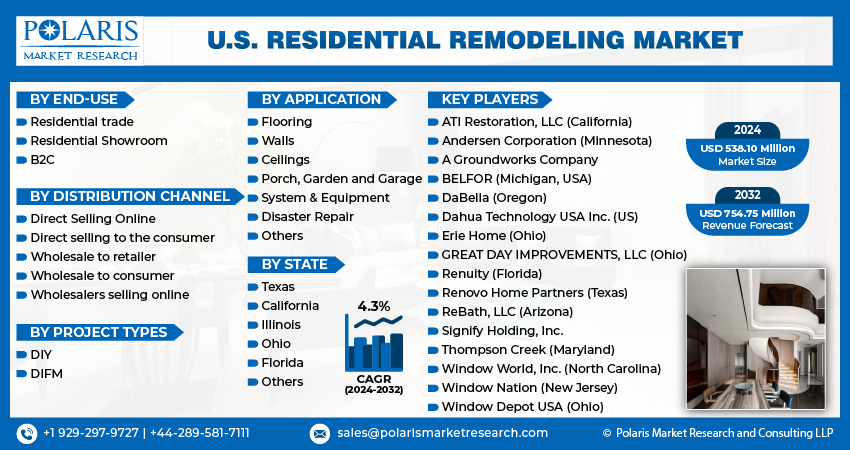

U.S. Residential Remodeling Market Share, Size, Trends, Industry Analysis Report, By End-Use (Residential Trade, Residential Showroom, and B2C); By Distribution Channel; By Project Types; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM4348

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

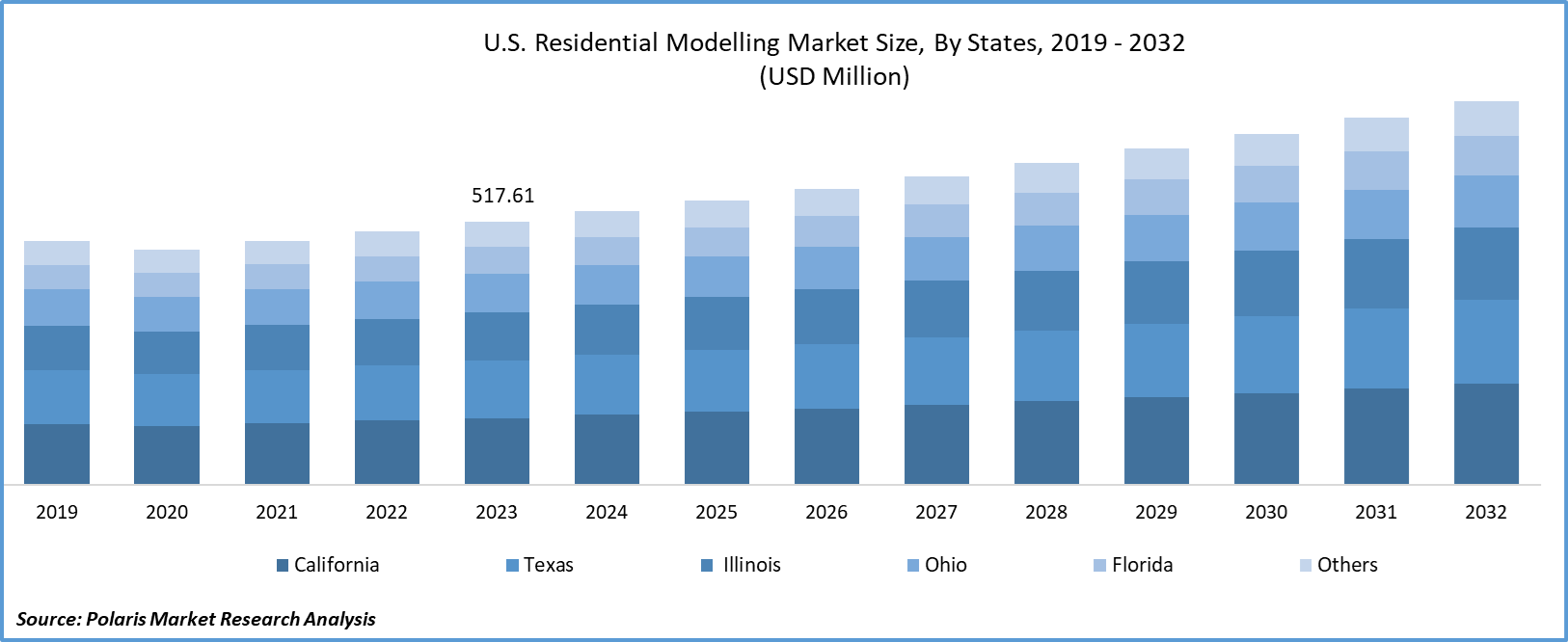

U.S. Residential Remodeling Market size was valued at USD 517.61 million in 2023. The market is anticipated to grow from USD 538.10 million in 2024 to USD 754.75 million by 2032, exhibiting the CAGR of 4.3% during the forecast period.

Market Overview

Growing consumers demand for modern lifestyle and a rise in the number of people in the U.S moving towards the adoption of advanced technology in attaining some advanced lighting with the security in their residential places, are the major factors projected to boost the demand and growth of the market. Also, the U.S. residential remodeling market share is increasing owing to the evolving consumer lifestyles that prioritize safety, enhanced security features including climate control and smart lighting, and current house technology. The development of devices by the major players and the adoption of secured detection devices by the people in the US is increased which is driving the growth of market share over the forecast period.

For instance, in August 2023, Signify has announced the introduction of a new product line that includes smart cameras, detection devices, and app functions from Philips Hue safeguard to help safeguard homes.

Moreover, home renovation to integrate better systems has increased due to advancements in home automation technology and ongoing innovation in the appliance industry, particularly for customers who are gradually increasing their use of smart appliances. Also, the government in the US is investing for the renovation of advanced housing technologies, which will likely fuel market growth soon. The nation is also targeting to reduce nations carbon emission by 2050.

For instance, in March 2022, the U.S. Department of Energy (DOE) announced that over thirty next generation building retrofit projects that will significantly advance affordable housing technology will be funded by $32 million.

To Understand More About this Research: Request a Free Sample Report

Although, this will evaluate restoration methods that minimize tenant disturbance while enhancing the energy and environmental efficiency of buildings in a timely, cost-effective, and efficient manner. These methods, which can transform building and remodeling, include prefabricating walls and installing drop-in replacements for HVAC, hot water, and heating systems. In order to achieve objectives of a net zero carbon economy by 2050, the US can also offer the tools to decarbonize America's 130 million structures at the rate required.

Growth Factors

Rising Awareness Towards Advanced Construction Industry and More Energy-Efficient Construction

The rising awareness among key players and buyers across the nation regarding the energy efficient construction has fueled the adoption of U.S. Residential Remodeling and driven the global U.S. Residential Remodeling Market growth at a rapid pace. Additionally, energy-saving has recently become a vital issue among urban population which has favorably influenced the entire market in United States. To elaborate, the region's need for energy-efficient buildings has prompted the refurbishment of aging structures. In this sense, thermal insulation of the walls, ceiling, and floors is common in both the residential and commercial building industries. Additionally, a number of government efforts to encourage energy conservation and the construction of energy-efficient buildings are enhancing the business environment.

Increase in Advanced Technology Adoption for Home Improvement

The rise in the various advancements in the home improvements products by the manufacturers and adoption of them by the people is the major factor driving the US residential remodeling market share at the highest rate. Homeowners have been inspired to make desired improvements to their homes by the development of sophisticated computer-based technology such as 3D software and visualization apps. Manufacturers are concentrating on introducing innovative products like doors and windows that open effortlessly and with less effort.

For instance, in January 2022, REHAU announced the REHAU Aspekt+TM 1800, a casement window portfolio addition that has a strength-enhancing sash made of the company's cutting-edge RAU-FIPRO® glass-fiber reinforced PVC materials.

Restraining Factors

Rising Raw Material Prices are Likely to Impede the Market Growth

The rising price of various raw materials that are being using in the renovation of residential spaces and the inflation in the nation is the factor that is impeding the growth of market over the forecast period. Furthermore, the COVID-19 epidemic has negatively impacted the sector due to a lack of workers, frequent project cancellations, and supply chain interruptions. The economic downturn has caused a serious financial crisis for the building industry, which has caused numerous commercial construction projects to be delayed.

Report Segmentation

The market is primarily segmented based on end-use, distribution channel, project types, application, and region.

|

By End-Use |

By Distribution Channel |

By Project Types |

By Application |

By State |

Showroom

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Application Insights

System & Equipment Segment is Expected to Witness Highest Growth During Forecast Period

The system & equipment segment will grow rapidly, due to its wide range of equipment available with their beneficial characteristics and features such as easy availability, wide range, high flexibility, and suitable for various application. This is rising due to growing consumer attitudes toward smart homes and rising home appliance usage. Due to this, the United States now needs updated technologies to assist with grounding electricity in residential buildings. Further, Climate change is to blame for the rise in natural catastrophes like hurricanes and fires that have occurred in the nation recently.

For instance, as per the Climate.gov, The United States saw 28 distinct weather-related and climate-related disasters in 2023 that cost at least $1 billion. 1 wildfire event that destroyed the town of Lahaina, one heat wave and drought event that affected the central and southern US, and 4 flooding events that affected California, Florida, and the eastern and northeastern US are among the 28 catastrophes that will occur in 2023. and the other two tornado outbreaks in the US' east and central regions.

Walls segment dominated the market, largely attributable to development in advanced technologies that are using for the renovations of walls. The growing number of individual instances is driving up demand for the sector, which in turn is driving up need for contemporary architectural design and attractive look of the wall. This is also increasing as a result of technological developments like attractive insulation panels, which have produced exterior and interior walls with lower energy usage for residential structures.

By Project Type Insights

Professional Projects Segment Accounted for the Largest Market Share in 2023

The professional projects segment held the largest share. This is owing to the rising number of renovations in the buildings for professional purposes. The rental segment is also increasing in the region so the rental property owners are continuously investing in their projects so the external factor can have low impact on buildings and also advanced technology can maker safer their buildings in terms of security.

The DIY Projects segment will grow rapidly, on account of the rapid increase in the do it yourself due to the growing concerns regarding less expenses and energy efficient projects. People are more interested in using advanced technology with eco-friendly projects that is rising the growth of segment. Also, these projects are less expensive as it saves labor cost and also third-party cost. These are the reasons that are assisted the DIY projects segment in the US residential remodeling market share growth.

Regional Insights

California State Dominated the Global Market in 2023

The California dominated the global market. This growth is due to the rapidly increasing demand for renovation in the residential buildings. Rising building and real estate costs in the state have increased demand for residential renovation and remodeling as a more affordable option than purchasing a new home.

Furthermore, the Utah and Idaho states that are in the United States has grown significantly in the recent years owing to the large number or residentials remodeling and higher rate of loan per capita, that has driven the growth of market over the forecast period. The two states with the quickest rates of growth, Idaho and Utah, had the highest rates of home renovation loans per capita (26.0 and 18.9 loans per 1,000 homeowners, respectively). Other notable states are New England's Rhode Island, New Hampshire, Massachusetts, and Vermont; Washington, and Oregon are also among the top states. On the other hand, with only 1.6 loans per 1,000 homes, Alaskan homeowners obtained the fewest home repair loans.

Key Market Players & Competitive Insights

Mergers and Acquisitions to Drive the Competition

The U.S. Residential Remodeling market is fragmented and is anticipated to witness competition due to several players' presence. Also, the main focus of the players behind the mergers is to expand the market, increase market share, cutting costs, growth opportunities, diversification, eliminating competition among them.

Some of the major players operating in the global market include:

- ATI Restoration, LLC (California)

- Andersen Corporation (Minnesota)

- A Groundworks Company (Virginia Beach, US)

- BELFOR (Michigan, USA)

- DaBella (Oregon)

- Dahua Technology USA Inc. (US)

- Erie Home (Ohio)

- GREAT DAY IMPROVEMENTS, LLC (Ohio)

- Renuity (Florida)

- Renovo Home Partners (Texas)

- ReBath, LLC (Arizona)

- Signify Holding, Inc. (Netherlands) (Philip Hue-US)

- Thompson Creek (Maryland)

- Window World, Inc. (North Carolina)

- Window Nation (New Jersey)

- Window Depot USA (Ohio)

Recent Developments in the Industry

- In December 2023, Dahua Technologies, has announced the introduction of its cutting-edge video access controller. This innovative gadget promises a new degree of security for residences by combining cutting-edge security technology and intuitive, user-friendly functions, redefining residential control of access systems.

Report Coverage

The U.S. Residential Remodeling market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product types, applications, end-users, and their futuristic growth opportunities.

U.S. Residential Remodeling Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 538.10 million |

|

Revenue forecast in 2032 |

USD 754.75 million |

|

CAGR |

4.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The U.S. Residential Remodeling Market report covering key segments are end-use, distribution channel, project types, application and region.

U.S. Residential Remodeling Market Size Worth $754.75 Million By 2032

U.S. Residential Remodeling Market exhibiting the CAGR of 4.3% during the forecast period.

key driving factors in U.S. Residential Remodeling Market Rising awareness towards advanced construction industry and more energy-efficient construction