Usage-Based Insurance for Automotive Market Size, Share, Trends, Industry Analysis Report: By Type, Technology, Vehicle (Passenger Auto and Commercial Auto), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM5448

- Base Year: 2024

- Historical Data: 2020-2023

Usage-Based Insurance for Automotive Market Overview

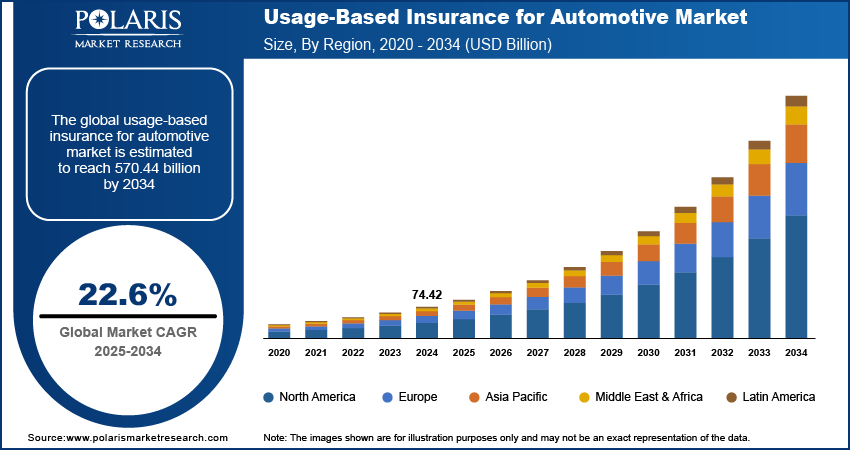

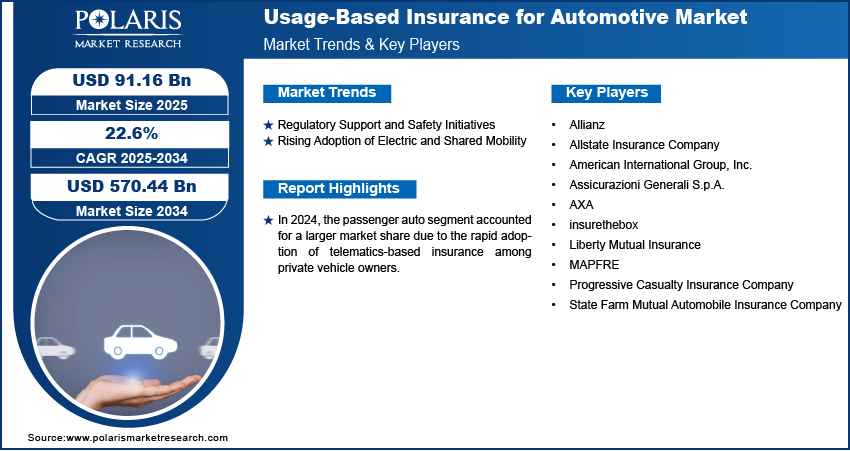

The usage-based insurance for automotive market size was valued at USD 74.42 billion in 2024 and is expected to reach USD 91.16 billion by 2025 and USD 570.44 billion by 2034, exhibiting a CAGR of 22.6% during 2025–2034.

The usage-based insurance (UBI) for automotive market focuses on insurance policies where premiums are determined based on real-time driving behavior, vehicle usage patterns, and telematics data. Unlike traditional fixed-rate insurance, UBI leverages GPS, onboard diagnostics (OBD-II), and connected vehicle technologies to assess factors such as mileage, driving speed, acceleration, braking patterns, and time of use.

The increasing integration of telematics, AI-driven analytics, and IoT in connected vehicles is enhancing insurers' ability to assess real-time driving behavior, which is significantly contributing to the usage-based insurance for automotive market growth. Moreover, consumers and businesses are increasingly seeking cost-effective insurance solutions based on actual vehicle usage, rather than traditional fixed-premium models which is further driving market demand.

To Understand More About this Research: Request a Free Sample Report

Usage-based insurance allows insurers to better assess risks, reduce fraudulent claims, and improve underwriting efficiency, driving market value and profitability. Furthermore, the adoption of app-based UBI solutions, eliminating the need for additional hardware installations, is further accelerating usage-based insurance for automotive market development.

Usage-Based Insurance for Automotive Market Dynamics

Regulatory Support and Safety Initiatives Driving Usage-Based Insurance (UBI) For Automotive Market

Governments worldwide are implementing regulatory frameworks that promote telematics adoption and data-driven insurance models. Stringent road safety initiatives and policies aimed at reducing accident-related costs are driving UBI for automotive market demand, as insurers leverage real-time driving data to assess risk more accurately. Regulatory mandates in regions such as North America and Europe are encouraging fairer premium structures and incentivizing safer driving behaviors. Additionally, government-backed programs supporting vehicle connectivity and data privacy regulations are shaping market dynamics, ensuring transparency and consumer trust. Insurers and policymakers are aligning to create a more efficient and cost-effective auto insurance ecosystem. Thus, the regulatory support and safety initiatives play a crucial role in usage-based insurance (UBI) for automotive market growth.

Rising Adoption of Electric and Shared Mobility

The increasing adoption of electric vehicles (EVs) and shared mobility services is reshaping the automotive insurance landscape, driving usage-based insurance (UBI) for automotive market expansion. According to IEA, in 2023, nearly 14 million new electric vehicles (EVs) were registered globally, bringing the total on the road to 40 million, in line with 2023. This marks a 35% year-on-year increase, with 3.5 million more EVs sold compared to 2022. Moreover, traditional insurance models struggle to accommodate the unique risk profiles of EV drivers and shared vehicle users, UBI demand is surging due to its flexible, data-driven approach. Insurers are leveraging telematics to offer customized coverage based on real-time driving behavior, optimizing UBI requirements by both providers and consumers. The shift toward mobility-as-a-service (MaaS) and pay-per-use vehicle access is further creating significant UBI for automotive market opportunities as insurers develop innovative policies tailored to evolving transportation trends.

Usage-Based Insurance for Automotive Market Segment Insights

Usage-Based Insurance for Automotive Market Assessment by Type Outlook

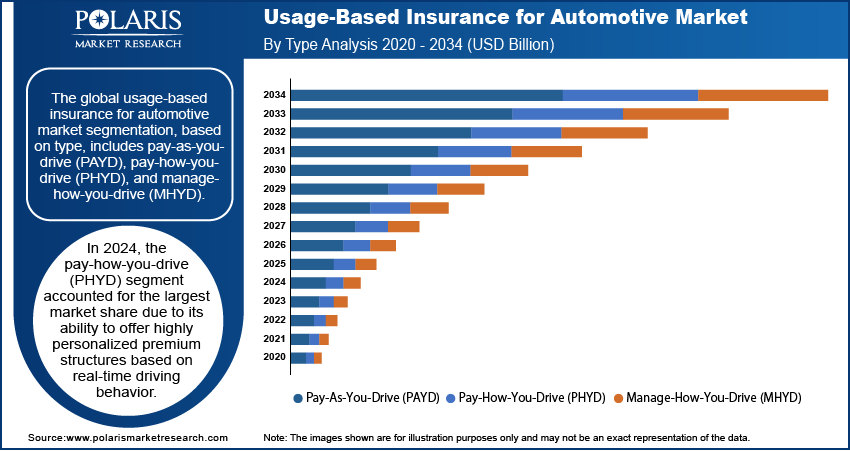

The global usage-based insurance for automotive market segmentation, based on type, includes pay-as-you-drive (PAYD), pay-how-you-drive (PHYD), and manage-how-you-drive (MHYD). In 2024, the pay-how-you-drive (PHYD) segment accounted for the largest market share due to its ability to offer highly personalized premium structures based on real-time driving behavior. Insurers are leveraging advanced telematics and AI-driven analytics to assess factors such as acceleration, braking patterns, and adherence to speed limits, allowing for risk-adjusted pricing models that appeal to safety-conscious drivers. The increasing consumer preference for fair and transparent insurance premiums, combined with regulatory support for telematics-based risk assessment, is contributing to PHYD segment expansion. Additionally, the integration of PHYD models with connected vehicle ecosystems enhances market demand, further strengthening insurer competitiveness in this evolving sector.

Usage-Based Insurance for Automotive Market Evaluation by Vehicle Outlook

The global usage-based insurance for automotive market segmentation, based on vehicle, includes passenger auto and commercial auto. In 2024, the passenger auto segment accounted for the largest market share due to the rapid adoption of telematics-based insurance among private vehicle owners. Increasing consumer demand for cost-effective and behavior-based insurance solutions, especially among urban and younger demographics, has accelerated market growth for the passenger auto segment. Automakers are also partnering with insurers to integrate telematics solutions directly into new vehicles, facilitating seamless data collection for risk assessment. Additionally, rising vehicle connectivity, advancements in AI-powered risk modeling, and the growing acceptance of pay-as-you-drive (PAYD) and pay-how-you-drive (PHYD) models are driving the passenger auto segment expansion.

Usage-Based Insurance for Automotive Market Regional Analysis

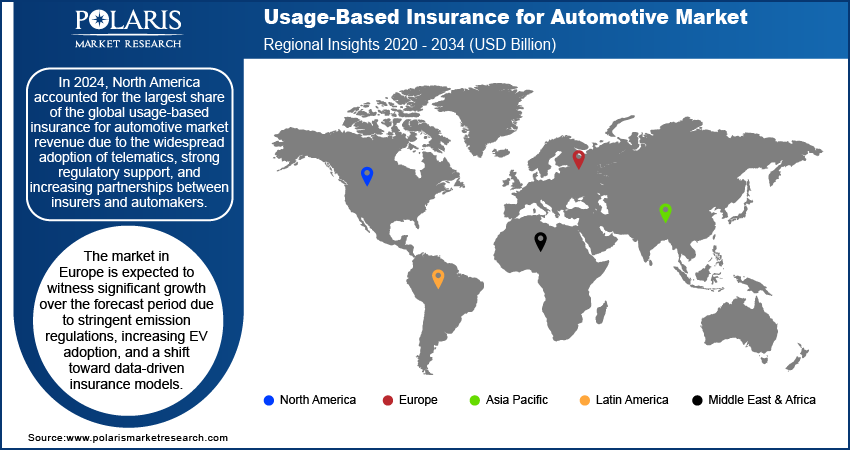

By region, the study provides usage-based insurance for automotive market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest market share due to the widespread adoption of telematics, strong regulatory support, and increasing partnerships between insurers and automakers. In November 2022, Mobilize Financial Services partnered with Accenture to launch a new usage-based insurance (UBI) offering. The region’s advanced connected vehicle infrastructure and high consumer awareness regarding cost-saving insurance models are driving UBI for automotive market expansion. Additionally, the growing integration of telematics in new vehicles, facilitated by regulatory mandates and insurer incentives, has further strengthened market demand. The presence of leading telematics providers and insurance firms investing in AI-driven risk assessment models has also contributed to market growth across the region.

The Europe usage-based insurance for automotive market is expected to witness significant growth over the forecast period due to stringent emission regulations, increasing EV adoption, and a shift toward data-driven insurance models. The region’s focus on road safety and regulatory frameworks promoting telematics-based insurance is driving market development. Additionally, the expansion of shared mobility services and the rising penetration of connected vehicles are creating usage-based insurance for automotive market opportunities for insurers. Technological advancements in telematics and AI-driven risk analysis, coupled with consumer demand for flexible and fair insurance premiums, are further accelerating market growth in Europe.

Usage-Based Insurance for Automotive Market – Key Players & Competitive Analysis Report

The competitive landscape of the usage-based insurance for automotive market is characterized by intense competition among insurance providers, telematics companies, and automotive OEMs striving to gain a larger market share through strategic partnerships, technological advancements, and product innovations. Key players are investing in AI-driven analytics, real-time data monitoring, and predictive modeling to refine risk assessment and offer more personalized insurance plans, contributing to UBI for automotive market expansion. Insurers are forming alliances with automakers and mobility service providers to integrate telematics into vehicles, enhancing market demand. The rise of pay-as-you-drive (PAYD) and pay-how-you-drive (PHYD) models has led companies to enhance their telematics platforms to improve data accuracy and user experience. Moreover, regulatory compliance and data privacy remain crucial competitive factors, influencing market dynamics. Companies are also focusing on customer engagement strategies, such as usage-based rewards and dynamic pricing, to attract a wider consumer base. With the increasing adoption of electric vehicles and connected cars, the market is witnessing new entrants and technology-driven startups, further intensifying competition and fueling the UBI for automotive market growth.

Allianz Life Insurance Company of North America, established in 1896 and headquartered in Minnesota, US, specializes in providing financial and retirement solutions. The company's offerings include annuities and life insurance products designed to help individuals manage risks in retirement. Its annuity products, such as fixed index annuities, offer tax-deferred growth potential and protection from market downturns. For instance, the Allianz Benefit Control Annuity provides options for accumulation and income flexibility. In the realm of life insurance, Allianz offers indexed universal life insurance policies such as the Allianz Life Accumulator, which combines a death benefit with the potential for cash value accumulation based on market index performance. These products are utilized by individuals seeking financial protection and strategies to secure their financial future.

Allstate Insurance Company is a personal lines insurer in the US. The company was founded in 1931 as part of Sears, Roebuck & Co., and Allstate became an independent company in 1995. Allstate Insurance offers a wide range of insurance products, such as auto, home, life, and health insurance, distributed through various channels, such as exclusive agencies, independent agencies, and online platforms. Allstate has been in usage-based insurance (UBI) through its Drivewise program in the automotive sector. Drivewise is a telematics-based system that tracks driving habits, such as speed, braking, and acceleration, to provide personalized insurance rates. This program allows safe drivers to lower their premiums by demonstrating responsible driving behaviors. Additionally, Allstate's Esurance brand offers similar UBI options with DriveSense, which also uses data from vehicle telematics to adjust insurance costs based on driving performance. Allstate's focus on UBI reflects its commitment to leveraging technology to improve customer experience and offer tailored insurance solutions. Allstate aims to provide more accurate risk assessments and reward safe driving practices by integrating advanced data analytics and telematics, aligning with its mission to protect families and belongings while enabling a culture of safety on the roads.

List of Key Companies in Usage-based Insurance for Automotive Market

- Allianz

- Allstate Insurance Company

- American International Group, Inc.

- Assicurazioni Generali S.p.A.

- AXA

- insurethebox

- Liberty Mutual Insurance

- MAPFRE

- Progressive Casualty Insurance Company

- State Farm Mutual Automobile Insurance Company

Usage-Based Insurance for Automotive Industry Developments

In September 2024, Novo launched innovative cloud usage-based car insurance for connected vehicles.

In September 2023, Definity launched a new usage-based insurance (UBI) offering, enabling drivers to have greater control over their premiums while incentivizing safer driving behaviors through advanced telematics.

In April 2021, Farmers Insurance introduced FairMile(SM), a usage-based commercial auto insurance program in Washington State, leveraging telematics to offer businesses mileage-based premium calculations for enhanced cost efficiency and risk management.

Usage-Based Insurance for Automotive Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Pay-As-You-Drive (PAYD)

- Pay-How-You-Drive (PHYD)

- Manage-How-You-Drive (MHYD)

By Technology Outlook (Revenue – USD Billion, 2020–2034)

- OBD II

- Black Box

- Smartphones

- Others

By Vehicle Outlook (Revenue – USD Billion, 2020–2034)

- Passenger Auto

- Commercial Auto

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Usage-Based Insurance for Automotive Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 74.42 Billion |

|

Market Size Value in 2025 |

USD 91.16 Billion |

|

Revenue Forecast by 2034 |

USD 570.44 Billion |

|

CAGR |

22.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 74.42 billion in 2024 and is projected to grow to USD 570.44 billion by 2034.

The global market is projected to register a CAGR of 22.6% during the forecast period.

In 2024, North America accounted for the largest market share due to the widespread adoption of telematics, strong regulatory support, and increasing partnerships between insurers and automakers.

A few of the key players in the market are Allianz; Allstate Insurance Company; American International Group, Inc.; Assicurazioni Generali S.p.A.; AXA; insurethebox; Liberty Mutual Insurance; MAPFRE; Progressive Casualty Insurance Company; and State Farm Mutual Automobile Insurance Company.

In 2024, the pay-how-you-drive (PHYD) segment accounted for the largest market share due to its ability to offer highly personalized premium structures based on real-time driving behavior.

In 2024, the passenger auto segment accounted for a larger market share due to the rapid adoption of telematics-based insurance among private vehicle owners.