US Organoids and Spheroids Market Size, Share, Trends, Industry Analysis Report: By Type (Organoids and Spheroids), Application, and End Use; Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 116

- Format: PDF

- Report ID: PM5204

- Base Year: 2024

- Historical Data: 2020-2023

Market Outlook

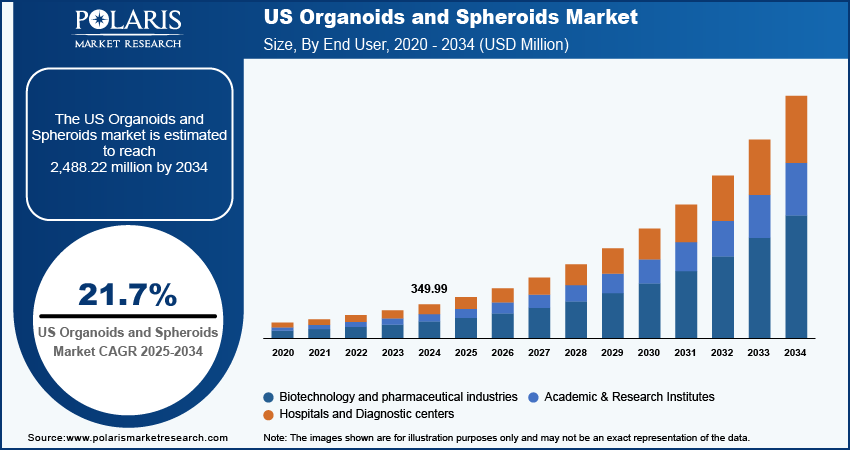

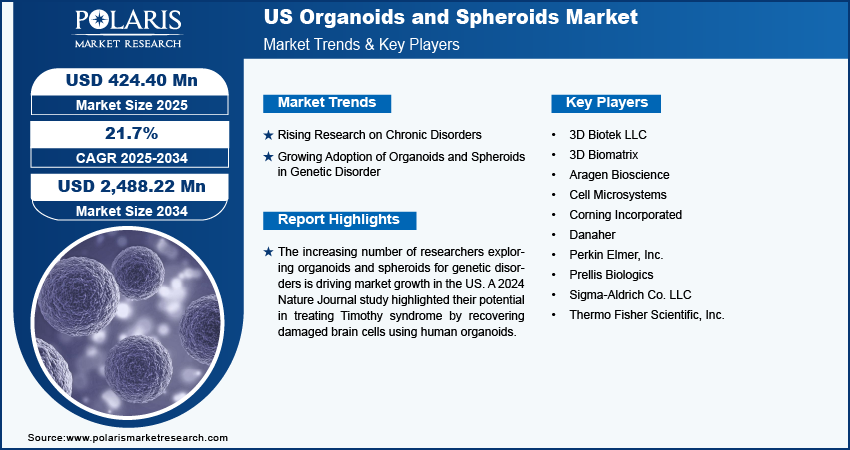

The US organoids and spheroids market size was valued at USD 349.99 million in 2024. The market is anticipated to grow from USD 424.40 million in 2025 to USD 2,488.22 million by 2034, exhibiting a CAGR of 21.7% during 2025–2034.

Market Overview

The US organoids and spheroids market involves 3D cell culture systems that replicate the structure and function of organs or tissues. These models enhance drug discovery, disease modeling, and regenerative medicine by providing more accurate biological representations compared to traditional 2D cultures. An increasing focus on therapeutic discovery and drug development fuels the US organoids and spheroids market growth. This rise in research is fueled by the increasing prevalence of health issues linked to evolving dietary habits. The presence of established biotechnology firms and skilled researchers is expected to enhance research activities focused on organoids and spheroids. Additionally, rising research funding initiatives and a growing focus on treating neurological conditions, particularly dementia, are anticipated to drive the US organoid and spheroid market growth during the forecast period.

To Understand More About this Research: Request a Free Sample Report

Technological advancements in the healthcare sector are expected to fuel the US organoids and spheroids market growth during the forecast period. The rising demand for new technologies and integration of artificial intelligence (AI) would increase the number of research activities, driving the requirement for organoids and spheroids in the country. In December 2023, a study published in Nature Electronics focused on building biological neurological networks in brain organoids using AI hardware methods. This will drive new advancements in the US organoids and spheroids market during the forecast period.

US Organoids and Spheroids Market Growth Drivers

Rising Research on Chronic Disorders

The rising prevalence of chronic health issues, including cancer and cardiac conditions, is encouraging researchers to deepen their understanding of disease dynamics, thereby propelling the demand for organoids and spheroids for disease-modeling applications. According to the American Cancer Society, an estimated 611,000 cancer-related deaths are anticipated in the US in 2024, highlighting the urgent need for innovative research solutions. The rising demand for effective treatments for chronic diseases accelerates research efforts in the country, fueling the demand for organoids and spheroids in the US.

Growing Adoption of Organoids and Spheroids in Genetic Disorder

A growing number of scientific researchers studying the true potential of organoids and spheroids for treating a variety of genetic disorders is increasing the adoption of organoids and spheroids, contributing to the growth of US organoids and spheroids market growth. For instance, in April 2024, a study published in the Nature Journal focused on designing treatments for a genetic disorder. The researchers recovered the damaged brain cells, infected by the Timothy syndrome, with the integration of the human organoids. This advancement underscores the accelerated adoption of organoids and spheroids, impacting the growth of the organoids and spheroids market positively during the projected years.

Restraining Factors

High Initial Investment

The high initial capital required for research activities and the risk of attaining losses restrict new firms from entering the US organoids and spheroids market. The complex process of developing spheroids and organoids lowers their supply in the country, significantly restraining the adoption of organoids and spheroids in the US.

Report Segmentation

The US organoids and spheroids market is primarily segmented on the basis of type, application, and end use.

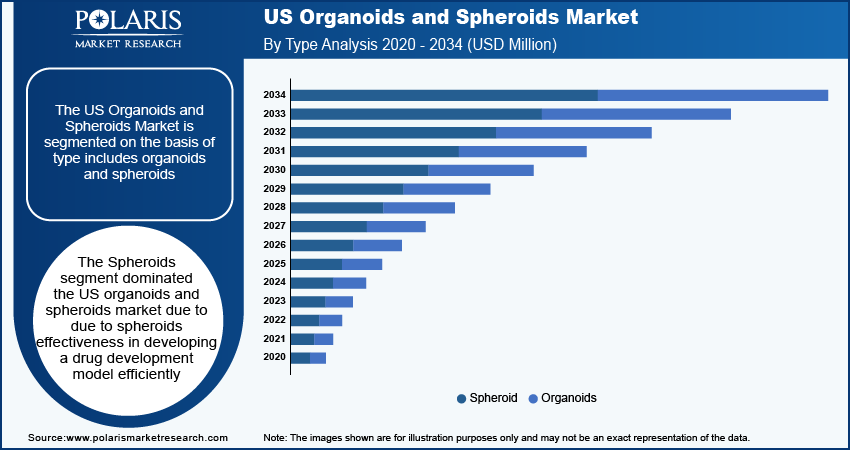

US Organoids and Spheroids Market Breakdown – By Type Analysis

Spheroids Segment to Witness Higher Growth Rate During Forecast Period

The spheroids segment is projected to register a higher CAGR in the US organoids and spheroids market during the forecast period due to the effectiveness of spheroids in developing a model efficiently, as it can increase cell-to-cell interaction. The rising efforts by the pharmaceutical players to produce innovative therapeutics for multiple diseases are expected to facilitate new growth potential for the segment during the forecast years.

US Organoids and Spheroids Market Breakdown – By Application Analysis

Developmental Biology Segment Accounted for Largest Market Share in 2024

The developmental biology segment held the largest share in the US organoids and spheroids market. This is mainly driven by the growing cell therapies and stem cell research, creating the demand for spheroids and organoids. Additionally, rising awareness about precision medicine is anticipated to propel R&D activities. The growing studies integrating organoids and spheroids in neurogenerative diseases and chronic health conditions propel their demand in the US.

US Organoids and Spheroids Market – Key Players and Competitive Insights

Strategic Innovations to Drive Competition

The US organoids and spheroids market is consolidated. The growing measures taken by biopharmaceutical companies to enhance their research activities through partnerships, collaborations, and acquisitions are boosting research innovations in the US. The growing innovations by the companies are expected to enhance the market expansion in the coming years. For instance, in April 2024, at the Advanced Wound Care Summit USA, FibroBiologics unveiled its data on spheroid-based dermal treatment for chronic wounds in the diabetic mouse model.

Major Players Operating in US Organoids and Spheroids Market

- 3D Biotek LLC

- 3D Biomatrix

- Aragen Bioscience

- Cell Microsystems

- Corning Incorporated

- Danaher

- Perkin Elmer, Inc.

- Prellis Biologics

- Sigma-Aldrich Co. LLC

- Thermo Fisher Scientific, Inc

Recent Developments in Industry

- February 2024: Danaher Corporation announced a strategic collaboration with Cincinnati Children's Hospital Medical Center to enhance liver organoid technology for drug toxicity screening. The initiative, part of the Danaher Beacons program, aims to improve patient safety in clinical trials.

- February 2024: Researchers at the Vienna University of Technology developed artificial cartilage tissue using a unique 3D printing process involving spheroids. This method utilized high-resolution laser printing to create tiny, porous, biocompatible spheres, which were colonized with differentiated stem cells. These spheroids were arranged in various geometries, allowing cells to integrate and form uniform cartilage tissue. This advancement opens pathways for potential medical applications, such as producing custom cartilage pieces for injury repair. The method showed significant advantages over traditional tissue engineering techniques.

US Organoids and Spheroids Market Segmentation

By Type Outlook (USD Million, 2020–2034)

- Organoids

- Spheroids

By Application Outlook (USD Million, 2020–2034)

- Developmental Biology

- Personalized Medicine

- Regenerative Medicine

- Disease Pathology Studies

- Drug Toxicity & Efficacy Testing

By End User Outlook (USD Million, 2020–2034)

- Biotechnology and pharmaceutical industries

- Academic & Research Institutes

- Hospitals and Diagnostic centers

Report Coverage

The US organoids and spheroids market report emphasizes key states across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, it covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, application, end use, and futuristic growth opportunities.

US Organoids and Spheroids Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2025 |

USD 424.40 million |

|

Revenue Forecast by 2034 |

USD 2,488.22 million |

|

CAGR |

21.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The US organoids and spheroids market size was valued at USD 349.99 million in 2024 and is projected to grow to USD 2,488.22 million by 2034.

The US market is projected to register a CAGR of 21.7% during the forecast period.

Key players in the market are 3D Biotek LLC; 3D Biomatrix; Aragen Bioscience; Cell Microsystems; Corning Incorporated; Danaher; Perkin Elmer, Inc.; Prellis Biologics; Sigma-Aldrich Co. LLC; and Thermo Fisher Scientific, Inc.

The spheroids segment is anticipated to experience substantial growth with a significant CAGR in the global market during the forecast period due to the effectiveness of spheroids in developing a model efficiently.

The developmental biology segment accounted for the largest revenue share of the market in 2024 due to the growing cell therapies and stem cell research, creating the demand for spheroids and organoids.