US Telemedicine Market Size, Share, Trends, Industry Analysis Report: By Component, Application, Mode of Delivery (Mobile Health Apps, Virtual, Telehealth Portals & Kiosks, and Others), and End Users – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 115

- Format: PDF

- Report ID: PM1672

- Base Year: 2023

- Historical Data: 2019-2022

US Telemedicine Market Overview

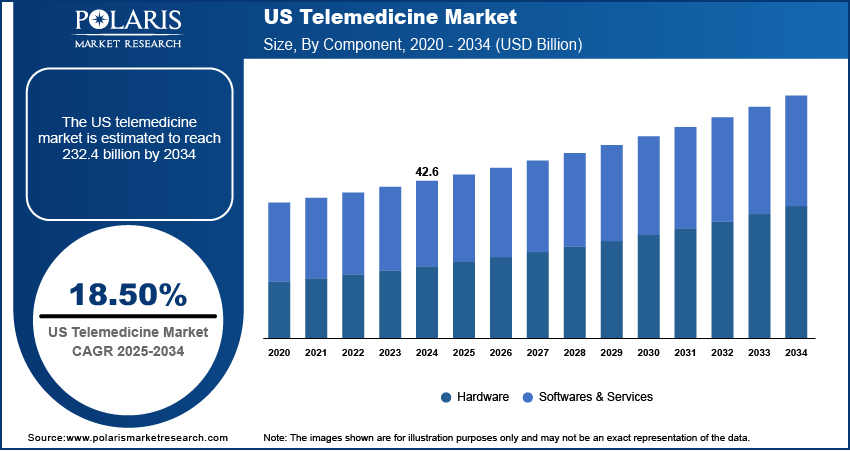

The US telemedicine market size was valued at USD 30.29 billion in 2023. The market is projected to grow from USD 35.63 billion in 2024 to USD 131.49 billion by 2032, exhibiting a CAGR of 17.7% from 2024 to 2032.

Telehealth offers health-related services, such as consultations and therapies, through electronic communications and digital platforms. The US telemedicine market has grown significantly due to advancements in digital health over the past decade. In some countries, slow growth in digital health is largely due to government and budget issues. However, increased funding from the US government is expected to help address these challenges. For instance, the United States Department of Health and Human Services reported that digital health funding reached $29.2 billion in 2021 across 738 deals, a sharp rise from $4.5 billion across 298 deals in 2014. Between 2014 and 2020, the total funding was lower compared to the number of deals, indicating that while more companies emerged, individual funding amounts were smaller. In 2019, $8.1 billion was raised across 416 deals, and in 2020, $14.3 billion was raised across 476 deals.

Post-COVID, funding has increased relative to the number of companies involved. This rising government funding is expected to drive innovation in digital health technologies and further boost the telemedicine market in the US during the forecast period.

Know more about this report: Request a Free Sample Report

The US telemedicine market is expected to grow due to supportive regulations by the US government for the expansion of telemedicine. For instance, in 2023, the government granted 65 million USD under the Distance Learning, Telemedicine, and Broadband Program to expand telemedicine services in rural areas of the country, as authorized by 7 U.S.C. 950aaa. The grant was directed under the Community Project Funding/Congressionally Directed Spending, with 5 million USD designated for specific purposes and 3 million USD available for grants authorized under section 379G of the Consolidated Farm and Rural Development Act. Similarly, flexibilities in Medicare and Medicaid policies are anticipated to boost the telemedicine market. For example, in 2023, the US government expanded Medicare telehealth expansions until December 2024. During these expansions, the government will study the impact on healthcare outcomes and possible changes in telehealth coverage guidelines. Thus, those supportive government guidelines are expected to boost the telemedicine market growth from 2024 to 2032.

US Telemedicine Market Drivers

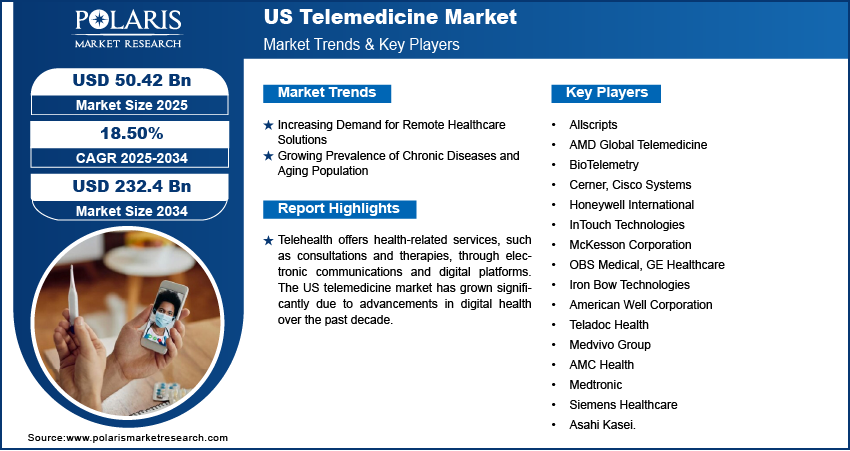

Increasing Demand for Remote Healthcare Solutions

The telemedicine market is expected to grow during the forecast period due to increased demand for remote healthcare solutions. Rural areas, in particular, are expected to drive demand for telemedicine due to benefits such as cost savings on travel, time efficiency, and government initiatives to provide broadband for expanding telemedicine services. Additionally, due to busy work schedules and extended working hours, telemedicine has become a major option for managing chronic diseases in almost all regions of the United States. For example, as of December 2022, the country had 50 million users equipped with at least one remote healthcare system, according to the Harvard Health Letter. Furthermore, 4 out of 5 individuals are in favor of using remote healthcare solutions in the coming years. According to the University of Pittsburgh Medical Center, the United States saw a 75% decrease in hospital readmissions after implementing telehealth and remote monitoring systems. Approximately 25% of hospitals and physicians have started adopting telehealth and remote monitoring to monitor and manage chronic healthcare conditions of their patients. Therefore, these factors are expected to boost the telemedicine market in the United States.

Growing Prevalence of Chronic Diseases and Aging Population

The growing prevalence of chronic diseases and the aging population are significant drivers of the US telemedicine market. Chronic conditions such as diabetes, heart disease, and hypertension require ongoing management and regular monitoring, which can be resource-intensive and burdensome for both patients and healthcare systems. Telemedicine offers an efficient solution by enabling continuous remote monitoring and virtual consultations, thereby improving disease management and patient adherence to treatment plans. For elderly patients, who often face mobility issues and multiple health conditions, telemedicine provides a practical means to access healthcare services without the need to travel, thus reducing the risk of complications associated with in-person visits. Additionally, telemedicine platforms facilitate timely interventions by allowing healthcare providers to track patients’ health data in real time, leading to early detection of potential issues and more personalized care. As the population ages and the incidence of chronic diseases rises, the demand for these remote healthcare solutions is expected to increase. This trend not only helps in managing healthcare costs but also enhances the quality of life for patients by offering convenient and effective care options tailored to their needs. Thus, the adoption of telemedicine among geriatric patients with chronic diseases is expected to grow and simultaneously affect the US telemedicine market positively.

US Telemedicine Market Segment Insights

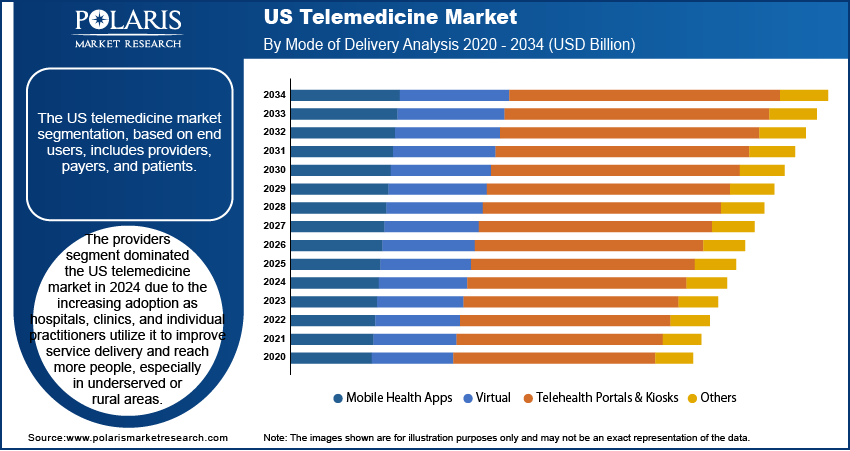

US Telemedicine Market Breakdown by Mode of Delivery Insights

The US telemedicine market segmentation, based on mode of delivery, includes mobile health apps, virtual, telehealth portals & kiosks, and others. The mobile health app segment is projected to grow significantly in the US market. These apps allow users to have remote consultations, manage health records, and monitor their wellness using their smartphones or tablets. They have a user-friendly interface that seamlessly integrates into daily life. The widespread use of smartphones and high-speed internet makes these apps more accessible to a larger segment of the population. Mobile health apps offer various functions, such as virtual consultations, appointment scheduling, medication reminders, and real-time health monitoring. These functionalities cater to the needs of tech-savvy consumers and support individuals managing chronic conditions by providing regular updates and interactions with healthcare providers. Moreover, the ability to integrate health data from wearables and other digital health tools enhances the appeal of these apps by offering a comprehensive view of health metrics. As patients increasingly prioritize convenience and personalized care, mobile health apps are poised to lead the telemedicine market by providing efficient, accessible, and continuous healthcare solutions. This trend reflects a broader shift towards digital health innovations that align with evolving consumer preferences and technological advancements.

US Telemedicine Market Breakdown by End Users Insights

The US telemedicine market segmentation, based on end users, includes providers, payers, and patients. The providers segment is expected to dominate the US telemedicine market in the coming years. Telemedicine adoption is on the rise as hospitals, clinics, and individual practitioners are using it to enhance service delivery and reach more people, especially in underserved or rural areas. Telemedicine enables virtual consultations and remote monitoring of chronic conditions, reducing the need for in-person visits. This not only addresses the shortage of healthcare professionals but also provides more convenient and flexible care for patients. By integrating telemedicine, providers can manage patient flow efficiently and reduce operational costs. With the increasing demand for remote healthcare solutions, healthcare providers are expected to lead the market by using telemedicine to improve care delivery, operational efficiency, and patient engagement.

US Telemedicine Market Market – Key Players & Competitive Insights

The US telemedicine market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading players dominate the market by leveraging extensive research and development, advanced software technologies, and significant capital to maintain a competitive edge. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the market by introducing innovative telehealth software and meeting the needs of specific market sectors. This competitive environment is amplified by continuous progress in product offerings and new applications, a greater emphasis on sustainability, and the rising requirement for tailor-made single-use products in diverse industries. Major players in the US telemedicine market include Allscripts; AMD Global Telemedicine; BioTelemetry; Cerner; Cisco Systems; Honeywell International; InTouch Technologies; McKesson Corporation; OBS Medical; GE Healthcare; Iron Bow Technologies; American Well Corporation; Teladoc Health; Medvivo Group; AMC Health; Medtronic; Siemens Healthcare; and Asahi Kasei.

Cisco Systems, Inc. is a global technology leader specializing in networking hardware, software, and telecommunications equipment. Founded in 1984 and headquartered in San Jose, California, Cisco is renowned for its innovation in developing solutions that enable connectivity and digital transformation across various industries. The company’s core products and services include networking infrastructure, cybersecurity solutions, collaboration tools, and data center technologies. Cisco’s networking portfolio encompasses routers, switches, and wireless systems that form the backbone of modern internet and enterprise networks. In addition to hardware, Cisco offers a range of software solutions for network management, security, and cloud computing. Their cybersecurity offerings are designed to protect against evolving threats, ensuring the integrity and privacy of data across networks. Cisco is also a key player in the realm of collaboration technology, providing tools such as WebEx for video conferencing and teleconsultation, which are integral to remote work and virtual meetings.

American Well Corporation, commonly known as Amwell, is a leading telehealth company based in Boston, Massachusetts. Founded in 2006, Amwell specializes in providing virtual healthcare services through its innovative telemedicine platform, which connects patients with healthcare providers for remote medical consultations. The company’s platform supports a wide range of services, including urgent care, primary care, and behavioral health, enabling patients to receive care from the comfort of their homes. Amwell’s technology integrates seamlessly with existing healthcare systems, offering solutions for both providers and health systems to enhance patient access and streamline care delivery. The company's platform is known for its user-friendly interface, high-quality video consultations, and robust security measures to ensure patient privacy and data protection. To support its continued growth and meet the increasing demand for telehealth services, American Well raised $194 million in funding in 2020.

List of Key Companies in US Telemedicine Market

- Allscripts

- AMD Global Telemedicine

- BioTelemetry

- Cerner

- Cisco Systems

- Honeywell International

- InTouch Technologies

- McKesson Corporation

- OBS Medical

- GE Healthcare

- Iron Bow Technologies

- American Well Corporation

- Teladoc Health

- Medvivo Group

- AMC Health

- Medtronic

- Siemens Healthcare

- Asahi Kasei.

US Telemedicine Market Developments

April 2024: The Joint Commission announced the launch of a new Telehealth Accreditation Program, aimed at hospitals and healthcare organizations offering remote care. This program introduces updated standards for telehealth, including emergency management, provider and patient education, and telehealth equipment requirements. With telehealth usage surging 154% during the COVID-19 pandemic, the new accreditation ensures safe, high-quality care across all settings. The program will replace existing telehealth accreditation products under The Joint Commission’s Ambulatory and Behavioral Health Care Programs.

July 2023: Travel insurer Faye launched a new telemedicine service in partnership with Air Doctor, enhancing its emergency medical coverage. Available to policyholders traveling to 75 countries, the service offers near-instant voice and video consultations with doctors in 21 languages. To use the service, travelers can chat with Faye’s support team via the app, select a doctor by specialty, and have appointments covered at no extra cost. Alternatively, Faye’s support team can assist in locating local emergency medical facilities.

September 2022: Memorial Sloan Kettering Cancer Center, in collaboration with Microsoft, Accenture, and Avanade, has launched a new telemedicine platform designed to enhance cancer care quality and patient experience. This innovative platform aims to streamline consultations, improve access to specialist care, and offer personalized treatment options. By integrating advanced technology and expert insights, the platform seeks to provide a more efficient and supportive care experience for cancer patients, leveraging the combined expertise of the partnering organizations.

US Telemedicine Market Segmentation

By Component Outlook

- Hardware

- Telemedicine Carts

- Kiosks

- Digital Cameras

- Telemedicine Kits

- Mobile Medical Devices

- Other Devices

- Softwares & Services

- Remote Patient Monitoring Software & Services

- Real-Time Interaction Software & Services

- Store-And-Forward Software & Services

- Remote Order Entry Service

- Others

By Application Outlook

- Teleradiology

- Telepsychiatry

- Telestroke

- Tele-ICU

- Teledermatology

- Teleconsultation

- Other Applications

By Mode of Delivery Outlook

- Mobile Health Apps

- Virtual

- Telehealth Portals & Kiosks

- Others

By End Users Outlook

- Providers

- Payers

- Patients

US Telemedicine Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 30.29 billion |

|

Market Size Value in 2024 |

USD 35.63 billion |

|

Revenue Forecast in 2032 |

USD 131.49 billion |

|

CAGR |

17.7% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Mode Of Delivery |

|

|

Customization |

Report customization as per your requirements with respect to segmentation. |

FAQ's

The US telemedicine market size was valued at USD 30.29 billion in 2023 and is projected to grow to USD 131.49 billion by 2032.

The US market is projected to grow at a CAGR of 17.7% from 2024 to 2032

The key players in the market are Allscripts; AMD Global Telemedicine; BioTelemetry; Cerner; Cisco Systems; Honeywell International; InTouch Technologies; McKesson Corporation; OBS Medical; GE Healthcare; Iron Bow Technologies; American Well Corporation; Teladoc Health; Medvivo Group; AMC Health; Medtronic; Siemens Healthcare; and Asahi Kasei.

The Mobile health App segment is anticipated to experience substantial growth with a significant CAGR in the US market. This growth is attributed due to its advantage in remote consultations, manage health records, and monitor their wellness using their smartphones or tablets .

The Providers segment accounted for the largest revenue share of the market in 2023 due to increae in number of hospitals, clinics, and individual practitioners