US Rigid Thermoform Plastic Packaging Market Size, Share, Trends, Industry Analysis Report: By Material, Product (Blister Pack, Clamshells, Trays and Lids, Containers, and Others), and Application – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 125

- Format: PDF

- Report ID: PM5409

- Base Year: 2024

- Historical Data: 2020-2023

US Rigid Thermoform Plastic Packaging Market Overview

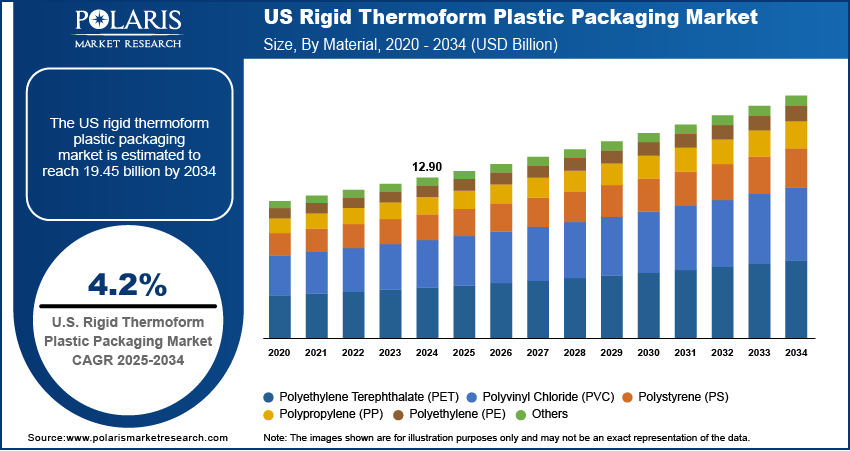

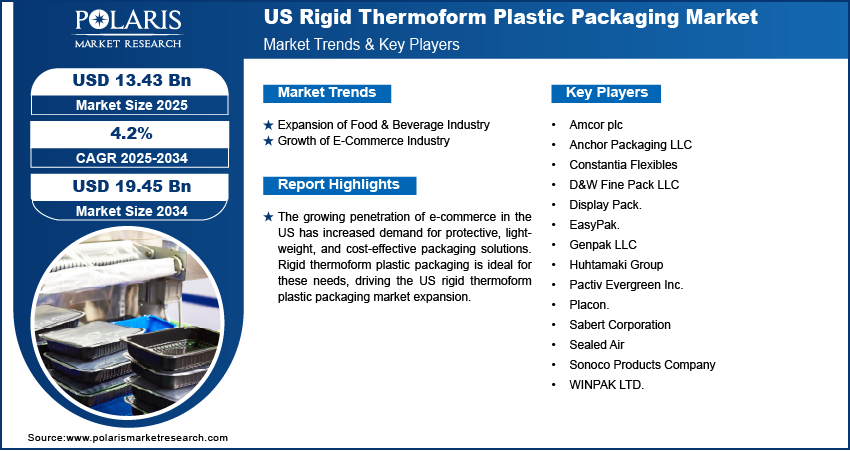

The US rigid thermoform plastic packaging market size was valued at USD 12.90 billion in 2024. The US rigid thermoform plastic packaging industry is projected to grow from USD 13.43 billion in 2025 to USD 19.45 billion by 2034, exhibiting a CAGR of 4.2% during 2025–2034.

Rigid thermoform plastic packaging is a type of packaging made of heated plastic sheets that are molded into a rigid shape to hold and protect products. The packaging is commonly used for food items, medical products, and consumer goods due to its durability, ease of customization, and ability to preserve product integrity.

Consumers in the US are increasingly seeking convenient, ready-to-eat, and easy-to-use products. This trend is especially evident in the food & beverage industry, where busy lifestyles push people toward packaged foods that are quick to prepare and consume. Rigid thermoform plastic packaging plays a key role in providing safe, easy-to-open, and portable containers for such products. Its ability to maintain food freshness, ensure hygiene, and provide convenience for consumers makes it highly popular. The use of rigid thermoform plastic packaging continues to rise as demand for on-the-go meals and snacks grows, thereby driving the US rigid thermoform plastic packaging market demand.

To Understand More About this Research: Request a Free Sample Report

Owing to the rising focus on sustainability, consumers and businesses in the US are pushing for more green packaging options. This has led to a growing demand for recyclable and environmentally friendly rigid thermoform plastics. Manufacturers are responding by developing new sustainable materials and packaging designs that reduce waste and are easier to recycle. The US market’s focus on sustainability has driven the adoption of these advanced materials, which help minimize plastic waste while offering the durability and functionality required in packaging. This shift toward greener options is driving the US rigid thermoform plastic packaging market growth.

US Rigid Thermoform Plastic Packaging Market Dynamics

Expansion of Food & Beverage Industry

The US food & beverage industry is rapidly expanding, and as more packaged foods are produced, the need for reliable packaging solutions is rising. According to the US Department of Agriculture, in 2021, the industry employed 1.7 billion people, showcasing the expansion of the food & beverage industry. Rigid thermoform plastic packaging offers excellent protection, maintaining the freshness and quality of food products. Its durability and versatility make it ideal for packaging everything from fresh produce to ready-to-eat meals. Additionally, the rising demand for convenient, well-preserved food options in supermarkets and convenience stores has increased the adoption of this packaging type, thereby driving the US rigid thermoform plastic packaging market development.

Growth of E-Commerce Industry

Increasing preference for online shopping due to convenience, time savings, and better prices has created a demand for packaging that ensures protection during transit and maintains product quality. Rigid thermoform plastic packaging is well-suited for e-commerce as it provides robust protection against damage while remaining lightweight and cost-effective. Hence, the continued growth of the e-commerce industry is expected to drive the US rigid thermoform plastic packaging market demand. For instance, according to the US Census Bureau, sales from e-commerce grew by 2.6% in the third quarter of 2024 compared to the second quarter of the same year, showcasing the growth of e-commerce in the US.

US Rigid Thermoform Plastic Packaging Market Segment Analysis

US Rigid Thermoform Plastic Packaging Market Assessment by Material Outlook

The US rigid thermoform plastic packaging market assessment , based on material, includes polyethylene terephthalate (PET), polyvinyl chloride (PVC), polystyrene (PS), polypropylene (PP), and polyethylene (PE). The polyethylene terephthalate (PET) segment is expected to witness fastest growth during the forecast period. PET is favored for its durability, clarity, and recyclability, making it a top choice for packaging applications in food, beverages, and consumer goods. Its ability to be easily recycled aligns with the growing demand for sustainable and eco-friendly packaging solutions propels its demand. Additionally, PET’s versatility in packaging design contributes to its increasing adoption, thereby driving the segmental growth in the US rigid thermoform plastic packaging market report.

US Rigid Thermoform Plastic Packaging Market Evaluation by Product Outlook

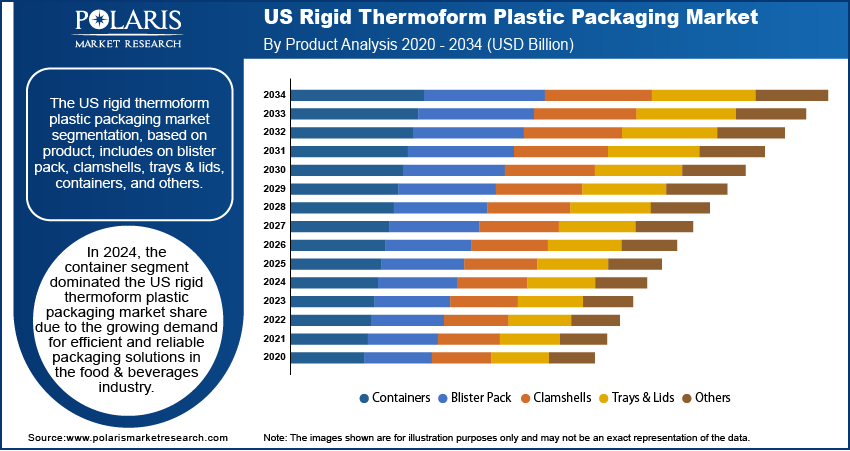

The US rigid thermoform plastic packaging market evaluation, based on product, is segmented into blister pack, clamshells, trays & lids, containers, and others. The containers segment dominated the US rigid thermoform plastic packaging market share in 2024. Containers are essential for packaging a wide range of products, including food, beverages, cosmetics, and pharmaceuticals, due to their durability and protective features. They provide better stacking, storage, and transport options, making them a preferred choice across various industries. Additionally, the growing demand for efficient and reliable packaging solutions is contributing to the demand for containers, thereby driving the US rigid thermoform plastic packaging market expansion.

US Rigid Thermoform Plastic Packaging Market – Key Players & Competitive Analysis Report

The US rigid thermoform plastic packaging market statistics is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the US rigid thermoform plastic packaging industry by introducing innovative products to meet the demand of specific end-use sectors. According to the US rigid thermoform plastic packaging market stats, this competitive index is amplified by continuous progress in product offerings. A few major players in the market include Amcor plc, Anchor Packaging LLC, Constantia Flexibles, D&W Fine Pack LLC, Display Pack, EasyPak., Genpak LLC, Huhtamaki Group, Pactiv Evergreen Inc., Placon, Sabert Corporation, Sealed Air, Sonoco Products Company, and WINPAK LTD.

Genpak LLC, founded in 1969, is a North American manufacturer of food service packaging solutions serving retail businesses and fast-casual restaurant chains. The company provides a range of packaging options, including foam containers, plates, plastic bowls, deli containers, and condiment cups. Genpak also offers eco-friendly packaging and custom-engineered solutions. Their product line includes items such as the Harvest Fiber eco-friendly line and Smart Set Pro microwave-safe containers. Specializing in vacuum-formed plastic packaging, Genpak produces hinged containers, bakery containers, compartment trays, plates, cups, and bowls in various sizes, shapes, and colors for the food service and retail sectors. The company offers custom tooling, design, and engineering support, as well as printing and labeling services. With its corporate headquarters in Charlotte, NC, Genpak operates 18 manufacturing facilities across the US and Canada.

Anchor Packaging LLC, founded in 1963, is a North American thermoform packaging producer known for its foodservice product designs and custom package capabilities. Headquartered in St. Louis, MO, the company has production and distribution facilities in Arkansas and Wisconsin. Anchor Packaging's product lines cater to hot, refrigerated, and ambient temperature protection, with capabilities up to 230 degrees. The company offers a range of rigid packages and cling film products, serving various channels, including restaurants, retail, supermarkets, convenience stores, businesses, and education. Their products include containers designed to maintain the quality of specific foods and tamper-evident containers for cold food. They also offer custom product development. Anchor Packaging specializes in rigid food containers and foodservice cling film. They use thermoforming, a plastic molding process that offers advantages such as lower tooling costs, less material wastage, and lower per-unit costs compared to injection molding. Anchor manufactures in the US, using polypropylene (PP) and PET, both recyclable plastic packaging materials. The company operates across the US, with a presence in the Midwest and South.

List of Key Companies in US Rigid Thermoform Plastic Packaging Market

- Amcor plc

- Anchor Packaging LLC

- Constantia Flexibles

- D&W Fine Pack LLC

- Display Pack.

- EasyPak.

- Genpak LLC

- Huhtamaki Group

- Pactiv Evergreen Inc.

- Placon.

- Sabert Corporation

- Sealed Air

- Sonoco Products Company

- WINPAK LTD.

US Rigid Thermoform Plastic Packaging Market Developments

In May 2024, Anchor Packaging formed a collaboration with Cyclyx Consortium to enhance the recyclability of food-grade plastic. The partnership aimed to increase plastic recovery and support sustainable packaging efforts.

US Rigid Thermoform Plastic Packaging Market Segmentation

By Material Outlook (Volume Kilotons, Revenue USD Billion, 2020–2034)

- Polyethylene Terephthalate (PET)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polypropylene (PP)

- Polyethylene (PE)

- Others

By Product Outlook (Volume Kilotons, Revenue USD Billion, 2020–2034)

- Blister Pack

- Clamshells

- Trays & Lids

- Containers

- Others

By Application Outlook (Volume Kilotons, Revenue USD Billion, 2020–2034)

- Food & Beverages

- Electronics

- Personal Care & Cosmetics

- Pharmaceuticals

- Homecare

- Others

US Rigid Thermoform Plastic Packaging Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 12.90 billion |

|

Market Size Value in 2025 |

USD 13.43 billion |

|

Revenue Forecast by 2034 |

USD 19.45 billion |

|

CAGR |

4.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in Kilotons, Revenue in USD billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Volume Forecast, Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The US rigid thermoform plastic packaging market size was valued at USD 12.90 billion in 2024 and is projected to grow to USD 19.45 billion by 2034.

The market is projected to register a CAGR of 4.2% during 2025–2034

A few key players in the market are Amcor plc, Anchor Packaging LLC, Constantia Flexibles, D&W Fine Pack LLC, Display Pack, EasyPak., Genpak LLC, Huhtamaki Group, Pactiv Evergreen Inc., Placon, Sabert Corporation, Sealed Air, Sonoco Products Company, and WINPAK LTD.

The container segment dominated the market in 2024 due to the growing demand for efficient and reliable packaging solutions in the food & beverages industry.

The polyethylene terephthalate segment is expected to witness highest growth rate during the forecast period due to its several advantages such as durability, clarity, and recyclability.