V2X Cybersecurity Market Share, Size, Trends & Industry Analysis Report

By Connectivity (DSRC and Cellular); By Unit Type; By Communication; By Vehicle Type; and By Region; Segment Forecast, 2025 - 2034

- Published Date:Jun-2025

- Pages: 118

- Format: PDF

- Report ID: PM3433

- Base Year: 2024

- Historical Data: 2020-2023

V2X Cybersecurity Market Overview

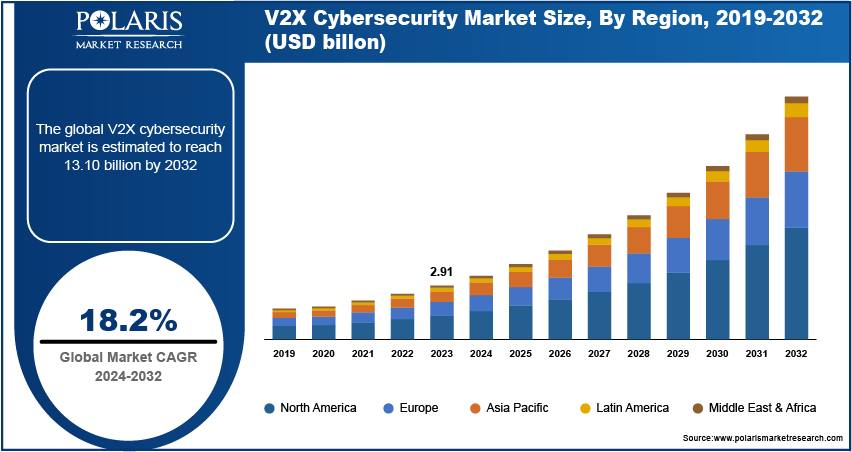

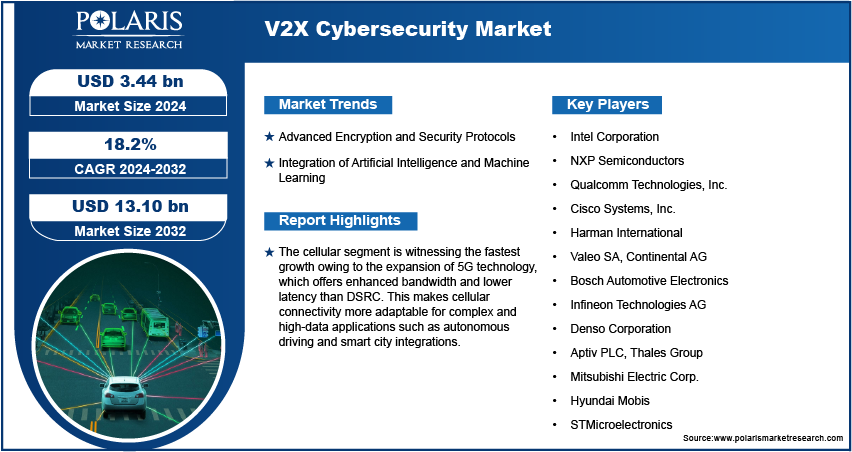

The global V2X Cybersecurity Market was valued at USD 2.65 billion in 2024 and is expected to grow at a CAGR of 18.20% from 2025 to 2034. Rapid development of connected vehicles and data security concerns are key growth enablers.

V2X Cybersecurity refers to the protection measures and technologies designed to safeguard the communications and data exchanged between vehicles and their external environments. The global V2X (Vehicle-to-Everything) cybersecurity market growth is attributed to the increasing adoption of connected and autonomous vehicles that are highly susceptible to cyber threats. Other key drivers are the rising adoption of vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication technologies, necessitating robust security measures to protect sensitive data and ensure safe vehicle operation. Future trends that would be shaping the market are the growing emphasis on advanced encryption technologies, integration of AI and machine learning (ML) for threat detection and response, and regulatory developments aimed at enhancing automotive cybersecurity standards. As the automotive industry continues to evolve toward greater connectivity, the demand for comprehensive V2X cybersecurity solutions is expected to rise to safeguard against evolving cyber threats and maintain consumer trust.

To Understand More About this Research: Request a Free Sample Report

V2X Cybersecurity Market Trends

Advanced Encryption and Security Protocols

As connected and autonomous vehicles become prevalent, the demand for advanced encryption and security protocols is increasing significantly. Vehicles equipped with V2X communication systems transmit and receive vast amounts of data, including sensitive information about vehicle location and driving patterns. To safeguard this data from potential cyber threats, automotive manufacturers and cybersecurity providers are investing heavily in robust encryption methods and sophisticated security protocols. These technologies are designed to ensure the integrity and confidentiality of data transmissions, preventing unauthorized access and manipulation. As the complexity of vehicle communication systems evolves, encryption and security protocols are continuously being enhanced to address new vulnerabilities and provide a higher level of protection.

Integration of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) is revolutionizing V2X cybersecurity by improving threat detection and response capabilities. AI and ML algorithms can analyze vast amounts of data in real time, identifying patterns and anomalies that might indicate potential security breaches. This proactive approach enables faster detection of threats and more effective response strategies, reducing the risk of cyberattacks on vehicle communication systems. Additionally, AI-driven systems can adapt and evolve in response to emerging threats, providing a dynamic and resilient defense mechanism. As these technologies advance, their application in V2X cybersecurity is expected to grow to enhance the overall security of connected and autonomous vehicles.

Evolving Regulatory Standards and Compliance Requirements

Governments and regulatory bodies are establishing stringent guidelines and standards to address the cybersecurity challenges associated with connected vehicles. These regulations often mandate specific security measures and compliance protocols that automotive manufacturers must follow to ensure the safety and security of their V2X systems. The implementation of these standards helps in mitigating cybersecurity risks and drives the development and adoption of advanced security solutions. As regulatory frameworks continue to evolve, they will play a crucial role in shaping the future of V2X cybersecurity, promoting innovation while ensuring the protection of vehicle communication networks. The V2X cybersecurity market is also influenced by the evolving regulatory landscape and increasing compliance requirements.

V2X Cybersecurity Market Segment Insights

V2X Cybersecurity Market – Connectivity Insights

The V2X cybersecurity market, based on connectivity, is bifurcated into DSRC and cellular. Dedicated Short-Range Communications (DSRC), a short-range communication protocol, has been traditionally dominant due to its low latency and high reliability that are crucial for real-time vehicle communication and safety applications. However, cellular connectivity, particularly with advancements in 4G LTE and the emerging 5G networks, is increasingly gaining traction. This shift is driven by cellular connectivity's broader range, higher data transfer rates, and the ability to integrate with existing mobile networks, making it highly suitable for supporting a wide array of V2X applications beyond immediate vehicle-to-vehicle interactions.

The cellular segment is witnessing the fastest growth owing to the expansion of 5G technology, which offers enhanced bandwidth and lower latency than DSRC. This makes cellular connectivity more adaptable for complex and high-data applications such as autonomous driving and smart city integrations. As the automotive industry continues to embrace more advanced connectivity solutions and broader network capabilities, the cellular segment is poised to dominate the market, addressing the evolving demands of connected and autonomous vehicles more effectively than DSRC.

V2X Cybersecurity Market – Unit Type Insights

The V2X cybersecurity market, by unit types, is primarily segmented into on-board units (OBUs) and roadside units (RSUs). OBUs, installed within vehicles, are crucial for enabling communication between vehicles and their surroundings, ensuring real-time data exchange and safety measures. The on-board units (OBUs) segment dominates the market, driven by the widespread adoption of connected and autonomous vehicles that rely on OBUs for secure communication and data processing. These units are essential for vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) interactions, making them a central component in the V2X ecosystem.

The roadside unit (RSU) segment is experiencing the fastest growth. RSUs are deployed at strategic locations such as traffic lights and road signs to facilitate communication between vehicles and infrastructure, enhancing overall traffic management and safety. The growth in RSUs is fueled by the increasing development of smart city projects and the rising need for improved traffic management systems. As cities invest more in infrastructure to support connected vehicle technologies, the deployment of RSUs is expanding rapidly, complementing the capabilities of OBUs and driving innovation in the V2X cybersecurity market.

V2X Cybersecurity Market – Communication Insights

In terms of communication, the V2X cybersecurity market is segmented into Vehicle-to-Vehicle (V2V), Vehicle-to-Infrastructure (V2I), Vehicle-to-Pedestrian (V2P), and Vehicle-to-Cloud (V2C). The Vehicle-to-Vehicle (V2V) is the dominant segment due to its fundamental role in enhancing vehicle safety and coordination by enabling direct communication between vehicles. V2V systems are integral to prevent collisions, manage traffic flow, and ensure real-time data exchange, which makes them a central focus in the development of secure V2X systems.

The Vehicle-to-Cloud (V2C) is the highest-growing segment, driven by the increasing demand for advanced data analytics and remote diagnostics. V2C communication allows vehicles to connect to cloud-based platforms for data storage, analysis, and updates, facilitating more comprehensive insights and management of vehicle performance. This segment is expanding rapidly as automotive manufacturers and technology providers seek to leverage cloud capabilities for enhanced functionality, personalized services, and over-the-air updates. The growth in V2C is indicative of a broader trend toward integrating cloud technologies into connected vehicles, complementing the established V2V and V2I communications and reflecting a shift toward more data-driven and connected automotive ecosystems.

V2X Cybersecurity Market – Vehicle Type Insights

The V2X cybersecurity market, based on vehicle types, is segmented into commercial vehicles and passenger cars. The passenger cars segment dominates the market, driven by the rapid adoption of advanced connectivity features and autonomous driving technologies. The passenger cars segment leads the V2X cybersecurity market, primarily due to the rapid adoption of advanced connectivity features and autonomous driving technologies. The large number of passenger cars on the road and their growing integration with vehicle-to-everything (V2X) systems—enhancing safety, navigation, and entertainment—significantly contribute to this sector's dominant market share. As passenger cars increasingly incorporate various V2X technologies, they become a focal point for cybersecurity solutions. These solutions are essential for safeguarding consumer data and ensuring vehicle safety, underscoring the critical need for robust cybersecurity measures in the automotive industry.

The commercial vehicle segment is experiencing the highest growth rate. This surge is attributed to the rising emphasis on fleet management, logistics, and operational efficiency. Commercial vehicles, including trucks and buses, are increasingly incorporating V2X technologies to optimize routes, improve safety, and enable real-time data exchange for fleet management. As businesses and logistics companies seek to enhance operational efficiency and safety through advanced connectivity, the demand for V2X cybersecurity solutions in the commercial vehicle sector is rapidly increasing, highlighting a growing trend towards securing commercial transportation networks.

V2X Cybersecurity Market Regional Insights

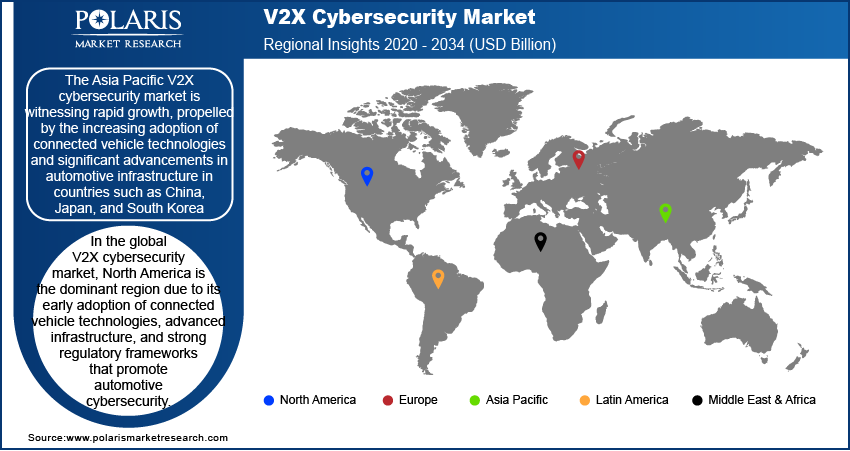

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In the global V2X cybersecurity market, North America is the dominant region due to its early adoption of connected vehicle technologies, advanced infrastructure, and strong regulatory frameworks that promote automotive cybersecurity. The presence of major automotive manufacturers and technology providers, coupled with substantial investments in smart city initiatives and autonomous driving research, further reinforces North America's leading position. Additionally, the region's robust focus on developing and implementing comprehensive cybersecurity standards for V2X communication systems supports its dominance in the market. While Europe and Asia Pacific are significant players with growing investments in V2X technologies, North America's combination of technological leadership and regulatory support has solidified its top position in the V2X cybersecurity landscape.

Europe is a major region in the global V2X cybersecurity market, driven by its stringent regulatory environment and advanced automotive industry. The European Union has implemented comprehensive regulations and standards to enhance vehicle cybersecurity and support the development of connected and autonomous vehicle technologies. The rising focus of the region on creating smart transportation infrastructure and integrating V2X technologies into its urban environments boosts market growth. Additionally, the presence of leading automotive manufacturers and technology companies in countries such as Germany, France, and the UK contributes to the region's strong position in the market. The push toward greener and smarter mobility solutions also fuels investments in V2X cybersecurity across Europe.

The Asia Pacific V2X cybersecurity market is witnessing rapid growth, propelled by the increasing adoption of connected vehicle technologies and significant advancements in automotive infrastructure in countries such as China, Japan, and South Korea. China, in particular, is investing heavily in smart city projects and autonomous vehicle development, driving demand for robust V2X cybersecurity solutions. The region's growing automotive sector and the rising technological innovation and government support for enhancing vehicle safety and connectivity contribute to its expanding market presence. As Asia Pacific continues to develop its automotive industry and infrastructure, the need for advanced V2X cybersecurity measures is expected to grow substantially.

V2X Cybersecurity Market – Key Players and Competitive Insights

Intel Corporation; NXP Semiconductors; Qualcomm Technologies, Inc.; Cisco Systems, Inc.; and Harman International are a few key players in the V2X cybersecurity market. Other notable companies are Valeo SA, Bosch Automotive Electronics, Infineon Technologies AG, and Continental AG. Additionally, firms such as Denso Corporation, Aptiv PLC, Thales Group, Mitsubishi Electric Corporation, and Hyundai Mobis are actively involved in this sector. These companies are at the forefront of developing and providing cybersecurity solutions tailored for V2X communications, focusing on securing vehicle-to-vehicle (V2V), vehicle-to-infrastructure (V2I), and other communication channels.

The competitive landscape of the V2X cybersecurity market is characterized by significant collaboration and innovation. Major players are leveraging their technological expertise and extensive research and development capabilities to enhance their product offerings. Companies such as Intel and NXP Semiconductors are majorly providing integrated solutions that address various aspects of V2X cybersecurity, including encryption and real-time threat detection. The competition is also intensified by the ongoing advancements in automotive technologies and the increasing focus on regulatory compliance, which drives companies to upgrade their cybersecurity solutions continuously.

Insights reveal that while established companies dominate the market, there is also a growing emphasis on partnerships and strategic alliances. Collaboration between technology providers and automotive manufacturers is crucial for developing effective V2X cybersecurity solutions that can address emerging threats. Additionally, the market is reporting increased investments in research and development to stay ahead of evolving cyber threats and regulatory requirements. As the automotive industry progresses toward connected and autonomous vehicles, the demand for advanced and adaptive cybersecurity solutions is expected to drive further innovation and competition among key players.

Intel Corporation is a global player in the V2X cybersecurity market, known for its leadership in semiconductor and computing technologies. The company focuses on providing integrated solutions for automotive cybersecurity, including advanced encryption and real-time threat detection systems designed to protect V2X communication networks. Intel’s extensive expertise in hardware and software integration positions it as a key player in developing secure and scalable V2X solutions.

NXP Semiconductors is another global player in the V2X cybersecurity market, renowned for its advanced semiconductor solutions tailored for automotive applications. The company provides a range of cybersecurity solutions aimed at securing V2X communication channels, including microcontrollers and secure elements designed to protect data integrity and vehicle safety.

Key Companies in V2X Cybersecurity Market

- Intel Corporation

- NXP Semiconductors

- Qualcomm Technologies, Inc.

- Cisco Systems, Inc.

- Harman International

- Valeo SA

- Bosch Automotive Electronics

- Infineon Technologies AG

- Continental AG

- Denso Corporation

- Aptiv PLC

- Thales Group

- Mitsubishi Electric Corp.

- Hyundai Mobis

- STMicroelectronics

V2X Cybersecurity Industry Developments

- In January 2024, AUTOCRYPT and Cohda Wireless signed a Memorandum of Understanding (MOU) at CES, marking the start of their partnership to create a secure Vehicle-to-Everything (V2X) solution.

- In August 2023, NXP Semiconductors unveiled its new V2X communication platform, featuring enhanced security protocols to safeguard against emerging cyber threats. This platform leverages NXP's expertise in secure connectivity and automotive technologies, reflecting the company's ongoing efforts to lead in V2X cybersecurity and support the development of safe and reliable connected vehicle systems.

- In July 2023, Intel announced the expansion of its automotive business with the launch of the Intel Atom P-series processors. These processors are designed to enhance vehicle safety and connectivity, offering improved security features for V2X communications. This move underscores Intel's commitment to advancing automotive cybersecurity and addressing the growing needs of connected and autonomous vehicles.

V2X Cybersecurity Market Segmentation

V2X Cybersecurity Market – Connectivity Outlook

- DSRC

- Cellular

V2X Cybersecurity Market – Unit Type Outlook

- On-Board Unit (OBU)

- Roadside Unit (RSU)

V2X Cybersecurity Market – Communication Outlook

- Vehicle-to-Vehicle (V2V)

- Vehicle-to-Infrastructure (V2I)

- Vehicle-to-Pedestrian (V2P)

- Vehicle-to-Cloud (V2C)

V2X Cybersecurity Market – Vehicle Type Outlook

- Commercial Vehicle

- Passenger Car

V2X Cybersecurity Market – Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

V2X Cybersecurity Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.65 billion |

|

Market size value in 2025 |

USD 3.13 billion |

|

Revenue forecast in 2034 |

USD 13.86 billion |

|

CAGR |

18.20% from 2025 to 2034 |

|

Base year |

2024 |

|

Historical data |

2020–2023 |

|

Forecast period |

2025–2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive landscape |

|

|

Report format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The V2X cybersecurity market has been broadly segmented on the basis of connectivity, unit type, communication, and vehicle type. Moreover, the study provides the reader with a detailed understanding of the different segments at the global and regional levels.

Growth/Marketing Strategy

The growth strategy for the V2X cybersecurity market focuses on expanding product offerings and enhancing technological capabilities to address evolving cyber threats. Key approaches are investing in advanced research and development to stay ahead of emerging vulnerabilities, forming strategic partnerships with automotive manufacturers and technology providers, and capitalizing on regulatory trends that demand higher cybersecurity standards. Companies are also focusing on geographic expansion into emerging markets with rising automotive connectivity and leveraging innovative solutions such as AI-driven threat detection and real-time data protection to attract a broader customer base and strengthen their market presence.

FAQ's

The global V2X cybersecurity market size was valued at USD 2.65 billion in 2024 and is projected to grow to USD 13.86 billion by 2034.

The global market is projected to register a CAGR of 18.20% during 2024–2034.

North America held the largest market share in 2024.

A few key players in the V2X cybersecurity market are Intel Corporation; NXP Semiconductors; Qualcomm Technologies, Inc.; Cisco Systems, Inc.; and Harman International. Other notable companies are Valeo SA, Bosch Automotive Electronics, Infineon Technologies AG, and Continental AG. Additionally, firms such as Denso Corporation, Aptiv PLC, Thales Group, Mitsubishi Electric Corporation, and Hyundai Mobis are actively involved in this market.

The DSRC segment dominated the market in 2024.

The on-board units segment held a larger share of the global market.

V2X cybersecurity refers to the protection of vehicle-to-everything (V2X) communication systems from cyber threats. V2X technology enables vehicles to communicate with various elements of their environment, including other vehicles (V2V), infrastructure (V2I), pedestrians (V2P), and cloud-based systems (V2C). This communication is crucial for enhancing road safety, traffic management, and enabling autonomous driving. In this context, cybersecurity focuses on safeguarding these communications from unauthorized access, data breaches, and malicious attacks.

A few key trends observed in this market are described below: Integration of Artificial Intelligence and Machine Learning: AI and ML technologies are being increasingly used for real-time threat detection and adaptive security measures, enhancing the ability to identify and respond to emerging cyber threats. Advanced Encryption and Security Protocols: There is a growing emphasis on developing and deploying sophisticated encryption techniques and security protocols to protect data exchanged in V2X communications from unauthorized access and tampering. Evolving Regulatory Standards: Governments and regulatory bodies are establishing stringent cybersecurity regulations and standards for V2X systems to ensure robust protection and compliance in the automotive sector. Expansion of 5G Technology: The rollout of 5G networks is driving the growth of V2X cybersecurity by enabling faster, more reliable communication and expanding the scope of connected vehicle applications.

A new company entering the V2X (Vehicle-to-Everything) cybersecurity market must focus on developing advanced threat detection and mitigation solutions that are specifically tailored for real-time vehicular communication. Prioritizing AI-driven anomaly detection, blockchain-based secure data exchange, and robust encryption methods can provide a competitive edge. Additionally, the company must consider collaborating with automotive OEMs and infrastructure providers to ensure seamless integration of their cybersecurity solutions. Keeping awareness of the latest regulatory changes and complying with industry standards can also help in staying ahead of the competition.

Companies offering V2X cybersecurity and related products and solutions must buy the report.