Utility Locator Market Share, Size, Trends, Industry Analysis Report

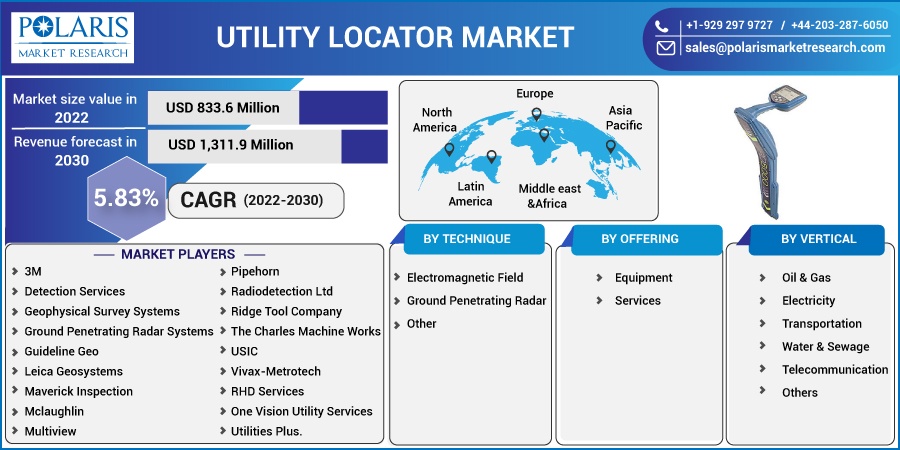

By Technique (Electromagnetic Field, Ground Penetrating Radar, Other); By Offering (Equipment, Services); By Vertical; By Region Segment Forecast, 2022 - 2030

- Published Date:Nov-2022

- Pages: 119

- Format: PDF

- Report ID: PM2745

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

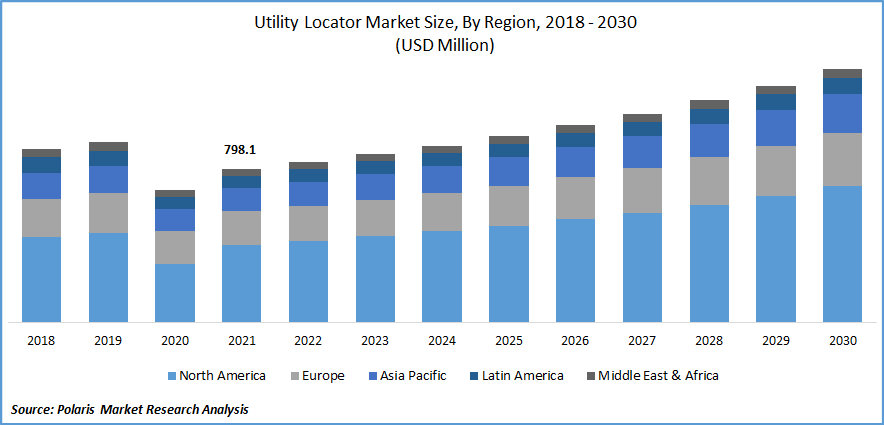

The utility locator market was valued at USD 798.1 million in 2021 and is expected to grow at a CAGR of 5.83% during the forecast period. The market is fueled by factors like the adoption of standards, the ease of laws governing utility locators, and the advantages of utility locator systems over more conventional technology.

Know more about this report: Request for sample pages

The process of identifying and labeling public utilities is handled by utility locators. It is the process that assists in the transmission of underground utilities and services by pinpointing paths of cables and other conduct that transfer utilities. Telecommunication, electricity distribution, natural gas, cable television, fiber optics, traffic lights, street lights, storm drains, water mains, and wastewater pipes are all part of it.

One of the new ideas and trends in the utility locator industry is the growing requirement for real-time examination of subsurface utilities, concrete structures, highways, and railway lines. Many methods like electromagnetic fields, ground penetrating radar, and others are used for locating.

Furthermore, many methods, equipment, and service providers have started utilizing fleet telemetry systems, GPS devices, GIS data devices, and GPR devices consisting of multiple GPR antennas, known as GPR arrays, to survey the areas more quickly by collecting several GPR profiles simultaneously and 3D images of the objects, as well as a more advanced data capture ability feature and other sensors, which is creating lucrative opportunities for the key players in coming years.

Covid-19 has negatively impacted the market due to the rules and regulations put forth by the government during the pandemic. Due to the social distancing circumstances, overall industries shut down, which led to a decline in services and equipment provided by the private key players.

Moreover, in order to deal to urgent difficulties and establish a new way of working after the pandemic, manufacturers are now concentrating on protecting their staff, operations, and supply chain.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

One of the key reasons anticipated to drive the market growth is the technological advancement in underground utility locators. For quick measurement of inaccuracies in the instance of faults in buried cables, the end-use industries prefer technologically advanced utility locators.

Additionally, the use of digital technology enables effective coordination and communication between various operating sites during the mapping and surveying process, such as penetrating radar and electromagnetic fields in utility locators. As a result, it is anticipated that the production of technically sophisticated utility locators will enhance the accuracy and precision of the surveying and mapping process. These factors are expected to boost the market’s growth.

Moreover, increasing utilization of ground penetrating radar technique for utility locations due to its significant benefit for finding both conductive and non-conductive utilities is stimulating the market’s growth. Additionally, GPR is a helpful tool that reduces the risk of accidental utility strikes.

Report Segmentation

The market is primarily segmented based on technique, offering, vertical, and region.

|

By Technique |

By Offering |

By Vertical |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Electromagnetic field techniques accounted for the largest market share

Electromagnetic field techniques acquired the largest market revenue in 2021 due to their lower cost compared to other techniques, and their suitability for locating metallic utilities are the contributing elements.

The most popular piece of equipment for detecting underground utilities is an electromagnetic field locator. A transmitter and a receiver are frequently found in electromagnetic field utility locating devices such as pipe and cable locators, electronic marker systems (EMS), e-line locators, terrain conductivity equipment, and metal detectors.

Additionally, the growing applications of this technique, such as non-destructive locating, measuring utility line depth, excavation progress monitoring, finding utility access points, accuracy, being portable, flexible, and tracing target lines, are responsible for the segment’s growth.

Services segment to grow at the highest CAGR during the forecast period

The services segment is growing at the highest CAGR during the forecast period. Rental, instruction, inspection, calibration, maintenance, and repair services are just a few of the services offered in relation to utility finding equipment. End users are encouraged to employ utility locating equipment on rent due to a utility locator's high ownership costs, accessories, and the ongoing need for innovative utility locating solutions for various applications.

For instance, one would not purchase a complete utility locator for a single use exclusively for domestic purposes. Instead, one would contact for service. Additionally, training services aid users in safe utility detection while maintaining equipment effectiveness and efficiency.

Telecommunication acquired a significant market share in 2021

Telecommunications accounted for the most significant market share in 2021 due to the increased use of utility locators to prevent communication system disruptions, the high expense of telephone line repairs, and the development of 5G technological infrastructure.

Telephone lines, TVs, fiber optic cables, and other lines are all part of telecommunications. Telecommunication lines, also known as TIP and RING, are insulated, paired copper wires used in communication systems.

North America dominated the regional market

North America dominated the utility locator regional market due to governmental efforts to avoid damage to pipelines and other utilities during the implementation of remodeling and infrastructure development. Additionally, rising government investments in transportation & infrastructure and growing demand for electricity distribution lines in a developed economy such as the US and Canada is supposed to propel the market’s growth in this region.

Asia Pacific is the fastest-growing region due to rapid infrastructure development projects and significant public and private investment in commercial, industrial, and residential buildings in this region. The government in China intends to make substantial investments in a variety of infrastructure development projects, including those involving the construction of railway and transportation infrastructure.

Competitive Insight

Some of the major players operating in the global market include 3M, Detection Services, Geophysical Survey Systems, Ground Penetrating Radar Systems, Guideline Geo, Leica Geosystems, Maverick Inspection, Mclaughlin, Multiview, on Target Utility Services, Pipehorn, Radiodetection Ltd, Ridge Tool Company, The Charles Machine Works, USIC, Vivax-Metrotech, RHD Services, One Vision Utility Services, and Utilities Plus.

Recent Developments

In April 2022, Radiodetection Ltd. launched 120CXB metallic cable analyzer TDR, the new high précised time domain reflectometer (TDR), to find cable faults quickly and easily.

Utility Locator Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 833.6 million |

|

Revenue forecast in 2030 |

USD 1,311.9 million |

|

CAGR |

5.83% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Technique, By Offering, By Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

3M, Detection Services, Geophysical Survey Systems, Ground Penetrating Radar Systems, Guideline Geo, Leica Geosystems, Maverick Inspection, Mclaughlin, Multiview, on Target Utility Services, Pipehorn, Radiodetection Ltd, Ridge Tool Company, The Charles Machine Works, USIC, Vivax-Metrotech, RHD Services, One Vision Utility Services, and Utilities Plus. |