US Pneumococcal Vaccine Market Size, Share, Trend, Industry Analysis Report, By Vaccine Type, By Product Type (Prevnar 13, Synflorix, Pneumovax23), By End User, Market Forecast, 2025 – 2034

- Published Date:Nov-2024

- Pages: 115

- Format: PDF

- Report ID: PM5205

- Base Year: 2024

- Historical Data: 2020-2023

Market Outlook

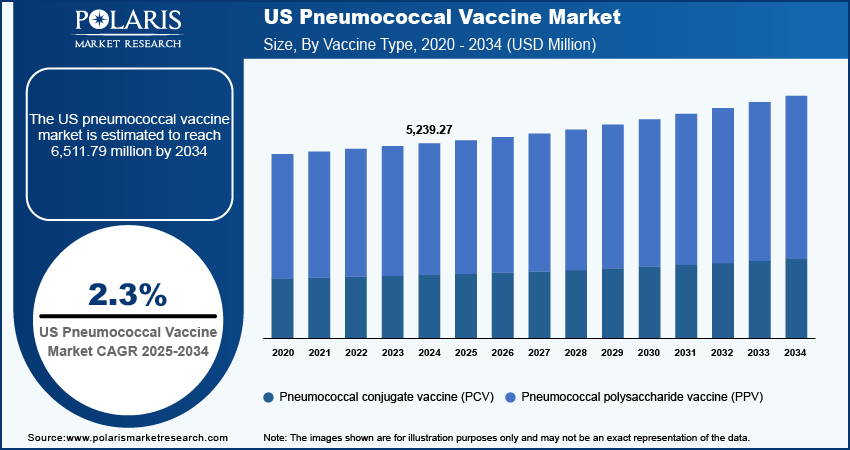

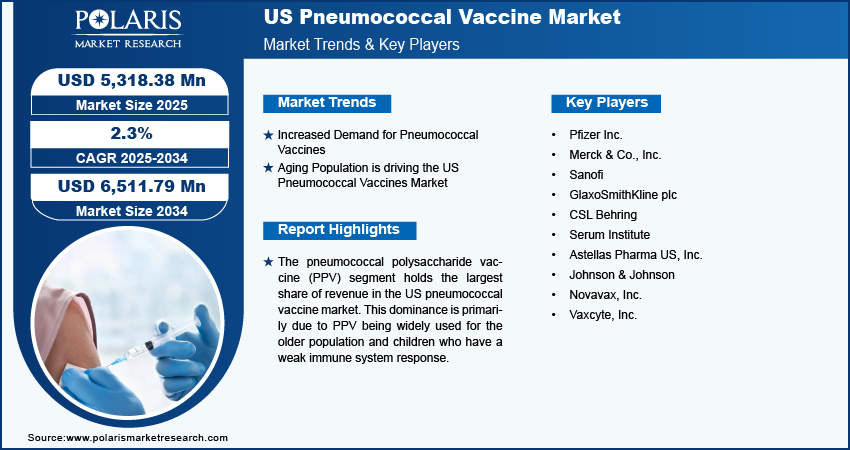

The US pneumococcal vaccine market size was valued at USD 5,239.27 million in 2024. The market is anticipated to grow from USD 5,318.38 million in 2025 to USD 6,511.79 million by 2034, exhibiting a CAGR of 2.3% during the forecast period.

Market Overview

Pneumococcal vaccines help prevent severe infections such as pneumonia, meningitis, and bloodstream infections. Increasing public health awareness and the use of FDA-approved licensed vaccines in the US contribute to the growth of the US pneumococcal vaccine market. Companies are collaborating with local governments and non-governmental organizations to develop effective vaccines for preventing pneumonia.

To Understand More About this Research: Request a Free Sample Report

The high prevalence of pneumococcal infections and the strong distribution network in the US drive the market significantly. Moreover, the increasing pneumococcal vaccinated population further facilitates the US pneumococcal vaccine market. For instance, according to the Centers for Disease Control and Prevention (CDC), in 2022, 23.9% of adults aged 18 and older had received a pneumococcal vaccination. Additionally, there were 1.4 million visits to emergency departments with pneumonia caused by infectious organisms as the primary diagnosis, resulting in 41,108 deaths.

Growth Drivers

Increased Demand for Pneumococcal Vaccines

The increased demand for pneumococcal vaccines is driving significant growth in the US market due to several key factors such as include rising awareness of vaccine benefits, increasing prevalence of respiratory diseases, healthcare policy support, and aging populations at higher risk. Pneumococcal diseases, including pneumonia, meningitis, and bloodstream infections, are on the rise, especially among vulnerable groups such as older adults, infants, and individuals with weakened immune systems. This has led to a greater need for effective vaccines. Public awareness campaigns and educational efforts have also encouraged more people to seek immunization. Government vaccination programs and recommendations from public health authorities like the CDC have expanded vaccine coverage for both children and adults, making pneumococcal vaccines a part of routine immunization schedules. Moreover, the growing aging population, which is more susceptible to pneumococcal diseases, as well as employer and school vaccination requirements, have further increased demand. These factors combined are contributing to the strong growth of the US pneumococcal vaccine market.

Increasing Aging Population

The increasing number of older individuals in the United States is fueling the demand for pneumococcal vaccines. Older adults face a significantly higher risk of developing severe pneumococcal diseases, such as pneumonia, meningitis, and bloodstream infections, due to a weakened immune system. Therefore, as the older population grows and people live longer, there is a greater need for preventive healthcare, including vaccines. Public health organizations, such as the CDC, strongly recommend pneumococcal vaccination for adults aged 65 and older to lower the occurrence of these diseases. This demographic shift, along with government health initiatives, has resulted in increased demand for pneumococcal vaccines, making the aging population a key driver of market growth.

Restraining Factors

Complex Vaccine Schedules

The complex vaccine schedules for the US pneumococcal vaccine market pose several challenges. Patients often struggle with compliance due to the need for multiple doses over extended periods, leading to missed appointments and immunity gaps. Healthcare providers also face difficulties managing different schedules for various age groups and at-risk populations, which increases the likelihood of errors or delays in administration, adding to the administrative burden for healthcare facilities, complicating coordination, and driving up costs. Furthermore, the complexity of these schedules can contribute to vaccine hesitation. Patients may find the process overwhelming, discouraging them from completing the vaccination regimen. These issues collectively hinder the effectiveness of vaccination programs and limit broader market growth.

Report Segmentation

The market is primarily segmented based on vaccine type, product type, and state.

|

By Product Type |

By Vaccine Type |

By End Use |

|

|

|

By Product Type

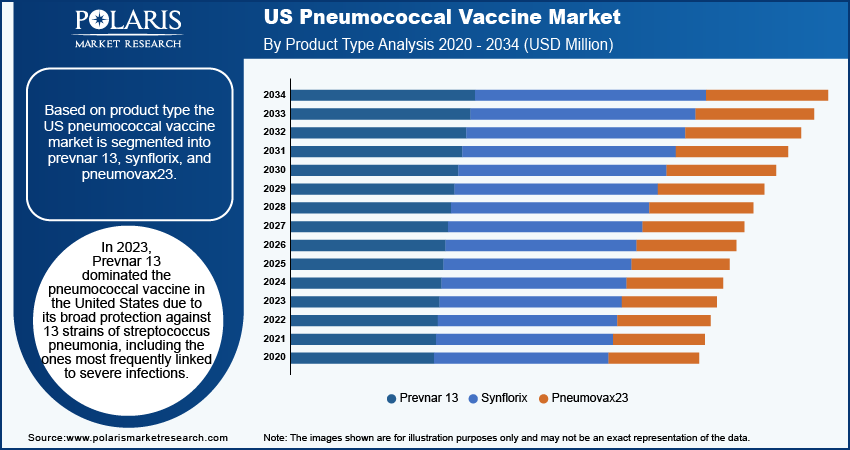

Prevnar 13 is the dominant pneumococcal vaccine in the United States. It provides broad protection against 13 strains of Streptococcus pneumonia, including those most commonly associated with severe infections. The vaccine is approved for use in both children and adults, making it widely available. It is included in childhood vaccination schedules and is recommended for adults, especially older individuals and those with weakened immune systems. Prevnar 13 has demonstrated strong clinical efficacy in preventing serious conditions such as pneumonia and meningitis, making it highly appealing. Manufactured by Pfizer, Prevnar 13 has established itself as a market leader with a strong reputation. Its widespread recommendation by public health authorities and coverage by insurance, including Medicare, ensure its continued dominance in the US market.

By Vaccine Type

The pneumococcal polysaccharide vaccine (PPV) segment holds the largest share of revenue in the US pneumococcal vaccine market. This dominance is primarily due to PPV being widely used for the older population and children who have a weak immune system response. PPV significantly boosts proceeds and provides longer protection against pneumococcus, making it applicable for a long time and driving segment growth.

The pneumococcal conjugate vaccine (PCV) segment of the US pneumococcal vaccine market is also expected to experience substantial growth in the upcoming years. This growth is due to the rising number of pneumococcal diseases and the strong support and initiatives from regulatory bodies such as the FDA. The expansion of the PCV vaccine recommendation for adults is anticipated to be a major factor driving the segment's future growth.

By End Use

The public sector's dominance in using pneumococcal vaccines, including hospitals, clinics, and healthcare facilities, can be attributed to several key factors. Government immunization programs prioritize pneumococcal vaccination, ensuring widespread access. Public healthcare infrastructure supports large-scale distribution and administration of vaccines. Public funding and subsidies make vaccines more accessible, reducing the cost burden for individuals. Disease prevention mandates from public health organizations guide hospitals and clinics to prioritize pneumococcal vaccination, further reinforcing the public sector's dominance in vaccine administration.

Key Market Players & Competitive Insights

The competitive landscape of the US pneumococcal vaccine market is characterized by a diverse array of global and regional players striving to capture market share through innovation, strategic partnerships, and geographic expansion. Major players in the industry, such as Pfizer Inc.; Merck & Co.; Sanofi Pasteur leverage their extensive R&D capabilities and broad distribution networks to offer a wide range of advanced products. These companies focus on product innovation, including improvements in safety, functionality, and cost-efficiency, to meet the evolving needs of healthcare providers. Additionally, smaller and regional companies are increasingly entering the market, offering specialized and niche products that cater to specific healthcare needs or local market demands. Competitive strategies often include mergers and acquisitions, partnerships with healthcare institutions, and investments in emerging markets to expand reach and enhance market presence. Major players include Pfizer Inc.; Merck & Co.; Inc., Sanofi; GlaxoSmithKline plc; CSL Behring; Serum Institute; Astellas Pharma US, Inc; Johnson & Johnson; Novavax Inc.; Vaxcyte Inc.

In April 2023, Pfizer, an American multinational pharmaceutical and biotechnology corporation based in Manhattan, New York City, announced that the US FDA approved PREVNAR 20 (20-valent Pneumococcal Conjugate Vaccine). This vaccine is approved for the prevention of invasive pneumococcal disease (IPD) caused by the 20 Streptococcus pneumonia (pneumococcal) serotypes contained in the vaccine in infants and children aged six weeks through 17 years. It is also approved for the prevention of otitis media in infants aged six weeks through five years caused by the original seven serotypes contained in PREVNAR.

In June 2024, Merck Sharp & Dohme, an American multinational pharmaceutical company headquartered in Rahway, New Jersey, and named for Merck Group, announced that the US FDA approved CAPVAXIVE (Pneumococcal 21-valent Conjugate Vaccine) for the prevention of Invasive Pneumococcal Disease and Pneumococcal Pneumonia in adults. This vaccine covers serotypes responsible for approximately 84% of invasive pneumococcal disease in adults 50 years of age and older, and in adults 65 years of age and older, CAPVAXIVE covers the serotypes responsible for approximately 85% of IPD cases, compared to approximately 51% covered by PCV20.

List of Key Players in US Pneumococcal Vaccine Market

- Pfizer Inc.

- Merck & Co., Inc.

- Sanofi

- GlaxoSmithKline plc

- CSL Behring

- Serum Institute

- Astellas Pharma US, Inc.

- Johnson & Johnson

- Novavax, Inc.

- Vaxcyte, Inc.

Recent Developments in the Industry

March 2024: Vaxcyte, Inc. successfully registered participants in their trial, a phase II study, while assessing VAX-24, a pneumococcal conjugate vaccine (PCV) composed of 24 valences that are tested among healthy infants. The firm intends to communicate topline safety, tolerability, and immunogenicity findings for the initial 3 dose series by the first quarter of 2025 and for the booster dose by 2025.

October 2023: Lonza and Vaxcyte, a US clinical-stage vaccine innovation company, expanded their partnership to increase manufacturing facility Vaxcyte's pneumococcal conjugate vaccine (PCV) candidates.

April 2022: Merck announced that the US Food and Drug Administration (FDA) is giving a breakthrough therapy designation to V116, an investigational 21-valent pneumococcal conjugate vaccine that will prevent invasive pneumococcal disease and pneumococcal pneumonia in adults.

Report Coverage

The US pneumococcal vaccine market report emphasizes key states across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, product type, vaccine type, distribution channel, state, and futuristic growth opportunities.

US Pneumococcal Vaccine Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2025 |

USD 5,318.38 million |

|

Revenue Forecast in 2034 |

USD 6,511.79 million |

|

CAGR |

2.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Segments Covered |

By Vaccine Type By Product Type By Distribution Channel |

|

Competitive Landscape |

The US Pneumococcal Vaccine Market Trend Analysis (2024) Company Profiles/Industry participants profiling includes company overview, financial information, product/service benchmarking, and recent developments |

|

Report Format |

PDF + Excel |

|

Customization |

Report customization as per your requirements with respect to states and segmentation. |

FAQ's

The global medical disposable market size was valued at USD 5,239.27 million in 2024 and is projected to grow to USD 6,511.79 million by 2034.

The market registers a CAGR of 2.3% during the forecast period.

The key players in the market Pfizer Inc.; Merck & Co. Inc.; Sanofi; GlaxoSmithKline plc; CSL Behring; Serum Institute; Astellas Pharma US, Inc.; Johnson & Johnson; Novavax Inc.; Vaxcyte Inc.

The pneumococcal conjugate vaccine (PCV) segment is expected to witness the highest growth over the study period, owing to the increasing number of pneumococcal diseases.

The pneumococcal polysaccharide vaccine (PPV) segment has the largest share of revenue in the US pneumococcal vaccine market. This dominance is primarily due to PPV being widely used for the older population and children who have a weak immune system response.