular diseases.

Vascular Stent Market Segment Insights

Vascular Stent Market Evaluation by Technology Outlook

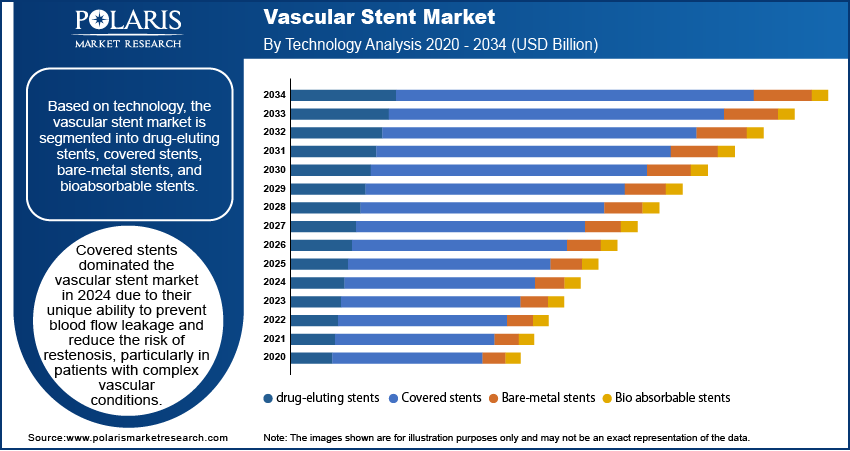

The global vascular stent market segmentation, based on technology, includes drug-eluting stents, covered stents, bare-metal stents, and bioabsorbable stents. Covered stents dominated the vascular stent market in 2024 due to their unique ability to prevent blood flow leakage and reduce the risk of restenosis, particularly in patients with complex vascular conditions. Covered stents feature a synthetic membrane that acts as a barrier against plaque and blockages, making them ideal for treating aneurysms and perforated vessels. Covered stents have grown in popularity as healthcare providers aim for more effective solutions for patients with severe problems, which need extra support and protection provided by covered stents. Additionally, ongoing advancements in stent materials and designs have improved the safety and effectiveness of covered stents, making them a preferred choice in challenging vascular procedures.

Vascular Stent Market Assessment by Mode of Delivery Outlook

The global vascular stent market segmentation, based on mode of delivery, includes balloon-expandable stents and self-expanding stents. Self-expanding stents are projected to register a high CAGR during the forecast period due to their flexibility and durability, which make them well suited for challenging vascular anatomies. Self-expanding stents naturally expand upon deployment, adapting to the shape of the vessel and providing continuous support, especially in areas subject to high movement, such as peripheral arteries. It makes them particularly effective in treating complex lesions and managing restenosis risks in patients with advanced vascular disease. Additionally, technological improvements in self-expanding materials, such as nitinol, enhance the stent's responsiveness and durability, further driving their adoption in the vascular stent market.

Vascular Stent Market Regional Analysis

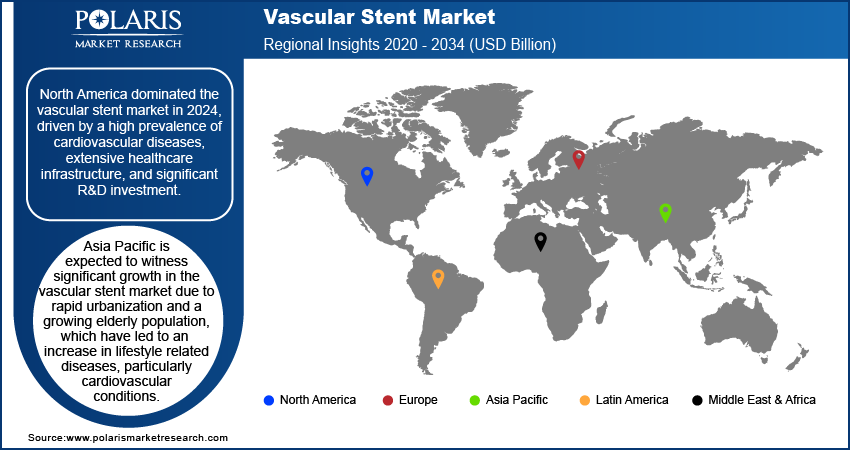

By region, the study provides vascular stent market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the global market in 2024, driven by a high prevalence of cardiovascular diseases, extensive healthcare infrastructure, and significant R&D investment. The region's aging population, combined with rising obesity and diabetes rates, has increased the demand for advanced stent solutions to address vascular conditions. Additionally, strong regulatory support and faster product approvals have encouraged innovation, enabling companies to introduce next-generation stents more rapidly. For instance, the XACT Carotid Stent System was approved by the FDA in February 2024 to reopen narrowed carotid arteries in the neck. The system is used for patients with moderate blockage in their blood vessels, which is defined as 50% or 70% blockage depending on the patient's symptoms. Moreover, the widespread adoption of minimally invasive procedures such as angioplasty with stent placement, endovascular aneurysm repair (EVAR), and others in the US and Canada have further boosted the demand for vascular stents as patients seek safer and less invasive treatment options.

Asia Pacific is expected to witness significant growth in the vascular stent market due to rapid urbanization and a growing elderly population, which have led to an increase in lifestyle related diseases, particularly cardiovascular conditions. Rising healthcare expenditures and improved access to healthcare facilities are also driving demand for advanced treatment options such as vascular stents. Additionally, countries such as China, India, and Japan are witnessing strong economic growth, which has boosted investments in healthcare infrastructure and encouraged the adoption of advanced medical devices. Furthermore, the expanding availability of minimally invasive procedures is making stents a preferred option for patients seeking less invasive solutions for vascular issues.

Vascular Stent Market – Key Players and Competitive Insights

The competitive landscape of the vascular stent market features a mix of global leaders and regional companies striving for market share through innovation, strategic partnerships, and geographic expansion. Major players in this market, such as Medtronic, Abbott, and Boston Scientific Corporation, focus on robust R&D efforts and use extensive distribution networks to introduce advanced vascular stent solutions that serve critical sectors, particularly healthcare. These companies prioritize product innovation, aiming to enhance stent performance, durability, and patient outcomes to meet growing healthcare demands. At the same time, smaller regional firms are emerging with niche stent products, offering unique designs and specialized applications for local markets. Key competitive strategies include mergers and acquisitions, collaborations with medical technology firms, and expanding product lines to strengthen presence in key regions. A few key major players are Medtronic, Abbott, Boston Scientific Corporation, B. Braun SE, Terumo Corporation, Biotronik, MicroPort Scientific Corporation, Koninklijke Philips N.V., and Stryker Corporation.

Koninklijke Philips N.V., commonly recognized as Philips, is a company that operates in various industries, including healthcare technology, consumer electronics, and lighting. Philips provides medical equipment, software, and services in healthcare, including imaging systems, patient monitoring systems, and clinical informatics solutions. Philips produces various products in consumer electronics, including televisions, audio equipment, and personal care products. The company also serves the lighting industry, providing energy-efficient lighting solutions for homes, businesses, and public spaces. Philips offers a range of mammography solutions, including digital mammography systems, breast tomosynthesis systems, and computer-aided detection (CAD) systems. These technologies are designed to provide high-quality images of breast tissue and help clinicians detect breast cancer at an early stage. In addition to mammography solutions, Philips provides a range of other medical imaging and diagnostic solutions, including ultrasound systems, MRI scanners, CT scanners, and nuclear medicine systems. Philips operates in more than 100 countries worldwide. Also, Koninklijke Philips N.V. offers advanced vascular stent solutions, enhancing minimally invasive treatments with precision.

Medtronic, headquartered in Dublin, Ireland, is a global leader in medical technology, committed to improving patient outcomes across various therapeutic areas. Established in 1949, the company specializes in developing and manufacturing a diverse range of advanced medical devices, including pacemakers, insulin pumps, vascular stents, spinal implants, robotic surgical systems, and deep brain stimulation systems. Medtronic's innovations are pivotal in treating conditions related to cardiovascular health, diabetes, neurological disorders, and spinal issues. With a presence in over 150 countries, the company leverages its extensive expertise and advanced research to address critical healthcare challenges. Medtronic’s mission is to alleviate pain, restore health, and extend life, reflecting its dedication to enhancing the quality of care and advancing medical science. Through continuous innovation and a focus on patient-centered solutions, Medtronic plays a crucial role in shaping the future of healthcare on a global scale.

List of Key Companies in Vascular Stent Market

- Medtronic

- Abbott

- Boston Scientific Corporation

- B. Braun SE

- Terumo Corporation

- Biotronik

- MicroPort Scientific Corporation

- Koninklijke Philips N.V.

- Stryker Corporation

Vascular Stent Industry Developments

In June 2024, Philips introduced the Duo Venous Stent System, an implantable device designed to address symptomatic venous outflow obstruction in patients with chronic venous insufficiency (CVI). This device specifically targets venous blockages, offering a treatment option for individuals suffering from symptoms associated with impaired venous flow.

In August 2022, Medtronic launched the Onyx Frontier drug-eluting stent (DES), following its CE Mark approval. This stent, based on the Resolute Onyx platform, includes an improved delivery system designed to enhance ease of placement and performance in challenging cases.

Vascular Stent Market Segmentation

By Technology Outlook (Revenue – USD Billion, 2020–2034)

- Drug-Eluting Stents

- Covered Stents

- Bare-Metal Stents

- Bio Absorbable Stents

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Coronary Stents

- Peripheral Stents

- Carotid Artery Stents

- Renal Artery Stents

- Femoral Artery Stents

- Iliac Artery Stents

- Other Peripheral Stents

- EVAR Stent Grafts

- Abdominal Aortic Aneurysm Stent Grafts

- Thoracic Aortic Aneurysm Stent Grafts

By Mode of Delivery Outlook (Revenue – USD Billion, 2020–2034)

- Balloon-Expandable Stents

- Self-Expanding Stents

By Material Outlook (Revenue – USD Billion, 2020–2034)

- Metallic Materials

- Cobalt Chromium

- Platinum Chromium

- Stainless Steel

- Nickel Titanium

- Polymer Materials

- Biodegradable Polymer

- Non-Biodegradable Polymer

By End User Outlook (Revenue – USD Billion, 2020–2034)

- Hospitals

- Cardiac Centers

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Vascular Stent Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 11.35 billion |

|

Market Size Value in 2025 |

USD 12.04 billion |

|

Revenue Forecast by 2034 |

USD 21.03 billion |

|

CAGR |

6.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global vascular stent market size was valued at USD 11.35 billion in 2024 and is projected to grow to USD 21.03 billion by 2034

• The global market is projected to register a CAGR of 6.4% during the forecast period.

• North America dominated the global in 2024, driven by a high prevalence of cardiovascular diseases, extensive healthcare infrastructure, and significant R&D investment.

• A few key players in the market are Medtronic, Abbott, Boston Scientific Corporation, B. Braun SE, Terumo Corporation, Biotronik, MicroPort Scientific Corporation, Koninklijke Philips N.V., Stryker Corporation.

• Covered stents dominated the market in 2024 due to their unique ability to prevent blood flow leakage and reduce the risk of restenosis, particularly in patients with complex vascular conditions.

• Self-expanding stents are projected to register a high CAGR during the forecast period.