U.S. Pet Insurance Market Share, Size, Trends, Industry Analysis Report, By Coverage Type (Accident Only, Accident & Illness, Others); By Animal type; By Sales Channel; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 117

- Format: PDF

- Report ID: PM4770

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

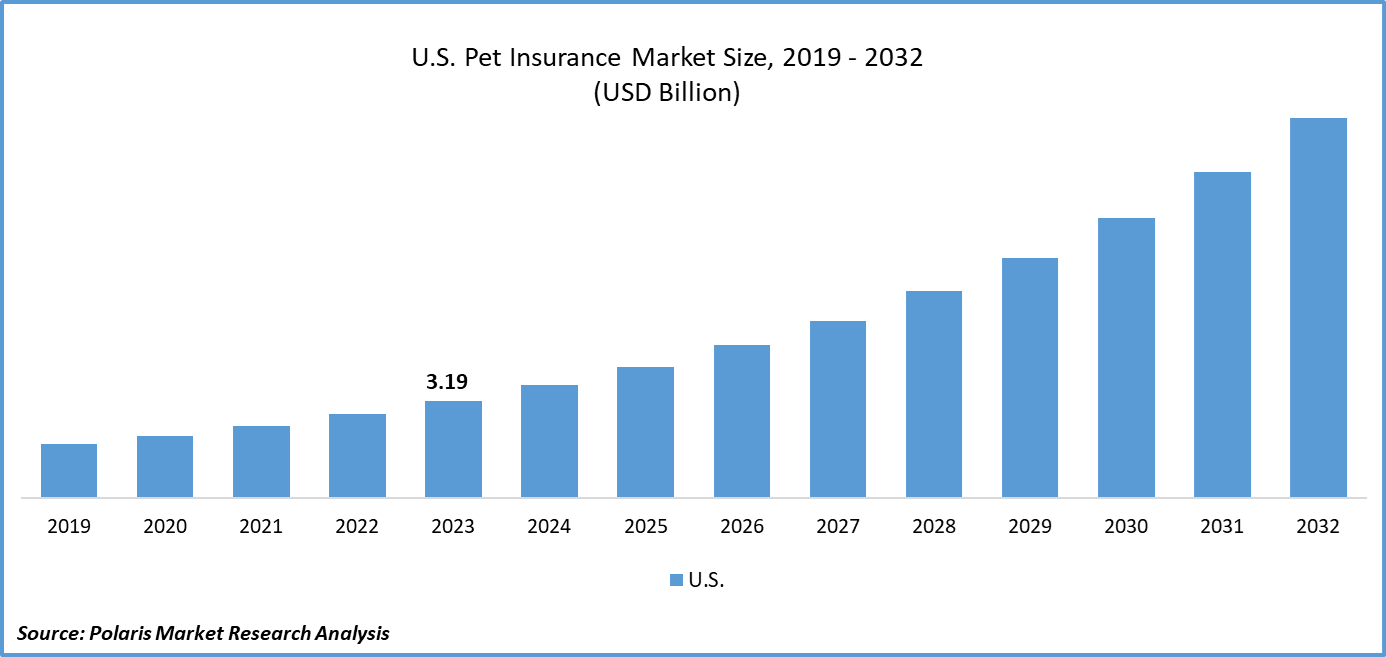

The U.S. pet insurance market size was valued at USD 3.19 billion in 2023. The market is anticipated to grow from USD 3.71 billion in 2024 to USD 12.48 billion by 2032, exhibiting a CAGR of 16.4% during the forecast period.

Industry Trends

Pet insurance covers the medical expenses of pets, such as dogs, cats, and other animals. It helps protect pet owners from unexpected veterinary bills that can result from accidents, illnesses, or routine care.

The U.S. pet insurance market has experienced significant growth in recent years, driven by a growing awareness of the importance of protecting pets' health and well-being. One of the key drivers is the increasing trend of pet humanization, where people consider their pets as part of the family and are willing to invest in their care and well-being. This market trend has led pet owners to purchase insurance policies that cover medical expenses, accidents, and illnesses. Also, advancements in veterinary medicine have resulted in a higher number of treatments and procedures available for pets, which further drives up the costs of pet care and makes insurance coverage more appealing.

To Understand More About this Research: Request a Free Sample Report

Another contributing factor to the growth of the pet insurance market is the rise of preventative care. Pet owners are now more aware of the importance of regular check-ups, vaccinations, and dental care in maintaining their pets' health. As a result, they are willing to pay extra for these services. This shift towards preventative care has created opportunities for insurers to offer policies that cover not only unexpected medical expenses but also routine care.

The pet insurance industry is facing a major challenge in terms of high premium costs, which may need to be more affordable to many pet owners. Overall, the U.S. pet insurance market is expected to continue to grow as pet owners become more conscious of their pets' health and well-being.

Key Takeaways

- By coverage type category, the accidents-only segment is expected to grow with a significant CAGR over the market forecast period

- By animal type category, the dogs segment held the dominating market share in 2023

- By sales channel category, the direct segment accounted for the largest market share in 2023

What are the market drivers driving the demand for the market?

The growing pet humanization trend drives the U.S. pet insurance market growth.

The growth of the pet insurance market in the United States is attributed to the increasing trend of pet humanization. Pet owners are increasingly treating their pets as family members and providing them with amenities and services that were once reserved for humans, such as spa treatments, gourmet food, and luxury travel. As a result of this shift in attitudes towards pets, pet owners are seeking better healthcare options for their furry friends, including insurance coverage.

Pet humanization has led to an increased demand for comprehensive pet insurance policies that cover a wide range of services, from routine check-ups to complex medical procedures. Also, many pet owners are now opting for preventative care and wellness services such as vaccinations and dental cleanings, which are often included in pet insurance plans. As a result, the U.S. pet insurance market is experiencing steady growth as more and more pet owners invest in policies to protect their beloved pets' health and well-being.

Which factor is restraining the demand for the market?

The high premium costs, along with limited coverage, are hampering the U.S. pet insurance market growth.

The increasing demand for pet insurance in the United States is facing significant challenges that could hinder the growth of the market. One of the most significant impediments is the exorbitant premium cost, which is prohibitive for many pet owners. Also, the coverage provided by most pet insurance policies is restricted, leaving pet owners with limited options to cover particular medical conditions or procedures. Some policies exclude pre-existing conditions, while others have stringent limits on the amount of coverage available for specific procedures. These limitations make it difficult for pet owners to justify the cost of purchasing a policy, mainly if they have low-risk pets or limited financial resources. In addition, the need for more transparency and standardization in the industry obscure consumers' ability to compare various policies and select the one that suits their requirements best. The combination of these factors is impeding the growth of the U.S. market.

Report Segmentation

The market is primarily segmented based on coverage type, animal type, and sales channel.

|

By Coverage Type |

By Animal Type |

By Sales Channel |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Coverage Type Insights

Based on coverage type analysis, the market is segmented on the basis of accident only, accident & illness, and others. The accident-only segment is expected to experience significant growth in the US pet insurance market over the forecast period, driven by increasing consumer awareness and demand for protection against unexpected medical expenses resulting from accidents or injuries. Unlike wellness policies that cover routine care, accident-only policies provide coverage for unforeseen events such as broken bones, poisoning, or surgery, which can be expensive and financially burdensome for pet owners. Also, accident-only policies are generally less expensive than comprehensive policies that cover both wellness and accidents, making them a more accessible option for budget-conscious consumers. Overall, the growing demand for affordable and flexible insurance options is expected to drive the growth of the accident-only segment in the US pet insurance market.

By Animal Type Insights

Based on animal type analysis, the market has been segmented on the basis of dogs, cats, and others. The segment of dogs accounted for the most significant market share in the pet insurance industry in the United States in 2023. The majority of households in the U.S. have dogs as their preferred household pets. For instance, in 2022, the American Veterinary Medical Association reported that pet dogs were owned by 44.6% of households in the United States. Consequently, there is a high demand for pet insurance since many dog owners acknowledge the importance of safeguarding their pets from unexpected medical expenses.

Also, dogs are susceptible to various health issues such as cancer, hip dysplasia, and dental problems, leading to expensive veterinary bills. As a result, dog owners are increasingly turning to pet insurance as a means of mitigating these costs and ensuring their pets receive the best possible care.

By Sales Channel Insights

Based on sales channel analysis, the market has been segmented on the basis of agency, bancassurance, broker, direct, and others. The direct sale channel segment accounted for the largest share of the pet insurance market in the United States. This is because many pet owners prefer to purchase insurance directly from the provider rather than through an agent or broker. Direct sales channels offer a convenient and straightforward way for pet owners to research, compare, and purchase policies online or over the phone. In addition, direct sales channels often have lower overhead costs compared to traditional agency models, which allows providers to offer more competitive pricing to customers.

Also, direct sales channels have greater control over the customer experience, allowing them to tailor their products and services to meet the specific needs of their target market. As a result, the direct sale channel segment has become the dominant force in the pet insurance market in the US, with many major players operating in this space.

Competitive Landscape

The pet insurance industry in the United States is marked by intense competition, with numerous players vying for a significant market share. The competitive landscape of the market is dynamic, with industry participants continually evolving to meet the changing needs and preferences of customers who have access to diverse options. Insurance companies operating in the U.S. pet insurance market are focusing on various aspects of pet illness and accident coverage. The market is expected to mature as competition and claims processing volume increase. In addition, established firms and new startups are entering the market to provide innovative pet insurance schemes.

Some of the major players operating in the U.S. market include:

- Crum & Forster Insurance

- Embrace Pet Insurance Agency, LLC

- Figo Pet Insurance LLC

- Healthy Paws Pet Insurance, LLC.

- MetLife Services and Solutions, LLC

- Nationwide Mutual Insurance Company

- Nationwide Pet Insurance

- PetPlan USA

- Pumpkin Insurance Services Inc.

- Trupanion

Recent Developments

- In October 2022, Petco and Nationwide collaborated to introduce co-branded pet insurance products that offer a comprehensive policy covering both accidents and illnesses.

- In February 2024, Odie Pet Insurance, a comprehensive pet health insurance firm recognized for its B2B tech-driven platform and personalization capabilities, unveiled a new collaboration with Tigerless Insurance, a US-based direct-to-consumer Insurtech company. This alliance is designed to broaden pet insurance's reach to global communities residing in the United States.

- In July 2020, Lemonade, an insurance company powered by artificial intelligence and behavioral economics, launched pet health insurance. With this launch, pet parents in 33 U.S. states can get AI-powered, socially impactful coverage for their pets.

Report Coverage

The Pet Insurance market research report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, coverage type, animal type, sales channel, and futuristic growth opportunities.

U.S. Pet Insurance Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.71 billion |

|

Revenue Forecast in 2032 |

USD 12.48 billion |

|

CAGR |

16.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Coverage Type, By Animal Type, By Sales Channel |

|

Country Scope |

The U.S. |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. Pet Insurance Market report covering key segments are coverage type, animal type, and sales channel.

U.S. Pet Insurance Market Size Worth USD 12.48 Billion by 2032

U.S. Pet Insurance Market exhibiting a CAGR of 16.4% during the forecast period.

key driving factors in U.S. Pet Insurance Market are rising focus on preventative care