Vaccine Adjuvants Market Size, Share, & Industry Analysis Report

: By Product Type (Particulate Adjuvants, Adjuvant Emulsions, Pathogen Components, Alum, and Others), Route of Administration, Disease Type, Application, and Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 119

- Format: PDF

- Report ID: PM1684

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

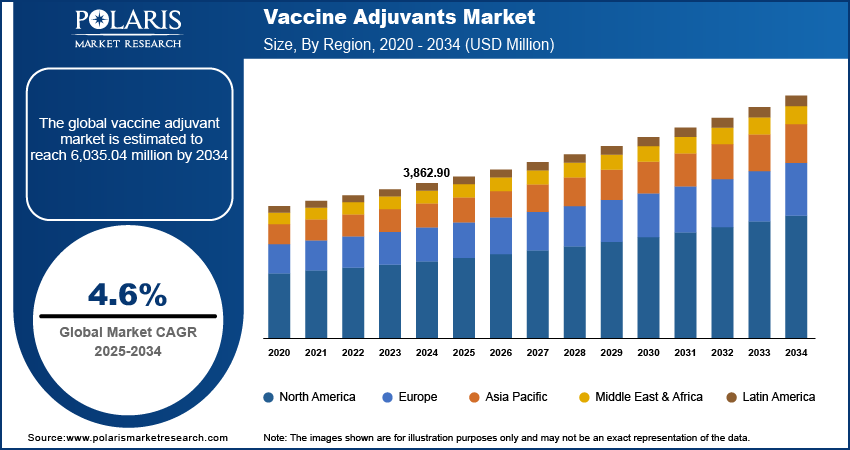

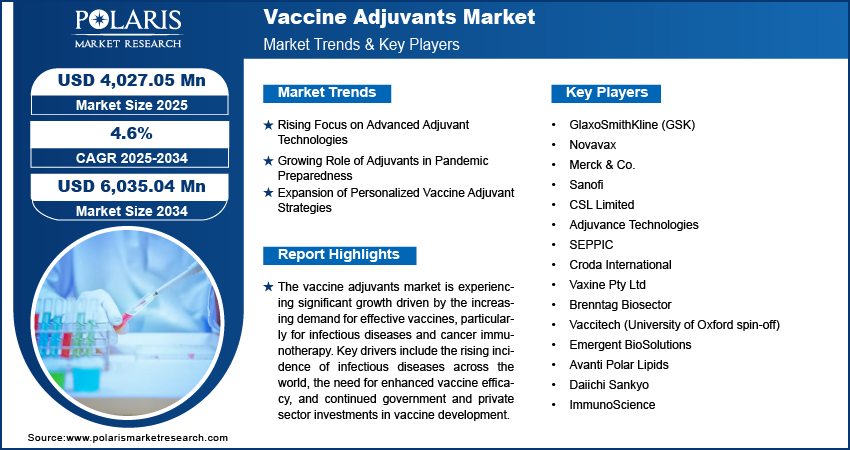

The global vaccine adjuvants market size was valued at USD 3,862.90 million in 2024. The market is projected to grow from USD 4,027.05 million in 2025 to USD 6,035.04 million by 2034, exhibiting a CAGR of 4.6% during 2025–2034. The market is driven by increasing demand for effective immunization, rising prevalence of infectious diseases, advancements in vaccine technologies, and growing global vaccination programs aimed at enhancing immune response and long-term protection, especially in vulnerable populations.

Key Insights

- The alum segment leads the market due to its extensive use in vaccines and well-estThe alum segment leads the market due to its extensive use in vaccines and well-established safety and efficacy in enhancing immune responses.

- The intramuscular route dominates vaccine delivery, supported by its effectiveness, ease of administration, and consistent absorption profile.

- Infectious diseases represent the largest application segment, driven by global demand for vaccines targeting widespread and emerging infections.

- The commercial application segment holds a larger share, fueled by widespread use of adjuvants in approved, globally distributed vaccine products.

- North America leads the market, supported by strong healthcare infrastructure, high R&D investment, and rapid adoption of advanced vaccine technologies.

Industry Dynamics

- Rising demand for vaccine adjuvants is driven by the need for enhanced immune responses, growing vaccination programs, and increasing prevalence of infectious and chronic diseases globally.

- Market expansion is supported by advancements in adjuvant formulation, rising R&D investments, and the development of novel vaccines for emerging and re-emerging diseases.

- Challenges such as stringent regulatory requirements, potential side effects, and high development costs may hinder rapid adoption in certain regions.

- Innovations in nanoparticle-based adjuvants, combination adjuvant systems, and personalized vaccine technologies are improving efficacy, safety, and long-term immune protection.

Market Statistics

- 2024 Market Size: USD 3,862.90 million

- 2034 Projected Market Size: USD 6,035.04 million

- CAGR (2025-2034): 4.6%

- North America: Largest market in 2024

AI Impact on Vaccine Adjuvants Market

- AI analyzes immunological and clinical trial data to identify optimal adjuvant candidates, improving vaccine formulation and response prediction.

- Integration of AI accelerates vaccine development by modeling immune responses and optimizing adjuvant-antigen combinations for better efficacy.

- AI-powered tools streamline R&D workflows, reducing development time and enhancing decision-making in adjuvant screening and testing.

- AI enhances production efficiency by predicting demand, optimizing raw material use, and ensuring consistent quality in vaccine adjuvant manufacturing.

To Understand More About this Research: Request a Free Sample Report

The global vaccine adjuvants market refers to the segment of the pharmaceutical and biotechnology industry focused on substances added to vaccines to enhance their immunogenicity. These adjuvants improve the body's immune response, making vaccines more effective. Key drivers of this market include the rising prevalence of infectious diseases, increasing government and private sector investments in vaccine research, and advancements in biotechnology.

Market Dynamics

Rising Focus on Advanced Adjuvant Technologies

The market is witnessing increased emphasis on developing advanced adjuvant technologies to address the limitations of traditional options such as aluminum salts. Innovations include saponin-based adjuvants, liposome-based delivery systems, and oil-in-water emulsions. These newer technologies provide enhanced immunogenicity while minimizing side effects. For example, adjuvants such as AS03 and MF59 are increasingly used in vaccines due to their ability to stimulate a broader immune response. Hence, the increasing focus on advanced adjuvant technologies drives the market development.

Growing Role of Adjuvants in Pandemic Preparedness

The demand for vaccine adjuvants surged significantly during the COVID-19 pandemic, underscoring their critical role in global health emergencies. Adjuvants have been integral in ensuring vaccine effectiveness across diverse population groups and in stretching limited antigen supplies. For instance, the WHO reported that adjuvants such as AS03 were used to boost immune responses in COVID-19 vaccines deployed during the pandemic. This trend is expected to continue as governments and health organizations prioritize preparedness for emerging infectious diseases. Additionally, the increasing frequency of zoonotic outbreaks highlights the need for robust adjuvant systems in vaccine development. Therefore, the emerging role of adjuvants in outbreak preparedness boosts the market growth.

Expansion of Personalized Vaccine Adjuvant Strategies

A growing trend is the adoption of personalized vaccine approaches that leverage adjuvants tailored to specific populations or conditions. For example, research into vaccines for elderly individuals often incorporates adjuvants that address age-related immune decline. Similarly, cancer immunotherapy vaccines utilize adjuvants to enhance the immune system's ability to target tumors. A 2023 publication in Nature Reviews Drug Discovery noted a significant rise in clinical trials using patient-specific adjuvants, reflecting this personalized focus. This trend is likely to advance further as biotechnology enables greater precision in vaccine design, which is expected to propel the market expansion during the forecast period.

Segment Insights

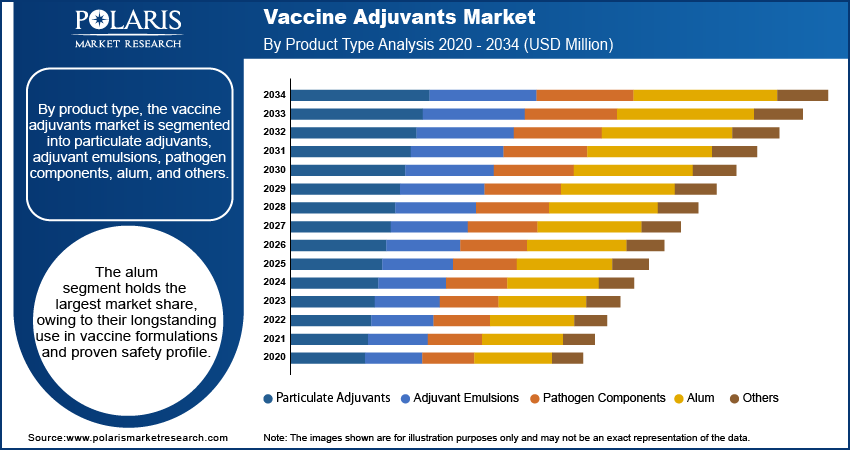

By Product Type-Based Insights

By product type, the vaccine adjuvants market is segmented into particulate adjuvants, adjuvant emulsions, pathogen components, alum, and others. The alum segment holds the largest market share, owing to their longstanding use in vaccine formulations and proven safety profile. Alum adjuvants are widely employed in vaccines for diseases such as hepatitis and diphtheria, benefiting from their ease of production and established regulatory acceptance. Their stability and cost-effectiveness further contribute to their dominance in the market, particularly in developing regions where affordability is a key consideration.

The adjuvant emulsions segment is registering the highest growth rate due to their advanced mechanisms in enhancing immunogenicity and increasing application in pandemic and seasonal vaccines. Emulsions such as MF59 and AS03 have gained prominence for their efficacy in influenza and COVID-19 vaccines, driving demand in developed regions with robust healthcare infrastructure. The rising adoption of these adjuvants in next-generation vaccines and their ability to stimulate both humoral and cellular immune responses underscore their expanding role in addressing global vaccination needs. Other product types, including particulate adjuvants and pathogen components, are also gaining traction in niche areas such as cancer immunotherapy and emerging infectious diseases.

By Route of Administration-Based Insights

The vaccine adjuvants market, by route of administration, is segmented into intramuscular route, subcutaneous route, and other. The intramuscular route segment holds the largest market share due to its widespread adoption in vaccine delivery. This route is preferred for its ability to provide consistent immune responses, its compatibility with a wide range of adjuvants, and established safety profiles across diverse demographic groups. Vaccines for diseases such as influenza, COVID-19, and human papillomavirus (HPV) are predominantly administered intramuscularly, supported by healthcare guidelines and routine immunization programs worldwide.

The subcutaneous route segment is experiencing the highest growth rate, driven by its emerging use in therapeutic vaccines and specialized immunization strategies. This route is particularly valued in cases where gradual antigen release and localized immune responses are required, such as in cancer immunotherapy and allergen-specific immunizations. Additionally, advancements in delivery technologies, including microneedle systems and depot formulations, are enhancing the feasibility and efficacy of subcutaneous administration, further propelling its growth in the market.

By Disease Type-Based Insights

The vaccine adjuvants market, by disease type, is segmented into infectious diseases, cancer, and other categories. The infectious diseases segment holds the largest market share due to the high demand for vaccines addressing prevalent and emerging infectious diseases globally. Vaccine adjuvants play a crucial role in enhancing the efficacy of vaccines for diseases such as influenza, hepatitis, and COVID-19, which have widespread vaccination programs supported by government initiatives and international health organizations. The continued development of vaccines for seasonal and pandemic-related diseases contributes to the dominance of the infectious diseases segment in the market.

The cancer segment is registering the highest growth rate, primarily driven by advancements in immunotherapy and the increasing number of clinical trials for therapeutic cancer vaccines. Adjuvants in cancer vaccines help stimulate a more robust immune response against tumor cells, and their growing use in personalized cancer treatments is propelling this segment. The increasing understanding of the immune system's role in cancer treatment, combined with significant investments in oncology research, further supports the accelerated development of cancer vaccines with adjuvants. This trend is expected to continue as more targeted and effective cancer immunotherapies emerge.

By Application-Based Insights

By application, the vaccine adjuvants market is bifurcated into research applications and commercial applications. The commercial application segment holds a larger market share, driven by the broad use of adjuvants in the development of licensed vaccines that are distributed globally. The significant demand for vaccines targeting various infectious diseases, such as influenza, hepatitis, and COVID-19, has made commercial applications a critical driver of market growth. Government procurement, immunization programs, and private healthcare investments continue to fuel the commercial adoption of adjuvants, further solidifying the segment's dominance in the market.

The research application segment is registering a higher growth rate, particularly due to the increasing number of clinical trials and ongoing research into next-generation vaccines. As new adjuvant technologies emerge, their potential applications in therapeutic vaccines, such as cancer and autoimmune disease treatments, are being rigorously explored. Moreover, advancements in biotechnology are driving innovation in vaccine adjuvants for hyper personalized medicine and specialized treatments. Research institutions, biotech firms, and pharmaceutical companies are investing heavily in the development of novel adjuvants, ensuring this segment experiences significant growth in the coming years.

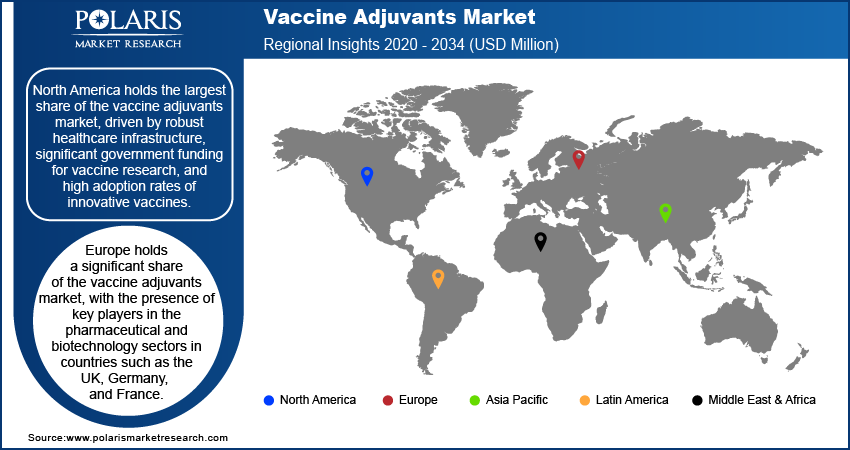

Regional Insights

By region, the study covers North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of the market, driven by robust healthcare infrastructure, significant government funding for vaccine research, and high adoption rates of innovative vaccines. The US is a key contributor to this growth due to its leadership in pharmaceutical and biotechnology research, with major pharmaceutical companies and research institutions actively developing and manufacturing adjuvanted vaccines. The region's strong regulatory framework, combined with high healthcare expenditure and advanced vaccine development programs, including COVID-19 and influenza vaccines, further strengthens its dominance. Additionally, the increasing demand for personalized medicine and cancer immunotherapy vaccines in North America is also driving the vaccine adjuvants market expansion in the region.

Europe holds a significant share of the market, owing to the presence of key players in the pharmaceutical and biotechnology sectors in countries such as the UK, Germany, and France. The region's strong healthcare infrastructure, coupled with robust public health programs, drives the demand for vaccines, especially for infectious diseases such as influenza, hepatitis, and COVID-19. European Union regulations also ensure the safe and effective use of vaccine adjuvants, which supports market growth. Additionally, the region’s focus on advanced research in immunotherapy and personalized vaccines is contributing to the increased adoption of adjuvants in cancer treatments and other therapeutic vaccines.

The Asia Pacific vaccine adjuvants market is experiencing rapid growth, fueled by the expanding healthcare needs of large populations and increasing government investments in vaccine development. Countries such as China, India, and Japan are major contributors to this growth, driven by the rising incidence of infectious diseases and the increasing adoption of immunization programs. The region's growing biotechnology sector is also facilitating the development and manufacturing of novel adjuvants, particularly for emerging diseases. Additionally, the expansion of public-private partnerships for vaccine research and development, alongside the rising demand for vaccines in both developed and developing markets, further accelerates market growth in Asia Pacific.

Key Players and Competitive Insights

Key players in the market such as GlaxoSmithKline (GSK), Novavax, Merck & Co., Sanofi, and CSL Limited are actively involved in the development, production, and distribution of adjuvanted vaccines. Other notable players include Adjuvance Technologies, SEPPIC, Croda International, Vaxine Pty Ltd, and Brenntag Biosector, which specialize in adjuvant technologies and supply adjuvants to vaccine manufacturers. Additionally, companies such as the University of Oxford spin-off Vaccitech, Emergent BioSolutions, and Avanti Polar Lipids contribute to the market growth. A few players, such as the Japanese pharmaceutical company Daiichi Sankyo, have a strong focus on therapeutic vaccines, which use adjuvants to enhance immune responses in areas such as cancer treatment. These companies often collaborate with governmental and private sectors to advance vaccine technologies and expand their market presence.

The competitive landscape of the market is shaped by large pharmaceutical companies and specialized biotech firms, each offering a range of adjuvant solutions. Large companies such as GSK, Merck, and Sanofi invest heavily in research and development, and they leverage their global distribution networks to bring adjuvanted vaccines to market. Their established partnerships with governments and healthcare organizations allow them to access large markets for their vaccine products. In contrast, smaller firms, such as Adjuvance Technologies and Vaxine Pty Ltd, are focusing on innovative adjuvant technologies and niche vaccine segments, which are gaining attention in therapeutic vaccine research and cancer immunotherapy.

The market is becoming increasingly competitive, with players differentiating themselves through technological innovation and strategic collaborations. Companies are investing in the development of novel adjuvants that enhance the immune response and improve vaccine efficacy while minimizing side effects. As the demand for vaccines targeting new infectious diseases and personalized medicine grows, these companies are focusing on creating more efficient and tailored solutions. Additionally, regulatory hurdles and the need for consistent product quality and safety are challenges faced by all players, requiring robust manufacturing processes and compliance with global health standards to maintain a competitive edge in the market.

GlaxoSmithKline (GSK) is a well-established player in the market, with a focus on the development and production of vaccines for infectious diseases, including influenza, hepatitis, and COVID-19. GSK's adjuvant platform, AS03, has been used in vaccines such as the H1N1 influenza vaccine and COVID-19 vaccines. The company emphasizes research and innovation in vaccine development, leveraging its strong global presence and extensive expertise in immunology.

Merck & Co. is another major player, actively involved in the market. The company has developed several vaccines for diseases such as human papillomavirus (HPV), hepatitis, and pneumonia. Merck is focused on expanding its vaccine offerings and improving vaccine effectiveness, with adjuvants playing a key role in these efforts.

List of Key Companies

- GlaxoSmithKline (GSK)

- Novavax

- Merck & Co.

- Sanofi

- CSL Limited

- Adjuvance Technologies

- SEPPIC

- Croda International

- Vaxine Pty Ltd

- Brenntag Biosector

- Vaccitech (University of Oxford spin-off)

- Emergent BioSolutions

- Avanti Polar Lipids

- Daiichi Sankyo

- ImmunoScience

Industry Developments

- In May 2024, Merck announced that it was expanding its vaccine pipeline, particularly in cancer immunotherapy, where it is exploring new adjuvant-based formulations for personalized treatments. This move underscores Merck's commitment to advancing vaccine technology across both infectious diseases and therapeutic applications.

- In December 2024, GSK and Zhifei extended their strategic collaboration to commercialize Shingrix, GSK's shingles vaccine, in China through 2034 and explore a potential partnership on RSV vaccines, benefiting over 500 million people.

- June 2023: Novavax and the Gates Foundation agreed to work together to create TB and malaria vaccines. The Gates Foundation also announced its plans to conduct preclinical studies using Novavax's vaccine adjuvant Matrix-M.

- May 2023: Croda and Botanical Solution formed a strategic alliance to facilitate the manufacturing of the sustainable vaccine adjuvant QS-21.

Market Segmentation

By Product Type Outlook

- Particulate Adjuvants

- Adjuvant Emulsions

- Pathogen Components

- Alum

- Others

By Route of Administration Outlook

- Intramuscular Route

- Subcutaneous Route

- Others

By Disease Type Outlook

- Infectious Diseases

- Cancer

- Others

By Application Outlook

- Research Application

- Commercial Application

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3,862.90 million |

|

Market Size Value in 2025 |

USD 4,027.05 million |

|

Revenue Forecast by 2034 |

USD 6,035.04 million |

|

CAGR |

4.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The vaccine adjuvants market has been segmented on the basis of product type, route of administration, disease type, and application. Moreover, the study provides the reader with a detailed understanding of the different segments at the global and regional levels.

Growth/Marketing Strategy

The vaccine adjuvants market growth and marketing strategies focus on innovation, strategic partnerships, and expanding product portfolios. Companies are investing heavily in research and development to create novel adjuvants that enhance vaccine efficacy and broaden their applications, particularly in emerging infectious diseases and cancer immunotherapy. Collaborations with governments, healthcare organizations, and research institutions are crucial for gaining access to large markets and securing funding for vaccine development. Additionally, players are working on improving manufacturing capabilities to meet increasing global vaccine demand and addressing regional healthcare needs through tailored marketing strategies.

FAQ's

The market size was valued at USD 3,862.90 million in 2024 and is projected to grow to USD 6,035.04 million by 2034.

The global market is projected to register a CAGR of 4.6% during the forecast period

North America had the largest global market share in 2024.

A few key players in the vaccine adjuvants market such as GlaxoSmithKline (GSK), Novavax, Merck & Co., Sanofi, and CSL Limited are actively involved in the development, production, and distribution of adjuvanted vaccines. Other notable players include Adjuvance Technologies, SEPPIC, Croda International, Vaxine Pty Ltd, and Brenntag Biosector, which specialize in adjuvant technologies and supply adjuvants to vaccine manufacturers.

The alum segment accounted for the largest share of the global market in 2024.

The intramuscular route segment accounted for the largest share of the global market in 2024.

Vaccine adjuvants are substances added to vaccines to enhance the body's immune response to the vaccine's active ingredient (antigen). They help improve the effectiveness of vaccines by stimulating the immune system to recognize and respond more efficiently to the pathogen, thereby providing stronger and longer-lasting protection. Adjuvants are particularly useful in vaccines with weaker immune responses or when limited amounts of the antigen are available. A few common types of adjuvants are aluminum salts, oil-based emulsions, and liposomes, each with specific mechanisms to boost immune reactions.

A few key vaccine adjuvants market trends are described below: Development of Next-Generation Adjuvants: Increased focus on creating adjuvants with improved safety profiles and enhanced immune responses, such as saponin-based and liposome-based adjuvants. Rising Use in Pandemic and Infectious Disease Vaccines: The ongoing development of vaccines for emerging infectious diseases such as COVID-19 and influenza, with adjuvants playing a critical role in vaccine efficacy. Personalized Medicine: Growing interest in adjuvants for cancer immunotherapy and vaccines tailored to specific patient populations, especially in oncology and autoimmune diseases. Increased Research Investment: Governments and private sector investments in adjuvant-related research, particularly in response to global health emergencies and the need for faster vaccine development.

A new company entering the vaccine adjuvants market must focus on developing innovative adjuvants that offer enhanced safety, efficacy, and versatility, particularly for emerging infectious diseases and cancer immunotherapy. Investing in research to create next-generation adjuvants that improve immune responses with fewer side effects could provide a competitive edge. Additionally, focusing on partnerships with research institutions and vaccine manufacturers can help establish a strong market presence. Leveraging advancements in biotechnology, such as personalized vaccines and targeted adjuvant formulations, could also offer significant growth opportunities. Further, ensuring compliance with global regulatory standards and emphasizing cost-effective production methods will be crucial for success.

Companies manufacturing, distributing, or purchasing vaccine adjuvants and related products, and other consulting firms must buy the report.