U.S. Sports Betting Market Share, Size, Trends, Industry Analysis Report, By Platform (Online and Offline); By Type; By Sports; By Application; Segment Forecast, 2024- 2032

- Published Date:Apr-2024

- Pages: 116

- Format: PDF

- Report ID: PM4811

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

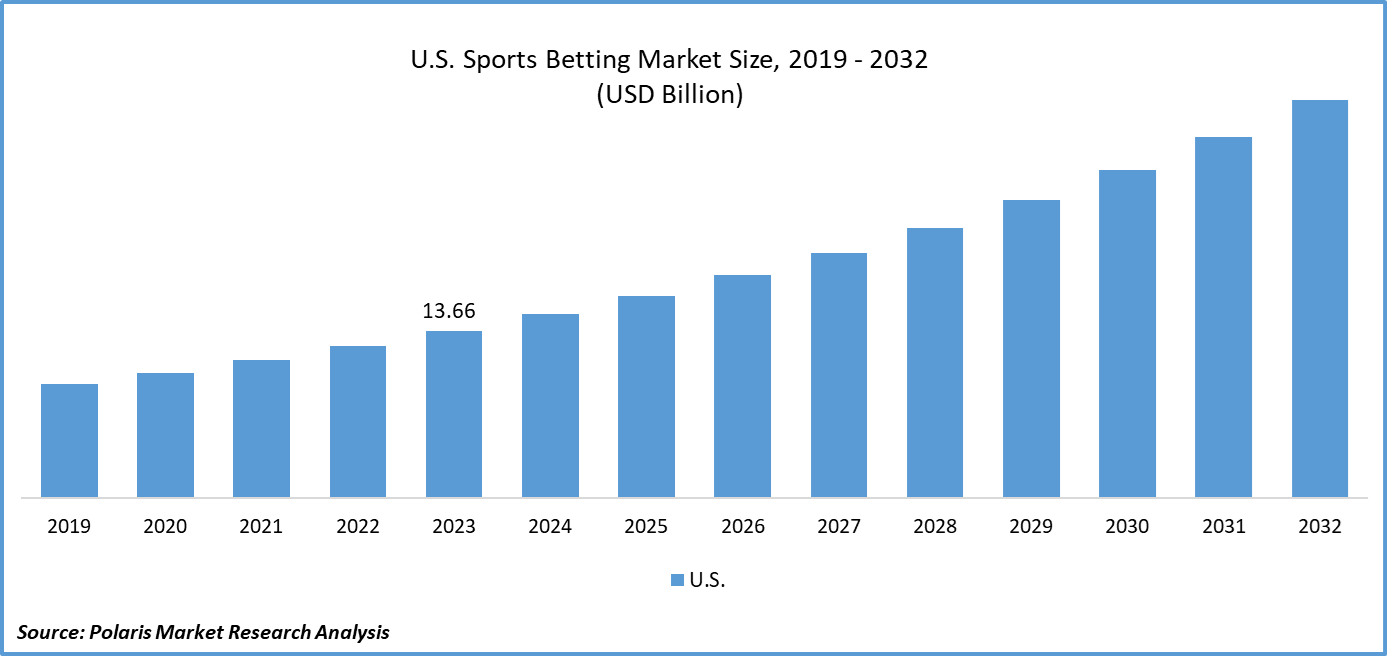

The U.S. sports betting market size was valued at USD 13.66 billion in 2023. The market is anticipated to grow from USD 15.04 billion in 2024 to USD 32.63 billion by 2032, exhibiting a CAGR of 10.2% during the forecast period.

Industry Trend

Sports betting involves placing a wager on the outcome of a sporting event. It is usually facilitated through sportsbooks, commonly referred to as bookmakers or bookies. The surge in connected device usage, increasing adoption of sports betting, and advancing digital infrastructure collectively drive the demand for sports betting. The online sector of the sports betting market is expected to witness substantial expansion, influenced by the rising trend towards digitalization.

Moreover, regulatory frameworks set by governments may shape future trends in the sports betting market, offering consumers new opportunities for employment and enhanced experiences. The anticipated growth of the sports betting market is expected to be driven by the expanding array of sporting leagues and events. These leagues, comprising teams, nations, associations, or individuals competing for trophies or championships, are organized at specific times or seasons to determine the overall champion, thus fostering the adoption of sports betting markets are positively impacting future market trends.

To Understand More About this Research:Request a Free Sample Report

The emergence of new professional sports leagues worldwide offers customers opportunities to diversify their betting activities, consequently fueling the expansion of the sports betting market. Moreover, the proliferation of digital infrastructure plays a pivotal role in driving market growth. Additionally, the increasing number of sports leagues and events, coupled with rising demand for sports betting among both millennials and older demographics, further catalyzes the market's growth trajectory and adoption trends. The surge in sports events and leagues like the NFL, FIFA World Cup, Premier League, Big Bash and others has notably bolstered sports betting market share growth.

Additionally, the uptick in disposable income among individuals presents further opportunities for market expansion. Moreover, the increasing utilization of AI and blockchain technologies to enhance prediction algorithms in betting software is expected to propel sports betting market size growth throughout the forecast period.

Key Takeaway

- By Platform category, the online segment accounted for the largest market share in 2023.

- By sports category, the football segment is projected to grow at a significant CAGR during the projected period.

What are the market drivers driving the demand for the U.S. Sports Betting Market?

- Sports betting is becoming more socially acceptable and popular among Americans, leading to a surge in demand for betting services and platforms.

The increasing acceptance and popularity of sports betting among Americans can be attributed to a variety of interconnected factors. Firstly, there has been a notable shift in societal attitudes towards sports betting, moving away from previous stigmas and viewing it more as a form of entertainment or leisure activity. This change in perception has been further facilitated by the gradual legalization of sports betting across numerous states in the U.S. As more states embrace legalization, sports betting becomes more normalized and integrated into mainstream culture. Additionally, the prominent role of sports in American culture has contributed to the popularity of betting on sports events. With sports being deeply ingrained in daily life and discussions, betting on these events becomes a natural extension of the passion and engagement with sports. This results in an increasing sports betting market share in the forecast period.

Moreover, the widespread media coverage of sports events, including discussions on odds and predictions, has helped to familiarize the public with sports betting further, making it more accessible and appealing. Furthermore, the advent of online betting platforms and mobile betting apps has made it easier than ever for Americans to engage in sports betting, enhancing its convenience and accessibility. Finally, sports betting often serves as a social activity, whether it's among friends, colleagues, or within communities, fostering a sense of camaraderie and shared enjoyment. Overall, these factors collectively contribute to the growing acceptance and popularity of sports betting among Americans, shaping it into a mainstream and socially acceptable pastime.

Which factor is restraining the demand for U.S. Sports Betting?

- The demand for U.S. sports betting is regulatory restrictions or limitations in certain states are expected to hinder the growth of the market.

The demand for U.S. sports betting is regulatory restrictions or limitations in certain states. While the legalization of sports betting has been a significant driver of market growth, not all states have embraced it to the same extent. Some states may have more stringent regulations or may have chosen not to legalize sports betting altogether. This lack of uniformity across states can create barriers for consumers, particularly if they reside in states where sports betting is not legal or where there are limited options for betting. Additionally, regulatory uncertainties or changes in legislation could also impact the demand for sports betting by creating instability or discouraging investment in the industry. Therefore, regulatory factors play a crucial role in shaping the demand for sports betting in the U.S. and could potentially act as a restraint on market growth.

Report Segmentation

The market is primarily segmented based on platform, type, sports, and application.

|

By Platform |

By Type |

By Sports |

By Application |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Platform Insights

Based on platform analysis, the market is segmented on the basis of online and offline. The online segment accounted for the largest market share in 2023. The increasing prevalence and accessibility of internet-enabled devices, such as smartphones, tablets, and computers, have made online sports betting more convenient and widely accessible to consumers. This has led to a significant shift in consumer preferences towards online platforms for placing bets on sports events.

Moreover, advancements in technology, particularly in the development of user-friendly and secure online betting platforms, have enhanced the overall online betting experience for users. These platforms often offer a wide range of betting options, real-time updates on sports events, and secure payment methods, thereby attracting a larger user base.

Additionally, the COVID-19 pandemic played a significant role in driving the growth of the online segment in 2023. With restrictions on in-person activities and the closure of physical sportsbooks, many bettors turned to online platforms as an alternative way to engage in sports betting.

By Sports Insights

Based on sports analysis, the market has been segmented on the basis of football, basketball, baseball, horse racing, cricket, hockey, and others. The football segment is expected to grow significant market growth during the forecast period. Football, particularly the National Football League (NFL), holds a prominent position in American sports culture, boasting a massive fan base and attracting considerable attention from bettors. The popularity of football ensures a steady stream of betting activity throughout the season, including regular-season games, playoffs, and the highly anticipated Super Bowl.

Furthermore, the rise of online betting platforms has made it easier for fans to place bets on football games, contributing to increased participation and betting volume. Online platforms offer a wide range of betting options, including traditional bets such as point spreads and totals, as well as prop bets and live betting, providing bettors with ample opportunities to wager on football events.

Competitive Landscape

The competitive landscape of the U.S. sports betting market is characterized by a dynamic interplay among numerous players vying for market share and consumer attention. With the increasing legalization and expansion of sports betting across various states, competition has intensified, giving rise to a diverse array of operators, platforms, and service providers. These entities range from traditional brick-and-mortar sportsbooks to online betting platforms, each offering unique features, betting options, and user experiences. Furthermore, partnerships between sports leagues, teams, and betting operators add another layer of complexity to the competitive dynamics.

Some of the major players operating in the US market include:

- Bet America

- Caesars

- clutchbet.

- Desert Diamod Sports

- Draft Kings

- Fanduel

- Fanatics

- Fanduel

- TVG

- Twinspires

Recent Developments

- In March 2023, Entain, a prominent player in sports betting, gaming, and interactive entertainment, revealed that its unikrn brand, known as the most extensive esports betting platform and video games available, has formed a multi-year global collaboration with BLAST, an esports entertainment company.

Report Coverage

The U.S. sports betting market report emphasizes on key country across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, platform, type, sports, and application, and their futuristic growth opportunities.

U.S. Sports Betting Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 15.04 Billion |

|

Revenue forecast in 2032 |

USD 32.63 billion |

|

CAGR |

10.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Platform, By Type, By Sports, By Application |

|

Customization |

Report customization as per your requirements with respect to countries, country and segmentation. |

FAQ's

The key companies in U.S. Sports Betting Market are Bet America, Caesars, Clutchbet, Desert Diamond Sports, Draft Kings

The U.S. sports betting market exhibiting a CAGR of 10.2% during the forecast period.

U.S. Sports Betting Market report covering key segments are platform, type, sports, and application

The key driving factors in U.S. Sports Betting Market are increasing use of internet have dominated the market.

U.S. Sports Betting Market Size Worth $ 32.63 Billion by 2032