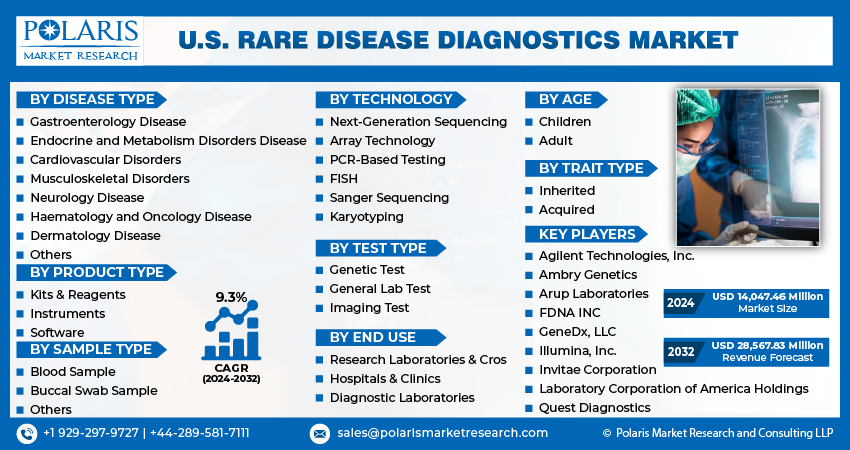

U.S. Rare Disease Diagnostics Market Share, Size, Trends, Industry Analysis Report, By Disease Type (Gastroenterology Disease, Endocrine and Metabolism Disorders Disease, Cardiovascular Disorders, Musculoskeletal Disorders, Neurology Disease, Hematology and Oncology Disease, Dermatology Disease, And Others), By Product Type, By Sample Type, By Technology, By Test Type, By Age, By Trait Type, And By End Use; Segment Forecast, 2024- 2032

- Published Date:May-2024

- Pages: 117

- Format: PDF

- Report ID: PM4908

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

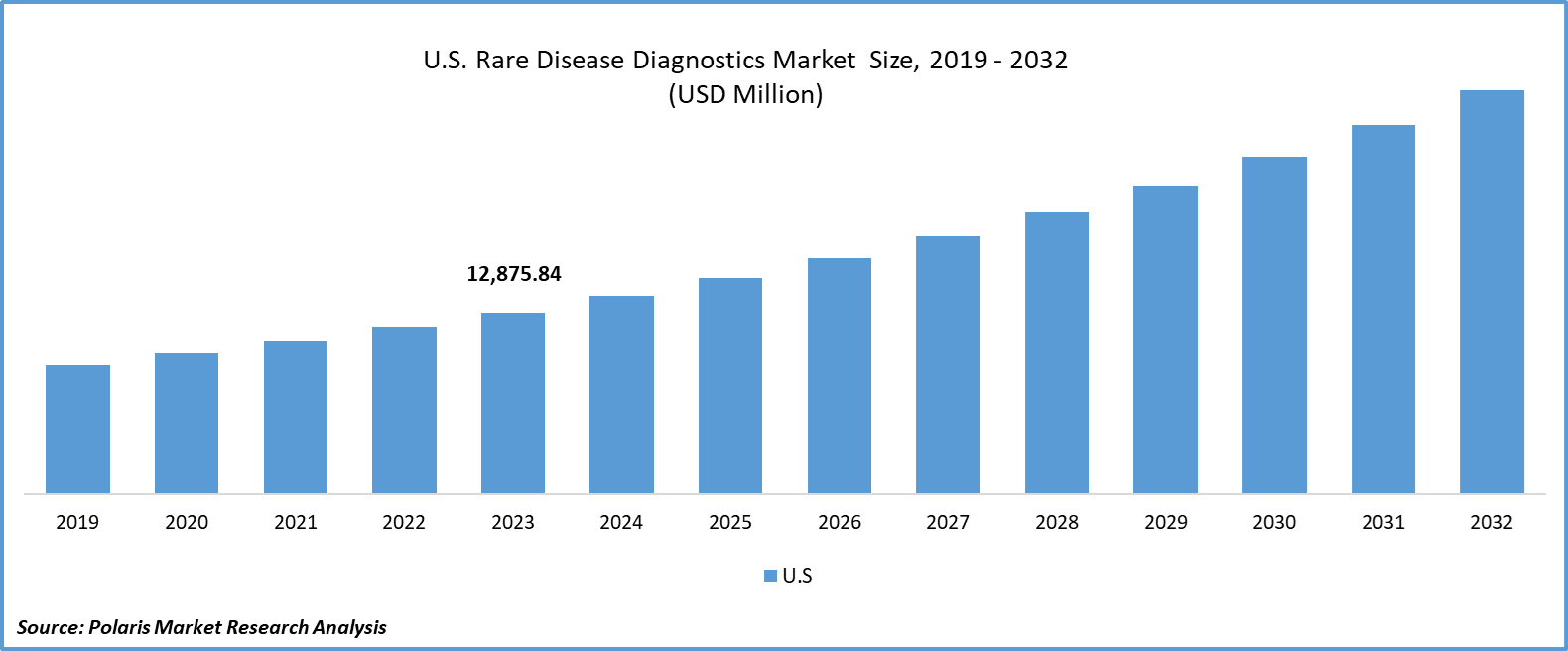

The U.S. rare disease diagnostics market size was valued at USD 12,875.84 million in 2023. The market is anticipated to grow from USD 14,047.46 million in 2024 to USD 28,567.83 million by 2032, exhibiting a CAGR of 9.3% during the forecast period.

Industry Trend

Rare disease diagnosis represents a pivotal aspect of healthcare, focusing on identifying and managing medical conditions that affect a small percentage of the population. Rare diseases, also known as orphan diseases, typically afflict fewer than 1 in 2,000 individuals, varying in prevalence and severity. Despite their rarity, collectively, rare diseases impact millions worldwide, presenting significant challenges in diagnosis and treatment. These conditions often involve complex genetic, biochemical, or environmental factors, necessitating specialized diagnostic approaches and multidisciplinary care.

Rare diseases encompass a broad spectrum of disorders spanning various organ systems and medical specialties. Examples include genetic disorders like cystic fibrosis, a progressive lung disease caused by mutations in the CFTR gene, and Duchenne muscular dystrophy, a degenerative muscle disorder resulting from mutations in the DMD gene.

To Understand More About this Research: Request a Free Sample Report

Additionally, rare autoimmune diseases such as systemic lupus erythematosus (SLE), a chronic inflammatory condition affecting multiple organs, and rare cancers like mesothelioma, a tumor arising from the mesothelial cells lining the lungs or abdomen, fall under this category. Treatment for rare diseases varies depending on the underlying cause, disease progression, and individual patient factors. In some cases, symptomatic management and supportive care are the primary strategies aiming to alleviate symptoms and improve quality of life.

In the landscape of rare disease diagnosis, collaboration plays a vital role in navigating the challenges posed by these uncommon conditions. Bringing together healthcare professionals, researchers, pharmaceutical companies, patient advocacy groups, and regulatory bodies fosters a multidisciplinary approach to diagnosis and treatment. This collaboration facilitates the sharing of expertise, resources, and data, leading to improved understanding of rare diseases and the development of innovative diagnostic solutions.

- For instance, in April 2024, Quest Diagnostics, a top-tier provider of diagnostic information services, and Broad Clinical Labs, recognized for their mastery in whole genome sequencing (WGS), have announced a joint research initiative. Their collaboration is focused on highlighting the pivotal role of WGS as the primary genetic testing method for diagnosing developmental delay disorders after birth.

However, heightened awareness among healthcare providers leads to a quick identification of symptoms associated with rare diseases and facilitates the directed referral of patients to specialized diagnostic centres. As medical professionals gain a deeper understanding of the varied presentations of rare diseases, they are empowered to request relevant diagnostic assessments and interpret findings with precision. This proactive stance increases the chances of early diagnosis, a critical factor in promptly initiating treatment and enhancing patient prognosis.

Key Takeaway

- By trait type category, the inherited segment accounted for the largest market share in 2023.

- By end use category, the industrial manufacturing segment is projected to grow at a highest CAGR during the projected period.

What are the market drivers driving the demand for the U.S. rare disease diagnostics market?

Increased awareness and education have been projected to spur product demand.

Growing awareness among healthcare providers about rare diseases is a significant driver in the demand for rare disease diagnostics within the United States. This heightened awareness stems from various factors, including advancements in medical education, increased dissemination of medical information through conferences, workshops, and publications, as well as the efforts of patient advocacy groups in raising awareness about these conditions.

As healthcare providers become more knowledgeable about rare diseases and their diverse manifestations, they are better equipped to recognize the subtle signs and symptoms that may indicate such conditions. This improved recognition is crucial, as rare diseases often present with symptoms that overlap with more common ailments, leading to misdiagnosis or delayed diagnosis. By understanding the unique clinical features of rare diseases, healthcare professionals can avoid these pitfalls and promptly consider rare diseases in their differential diagnoses.

Moreover, increased awareness empowers healthcare providers to order appropriate diagnostic tests tailored to the suspected rare disease, such as genetic testing, molecular diagnostics, or specialized imaging studies. This targeted approach to diagnostics improves the accuracy and efficiency of the diagnostic process, leading to more timely identification of rare diseases.

Which factor is restraining the demand for U.S. rare disease diagnostics?

The high cost associated with specialized diagnostic tests and procedure is expected to hinder the growth of the market.

While advancements in diagnostic technologies have enabled more accurate and efficient identification of rare diseases, these tests often come with a hefty price tag. Since rare diseases affect only a small percentage of the population, the market for diagnostic tests targeting these conditions may be relatively niche. As a result, the economies of scale typically seen with more common diagnostic tests may not apply, leading to higher per-test costs. Additionally, many rare diseases are chronic or lifelong conditions, requiring ongoing monitoring and diagnostic testing to manage effectively. The cumulative cost of repeated diagnostic tests, coupled with the expenses associated with treatment and care for rare diseases, can impose a significant financial burden on patients, healthcare providers, and payers. Furthermore, limited insurance coverage for rare disease diagnostics may exacerbate the financial challenges faced by patients seeking diagnosis and treatment for these conditions. Insurance reimbursement policies may not adequately cover the costs of specialized tests or may impose high out-of-pocket expenses for patients, limiting access to diagnostic services.

Report Segmentation

The market is primarily segmented based on disease type, product type, sample type, technology, test type, age, trait type, and end use.

|

By Disease Type |

By Product Type |

By Sample Type |

By Technology |

By Test Type |

By Age |

By Trait Type |

By End Use |

|

|

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Trait Type Insights

Based on a trait type analysis, the market is segmented into inherited, and acquired. Inherited held the largest market in 2023 Inherited or genetic diseases represent a significant portion of rare diseases. These conditions result from mutations or variations in the individual's genetic makeup and are often passed down from one generation to another. Due to the prevalence of inherited diseases among rare diseases, diagnostics for these conditions constitute a substantial portion of the market. The advancements in genetic testing technologies have revolutionized the diagnosis of inherited diseases. Techniques such as next-generation sequencing (NGS), microarray analysis, and polymerase chain reaction (PCR) have greatly improved the speed, accuracy, and cost-effectiveness of genetic testing. These technological advancements have facilitated the diagnosis of a wide range of inherited diseases, driving the growth of the inherited diseases diagnostics market.

By End Use Insights

Based on end-use analysis, the market has been segmented on the basis of research laboratories & cros, hospitals & clinics, diagnostic laboratories. The diagnostic laboratories segment is expected to be the fastest-growing CAGR during the forecast period. Diagnostic laboratories offer specialized testing services, including genetic testing, molecular diagnostics, and biochemical assays, which are essential for diagnosing rare diseases. Diagnostic laboratories provide specialized testing services crucial for diagnosing rare diseases, encompassing genetic testing, molecular diagnostics, and biochemical assays. These laboratories are continuously enhancing their testing capabilities to offer a comprehensive suite of tests tailored for rare diseases. Investments are directed towards developing novel assays, broadening test menus, and improving laboratory infrastructure to address the changing requirements of healthcare providers and patients. The holistic approach of diagnostic laboratories, offering end-to-end solutions for rare disease diagnostics encompassing testing, interpretation, and reporting, positions them as the preferred choice for healthcare stakeholders.

Competitive Landscape

The competitive landscape of the U.S. rare disease diagnostics market, Large diagnostic companies with diverse portfolios often have a presence in the rare disease diagnostics market. These companies leverage their expertise in molecular diagnostics, genetic testing, and specialty laboratories to offer comprehensive diagnostic solutions for rare diseases. They may also have established relationships with healthcare providers, payers, and patient advocacy groups.

Some of the major players operating in the market include:

- Agilent Technologies, Inc.

- Ambry Genetics

- Arup Laboratories

- FDNA INC

- GeneDx, LLC

- Illumina, Inc.

- Invitae Corporation

- Laboratory Corporation of America Holdings

- Quest Diagnostics

Recent Developments

· In April 2024, GeneDx, has unveiled a strategic alliance with Komodo Health, a leading healthcare technology firm serving the pharmaceutical industry. This collaboration aims to broaden access to GeneDx's vast de-identified rare disease dataset, now accessible through Komodo Health’s MapEnhance offering. This dataset encompasses data from over 500,000 exomes, empowering biopharmaceutical companies to tap into genetic insights for informed decisions regarding drug pipelines and expediting clinical trial enrolment.

· In November 2023, Quest Diagnostics has introduced its inaugural consumer-initiated genetic test, accessible via the company's consumer health division at questhealth.com. Dubbed Genetic Insights, this innovative service empowers individuals to comprehend their susceptibility to specific hereditary health conditions. It provides comprehensive support, including personalized health reports and access to genetic counselling.

· In August 2023, PacBio and GeneDx have initiated a research partnership with the University of Washington to investigate the efficacy of long-read whole genome sequencing in neonatal care, aiming to enhance diagnostic yield.

· In March 2023, Illumina Inc. launched a new cloud-based software named Connected Insights, which facilitates tertiary analysis for clinical next-generation sequencing (NGS) data.

Report Coverage

The U.S. rare disease diagnostics market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, disease type, product type, sample type, technology, test type, age, trait type, and end use, and their futuristic growth opportunities.

U.S. Rare Disease Diagnostics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 14,047.46 Million |

|

Revenue forecast in 2032 |

USD 28,567.83 Million |

|

CAGR |

9.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

Disease Type, Product Type, Sample Type, Technology, Test Type, Age, Trait Type, And End Use |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The U.S. Rare Disease Diagnostics Market report covering key segments are disease type, product type, sample type, technology, test type, age, trait type, and end use.

U.S. Rare Disease Diagnostics Market Size Worth $28,567.83 Million By 2032

U.S. Rare Disease Diagnostics Market Size Worth $28,567.83 Million By 2032

key driving factors in U.S. Rare Disease Diagnostics Market are increasing focus on early diagnosis and intervention