US Spatial Genomics & Transcriptomics Market Size, Share, Trends, Industry Analysis Report – By Technology, Product, End Use (Translational Research, Academic Customers, Diagnostic Customers, Pharmaceutical Manufacturer); Market Forecast, 2025 - 2034

- Published Date:Nov-2024

- Pages: 116

- Format: PDF

- Report ID: PM5206

- Base Year: 2024

- Historical Data: 2020-2023

US Spatial Genomics & Transcriptomics Market Outlook

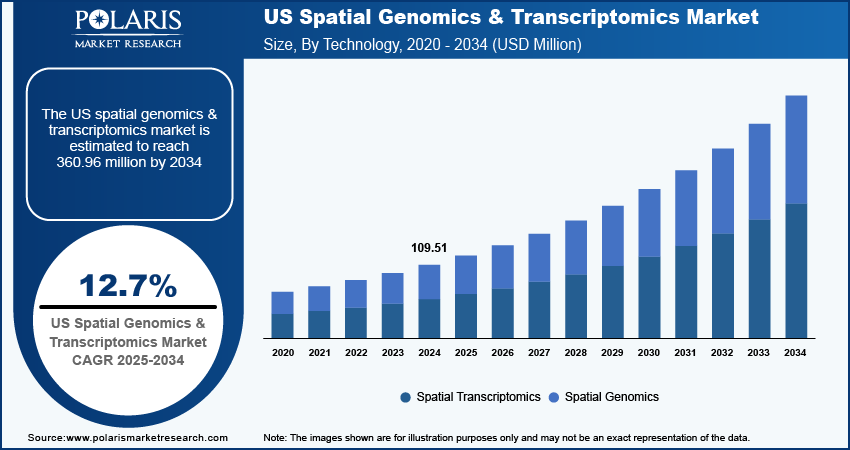

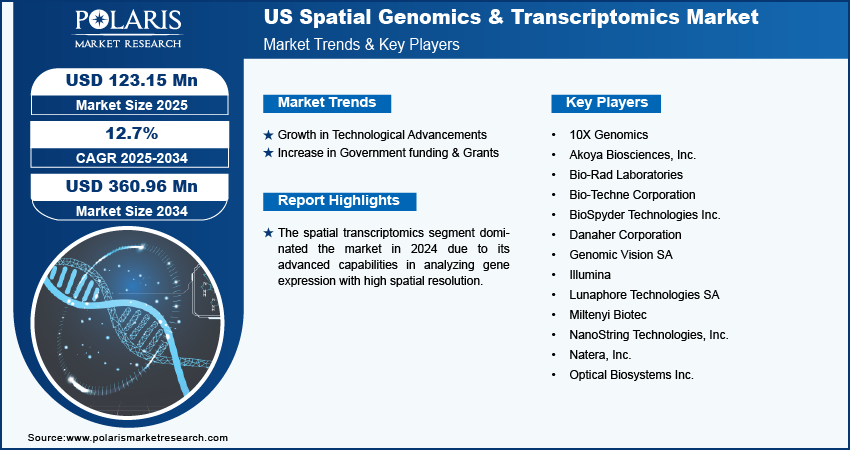

US spatial genomics & transcriptomics market size was valued at USD 109.51 million in 2024. The market is anticipated to grow from USD 123.15 million in 2025 to USD 360.96 million by 2034, exhibiting a CAGR of 12.7% during the forecast period.

US Spatial Genomics & Transcriptomics Market Overview

Spatial genomics focuses on the spatial organization of genes within tissues, providing insights into gene expression patterns and their relationship to disease states. This approach allows researchers to visualize and quantify gene activity in situ, enhancing the understanding of tissue heterogeneity and cellular interactions. Similarly, spatial transcriptomics combines traditional transcriptomic analysis with spatial information, enabling the profiling of gene expression at a single-cell resolution. This capability is crucial for studying the tumor microenvironment, where cellular interactions play a pivotal role in cancer progression.

To Understand More About this Research: Request a Free Sample Report

The rising drug discovery and development efforts in the United States are significantly propelling the spatial genomics and transcriptomics market. Spatial genomics techniques provide insights into how different tissues respond to drugs at the molecular level, enabling researchers to predict efficacy and resistance mechanisms. This critical information is essential for optimizing drug development strategies. As the demand for innovative therapies grows, so too does the need for spatial genomics and transcriptomics solutions. For instance, in 2022, approximately 1.9 million new cancer cases were diagnosed in the U.S., highlighting the urgent need for advanced research and effective treatment strategies in the market.

Spatial genomics plays a crucial role in advancing personalized medicine by providing detailed insights into how gene expression varies across different regions of tissues. This technology is pivotal in identifying disease-specific patterns, driving the way for more targeted and personalized medicine. Additionally, as spatial genomics applications expand into areas such as drug discovery and translational research, the demand for these technologies is set to grow significantly. Thus, its ability to deliver precise molecular information is driving its adoption in the medical field, facilitating the development of novel therapeutic approaches.

Growth Drivers

Growth in Technological Advancements

Increased technological advancements in high-resolution imaging and sequencing have completely enhanced the ability to analyze gene expression within tissue samples, which provides detailed, spatially resolved observations of how genes are expressed across different regions of tissue. For instance, the 10x Genomics Visium Spatial Gene Expression platform is a prime illustration of how high-resolution imaging and sequencing technologies are integrated to analyze gene expression in tissue samples. This platform combines high-resolution imaging with spatial transcriptomics to provide detailed maps of gene expression within tissue sections.

Increasing Government Funding and Grants

Increased financial support from government agencies and private organizations is playing a crucial role in accelerating the development and adoption of spatial genomics and transcriptomics technologies. Government funding, often provided through grants from institutions such as the National Institutes of Health (NIH) and the National Science Foundation (NSF), supports research projects that explore new methods and applications in spatial genomics. These funds enable researchers to invest in advanced technologies, conduct large-scale studies, and advance the field.

For instance, in September 2023, the National Institute of Health (NIH) announced an investment grant of USD 50.3 million for multi-omics research studies on human health problems such as genomics, epigenomics, transcriptomics, proteomics, and metabolomics as a part of the consortium's first-year funding.

Restraining Factors

Limited Proficiency in Spatial Genomics and Transcriptomics

Limited proficiency serves as a restraining factor in the market due to the complex nature of spatial genomics and transcriptomics technologies, which require specialized skills and knowledge for effective use. Additionally, the need for more trained professionals, standardized protocols, and the steep learning curve slow down the widespread adoption of spatial genomics and transcriptomics technologies. Thus, this makes it challenging for laboratories to adopt these advanced techniques effectively, creating a significant limitation to the growth of the market.

US Spatial Genomics and Transcriptomics Market Segmentation

US Spatial Genomics and Transcriptomics Market, by Technology

The spatial transcriptomics segment dominated the market in 2024 due to its advanced capabilities in analyzing gene expression with high spatial resolution. Spatial transcriptomics offers a powerful method for creating spatial maps of complex tissues, which is crucial for understanding tissue architecture and disease mechanisms. Its applications in immune profiling, drug target identification, and computational biology further boost its popularity and market growth. For instance, The Nanostring Technologies GeoMx Digital Spatial Profiler offers highly multiplexed spatial profiling of gene expression and protein levels, providing detailed maps of tissue samples. It is widely used in oncology for tumor microenvironment analysis and in neuroscience for brain tissue mapping. Its advanced capabilities and diverse applications have made GeoMx a leader in the spatial transcriptomics market.

US Spatial Genomics and Transcriptomics Market, by Product

The consumables segment dominated the spatial genomics & transcriptomics market in 2024 due to the essential use of items like reagents and kits in various procedures. Furthermore, advancements in technology and the introduction of new instruments drive the development of specialized consumables tailored to these innovations, further supporting their ongoing importance and market growth.

The software segment is projected to grow at the highest CAGR during the forecast period. For instance, bioinformatics tools are crucial for analyzing the complex data generated by spatial genomics and transcriptomics technologies. These tools facilitate data processing, visualization, and interpretation, making them indispensable for extracting meaningful insights from large datasets. Where data complexity increases, the demand for advanced bioinformatics solutions grow. Thereby fueling the spatial genomics and transcriptomics market.

US Spatial Genomics and Transcriptomics Market, by End-Use

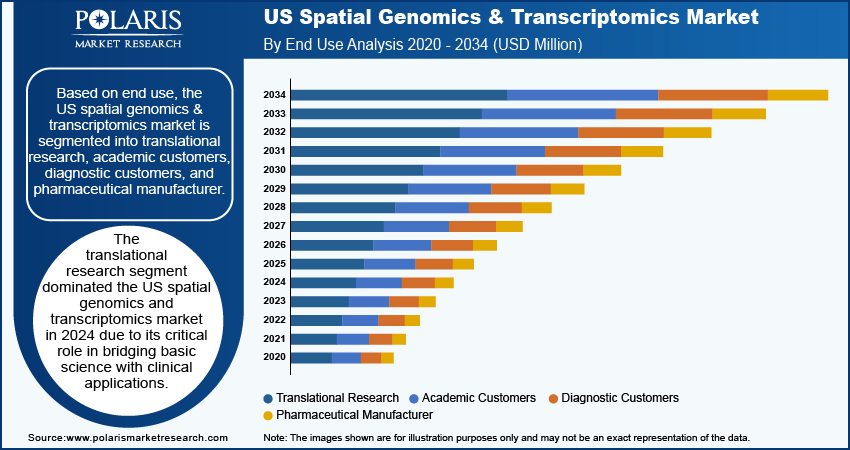

The translational research segment dominated the US spatial genomics and transcriptomics market in 2024 due to its critical role in bridging basic science with clinical applications. By leveraging spatial technologies, researchers can study gene expression in tissues at a granular level, providing valuable insights into disease mechanisms, discovering new biomarkers, and developing targeted therapies, especially for complex diseases such as cancer. Spatial profiling enables a deeper understanding of tissue microenvironments, which is crucial for drug development and preclinical testing. This segment is also essential in advancing precision medicine by tailoring treatments based on individual genetic profiles. Additionally, the identification of biomarkers through spatial technologies accelerates the development of new diagnostic tools. Supported by significant funding from government agencies such as the NIH and major pharmaceutical investments, translational research drives innovation, making it a dominant force in the US market.

The academic customer segment is also expected to experience a significant CAGR during the forecasted period. This growth can be attributed to the increasing use of spatial genomics analysis by research institutions. Academic researchers are using spatial genomics and transcriptomics to study how cells behave in diseases such as cancer, Alzheimer's, and diabetes. As a result, the market for spatial genomics analysis is expected to continue growing.

Key Market Players & Competitive Insights

Strategic Collaborations to Drive the Competition

The competitive landscape of the US spatial genomics & transcriptomics market is characterized by a diverse array of global and regional players striving to capture market share through innovation, strategic partnerships, and geographic expansion. Major players in the industry, such as 10X Genomics; Illumina, Inc.; and Dovetail Genomics, leverage their extensive R&D capabilities and broad distribution networks to offer a wide range of advanced products. These companies focus on product innovation, including improvements in safety, functionality, and cost-efficiency, to meet the evolving needs of healthcare providers. Additionally, smaller and regional companies are increasingly entering the market, offering specialized and niche products that cater to specific healthcare needs or local market demands. Competitive strategies often include mergers and acquisitions, partnerships with healthcare institutions, and investments in emerging markets to expand reach and enhance market presence. Major players include 10X Genomics; Akoya Biosciences, Inc.; Bio-Rad Laboratories; Bio-Techne Corporation; BioSpyder Technologies Inc.; Danaher Corporation; Genomic Vision SA; Illumina; Lunaphore Technologies SA; Miltenyi Biotec; NanoString Technologies, Inc.; Natera, Inc.; Optical Biosystems Inc.

Nanostring Technologies is a biotech company offering discovery and translational research solutions based in the US that launched CosMx SMI in December 2022 as the highest plex in situ imager with 1000-plex RNAs and 64-plex proteins analyzed in the same tissue at subcellular resolution. This joins Nanostring’s other products, including the first cloud-based spatial data analysis resource, AtoMx, and their established GeoMx, which has broader protein and RNA capability with low resolution.

Akoya Bioscience is a Spatial Biology Company based in the US that released PhenoCycler Fusion in January 2022, which offers a high throughput workflow at sub-cellular resolution for 100+ markers, either RNA or protein biomarkers. It is one of the fastest single-cell spatial biology solutions, able to map a million cells in 10 minutes.

Key Companies in US Spatial Genomics & Transcriptomics Market

- 10X Genomics

- Akoya Biosciences, Inc.

- Bio-Rad Laboratories

- Bio-Techne Corporation

- BioSpyder Technologies Inc.

- Danaher Corporation

- Genomic Vision SA

- Illumina

- Lunaphore Technologies SA

- Miltenyi Biotec

- NanoString Technologies, Inc.

- Natera, Inc.

- Optical Biosystems Inc.

Recent Developments in the Industry

May 2023: The NIH launched a new program, the Common Fund’s Somatic Mosaicism Across Human Tissues (SMaHT) Network, that aims to transform knowledge of how much genetic variation there is in the cells and tissues throughout our bodies. The SMaHT Network, with awards totaling $140 million dollars over five years, pending the availability of funds, seeks to discover and catalog the breadth of somatic mosaicism in human tissues.

September 2022: Vizgen MERSCOPE launched a protein co-detection kit, which allows users to take full advantage of the subcellular hi-plex nature of the instrument while detecting up to five proteins.

May 2023: ACD Biotechne and Standard Biotools created a workflow to combine the 12-plex RNAscope assay with the 40-plus protein Imaging Mass Cytometry assay to create RNA and protein multiomics outputs.

US Spatial Genomics & Transcript Market Segmentation

Product Outlook (Revenue, USD Million, 2020 - 2034)

-

- Instruments

- By Mode

- Automated

- Semi-automated

- Manual

- By Type

- Sequencing Platforms

- IHC

- Microscopy

- Flow Cytometry

- Mass Spectrometry

- Others

- By Mode

- Consumables

- Software

- Bioinformatics Tools

- Imaging Tools

- Storage and Management Databases

- Instruments

Technology Outlook (Revenue, USD Million, 2020 - 2034)

-

- Spatial Transcriptomics

- Sequencing-Based Methods

- Laser Capture Microdissection (LCM)

- FFPE Tissue Samples

- Others

- Transcriptome In-Vivo Analysis (TIVA)

- In Situ Sequencing

- Microtomy Sequencing

- Laser Capture Microdissection (LCM)

- IHC

- Microscopy-based RNA Imaging Techniques

- Single Molecule RNA Fluorescence In-Situ Hybridization (smFISH)

- Padlock Probes/ Rolling Circle Amplification

- Branched DNA Probes

- Sequencing-Based Methods

- Spatial Genomics

- FISH

- Microscopy-based Live DNA Imaging

- Genome Perturbation Tools

- Massively-Parallel Sequencing

- Biochemical Techniques

- Others

- Spatial Transcriptomics

End-Use Outlook (Revenue, USD Million, 2020 - 2034)

-

- Translational Research

- Academic Customers

- Diagnostic Customers

- Pharmaceutical Manufacturer

Report Coverage

The US spatial genomics & transcriptomics market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, technique, product, application, end user, and their futuristic growth opportunities.

U.S. Spatial Genomics & Transcriptomics Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2025 |

USD 123.15 million |

|

Revenue Forecast in 2034 |

USD 360.96 million |

|

CAGR |

12.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The US spatial genomics & transcriptomics market size was valued at USD 109.51 million in 2024 and is projected to grow to USD 360.96 million by 2034.

The US market registers a CAGR of 12.7% during the forecast period.

The spatial transcriptomics segment dominates the market in the US due to its advanced capabilities in analyzing gene expression with high spatial resolution.

The key players in the market are 10X Genomics; Akoya Biosciences, Inc.; Bio-Rad Laboratories; Bio-Techne Corporation; BioSpyder Technologies Inc.; Cantata Bio; Danaher Corporation; Genomic Vision SA; Illumina; Lunaphore Technologies SA; Miltenyi Biotec; NanoString Technologies, Inc.; Natera, Inc.; Optical Biosystems Inc.

The translational research segment dominates the US spatial genomics and transcriptomics market due to its critical role in bridging basic science with clinical applications.

The consumables segment accounted for the largest market share in 2023 due to the widespread adoption of consumables and items, including reagents, kits, and sample preparation materials, which are essential for performing a wide range of procedures and analyses.